- Vitalik Buterin’s unveiling addresses long-standing frustrations with Ethereum’s slow confirmation times, promising significant improvements.

- Despite challenges like network strain, SSF introduces Rollup and Based preconfirmation systems to enhance user experience.

Ethereum has taken a significant leap forward with Vitalik Buterin unveiling a groundbreaking enhancement aimed at speeding up transaction confirmations on the blockchain. The new feature, known as Single Slot Finality (SSF), promises to revolutionize Ethereum’s efficiency by simplifying the consensus process.

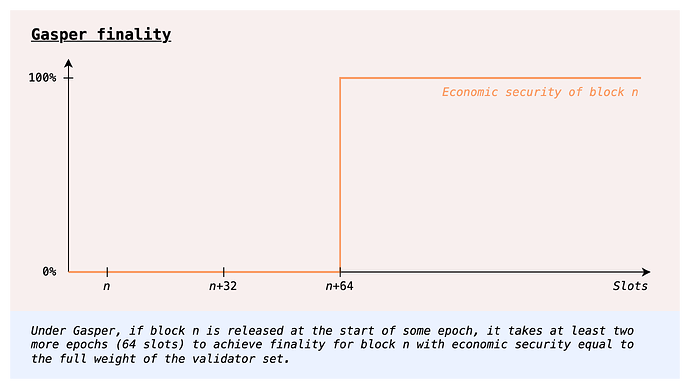

Following our coverage in ETHNews, about Ethereum, Ethereum’s transaction confirmations were hampered by a complex slot and epoch architecture under the Gasper consensus.

This approach involved validators voting on the chain’s head every 12 seconds, with finality achieved after two epochs, totaling around 12.8 minutes. This prolonged process had increasingly frustrated users due to its interaction flaws and extended waiting times.

