- Ethereum whales bought $815 million in ETH over five days during market corrections.

- ETH trades between $1,870 support and $2,050 resistance, per profit/loss address data.

Crypto analyst Ali Martinez reports that large investors purchased 420,000 Ethereum (ETH) — worth $815 million — within five days during a broader market downturn. This activity highlights institutional interest in ETH amid price volatility.

Whales have bought more than 420,000 #Ethereum $ETH in the last five days! pic.twitter.com/ZFF57gbq0e

— Ali (@ali_charts) March 14, 2025

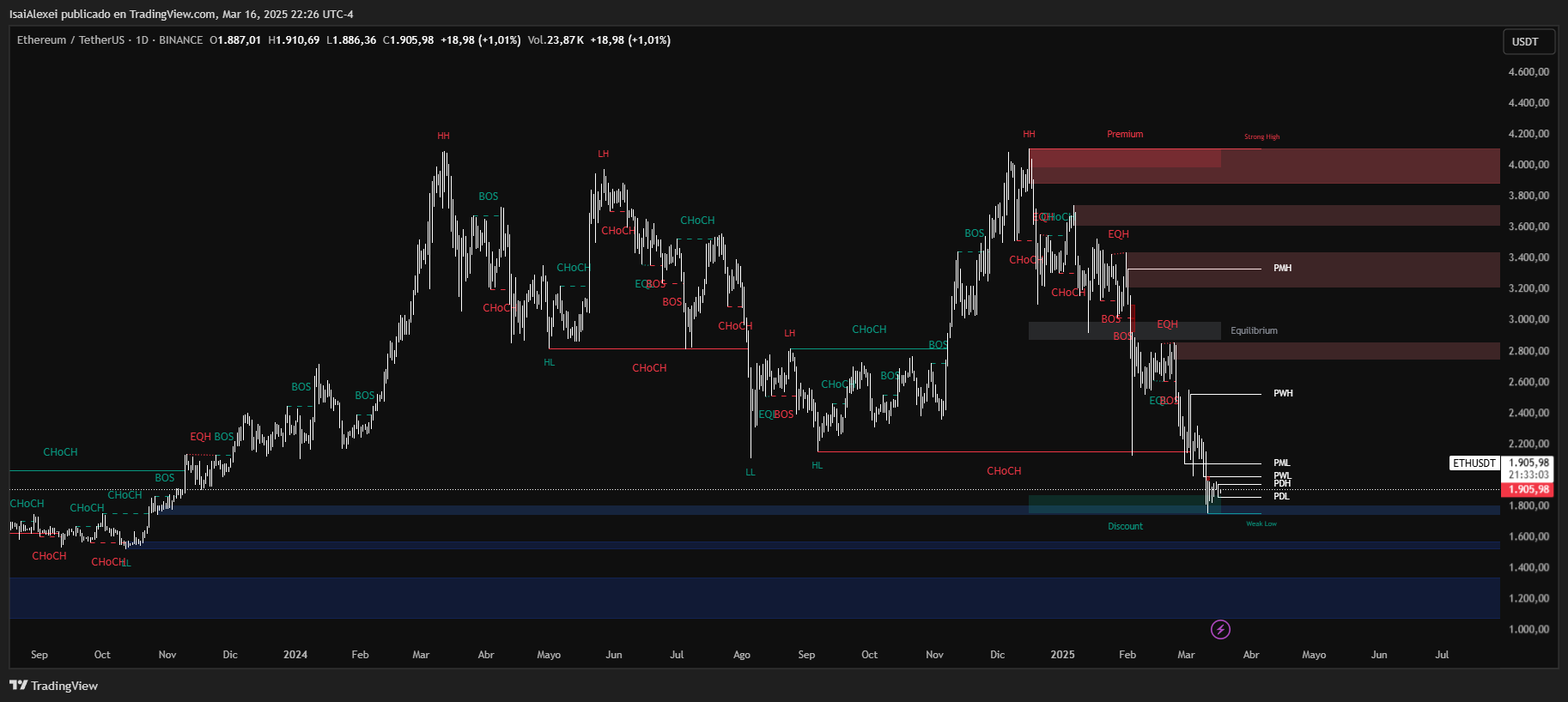

Martinez references Ethereum’s In/Out of the Money Around Price (IOMAP) metric, which tracks addresses holding ETH at profit, loss, or breakeven levels. ETH currently trades at $1,941, sandwiched between $1,870 (strong support) and $2,050 (key resistance).

#Ethereum $ETH key levels to watch! On-chain data reveals $1,870 as the strongest support and $2,050 as its toughest resistance! pic.twitter.com/IBjUmQIjqU

— Ali (@ali_charts) March 14, 2025

Martinez notes Bitcoin (BTC) surpassed a horizontal resistance level in an ascending triangle pattern, a formation often signaling bullish reversals. He projects a $90,000 target if BTC maintains support at $84,000. Bitcoin’s price stands at $84,288 at press time. Ascending triangles typically indicate upward momentum once resistance is breached.

#Bitcoin $BTC is breaking out! The target is $90,000 as long as the $84,000 support holds. https://t.co/NXcTCqYCWJ pic.twitter.com/tq1HiULS8b

— Ali (@ali_charts) March 14, 2025

Cardano’s Potential Breakout Scenario

For Cardano (ADA), Martinez identifies a triangle pattern with diagonal resistance near $0.75. A breakout above this level could trigger a 15% price swing, while a breakdown below the trendline may lead to declines. Triangle patterns reflect consolidation phases, with direction determined by price action.

#Cardano $ADA is about to break free! Busting out of this triangle will trigger a 15% price move. pic.twitter.com/HrKEdaA96Q

— Ali (@ali_charts) March 14, 2025

Martinez combines on-chain data and technical patterns to assess short-term trends. Whale accumulation in Ethereum (ETH) suggests confidence in its near-term outlook, while Bitcoin’s technicals align with upward potential. Cardano’s pending breakout underscores altcoin volatility amid uncertain market conditions.

As of today, Ethereum (ETH) is trading at $1,902.50, reflecting a 1.16% decline in the past 24 hours. Over the past week, ETH has dropped by 12.86%, and over the last month, it has decreased by 28.28%. Additionally, Ethereum has experienced a 46.00% decline over the past year, indicating sustained bearish momentum.

Ethereum’s all-time high was $4,864.30 on November 10, 2021, while its lowest recorded price in recent years was $886.60 on June 18, 2022. Currently, technical indicators signal a strong sell trend, with both daily and weekly timeframes showing bearish signals.