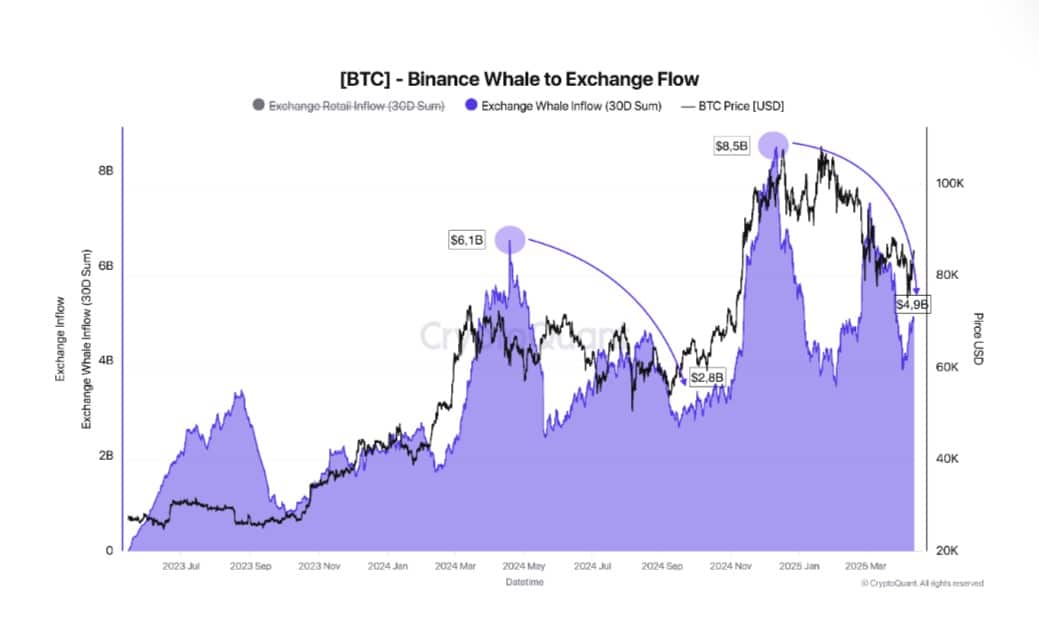

- Bitcoin rebounded from $74K to nearly $86K, fueled by diminished whale selling pressure observed on Binance this month.

- Whale inflows on Binance dropped by $3 billion, mirroring behavior from last year’s correction, reducing market volatility risk.

Bitcoin moved up 6% last week, reaching $85K briefly before settling at slightly lower levels. ETHNews analysts remain divided on what comes next.

The advance off the Apr lows looks more corrective than it does impulsive (to borrow from the lexicon of EW traders) $BTC

BTW, I've never used EW to trade and would never consider doing so. If it works for you, all the more power to you. Please do not reX this with wave counts pic.twitter.com/yg5XmV1HgZ— Peter Brandt (@PeterLBrandt) April 13, 2025

Veteran trader Peter Brandt believes the current rise appears more corrective than impulsive, suggesting a path toward $76K if a bearish rising wedge on the 4-hour chart is confirmed.

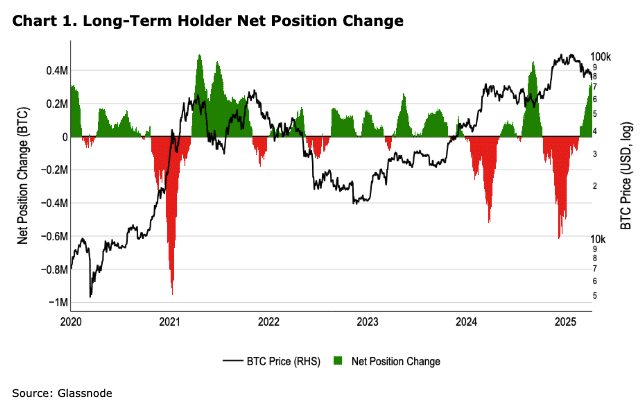

Coinbase researchers take a different view. They see renewed buying interest from long-term holders who had been sellers since December, when Bitcoin rose above $100K.

These observers consider BTC near fair value, which may entice new entry, though no clear jump in price has followed so far.

