- Daily new Ethereum addresses spiked to over 126,000, highest since June, indicating increased network engagement.

- Monochrome Asset Management applies for new spot Ethereum ETF in Australia, reflecting interest in direct crypto exposure.

Ethereum, the prominent blockchain network, has recently seen varying patterns in ownership and network engagement.

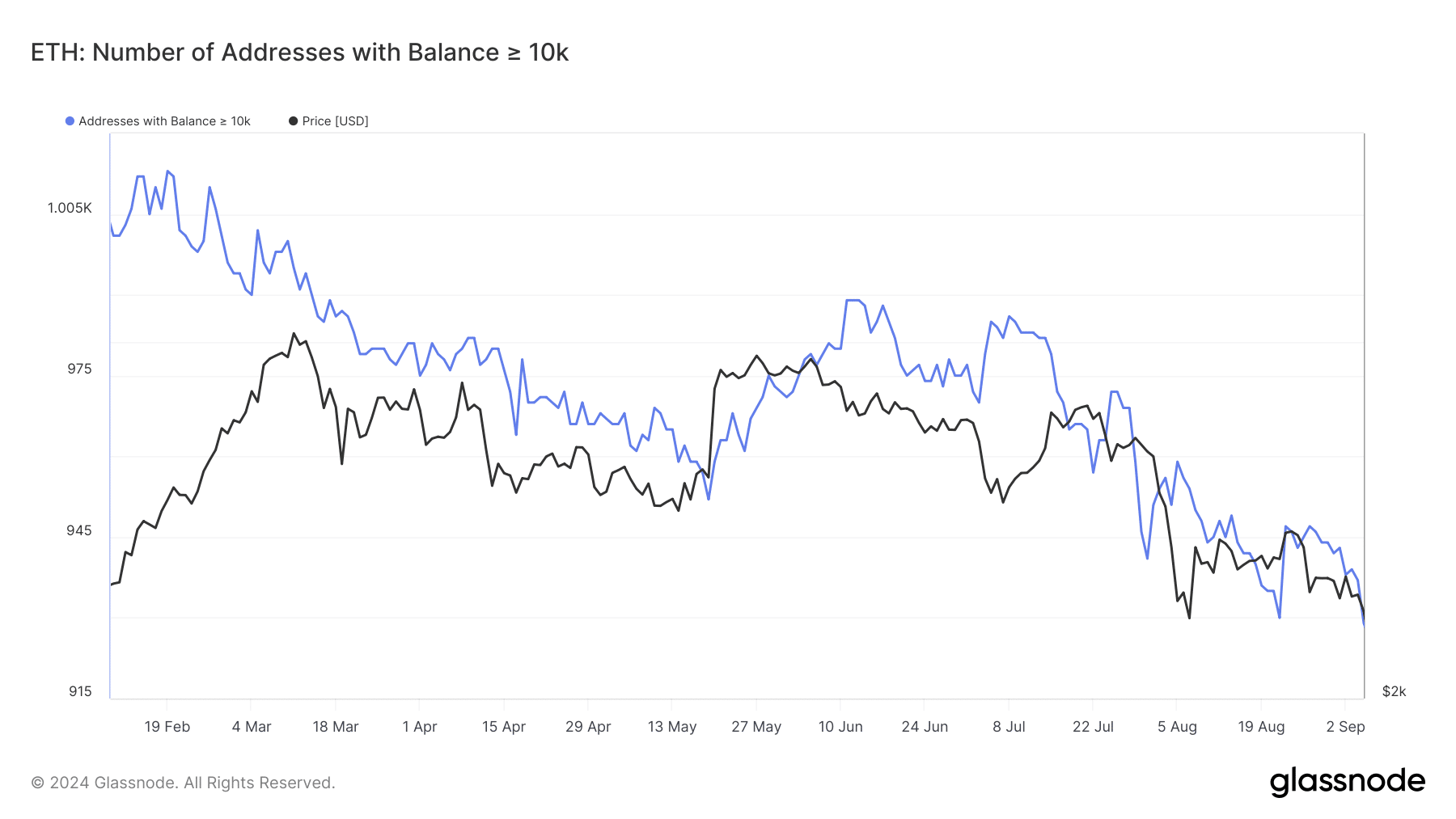

Glassnode’s data analysis indicates that Ethereum’s larger holders, often referred to as whales, have reduced their pace of acquiring more Ethereum.

Specifically, those holding between 1,000 to 10,000 ETH have halted their accumulation and begun to decrease their holdings since late August.

