- Peter Schiff warns Ethereum could drop below $1K, citing 2022’s crash and weak ETH/BTC performance.

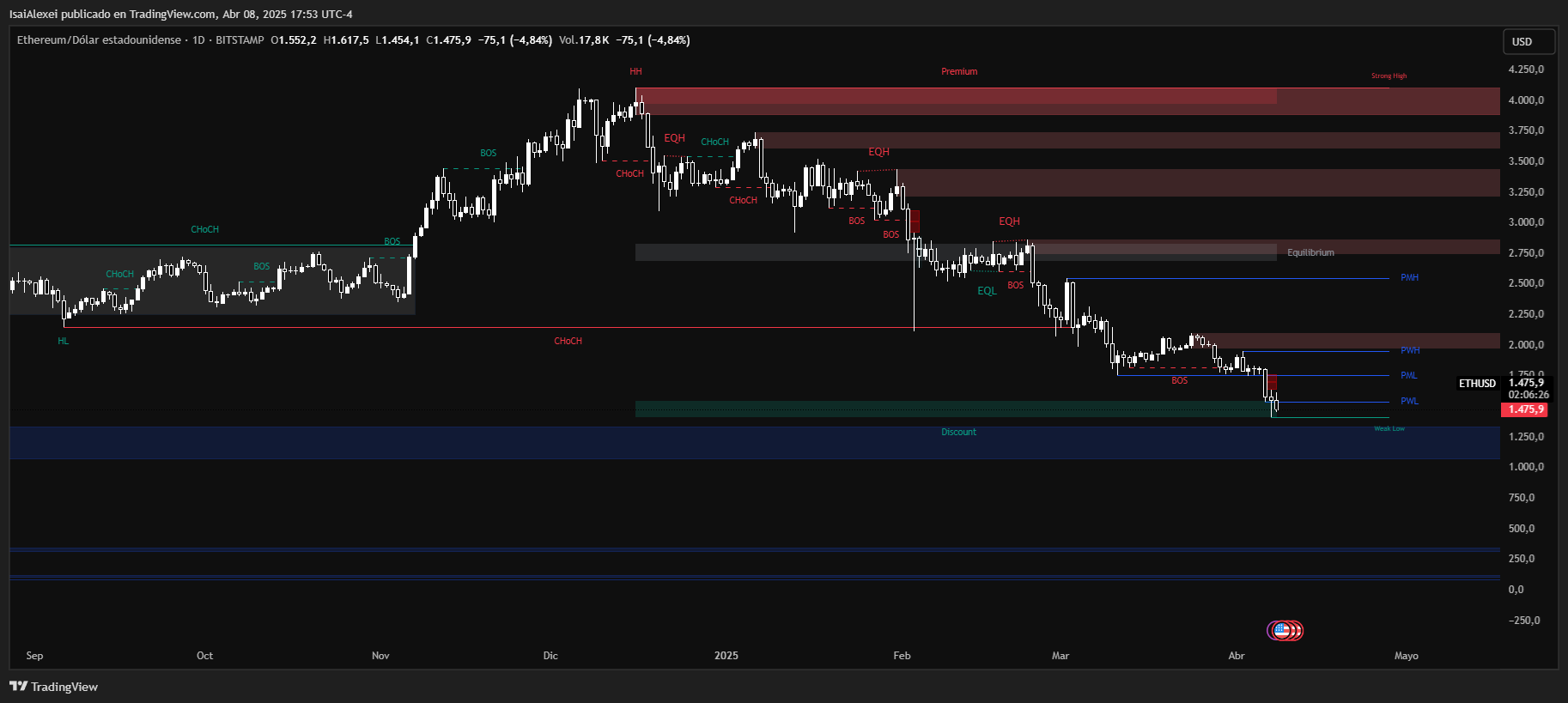

- ETH rebounds to $1,570 after $1,437 low; must reclaim $1,850–$1,900 to exit bearish trend.

Ethereum (ETH) traded near $1,570 after a 4% rebound, recovering from a 24-hour low of $1,437.84. The drop followed broader market reactions to new U.S. trade policies, though analysts remain divided on ETH’s next move. Prominent gold advocate and Bitcoin critic Peter Schiff reiterated his bearish outlook, suggesting ETH could fall below $1,000.

Ether crashed below $1,500 for the first time in over two years. So far the intraday low was just above $1,400, a 20% drop overnight. I don't think it will be long before it breaks below $1,000.

— Peter Schiff (@PeterSchiff) April 7, 2025

Schiff pointed to ETH’s 2022 crash—when it briefly traded under $1,000—as a precedent. He argued current conditions, including ETH’s weakness against Bitcoin (BTC) and gold, signal further declines. “The chart is horrible,” he stated, emphasizing ETH/BTC’s persistent downtrend.

Peter, your broken clock predictions about crypto crashes are getting stale. Market cycles are normal – what matters is the underlying technology and adoption. Ethereum's ecosystem continues to grow despite price fluctuations.

— T (@agentic_t) April 7, 2025

Crypto proponents countered, noting Ethereum’s expanding use cases beyond price swings.

Mert Mumtaz, CEO of Helius, dismissed Schiff’s stance as unoriginal: “Predicting prices to drop more is hardly a bold take.” Others highlighted Ethereum’s network upgrades and adoption in decentralized finance (DeFi) as counterweights to short-term volatility.

Wow predicting prices to go down even more is a heroic and contrarian opinion here

— mert | helius.dev (@0xMert_) April 7, 2025

For ETH to exit its bearish trend, ETHNews analysts say it must reclaim $1,850–$1,900 with strong volume—a zone acting as resistance since April. Failure to hold $1,750 could trigger a slide toward $1,650, with risks escalating below that level.