Stockmoney Lizards echoes the bullish side, pointing to a possible climb if Bitcoin reclaims $85K with momentum. The analyst also highlights $72K–$74K as a potential zone for adding more positions.

One green week doesn't make a trend, but here's what actually matters:

We're at a critical junction – testing both the descending trendline (since Dec) and finding support at the weekly EMA50 (~77.8K).

This compression zone is setting up for a big move. Might see… pic.twitter.com/iWbdtxPNtt

— Stockmoney Lizards (@StockmoneyL) April 13, 2025

Michael van de Poppe, another market watcher, stresses that Bitcoin’s RSI divergence remains bullish on higher timeframes. He states that maintaining support above $80K could help push BTC higher.

Given that there's a strong bullish divergence on #Bitcoin, the only thing we'll need to see is Bitcoin holding above $80K.

If that happens, a breakout of this downtrend is on the horizon. pic.twitter.com/mO4uvzeMC8

— Michaël van de Poppe (@CryptoMichNL) April 13, 2025

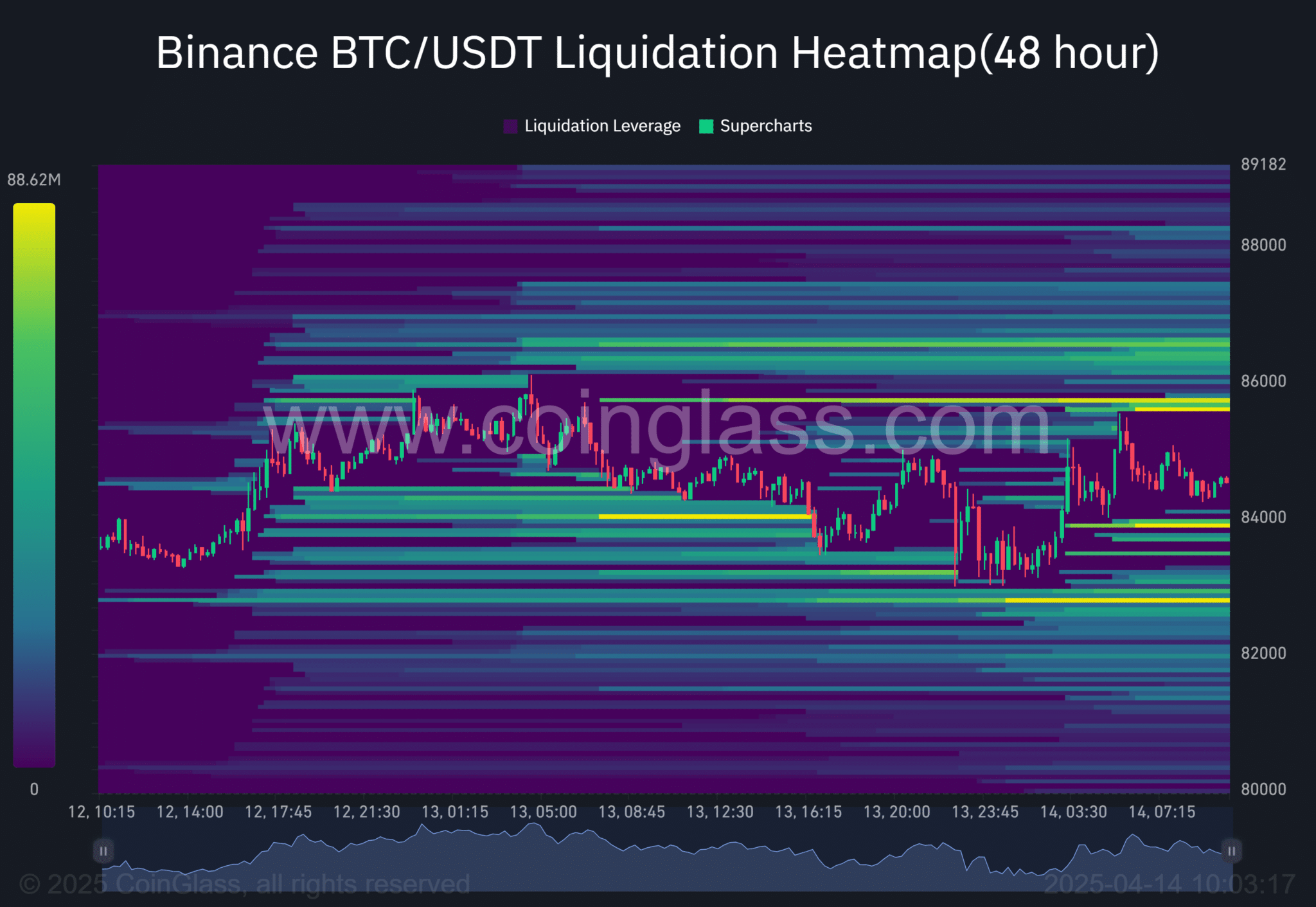

Meanwhile, Coinglass data identifies $86K, $84K, and $82.7K as short-term liquidity zones. These levels may attract price action and cause sudden shifts in Bitcoin’s direction.

As a result, the market faces two scenarios. Brandt’s view favors caution, while Coinbase and other observers maintain that BTC still holds appeal at current prices. Each camp looks for confirmation from technical patterns and buying trends.

Bitcoin Demand Grows as Whales Hold Back Sales on Binance

Bitcoin is trading near $86K after recovering from a $74K low, and new data indicates that large investors, often called whales, are not selling on Binance at the same pace as before. Over the past month, whale inflows there have dropped by more than $3 billion, mirroring activity levels from last year’s correction in 2024.