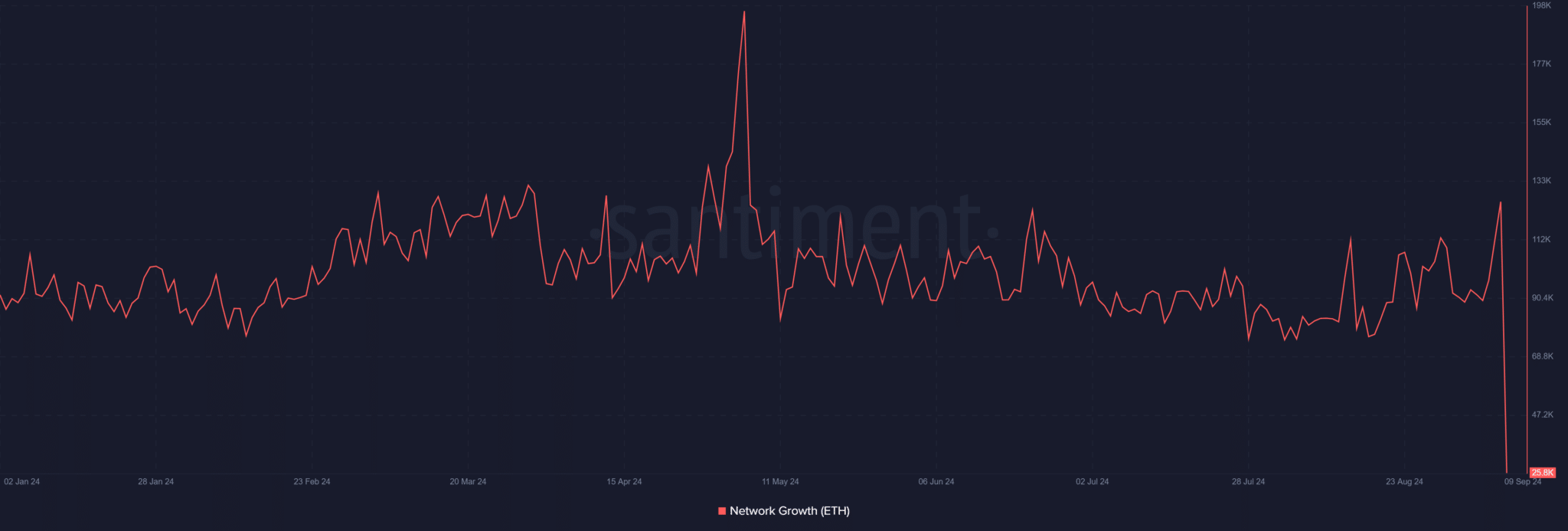

Simultaneously, the network has recorded an increase in new Ethereum addresses, suggesting rising activity and engagement.

Santiment, a blockchain analytics firm, reported that the daily creation of new Ethereum addresses had reached over 126,000, a peak not seen since June.

This increase in activity occurred on a typically low-activity day, which may highlight a rise in user engagement. These contrasting behaviors among Ethereum stakeholders come at a time when the market for Ethereum-based financial products is also changing.

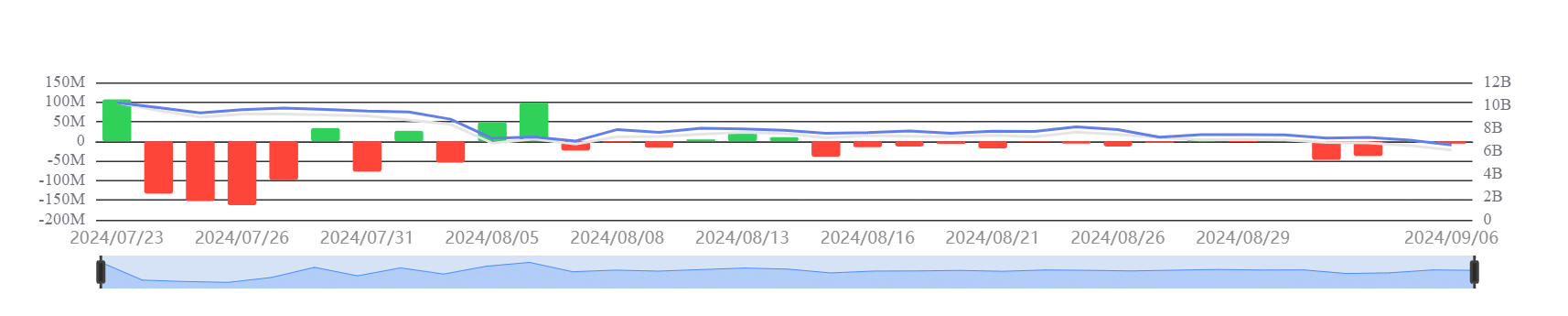

Notably, the ETF market for Ethereum has witnessed differing strategies by major asset managers.

For instance, Monochrome Asset Management in Australia has applied to list a new spot Ethereum ETF, aiming to provide direct exposure to Ethereum.

On the other hand, VanEck announced the closure of its Ethereum futures ETF due to low demand, illustrating a shift in investor preference towards spot ETFs over futures-based offerings.

This week, while some spot Ethereum ETFs experienced outflows, Monochrome’s move reflects an interest in expanding Ethereum’s accessibility through traditional financial markets.

The reduction in Ethereum holdings by large investors and the adjustment of ETF offerings could suggest a reassessment of Ethereum’s near-term financial prospects.

Ethereum Foundation and Vitalik Buterin’s Recent Transactions

Recent blockchain analysis has shown that the Ethereum Foundation has sold 450 Ethereum, worth approximately $1.0364 million, via Cow Protocol, redirecting these funds to other Ethereum Foundation addresses. This sale is part of a series of transactions that began following the introduction of spot Ethereum ETFs in June.

Additionally, Vitalik Buterin, Ethereum’s co-founder, is linked to a multi-signature wallet that has also been active in the market. This wallet received a total of 3,800 Ethereum from Buterin in late August, valued close to $9.99 million. Subsequently, this wallet has been offloading Ethereum, suggesting a strategic reduction in Buterin’s Ethereum holdings.

Market Response to High-Profile Ethereum Sales

These sales from both the Ethereum Foundation and Buterin have occurred alongside fluctuations in Ethereum’s market price. After a notable dip to $2,150, the price of Ethereum saw a modest recovery to $2,327.65, indicating a slight increase of 1.18% within 24 hours.

[mcrypto id=”12523″]Ethereum (ETH) is currently trading at $2,290.96 USD, up 0.78% in the last 24 hours, with a day’s range of $2,285.53 – $2,335.96. Its market cap is $275.658 billion, and the 24-hour trading volume stands at $13.26 billion.

Ethereum is testing resistance near $2,335.96, and a break above could lead to further gains, while support at $2,285.53 provides stability. The short-term momentum is bullish, with strong market participation, and the RSI suggests room for continued upward movement.