- Analysis by CryptoQuant highlights a significant increase in short positions as Ethereum reached the $2,700 price level.

- Large Ethereum holders accumulated between October 19 and October 22, suggesting possible preparation for market movement.

Ethereum (ETH), recently witnessed a pullback below $2,600 following a peak that breached the $2,700 threshold. This decline has sparked discussions about the potential for a short squeeze, given the recent rise in leveraged short positions.

CryptoQuant’s analysis indicated a significant surge in short positions as ETH reached above $2,700, suggesting a collective anticipation of a retracement by traders. This action has introduced a dominant sell pressure that nudged ETH’s price down to $2,584.

Despite this downward trend, the situation sets a classic stage for a possible short squeeze due to the accumulation of leveraged positions.

The concept of a short squeeze occurs when the price of an asset increases significantly, forcing short sellers to buy back at higher prices to close their positions, thereby pushing prices even higher.

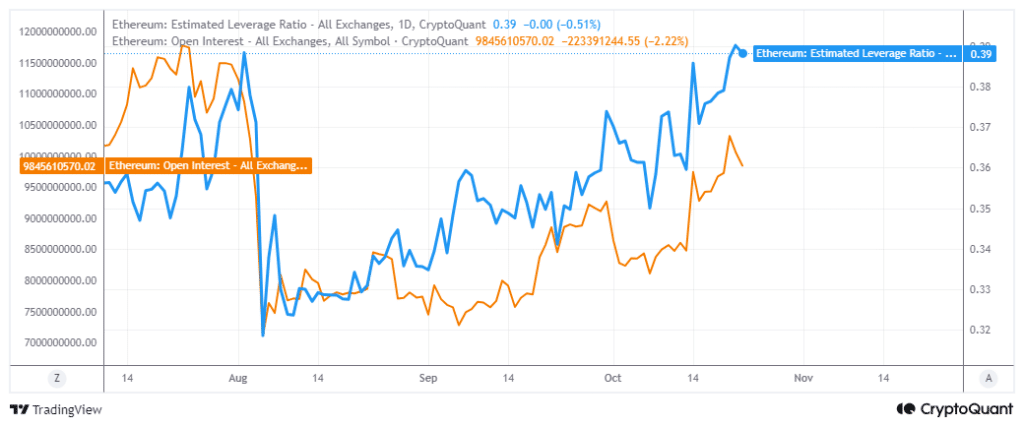

Ethereum’s derivatives market also shows signs of heightened activity with Open Interest—a measure of the total number of outstanding derivative contracts, such as options or futures, that have not been settled—increasing since early September.

This suggests a growing interest in Ethereum’s price movements, further evidenced by a spike in the estimated leverage ratio, a metric that reached heights last seen in July.

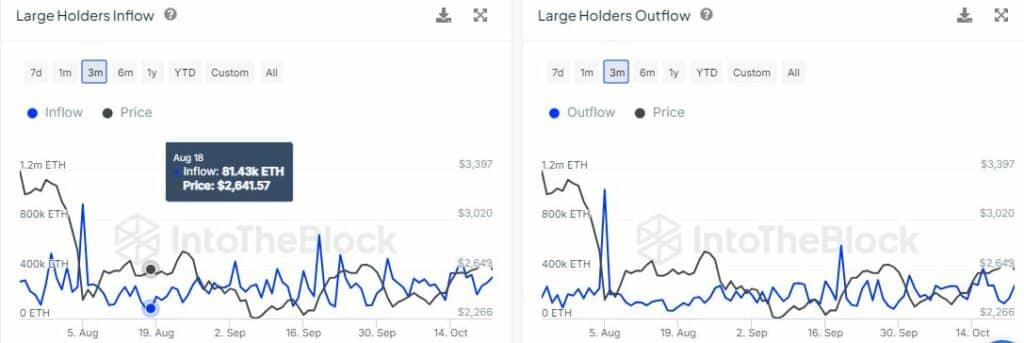

The chances of a short squeeze are also hinted at by movements of large holder activities. Data from IntoTheBlock revealed that from October 19 to October 22, Ethereum holdings in large addresses surged from 194,280 coins to 335,870 coins, indicating a lot of buying activity as prices fell.

Moreover, in the most recent 24 hours analyzed, large holders purchased an additional 68,690 ETH, valued at over $177 million. This purchasing behavior underscores a robust engagement from whales, potentially setting the stage for a market uplift to counter the prevailing short positions.

Overall, Ethereum’s market behavior continues to exhibit volatility, with a mix of bearish retractions and potential bullish undercurrents influenced by strategic large-scale transactions.

The current price of Ethereum (ETH) is approximately $2,540.2, showing a decline of -3.08%. It is currently in a downtrend, reflecting a market correction. The nearest support level is at $2,523.16, while the closest resistance is at $2,593.65.