- Ethereum sees a decline in active users and NFT market presence, with Bitcoin surpassing its sales and transactions.

- Notable decreases in popular NFT collections like Bored Ape and Mutant Ape contribute to Ethereum’s reduced network activity.

Base has recently surpassed Ethereum in terms of trading volumes on Uniswap, one of the largest DEX platforms. This development marks a shift as Ethereum, previously the dominant player in the crypto network, experiences stagnation with a noticeable decline in active addresses.

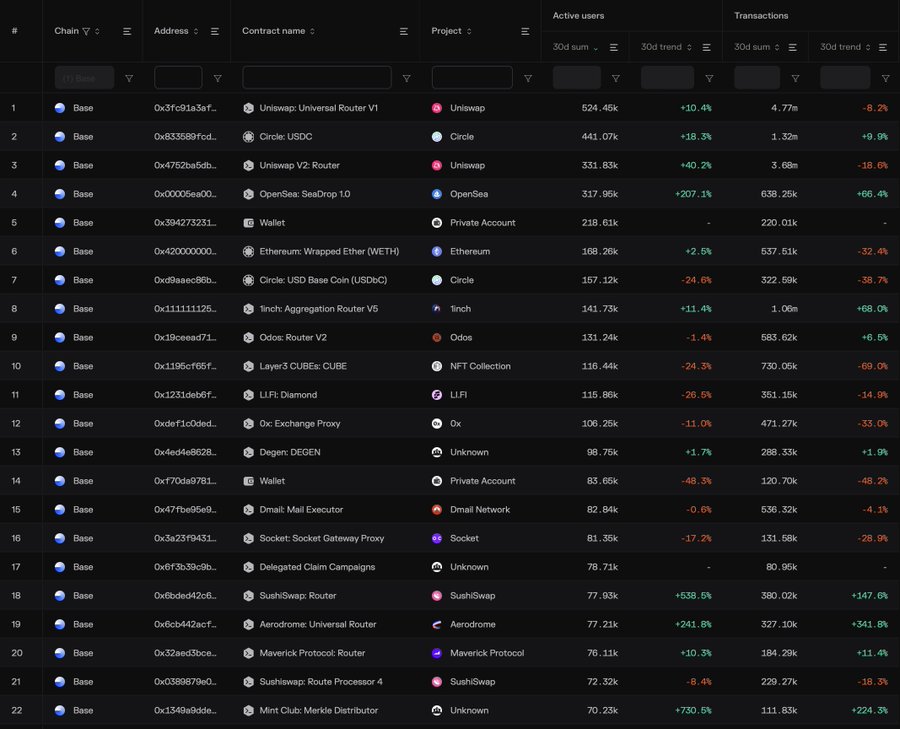

🔵Top contracts on @base based on monthly active users.

Top 10 applications:

1. @Uniswap

2. @circle

3. @opensea

4. @1inch

5. @odosprotocol

6. @lifiprotocol

7. @0xProject

8. @Dmailofficial

9. @AerodromeFi

10. @SushiSwap pic.twitter.com/w1XjDWNVQg— Token Terminal (@tokenterminal) June 9, 2024

Ethereum Faces Competition in DEX Usage

Base, a rising contender in the blockchain realm, achieved a higher percentage of daily active users on Uniswap, recording 36.30% compared to Ethereum’s 23.74%. This data, provided by Token Terminal via a tweet, underscores the increasing competition Ethereum faces not just from Base but also from other networks like Polygon [MATIC] and Solana [SOL], particularly in sectors like non-fungible tokens (NFTs).

Challenges in the NFT Market

Ethereum’s position in the NFT market has also seen challenges. According to ETHNEws, review of Bitcoin has overtaken Ethereum as the leading network in NFT sales volume and number of transactions.

Furthermore, popular NFT collections such as Bored Ape Yacht Club and Mutant Ape Yacht Club have experienced declines in floor prices and sales volumes, contributing to the reduced activity on Ethereum’s network.

