- Binance’s upcoming KernelDAO launch on April 14, 2025, seeks to enhance liquidity and staking features on BNB Chain.

- The re-staking protocol aims to boost usage for ETH, BTC, and BNB while attracting investors’ growing attention worldwide.

Binance plans to roll out the KernelDAO re-staking protocol on April 14, 2025, with the main goal of improving liquidity and staking choices for users on the BNB Chain platform.

The KernelDAO is a project led by Binance that seeks to expand staking features. The protocol brings fresh re-staking methods to the BNB Chain, working with tools such as Gain and Kelp. It receives support from Binance Labs, among other backers. Overseen by Binance, KernelDAO aims to convert economic security into programmable trust and liquidity.

The plan is expected to boost the overall usefulness of assets, especially ETH, BTC, and BNB. The launch could influence liquidity levels and yield potential across multiple tokens. Early trading activity often brings price swings, which might affect assets like BNB and ETH. The added liquidity may also shift market behavior.

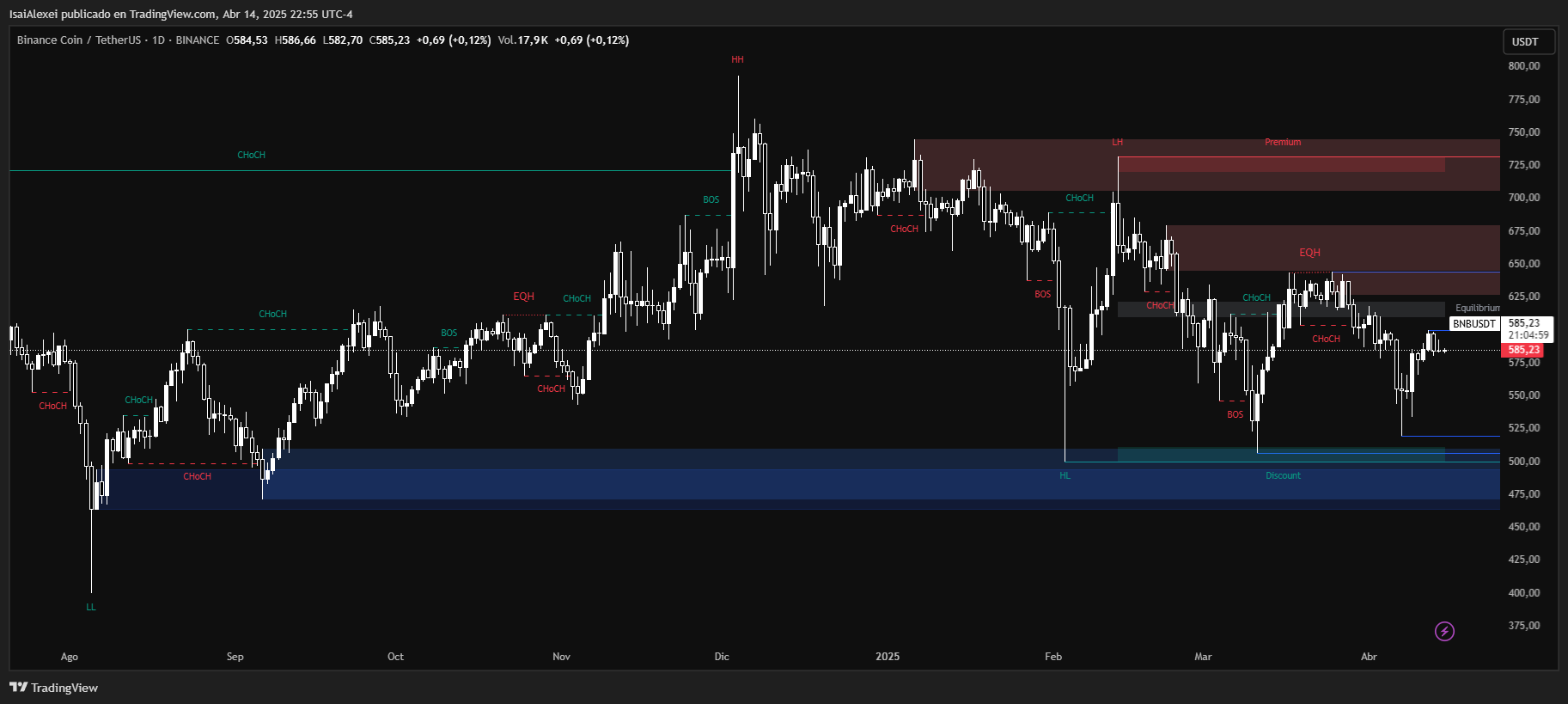

BNB is trading near $584.70, rising 0.05% in daily activity. This slight uptick suggests a stable phase after recent swings. Over the past week, BNB has climbed 5.47%, yet it remains 16.66% lower year-to-date, reflecting ongoing market challenges and regulatory concerns. The price hovers near an important mid-range area, with resistance around $600–$616 that has foiled past efforts to move higher.

Technical signals place BNB in a neutral-to-bullish zone. The price rebounded off rising trendline support at about $570, hinting at a bullish flag shape on lower charts. If it climbs beyond $600, the next targets are projected around $632–$650.

However, a failure to breach that ceiling could lead to a dip toward $555, where past liquidity holds some influence. Both RSI and MACD are flattening, implying a decisive shift could occur soon.

Tron (TRX) Overview

TRX sits at $0.2519, registering a -0.34% drop in daily terms, yet it retains a strong upward path overall. It has added 10.19% over the past week, 13.93% this month, and a sturdy 124.54% over the last year. TRX is regarded as relatively steady among top-tier Layer 1 tokens, aided by its large share of stablecoin settlement volumes and institutional DeFi infrastructure.

