- Ethereum whale sells 6,900 ETH, deviating from previous acquisition of 65,000 ETH between January and May.

- Despite significant whale sales, Ethereum’s netflow on exchanges remains balanced, indicating a stable trading environment.

Recently, Ethereum witnessed a transaction, a “whale,” sold approximately 6,900 ETH, which was valued around $17.87 million. This departure from the whale’s previous accumulation from January to May, where about 65,000 ETH were purchased, worth over $196 million.

Following this accumulation phase, the whale began divesting in July, with more than 21,000 ETH already sold.

A whale deposited 6,900 $ETH($17.87M) to #Binance again 30 minutes ago.

This whale withdrew 65K $ETH($196.4M) at $3,021 from exchanges between Jan 28 and May 28.

Then he started selling $ETH on Jul 16, having sold 21,865 $ETH($67.24M) at an average price of $3,075.… pic.twitter.com/3jQebO4QQ6

— Lookonchain (@lookonchain) August 29, 2024

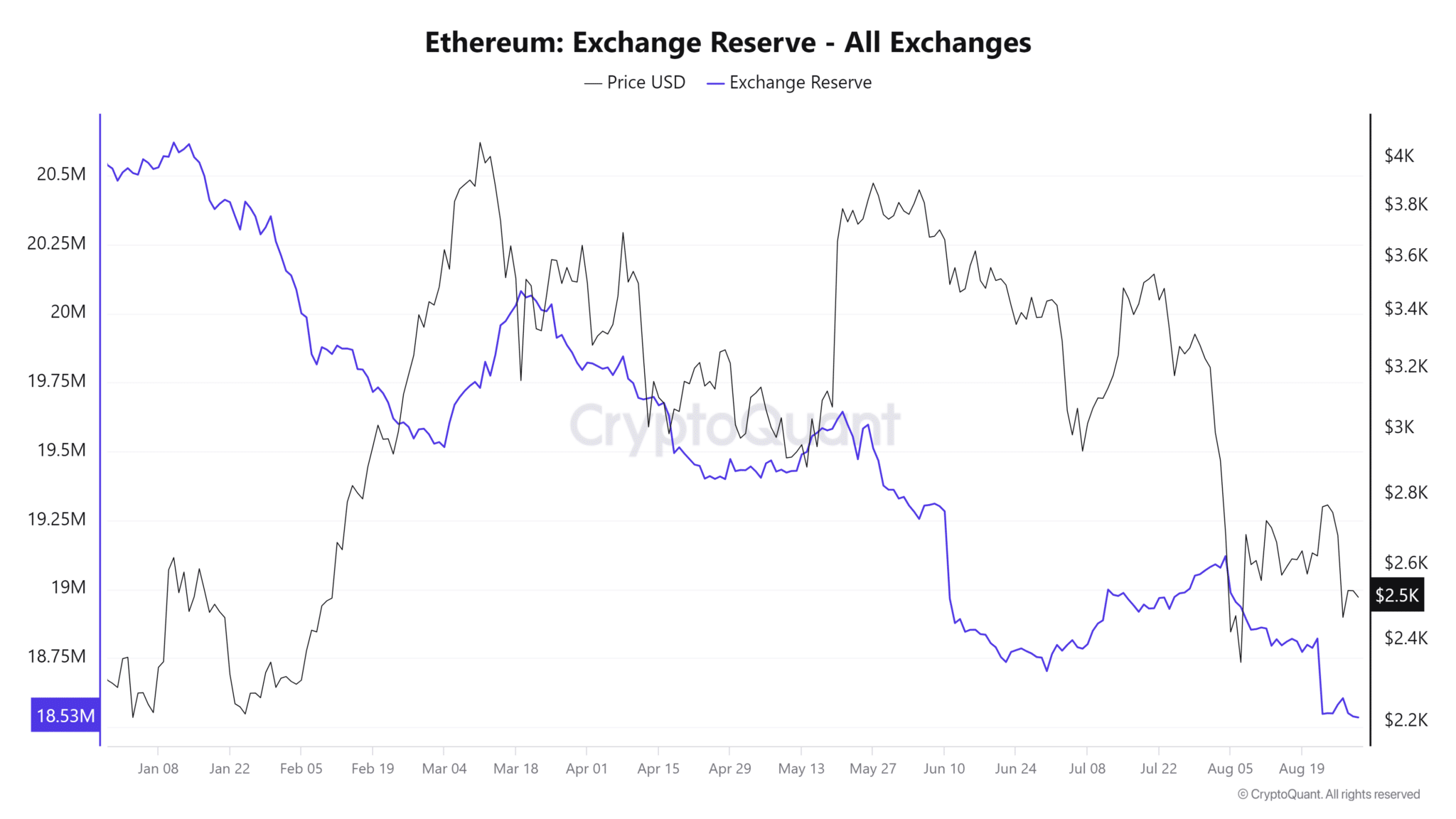

Analysis by ETHNews of Ethereum’s flow on exchanges suggests a balanced market despite these sales. Data from CryptoQuant reveals that the netflow of Ethereum—which measures the total inflows and outflows on exchanges—has not shown a strong bias towards either, indicating a stable exchange environment.

