- Bloomberg’s analyst predicts a 25% possibility of Ethereum ETF acceptance, citing purposeful regulatory disengagement.

- Market research suggests that Ethereum may be undervalued, with the potential for huge price gains.

Senior ETF analyst at Bloomberg, Eric Balchunas, doubts the possibility of an Ethereum ETF getting approved, putting its chances at a mere 25%.

This mistrust is not the result of a simple delay, but rather of what appears to be a deliberate disengagement on the part of regulators.

Re Eth ETF approval, we are holding the line at 25% odds altho tbh it is a very pessimistic 25%. The lack of engagement seems to be purposeful vs procrastination. No positive signs/intel anywhere you look. Personally hope they do approve it but it just ain't looking good. https://t.co/nuBdCDE18L

— Eric Balchunas (@EricBalchunas) March 25, 2024

Craig Salm, Chief Legal Officer of Grayscale, on the other hand, presents a more positive view, arguing that the regulators’ silence need not be taken negatively. He remembers the time leading up to the SEC and stakeholders’ significant debate about the workings of the ETF regarding Bitcoin.

Salm contends that lengthy fresh discussions may not be required this time around because the fundamental issues for both an Ethereum ETF and a Bitcoin ETF coincide.

The Regulatory Difficulties of Ethereum

The SEC may be considering classifying Ethereum as a security, which would complicate issues and make it more difficult to create an Ethereum ETF. Subpoenas issued to cryptocurrency companies on their interactions with the Ethereum Foundation serve as proof of this strict regulatory stance.

According to prior ETHNews reporting, the Chicago Board Options Exchange (CBOE) moved Franklin Templeton’s Spot Ethereum ETF’s chances of approval closer to approval, indicating a potential change in the landscape of cryptocurrency investments.

