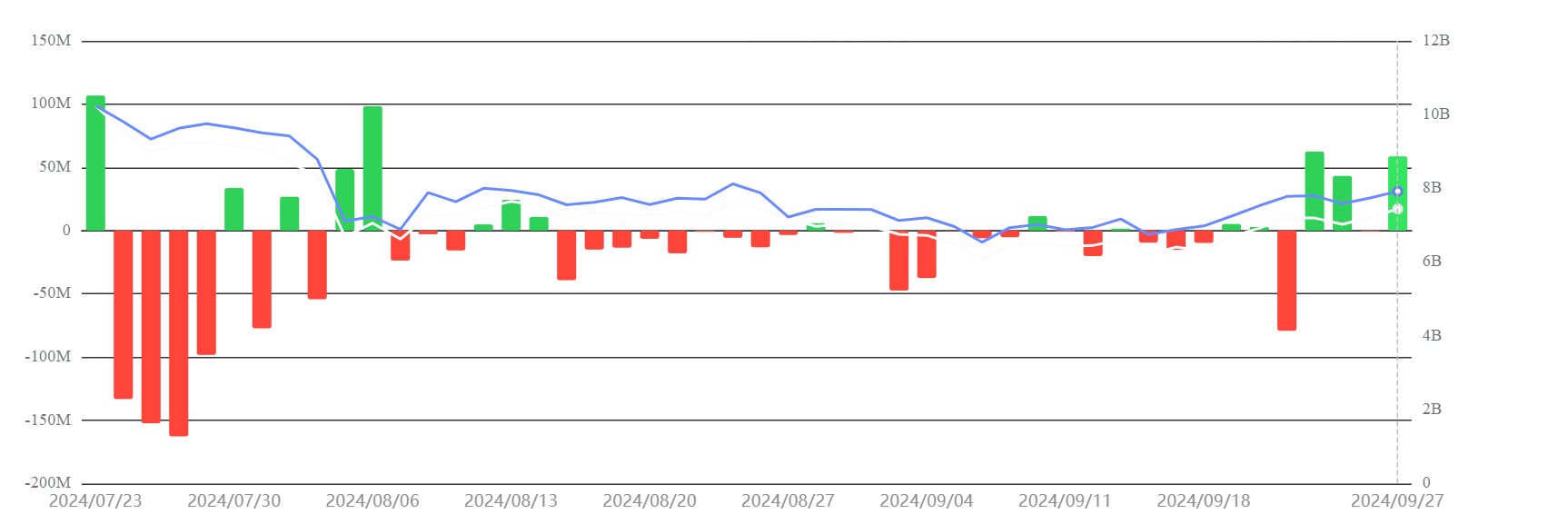

- Ethereum ETFs registered $84.6 million in weekly inflows, the highest since early August, signaling renewed investor interest.

- BlackRock’s ETHA and Fidelity’s FETH drove the inflow, with ETHA’s assets surpassing $1 billion shortly after launching.

Ethereum ETFs observed a weekly inflow of $84.6 million, marking a significant uptick and the highest since the beginning of August.

This boost in inflows suggests a renewed investor interest in Ethereum, although these funds still substantially trail behind Bitcoin ETFs, which captured $1.11 billion in the same period.

The increase in Ethereum inflows ended a streak of six weeks of outflows, with substantial contributions from BlackRock’s ETHA and Fidelity’s FETH, injecting $95.5 million and $64.8 million, respectively. Notably, ETHA’s total assets under management crossed the $1 billion threshold, ranking it within the top 20% of U.S. ETFs shortly after its introduction.

Bitcoin ETFs continue to dominate the sector, benefiting from an earlier launch that provided a first-mover advantage and attracting significantly higher investment volumes. Following Ethereum ETFs’ introduction, these funds saw about $500 million in net outflows, whereas Bitcoin ETFs have recorded over $5 billion in net inflows.

The preference for Bitcoin over Ethereum in the ETF market is partly due to Bitcoin’s larger share of the overall cryptocurrency market capitalization—over 50%, compared to Ethereum’s 14%. This disparity influences investor behavior, favoring the more liquid and widely held Bitcoin.

In recent trading sessions, Ethereum’s price has declined, falling below the $2,600 level. Despite this downturn, Ethereum maintains a position above its 50-day moving average, indicating a potential short-term upward trend.

The Relative Strength Index (RSI) for Ethereum is currently at 53, suggesting that the asset could sustain its momentum.

Sept 30 Update:

10 #Bitcoin ETFs

NetFlow: +7,111 $BTC(+$453.42M)🟢#ARK21Shares inflows 3,085 $BTC($196.71M) and currently holds 50,684 $BTC($3.23B).9 #Ethereum ETFs

NetFlow: +9,927 $ETH(+$25.95M)🟢#Fidelity inflows 15,750 $ETH($41.17M) and currently holds 161,500… pic.twitter.com/nSTZc1WBA7— Lookonchain (@lookonchain) September 30, 2024

Looking ahead, there is a cautious optimism about Ethereum ETFs, especially given that October has historically been a positive month for the cryptocurrency market. Meanwhile, the Ethereum Foundation has been converting some of its holdings into DAI, a stablecoin, to fund various research and development projects aimed at enhancing the Ethereum network.

[mcrypto id=”12523″]The current price of Ethereum (ETH) is $2,609.7, up 0.32% over the past 24 hours. Over the past month, it has seen a growth of 3.86%, though over the past six months it has declined by 21.19%. The market cap of Ethereum is approximately $314.12 billion.