The balance implies that while some large-scale exits occur, there is a similar scale of entries or holdings maintained by other market participants.

Ethereum’s exchange reserves have been trending downward, a pattern that continues despite periodic fluctuations. For instance, after peaking briefly at about 18.6 million ETH on August 27, reserves dipped again to 18.5 million ETH.

This persistent decline in reserves typically signals that a substantial quantity of Ethereum is being moved off exchanges for longer-term holding, which could be a positive sign for the currency’s value stability if demand remains consistent or increases.

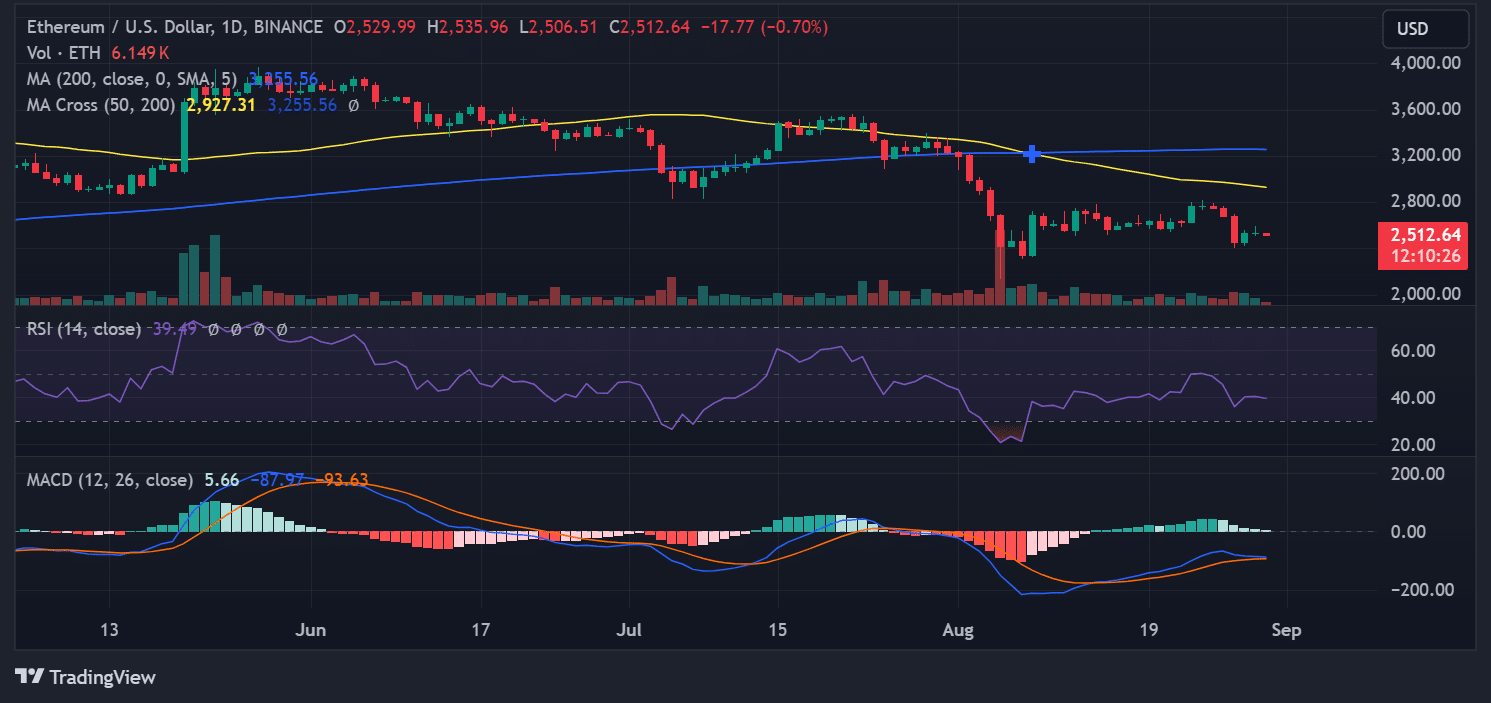

On the trading front, Ethereum’s current price trends are less optimistic. The cryptocurrency is trading around $2,512, with a decline of nearly 1% recently. Technical indicators like the Moving Average Convergence Divergence (MACD) and Relative Strength Index (RSI) reflect this bearish sentiment.

The RSI is under 40, suggesting a strong downward trend, and the MACD signal lines are below zero, which traditionally points to continued bearish control despite any temporary positive movements in the MACD histogram.

These various indicators—whale activities, exchange reserves, and technical analysis—provide a comprehensive view of Ethereum’s current market dynamics.

While the selling by holders introduces potential pressures, the steady state of exchange flows and the decrease in available exchange reserves might cushion against drastic price drops, maintaining a delicate balance in the market.