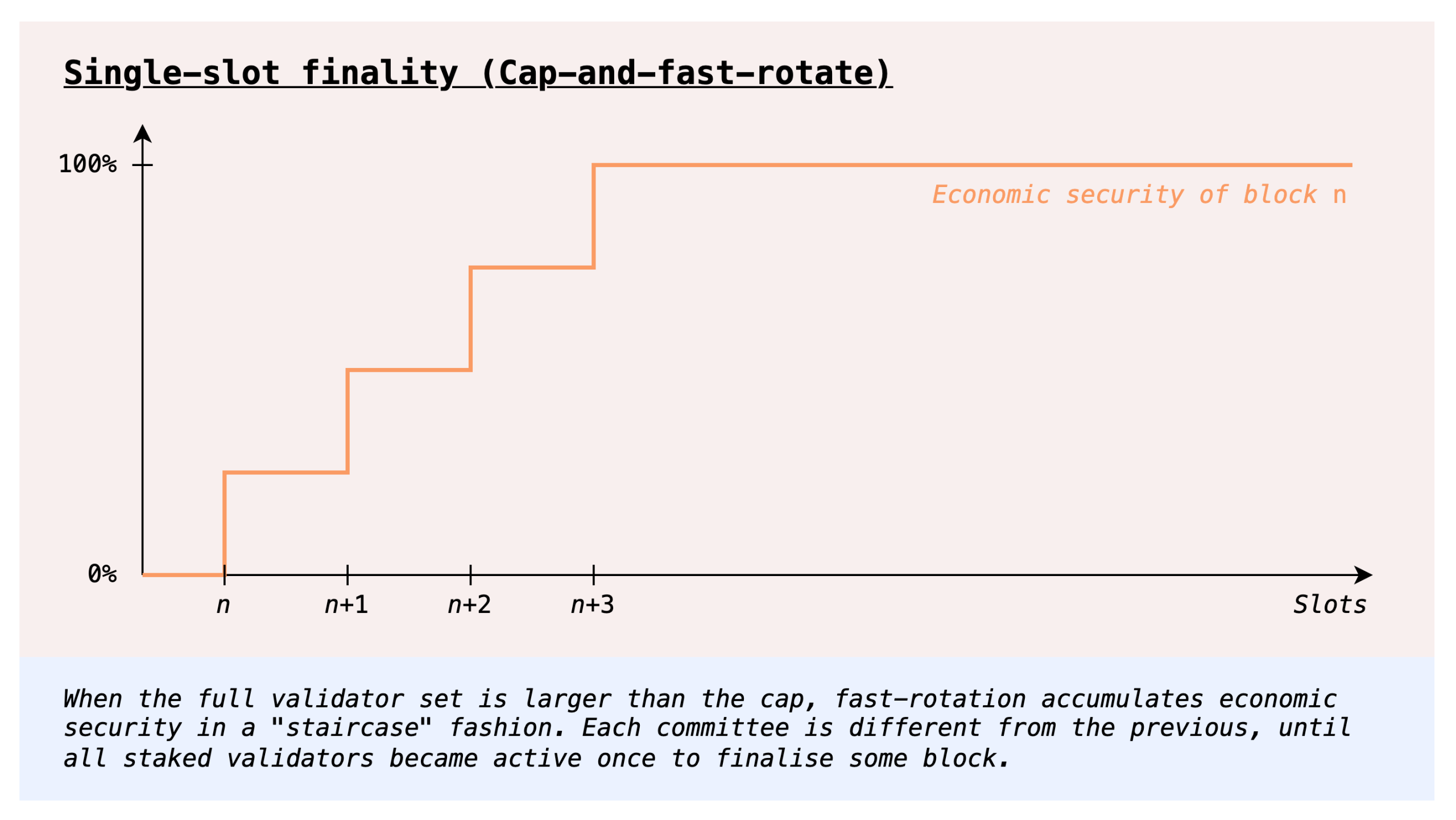

The SSF feature introduces a streamlined approach inspired by Tendermint consensus, ensuring that each block is finalized before the next one is created. This method not only accelerates transaction times but also includes safeguards like the “inactivity leak” to maintain chain integrity if validators go offline.

Implementing SSF comes with challenges

It requires Ethereum stakers to post messages every 12 seconds, potentially straining the network. Despite this, the new feature offers two distinct preconfirmation systems: Rollup and Based. Rollup emphasizes Ethereum’s layer 1 stability and security while layer 2 solutions focus on user engagement through technological adaptations.

“While there are clever ideas to mitigate this problem, including the recent Orbit SSF proposal, this remains a challenge. Although SSF significantly improves the user experience by accelerating ‘finality’, it Eliminates the need for users to wait 5-20 seconds.

Vitalik Buterin’s announcement underscores Ethereum’s ongoing evolution towards scalability and user experience enhancement. By addressing transaction efficiency concerns, SSF aims to bolster Ethereum’s utility and appeal across diverse user bases.

Protocol within a reasonable timeframe

The focus is on solutions that do not heavily rely on improvements in the signature aggregation process or propose large increases in slot time, which can lead to various externalities. Given these technical constraints, the emphasis is on achieving a minimal set of properties ideally desired:

- Validator Capping: Limiting the number of active validators to a manageable size, such as around 32,000, akin to the current committee size. Further reduction would likely necessitate the complete removal of attestation aggregation.

- Solo Staking Viability: Ensuring that staking with 32 ETH remains feasible and that solo staking yields remain competitive compared to delegated staking.

- High Eventual Economic Security: Providing economic security exceeding a threshold, for instance, 20 million ETH in the long term, without extending wait times beyond current standards (two epochs).

- Fast Finality: Achieving economic security shortly after proposing a block, ideally within 10 to 30 seconds rather than the current 10 minutes.

- Optimally Secure Consensus Protocol: Implementing a consensus protocol that is provably resilient to approximately half of the participants being adversaries under network synchrony and up to a third under partial synchrony.

These objectives aim to enhance the efficiency, security, and accessibility of the protocol, aligning with efforts to evolve Ethereum’s capabilities while addressing practical implementation challenges.

Bitcoin Sees Modest Inflows Despite Price Fluctuations

Institutional investor sentiment towards Bitcoin remains cautiously optimistic, as indicated by CoinShares’ latest Digital Asset Fund Flows Weekly report. Despite recent price dips, Bitcoin attracted $10 million in inflows last week, signaling sustained bullish sentiment among investors.

This modest influx contrasts with Ethereum’s challenges, highlighting Bitcoin’s resilience in the face of market volatility.

Ethereum Faces Significant Outflows Amid ETF Launch Delays

In contrast to Bitcoin, Ethereum encountered substantial challenges in institutional investor sentiment. The launch delays of Spot Ethereum ETFs contributed to Ethereum experiencing outflows totaling $61 million, the largest weekly outflow since August 2022.

With a net outflow of $119 million over the past two weeks, Ethereum surged as the weakest performer among major digital assets in terms of net flows year-to-date.