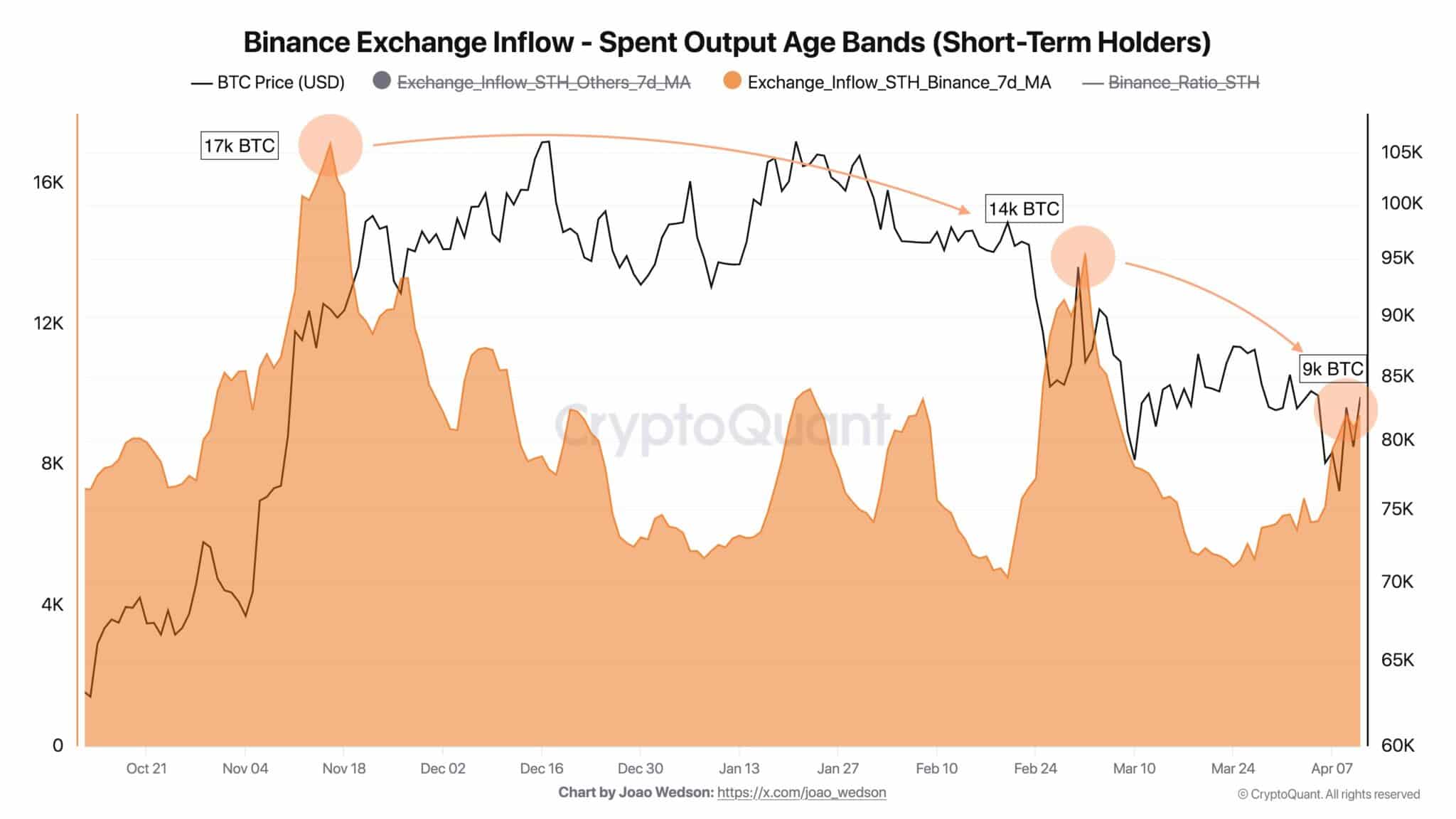

Short-term sellers have also eased, reflected by declining Exchange Whale Ratios and lower BTC inflow volumes, which now hover around 9,000. This shift hints that deeper sell pressure may be subsiding, with owners choosing to keep their BTC rather than offload it.

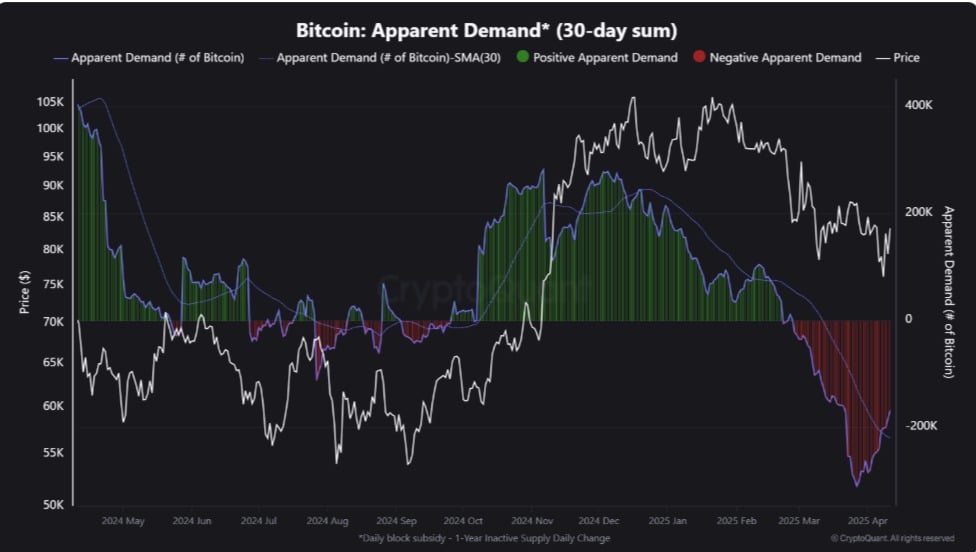

In addition, Bitcoin’s Apparent Demand (30-day sum) has rebounded from negative levels, pointing to recovering interest among market participants.

Meanwhile, the Fund Flow Ratio sits at 0.07, suggesting limited selling on exchanges. ETHNews analysts say this change in behavior could support future gains if the current levels hold.

With large players reducing sales and smaller investors showing fewer signs of panic, Bitcoin may see stronger price stability in the short term.

