- Whale addresses (10k+ ETH) dropped 10% since February; retail transactions slowed amid broader market caution.

- DApp demand drives ETH fees, but investor skepticism grows as Bitcoin’s stability overshadows Ethereum’s utility.

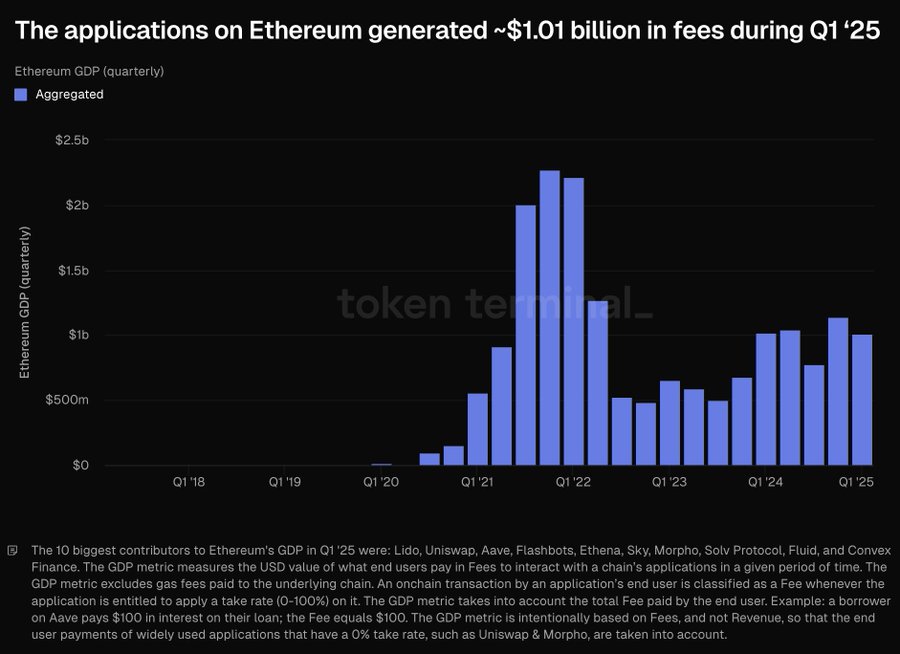

Ethereum’s decentralized applications (DApps) generated $1.01 billion in fees during the first quarter of 2025, according to on-chain data. This figure highlights continued demand for Ethereum-based services, from decentralized finance protocols to gaming platforms.

However, the network’s native token, ETH, fell 41.63% in value between January and April, underperforming Bitcoin and the S&P 500.

