- Ethereum’s resilience is evident as it maintains an uptrend, supported strongly at a price level above $3,700.

- SEC’s discussions on ETH staking in ETFs highlight regulatory dynamics impacting yields and network decentralization.

Today, Ethereum’s price displayed a sharp decline from above $3,900 to below $3,800, stirring discussions among traders and analysts regarding the cause of this sudden drop. Some market observers point to a transaction by a Maximum Extractable Value (MEV) trading firm, Symbolic Capital Partners, as a potential catalyst.

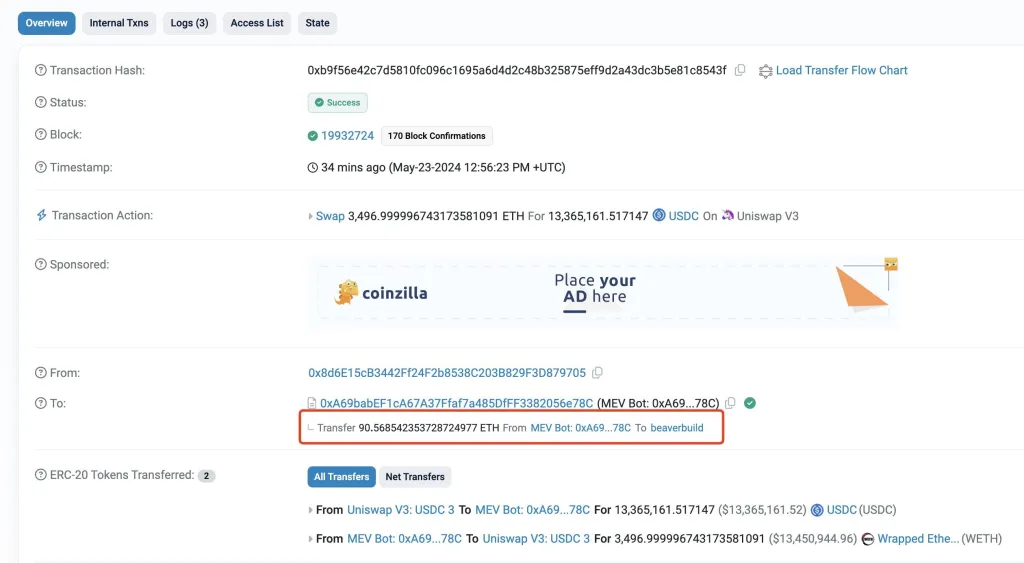

Reports suggest that Symbolic Capital Partners executed a large sell-off involving 6,968 ETH, valued at over $27 million. This sell order, averaging a price of $3,930 per ETH, was completed within one minute, with one of the transactions involving a single sale of 3,497 ETH.

It’s noted that this large transaction included a “high bribe fee” of 90 ETH, indicative of the complex within cryptocurrency transactions where transaction priority can be bought at a premium.

While the specific reasons behind this large-scale sell-off remain unclear, the timing and scale of the transaction coincided with the observed volatility in Ethereum’s price. This has led to speculation that such large transactions are influencing market conditions by triggering rapid price fluctuations.

Despite this episode of volatility, Ethereum continues to maintain an upward trend overall. As of the latest evaluations, Ethereum has risen 30% from its lows in May 2024, demonstrating resilience and potential for further gains.

Ethereum’s price remains well supported above $3,700, a level that previously acted as resistance and now serves as a strong base for potential future rallies.

The broader market sentiment towards Ethereum remains optimistic

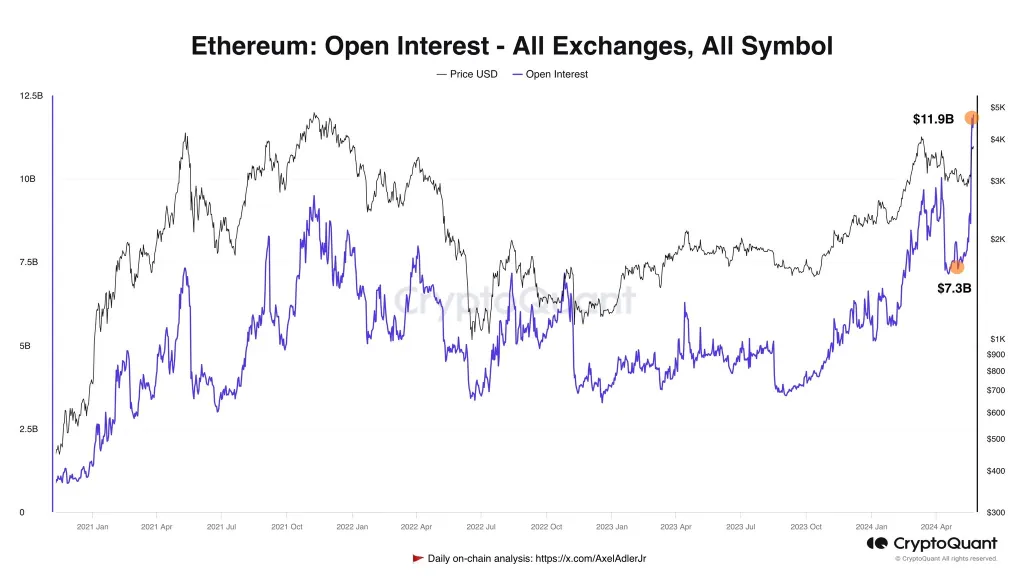

Analysis of the derivatives market shows a significant increase in open interest in Ethereum futures, totaling over $4.6 billion across several major exchanges, including Binance, OKX, and Bybit. This rise in open interest suggests a growing confidence among traders in Ethereum’s market prospects, reflecting an expectation of continued positive performance.

In addition to market trading dynamics, regulatory developments also play a crucial role in shaping the outlook for Ethereum. The excitement around Ethereum has been partly fueled by the progress in the approval process for spot ETFs by the SEC.

The SEC’s ongoing discussions with potential issuers about the specifics of these ETFs, especially concerning aspects like ETH staking, underscore the regulatory attention Ethereum is currently receiving.

Analysts have debated the implications of allowing staking for spot Ethereum ETFs. Some argue that permitting ETF issuers to stake could diminish yields and make individual staking less rewarding, which might affect the network’s decentralization.

This discussion highlights the complexities of integrating traditional financial instruments with decentralized technologies, illustrating the evolving relationship between regulation, market practices, and technology in the blockchain space.