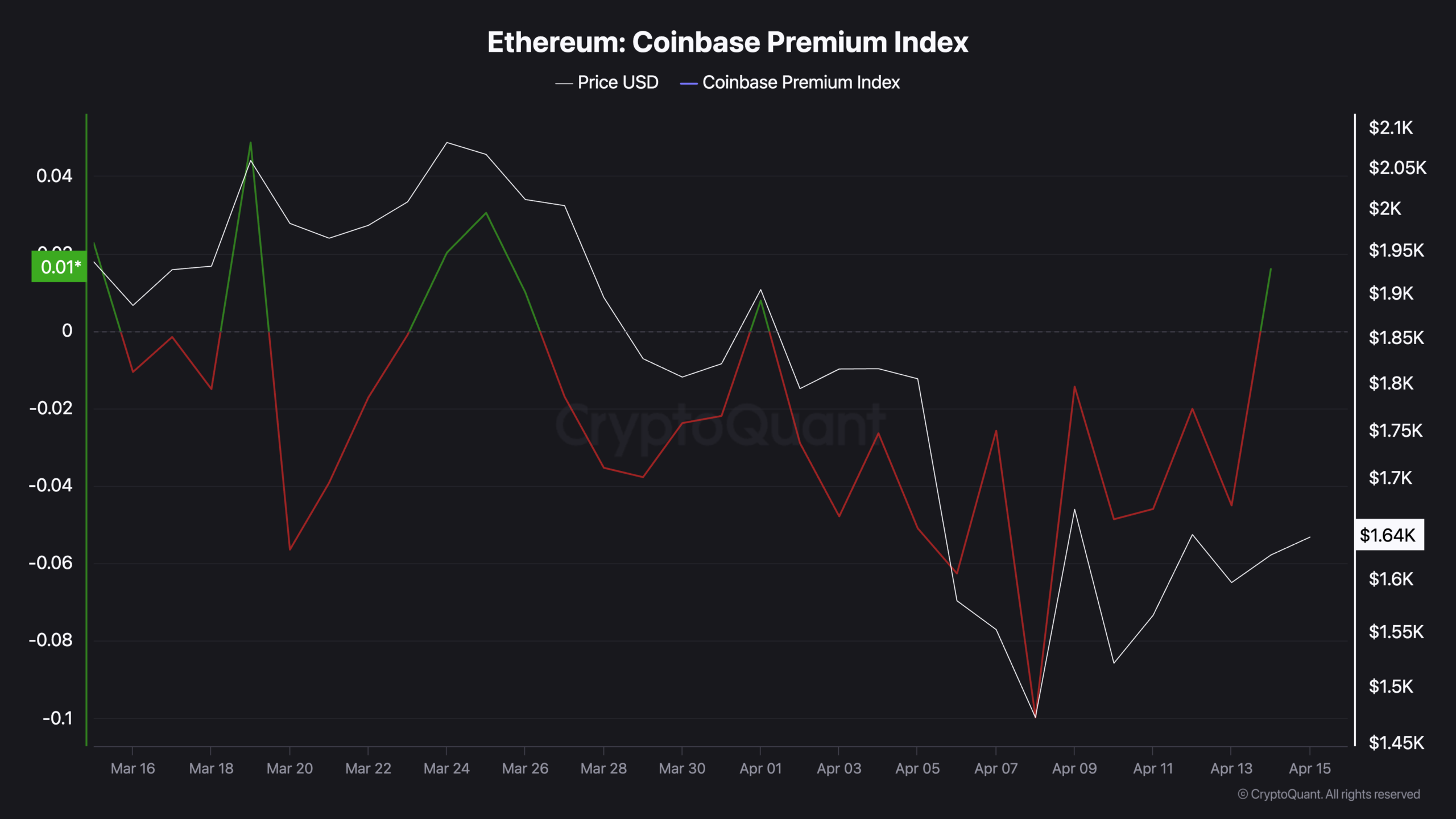

- On-chain data shows Coinbase Premium above zero, indicating active buying pressure by US-based investors purchasing ETH on Coinbase.