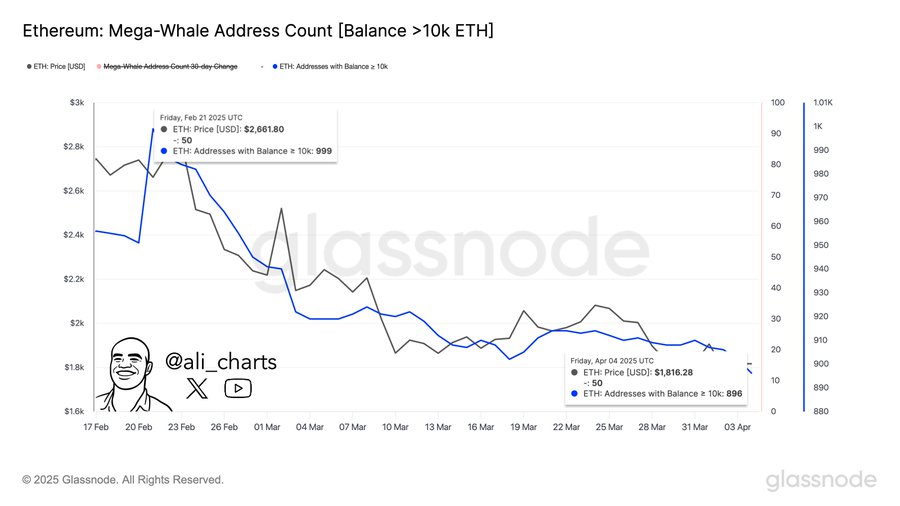

Whale Activity Drops as Retail Participation Slows

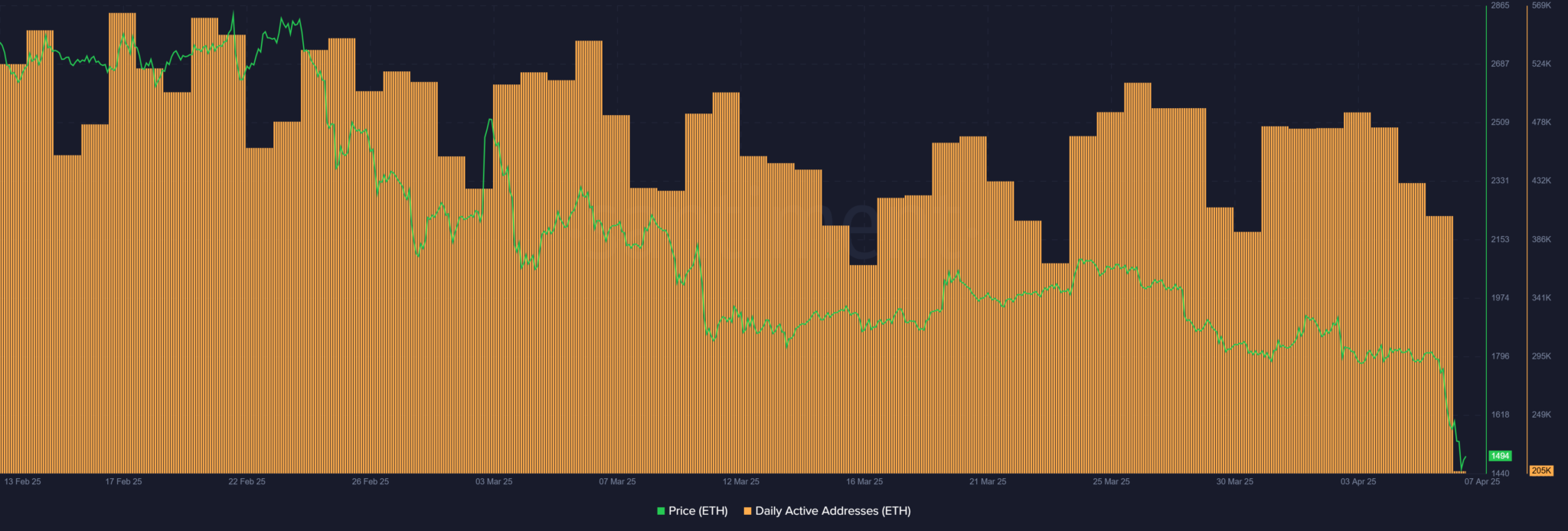

The number of wallets holding at least 10,000 ETH declined by 10% from February to April, dropping from 999 to 896. This reduction suggests larger investors may be redistributing holdings or reducing exposure. Retail activity also weakened, with smaller transactions slowing. The trend contrasts with Ethereum’s DApp revenue growth, raising questions about ETH’s appeal as an investment.

Ethereum’s DApp ecosystem thrives, but ETH’s price struggles signal a disconnect. Users pay fees in ETH to interact with applications, yet the token’s value fell sharply. ETHNews analysts note that Bitcoin’s relative stability during this period has shifted perceptions, with some investors viewing it as a more reliable store of value.

The decline in whale holdings and retail activity suggests skepticism about ETH’s short-term prospects. While DApps drive transactional demand, broader market sentiment appears cautious. Ethereum’s role as a platform for innovation remains intact, but its position as a preferred asset faces challenges.

Bitcoin’s resilience contrasts with ETH’s volatility, intensifying debates about Ethereum’s long-term role. The network’s ability to generate fees underscores its utility, but ETH’s price drop reflects concerns about competition, regulatory pressures, or shifting investor priorities.

For now, Ethereum’s dual narrative persists: a bustling DApp economy coexists with a struggling token. Whether developers and users can sustain fee revenue—and whether ETH recovers—will shape its trajectory in 2025.