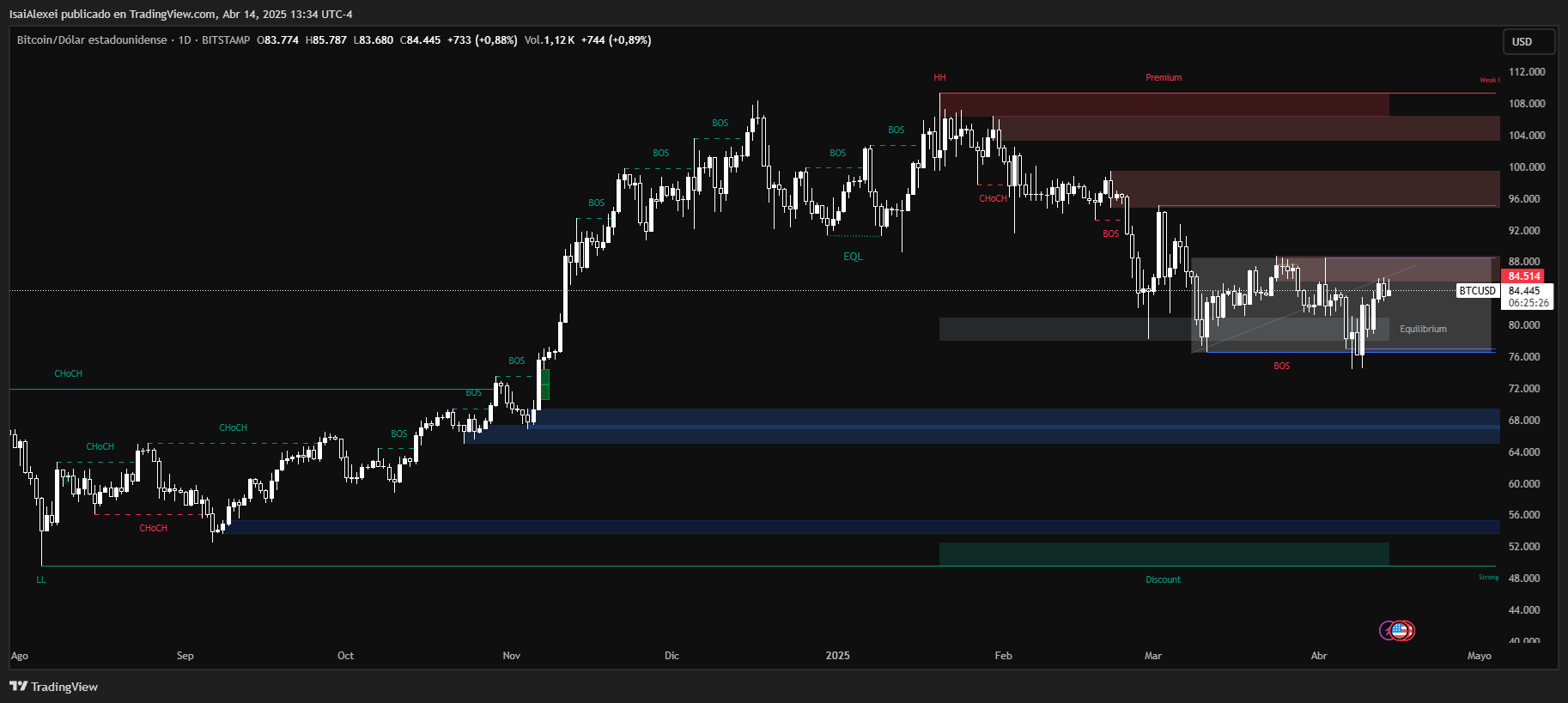

Bitcoin (BTC) is currently trading at $84,445, posting a moderate 0.88% daily gain and continuing a broader 7.81% weekly uptrend. Despite the recovery, BTC is still down 9.48% year-to-date, reflecting the high volatility and macroeconomic uncertainty that’s shaped early 2025.

After a 20% rebound from recent lows near $74,000, BTC now faces strong resistance around $85,500–$86,500. A breakout above this level could open the path toward the $88,000–$90,000 target range.

On the technical side, BTC has formed a bullish structure supported by a double bottom pattern and a successful retest of key moving averages. Momentum indicators like RSI are neutral, suggesting further room for upward movement without being overbought.

A decisive close above $86,500 would confirm continuation, while a rejection may lead to consolidation around $82,000–$80,000.

Fundamentally, bullish catalysts include MicroStrategy’s recent $286M BTC purchase, pushing its holdings above 531,000 BTC, and macro factors like increasing global liquidity and a weakening U.S. Dollar Index.

These tailwinds, paired with declining exchange reserves and ETF inflows, support the narrative of ongoing institutional accumulation.

Exact Price Prediction: Based on current price action, volume, and institutional momentum, Bitcoin is projected to reach $88,200 within the next 4 days, provided it clears the $85,850 resistance zone.c