- Decrease in exchange-held Ethereum could lead to higher market volatility due to reduced liquidity.

- Retail interest remains steady but insufficient to significantly influence Ethereum’s market price amid slow network growth.

Recent data suggests a trend in Ethereum management, with more holders transferring their tokens from exchanges to personal wallets. This movement reflects a shift in the cryptocurrency’s ecosystem, characterized by an increased preference for self-custody.

Trends in Holding and Liquidity

According to recent figures, the top 100 exchange wallets have dropped to their lowest levels since May 2018, now holding only 8.41 million ETH. This decline in Ethereum stored on exchanges indicates that holders are opting to manage their assets independently, thereby decreasing the amount of Ethereum controlled by centralized platforms.

🐳 The top 100 Ethereum wallets on exchanges recently fell below its May, 2018 all-time low, now at 8.41M total $ETH. This is a sign of increasing distribution over time.

Meanwhile, the top 100 non-exchange wallets tell the opposite story, holding an all-time high 68.39M $ETH. pic.twitter.com/OS0t4ByaNQ

— Santiment (@santimentfeed) June 14, 2024

In contrast, the top 100 non-exchange wallets have reached a record high, holding 68.39 million ETH. This trend toward self-custody not only grants holders more personal control over their assets but also supports the decentralized nature of blockchain technology.

Implications of Reduced Exchange Liquidity

This shift could affect Ethereum’s market dynamics. A reduction in the number of Ethereum tokens available on exchanges may decrease liquidity and lead to greater price volatility. As the supply available for trading drops, price fluctuations could become more frequent and intense in response to market activity.

Selling Trends Among Major Holders

While the move toward decentralization is generally viewed positively, there is an emerging trend where some large Ethereum holders are selling their stakes without buying more. This behavior might lower Ethereum’s price in the future.

Retail Investment and Network Growth

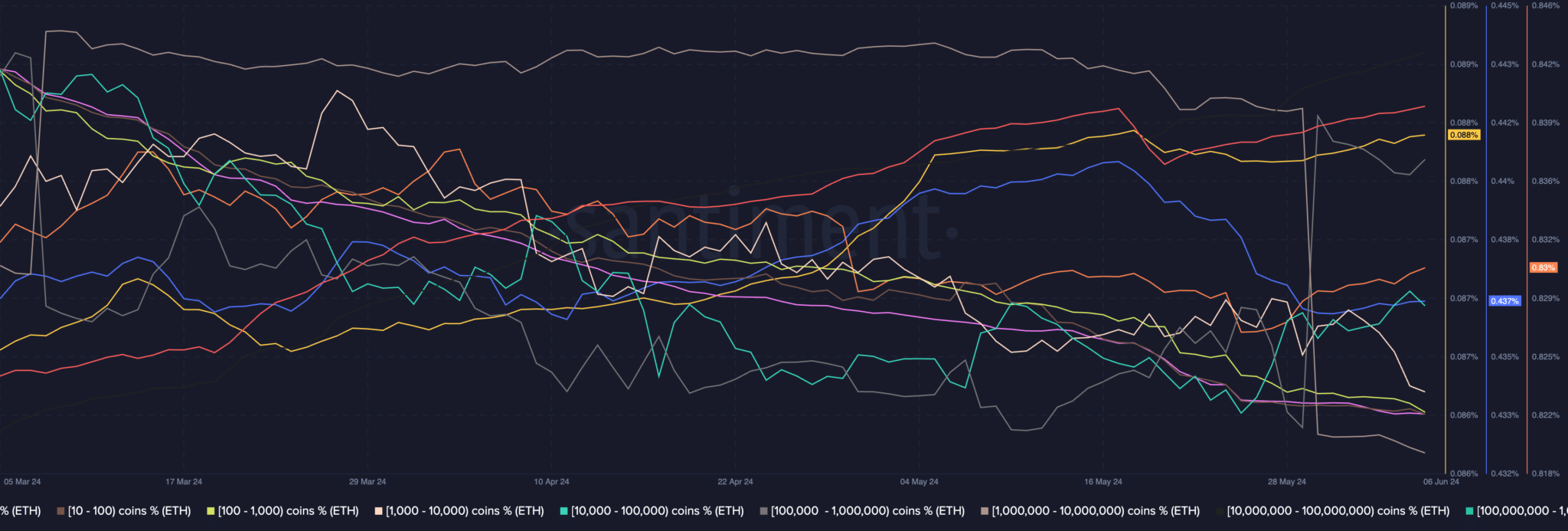

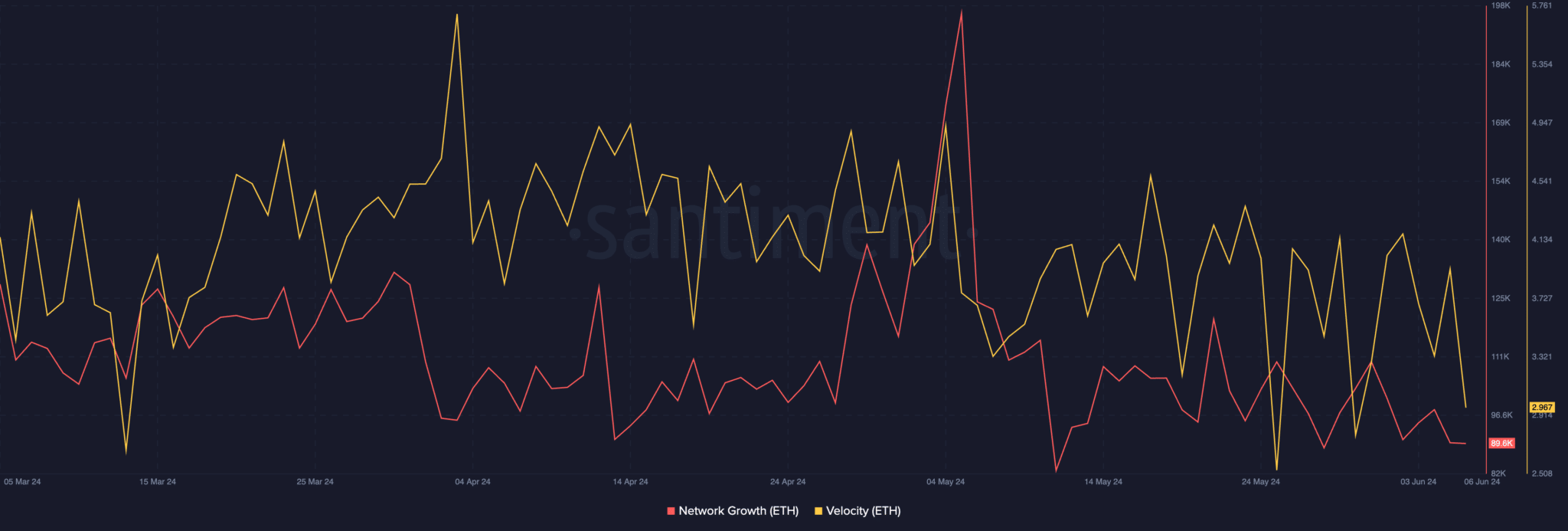

Retail interest in Ethereum continues, though it has not been strong enough to markedly affect the market price of Ethereum. Concurrently, the growth of Ethereum’s network has slowed, showing fewer new addresses and a reduced influx of new market participants. This suggests that the accumulation of Ethereum is mainly occurring among existing holders.

Additionally, Ethereum’s trading velocity has declined, indicating a slowdown in transaction frequency. This decrease might suggest a cautious or reserved approach among Ethereum traders and investors amid ongoing market uncertainties.