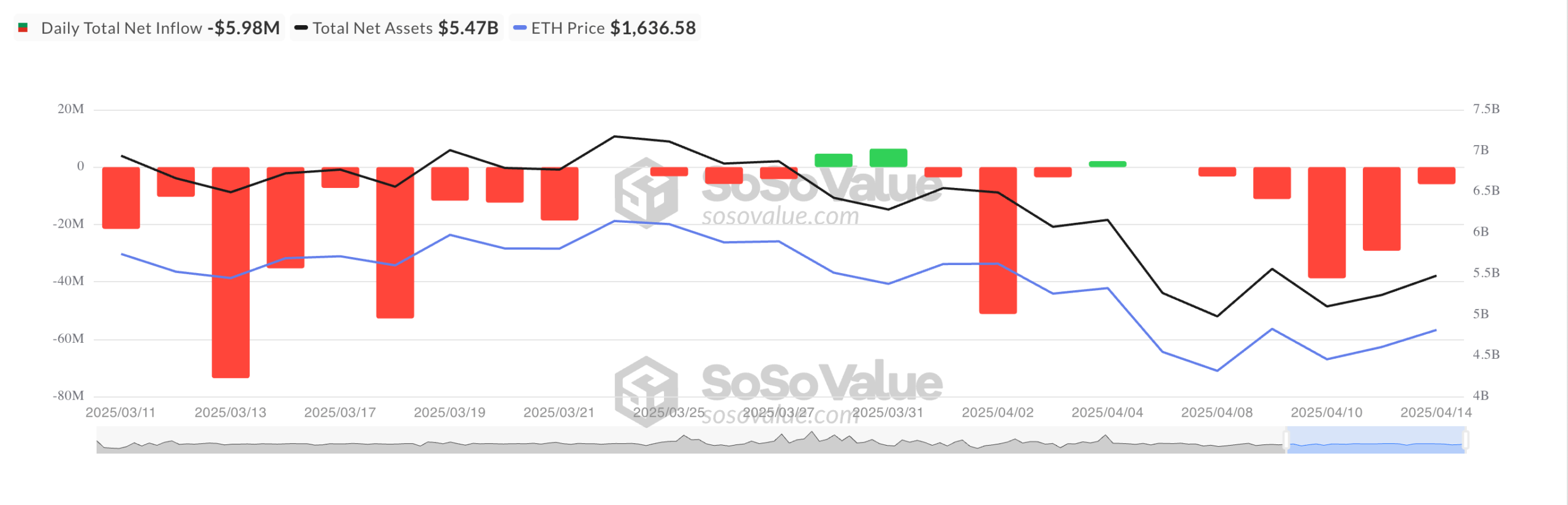

- Institutional investors remain cautious as they withdraw capital from ETH-backed funds for the seventh day in a row.

Ethereum records a 5% rise this past week as the altcoin benefits from a broader market recovery. Data from on-chain sources confirms increased interest from US retail traders. The price uptick reflects heightened purchasing activity on Coinbase, where the Coinbase Premium Index now sits above zero at 0.016.

The Coinbase Premium Index compares ETH prices on Coinbase and Binance

When the index exceeds zero, it points to an increase in buyer activity on Coinbase. This behavior suggests that US retail investors are showing more intent to acquire ETH. On the other hand, when the index falls below zero, it indicates that trading activity on Coinbase declines. In this case, the rise in the index signals bullish sentiment among retail traders.

They continue to withdraw capital from ETH-backed funds on US-based spot ETFs. The current trend marks the seventh day in a row of capital outflows. This divergence in behavior between retail and institutional investors hints at differing outlooks on ETH’s near-term price moves.

Retail buyers appear to lean into short-term gains, while institutional players refrain from further capital commitment amid uncertain economic conditions.

Today’s market recovery shows in ETH’s Balance of Power (BoP), which stands at 0.57. This number indicates that buying pressure exceeds selling pressure at present. If buying activity holds, ETH could potentially climb to around $2,114.

Nonetheless, the contrast between active US retail participation and cautious institutional behavior signals that the near-term market direction may not be straightforward.