Impact on Ethereum’s Network Activity

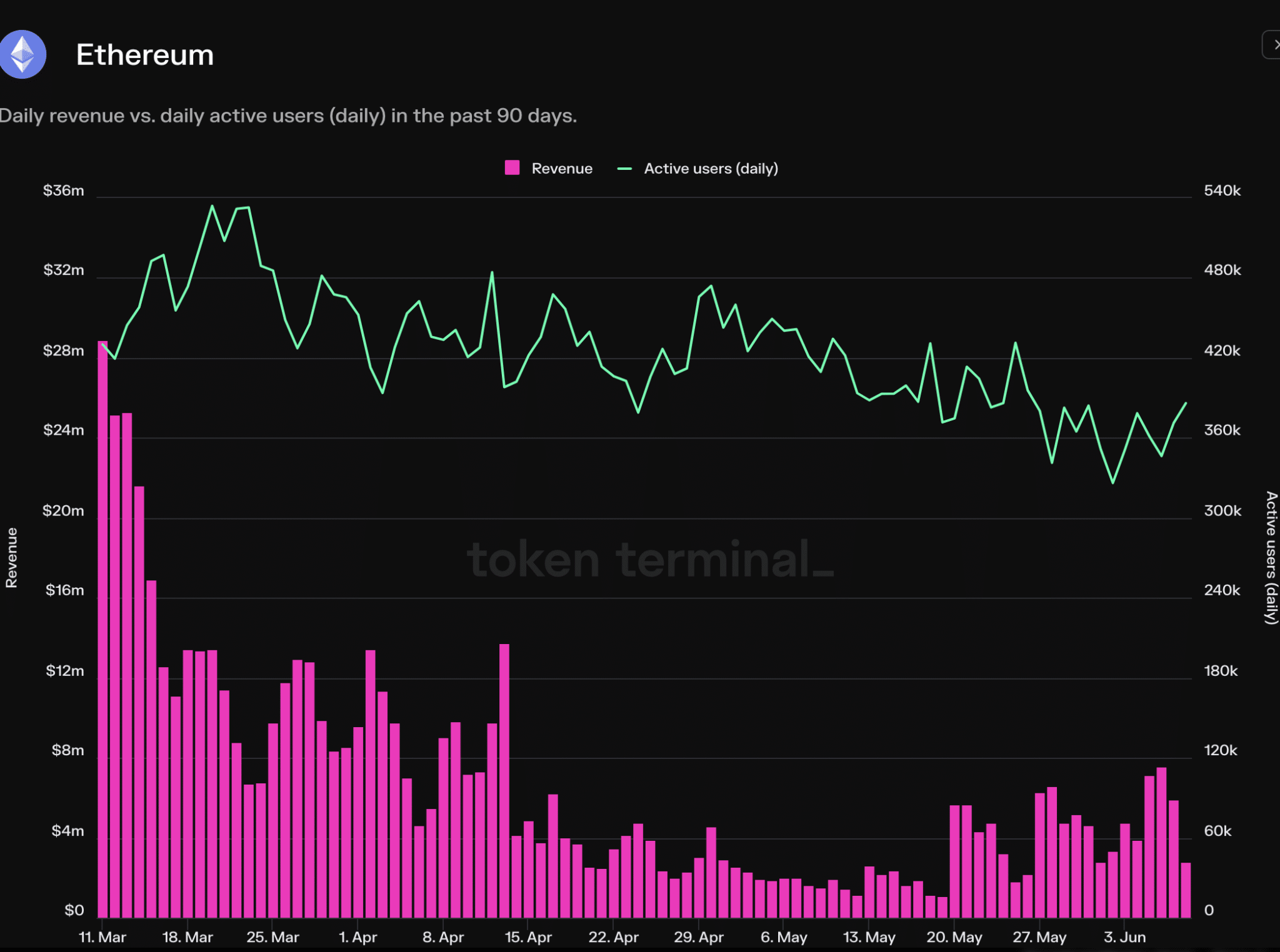

The reduced enthusiasm for Ethereum’s offerings has led to a decline in its network activity.

Token Terminal’s data analysis revealed a 5.8% drop in daily active addresses on Ethereum last month, which coincided with a decrease in network revenue.

ETH Price and Market Outlook

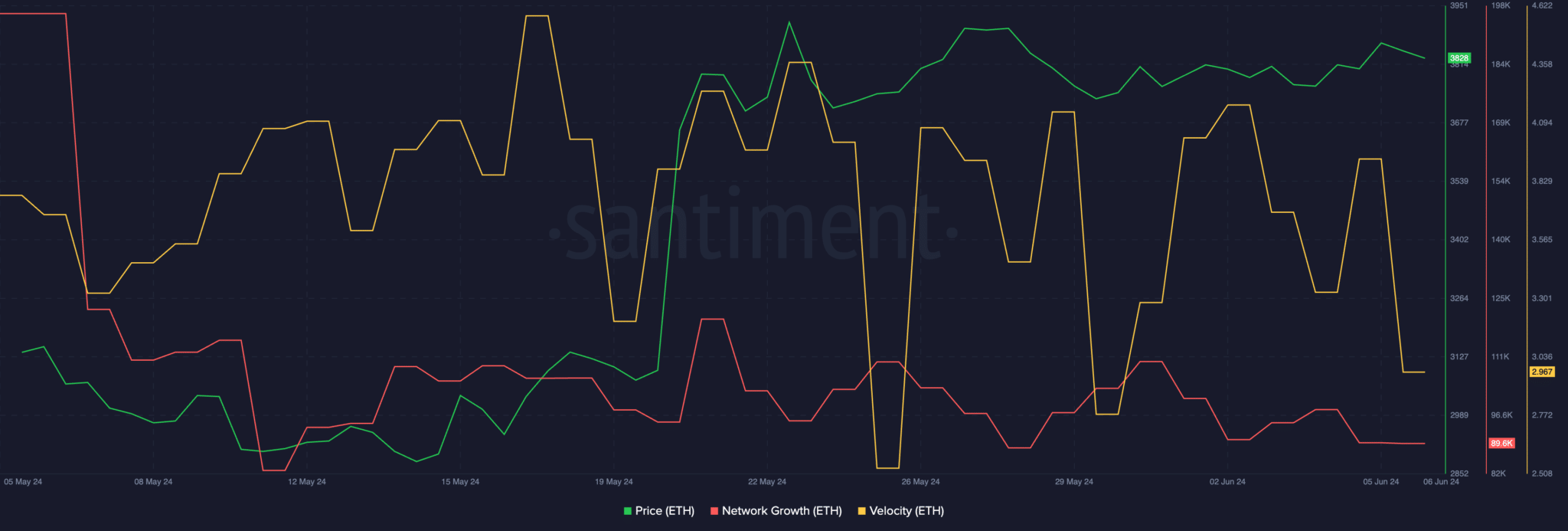

Despite these setbacks, the price of Ethereum’s native token, ETH, remains relatively stable. As of the latest update, ETH was trading at $3,688.41, with a minor correction of 0.13% over the last 24 hours. The trading velocity of ETH has decreased, indicating a lower frequency of transactions involving the token.

[mcrypto id=”12523″]

Looking forward, the Ethereum network might see changes with the potential approval of additional Ethereum ETFs and more clarity around them. With the possibility of increased institutional investment from Wall Street, Ethereum could experience another uptick in both interest and value.