- Ethereum’s funding rate increases, indicating optimism among traders with price targets aiming for $4,000 pre-Dencun.

- Ethereum surpasses 31 million in ETH staked, reinforcing long-term uptrend and anticipating further gains.

Ethereum’s funding rate is experiencing an increase, signaling an optimistic mood among traders, with the ETH price targeting $4,000 just ahead of Dencun’s anticipated update, as we mentioned on ETHNews.

Ethereum (ETH), positioning itself as the second most valuable cryptocurrency behind Bitcoin, continues its upward trajectory with a 7% increase, brushing the $3,900 mark.

Currently, Ethereum’s price is at $3,816, with its market capitalization surpassing $450 billion.

Rising Ethereum Funding Rates

The recent jump in the price of ETH is a reflection of investor confidence, detonating a surge of buying activity in the cryptocurrency market.

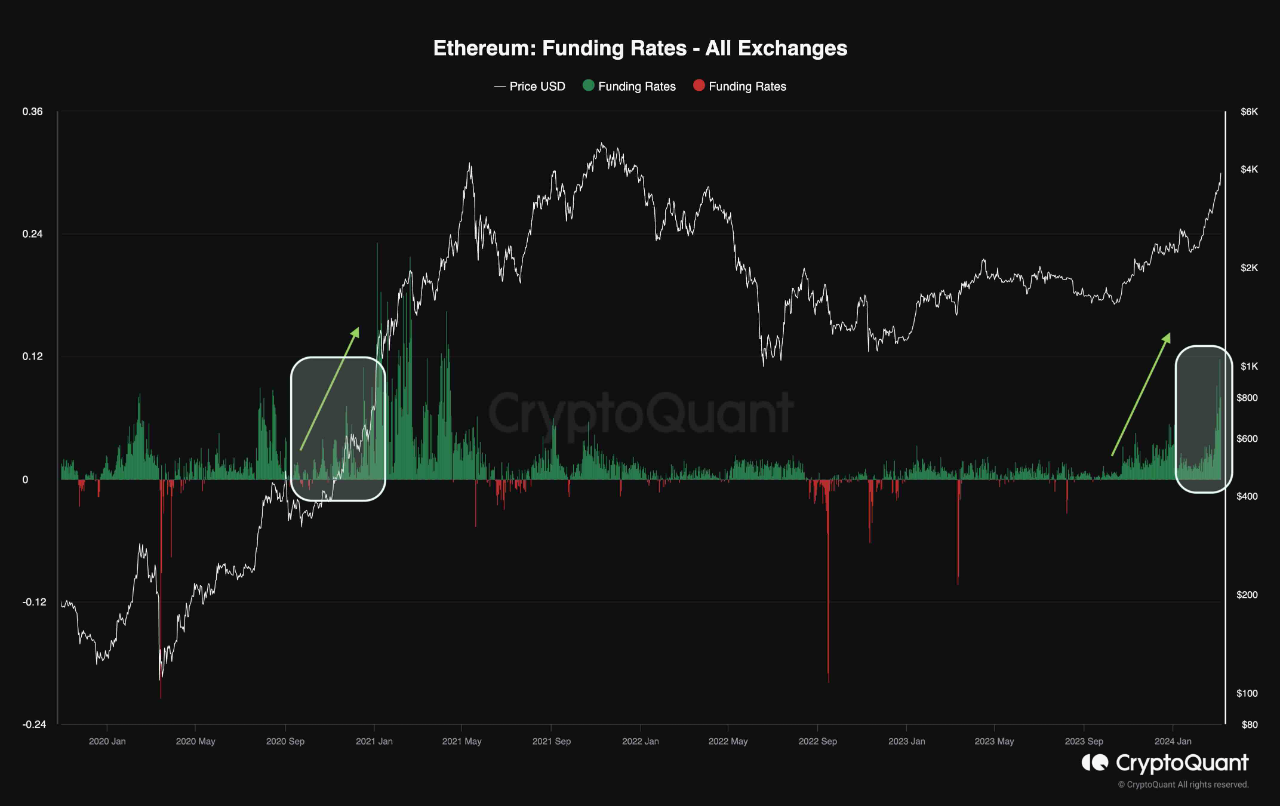

According to CryptoQuant analysis, a key indicator that about this phenomenon is Ethereum’s funding rate, which measures the intensity of trading in the futures market. Positive rates indicate an optimistic outlook, while negative rates point to a pessimistic perception among traders.

Ethereum’s funding rates have seen a notable increase, going back to levels seen in late 2020, when ETH began an uptrend towards its all-time high. This rise in funding rates underscores a prevailing bullish bias among futures traders, suggesting the possibility of an uptrend.

Ethereum Price Target at $5,000 with ETH Support in Staking

Ethereum price stabilizes near $3,800, facing firm resistance at $3,900. However, an increase in ETH staking supports the long-term bullish view of the project.

A 48% decline in trading volume to $26 billion and a 2.45% decline in market cap, according to CoinMarketCap data, suggest a decline in interest possibly due to an unresolved impasse between buyers and sellers at $3,800.

Ethereum Price Prediction: Technical Structure Points to More Gains

Ethereum price is holding above key levels, starting with the previous day’s Low Value Area (pdVAL) in the four-hour range at $3,760.

If this level holds as support, traders will expect a close above the start of the day at $3,822, which could incentivize the accumulation of more long positions for momentum towards $3,900 resistance.

The Relative Strength Index (RSI) suggests an immediate sideways trade to allow buyers and sellers to resolve the current stalemate. If the RSI advances into the overbought zone, it will indicate the return of buyers and an increase in price.

If profit-taking activities intensify in the face of growing uncertainty, Ethereum could drop below the pdVAL, capturing more liquidity near the support marked by the 20-day Exponential Moving Average (EMA) at $3,692.

Anticipation of staying out (FOMO) will likely capture investors with the release of the Dencun update on the mainnet on March 13, promising to further advance Ethereum as a proof-of-stake (PoS) protocol.

The Money Flow Index (MFI), a technical tool to watch

Although it currently shows a neutral and declining trend, keeping an eye out for a bounce could signal the next rise in the price of ETH. This indicator monitors the flow of money into and out of Ethereum.

Assets in Ethereum Exceed 31 Million

The total amount of Ether in staking within the Ethereum ecosystem has reached a new all-time milestone of 31 million ETH for the first time, according to analysis from IntoTheBlock. Since the smart contract platform completed its transition to a PoS mechanism, the staking trend has been on the rise.

Staking has a positive long-term impact on the price of an asset. By confirming bullish sentiment, it removes coins from active circulation, thus decreasing potential selling pressure.

Thus, as more holders tie up their tokens to participate in network security and earn rewards, the decrease in circulating supply could translate into noticeable increases in price.