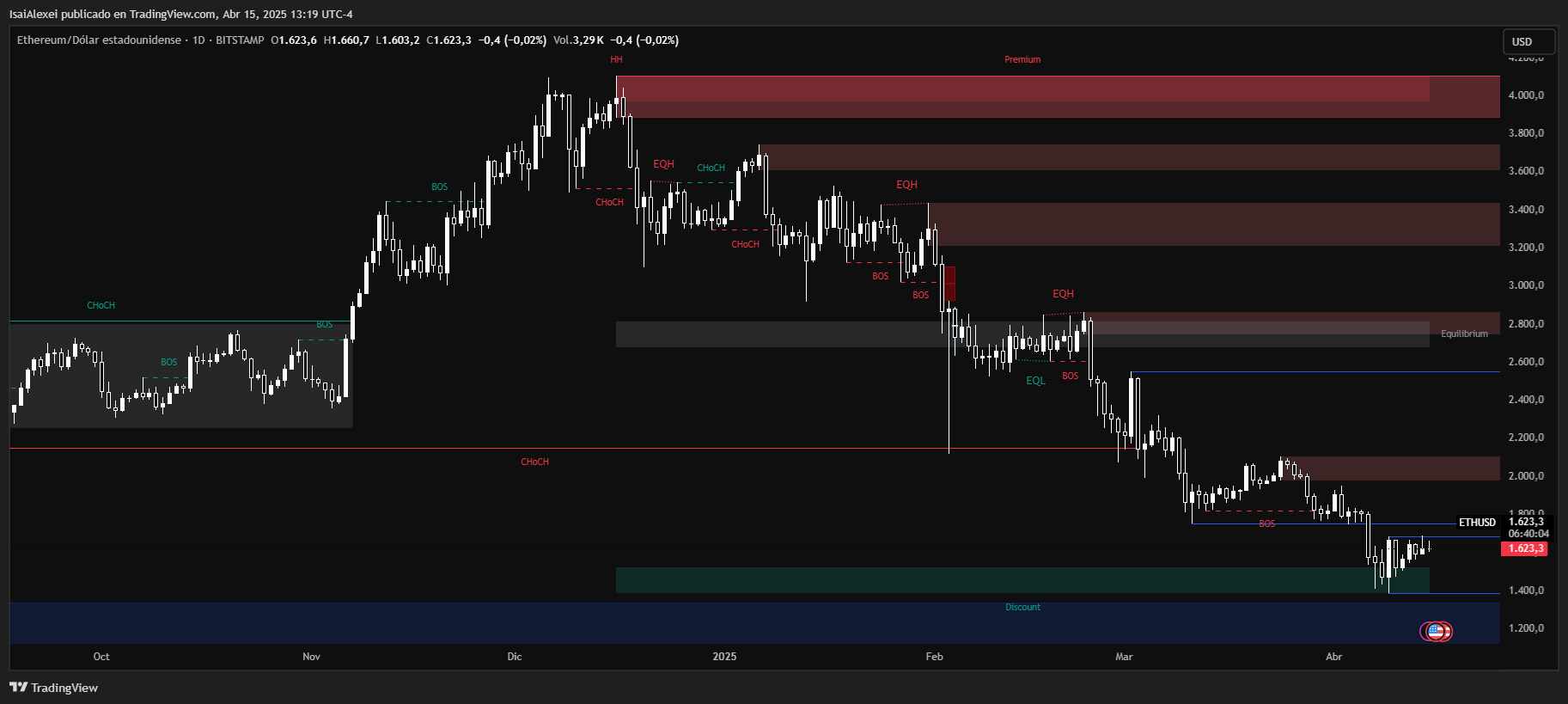

Ethereum (ETH) is currently trading at $1,623.00, down slightly by 0.35% on the day, but up nearly 5% in the last 24 hours and 4.23% over the week, signaling a strong recovery from the recent low of $1,380. Despite this bounce, ETH still reflects a 50% drawdown since early 2025 and a 48.62% loss over the past year, confirming it remains in a longer-term corrective phase.

From a technical standpoint, ETH is approaching $1,675 resistance, and a breakout above this level could trigger a move toward the $1,770–$1,850 range. Support is firm around $1,580, and bulls must defend this level to maintain structure.

Oscillators and moving averages are currently giving neutral to bearish signals, suggesting the market is in transition and awaiting confirmation before a clear trend emerges.

Fundamentally, Ethereum continues to innovate. The launch of Everclear, a cross-chain protocol backed by the Ethereum Foundation, adds new utility by enabling zero-fee digital asset rebalancing across major EVM-compatible chains.

However, Ethereum’s ecosystem continues to face criticism from figures like Peter Brandt, who recently referred to it as a “broken utility token” due to persistent high gas fees and user complexity—factors that weigh on sentiment.