On the charts, TRX holds a firm upswing, pausing just below the $0.26 mark. Pushing above that threshold may open room for $0.273 and $0.29, while support appears at $0.243 and $0.233. RSI stays in a balanced position, giving traders space for further upward moves. Volume remains strong, showing that buyers are still active.

Unless broader market sentiment turns negative, a bullish breakout seems likely. Furthermore, talk of a possible Tron ETF and remarks from founder Justin Sun have stirred attention around a new high in the second quarter of 2025.

Toncoin (TON) Situation

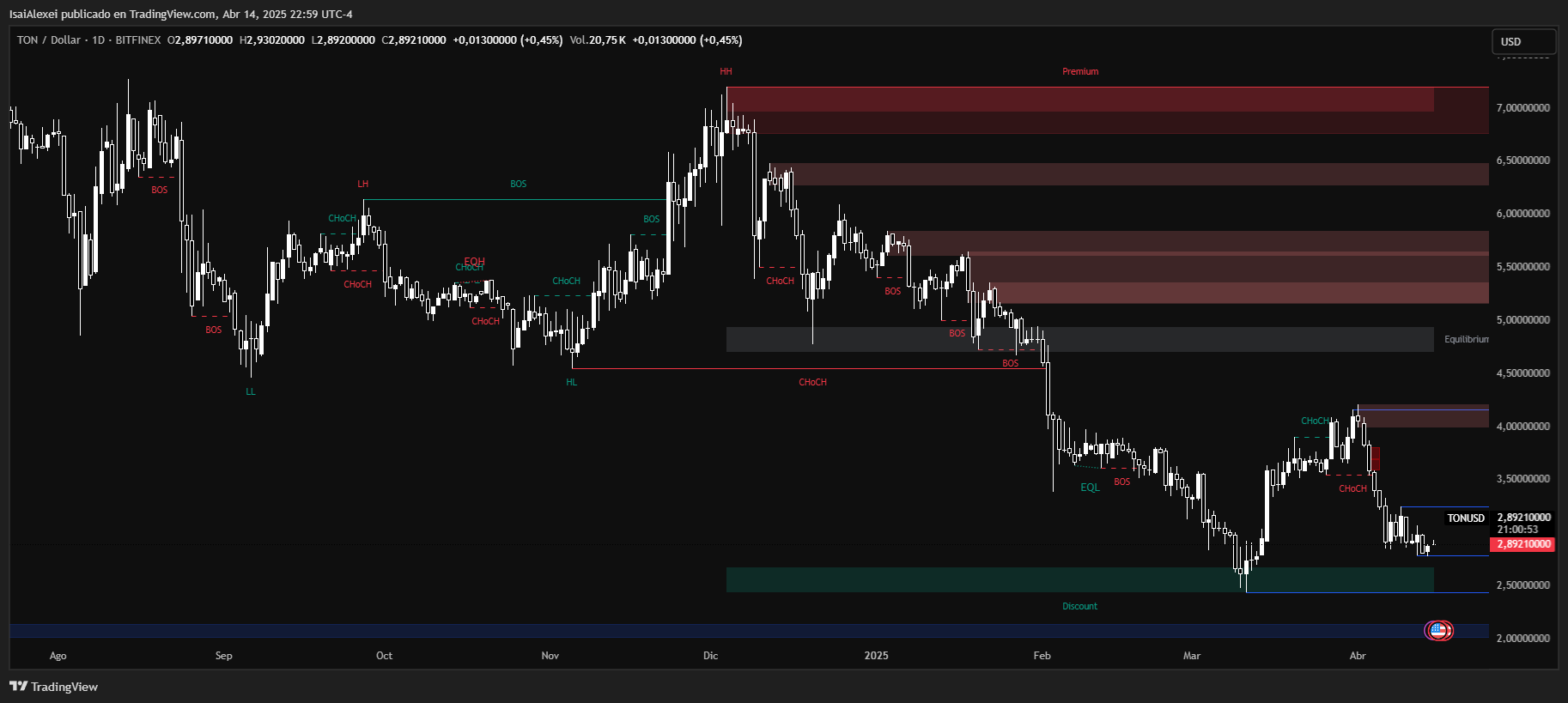

TON changes hands at $2.89, up by 0.32% on the day, though it has followed a downward path overall. Its price is lower by 47.24% since the start of the year and 57.23% across the last 12 months, reflecting a long correction from its previous peak near $8.28.

Within the last month, TON has slipped 19.08%, yet it appears to find support in the $2.80–$2.85 range. This area may serve as a short-lived floor for a bounce.

Technical patterns show TON trying to establish a bottom. RSI is near a midpoint, and MACD looks neutral—pointing to a possible reversal if more buyers step in.

Still, resistance stands around $3.10–$3.25, and failing to reclaim that zone could lead to a retest of $2.60. Trading volume appears moderate, suggesting some accumulation is taking place.

On a deeper level, Toncoin has seen new moves within the Telegram network. These include Tonkeeper tie-ins and upcoming modular lending services. The token, however, needs to restore investor trust after repeated failed attempts to break higher, most visibly the strong rejection at $4.34.

Price Projection

If TON can hold steady above $2.85 and gather momentum, it may aim for $3.12 within the next five days, assuming it clears short-term barriers.

Furthermore, traders appear to weigh the chance of fresh price swings as KernelDAO joins the BNB Chain arena. Some predict a step-by-step increase in re-staking usage, while others expect broader liquidity to strengthen the chain’s base.

TRX continues to draw attention with its stablecoin settlement role, which may help maintain its growth path. TON, meanwhile, remains on watch for any breach of its resistance levels, though many are still cautious about further setbacks.