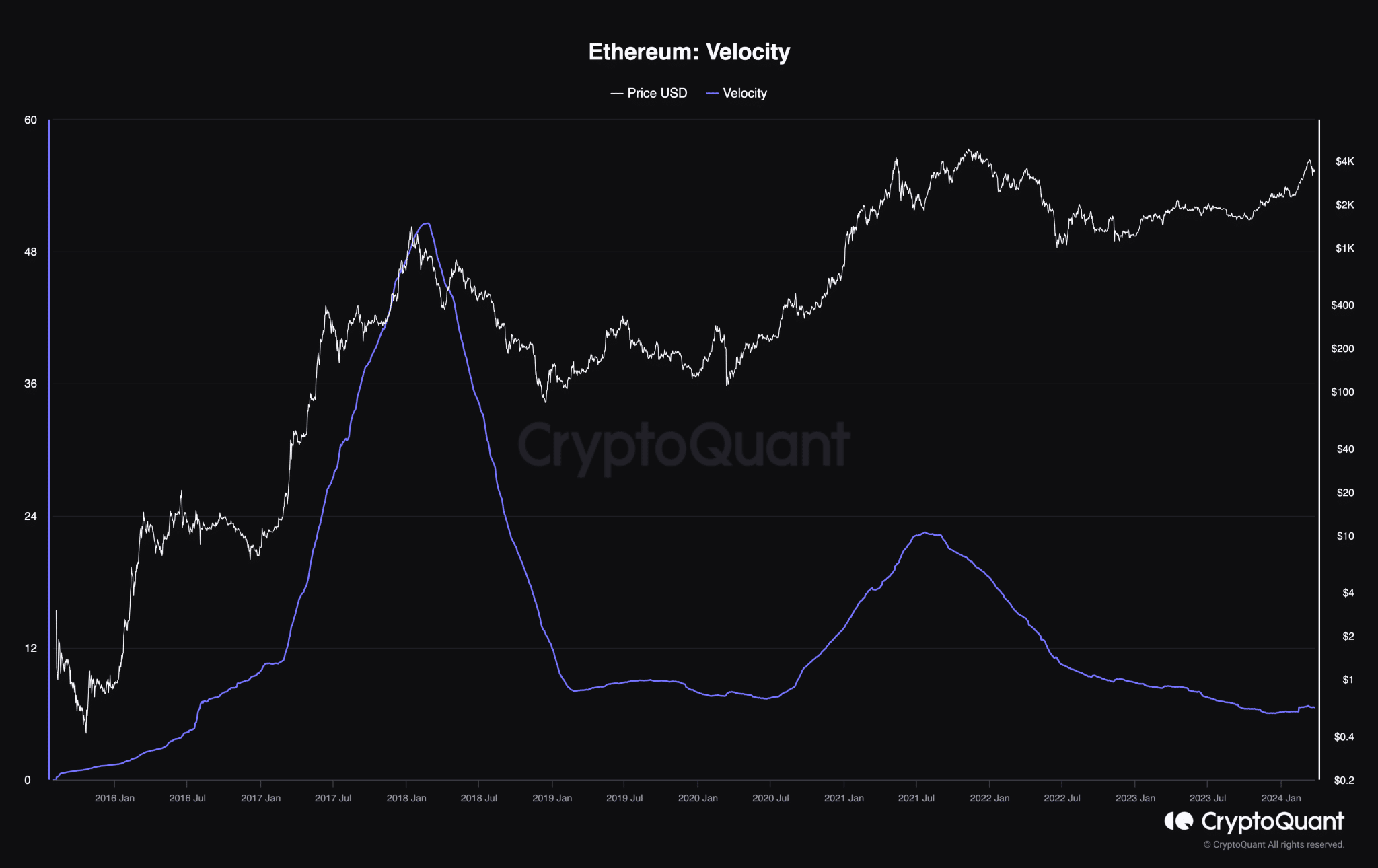

In addition to legal challenges, Ethereum’s market performance is gaining notice. According to CryptoQuant’s research, Ethereum’s velocity has decreased.

It indicates that investors are holding their position strongly and raising the possibility of an undervaluation and speculation of a price surge that may see the cryptocurrency hit $3,800 and test the $4,000 mark once more.

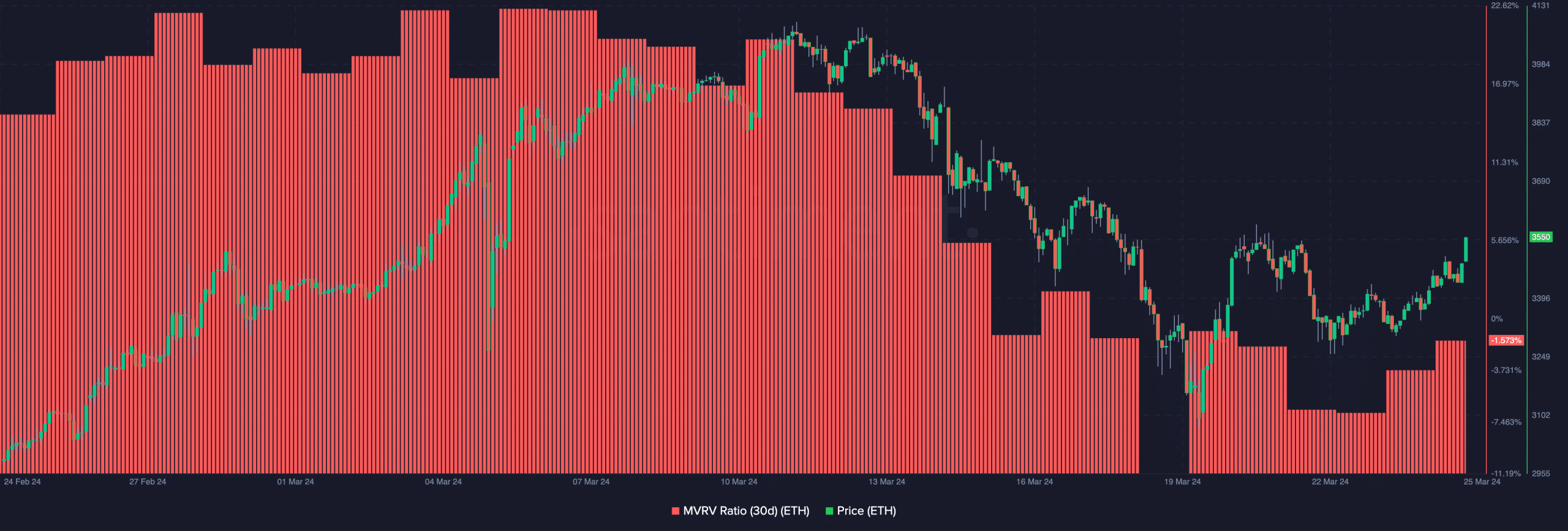

The Market Value to Realized Value (MVRV) ratio, which is currently -1.573% and indicates that selling now would result in losses, adds an additional analytical layer.

In the past, a negative MVRV has frequently indicated accumulation phases, particularly during bullish cycles when Ethereum has seen significant increases with MVRV ratios rising above 40%.

Meanwhile, the Ether (ETH) price has risen in the last 24 hours and 7 days, by 5.41% and 13.53%, bringing it to $3,657.43.

[mcrypto id=”12523″]