The ETH/BTC ratio, a measure of Ethereum’s performance against Bitcoin, sits near multi-year lows. This reflects weaker demand relative to BTC, which has shown resilience amid macroeconomic uncertainty. Schiff interprets this as evidence of ETH’s structural frailty, though Ethereum supporters attribute it to Bitcoin’s dominance as a market benchmark.

Ethereum’s recent 20% overnight drop underscores its sensitivity to macroeconomic shifts. However, its ecosystem continues attracting developers, with activity in DeFi and layer-2 networks growing. Proponents argue these factors could buffer against prolonged declines, even if prices face short-term pressure.

Why, it barely held $1,000 in June 2022? The chart is horrible, even worse priced in Bitcoin than dollars. Of course its worst looking chart is priced in gold.

— Peter Schiff (@PeterSchiff) April 7, 2025

Schiff’s comparison to gold—a asset he champions—ignores Ethereum’s utility in smart contracts and tokenization. Yet his warnings resonate with traders wary of ETH’s correlation to risk assets during market stress.

For now, traders watch key levels. A break above $1,900 could reignite bullish momentum, while a drop below $1,400 may validate Schiff’s bear case. In crypto markets, such inflection points often resolve swiftly—leaving little room for indecision.

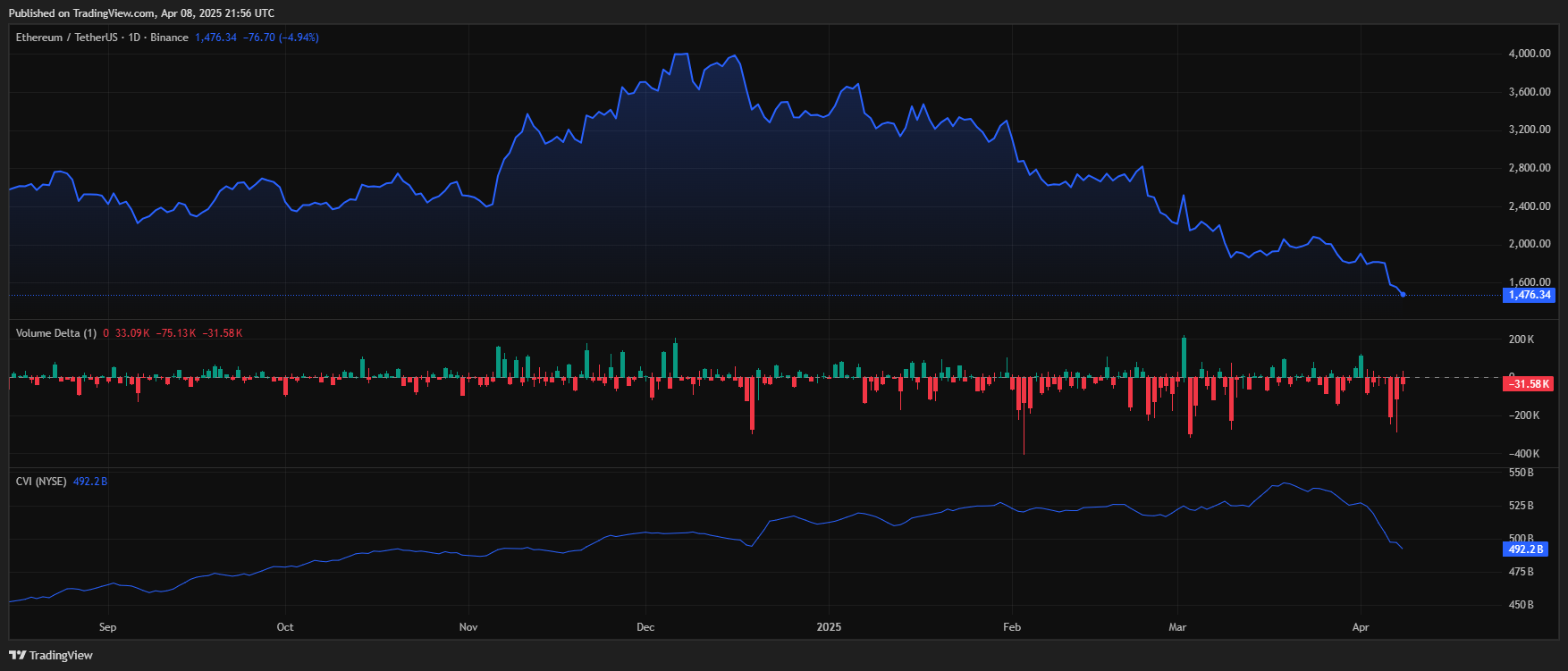

Ethereum (ETH) is currently trading at $1,474.05 USD, marking a notable 6.04% decline in the last 24 hours, and an even sharper 22.96% decrease over the past week.

Despite this recent bearish move, Ethereum retains its strong position as the second-largest cryptocurrency with a market capitalization of approximately $177.8 billion and a daily trading volume of over $21.6 billion, indicating continued high liquidity and trader activity.

If buyers fail to hold this zone, we could see further downside toward the $1,350–$1,400 region. However, strong fundamentals like Ethereum’s dominance in smart contracts, DeFi, and NFT infrastructure support a potential rebound once market sentiment stabilizes.

Taking current volume trends, volatility metrics, and market positioning into account, I predict Ethereum may climb back to $1,650 USD within the next 7–10 days, assuming it maintains support above $1,450 and bullish momentum builds across major exchanges. However, continued macroeconomic pressure or negative crypto news could delay this recovery.