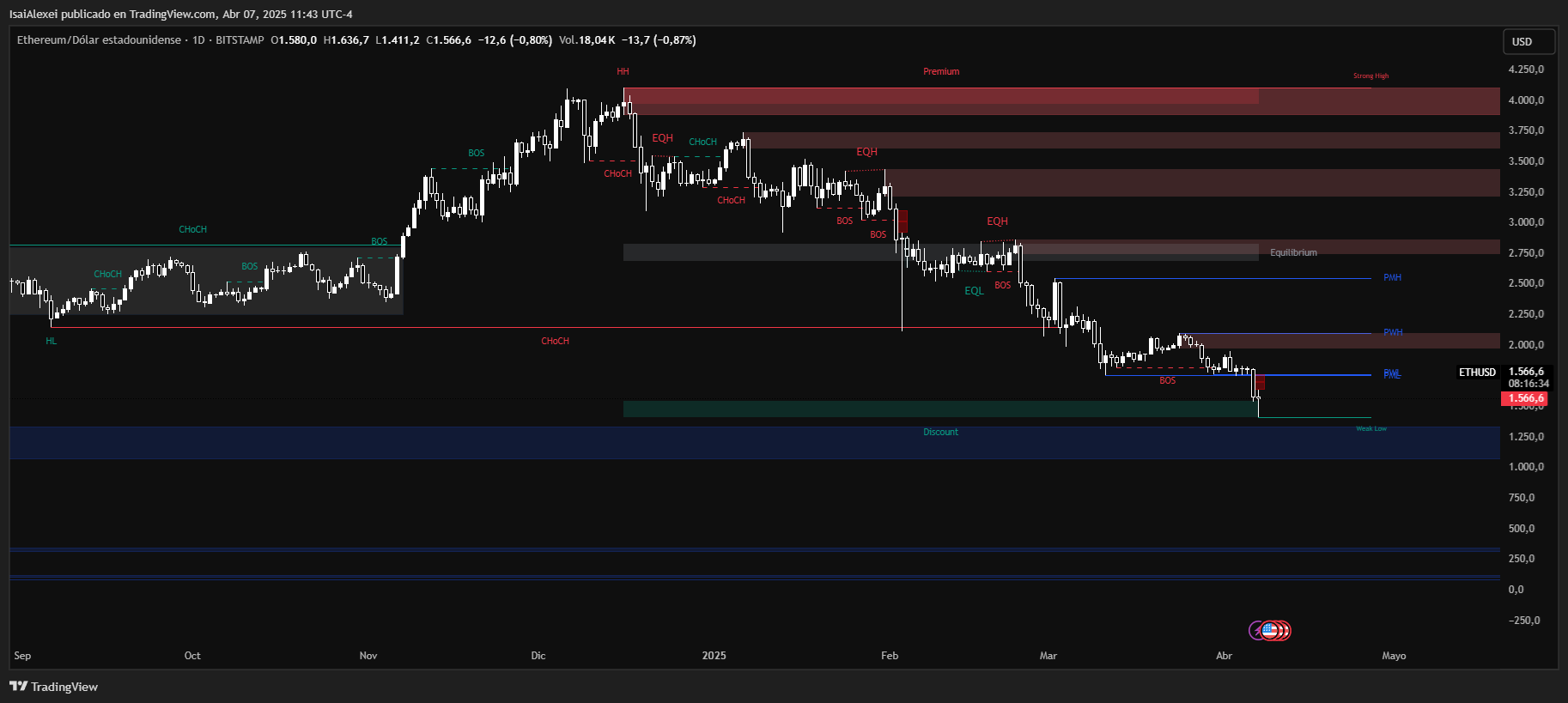

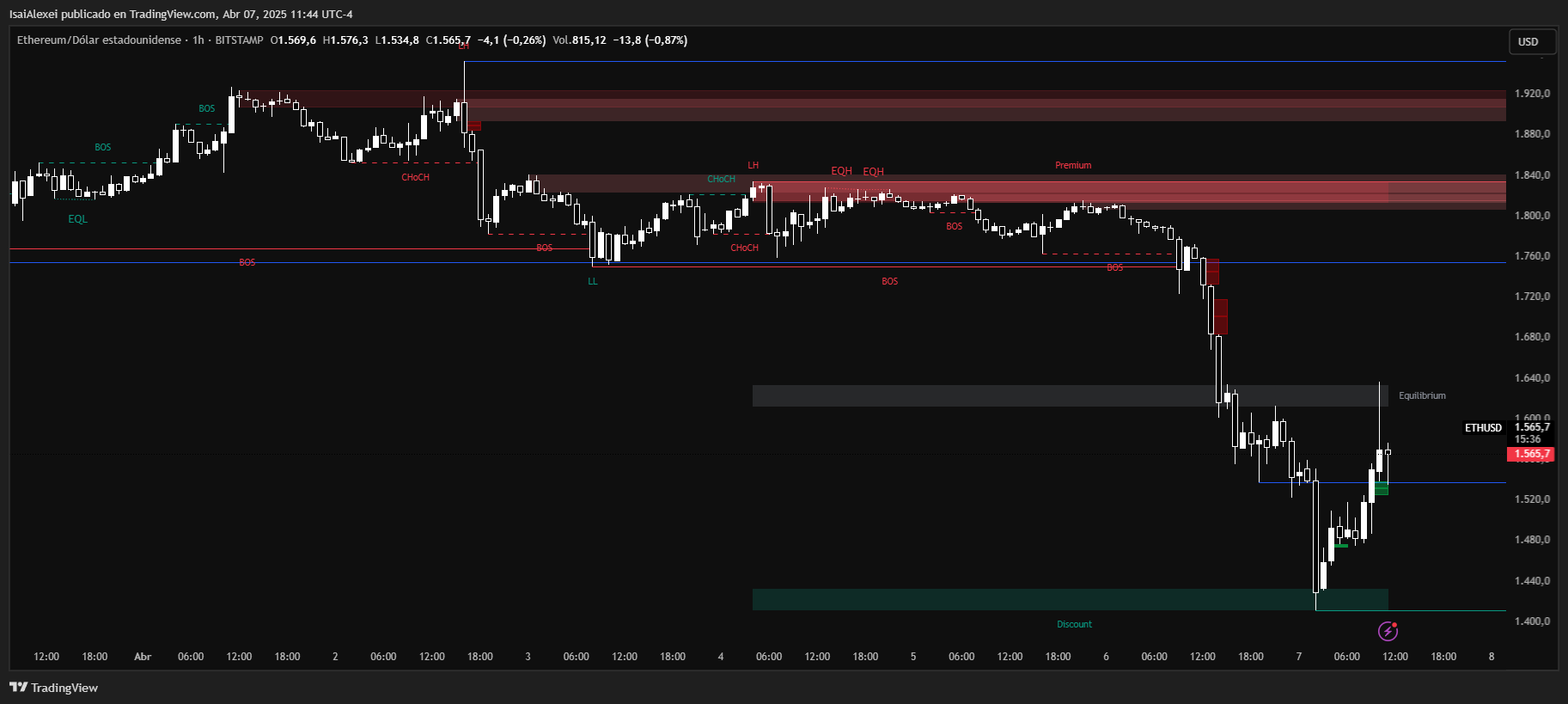

Ethereum (ETH) is trading at $1,559.90 USD, marking a −1.22% drop for the day. This decline continues a broader bearish trend that has seen ETH fall −13.78% over the past week and −27.12% in the last month. The year-to-date losses are significant, standing at −53.22%, and bringing ETH back to levels not seen since early 2023. This dramatic correction has now erased more than 65% from Ethereum’s 2024 highs, with the market facing persistent sell pressure.

The breakdown below the critical $1,800 support was a major technical event, signaling further weakness. With ETH now hovering just above the $1,500 zone, traders are eyeing this level as the last stronghold before deeper capitulation. If the $1,500 floor fails to hold, the next major support lies between $1,000 and $1,200, which could act as a long-term demand zone.