- Analysts foresee a potential recovery based on short-term Sharpe ratios mirroring previous cycles.

- Despite market volatility, Bitcoin shows signs of decoupling from traditional equity markets like the S&P 500.

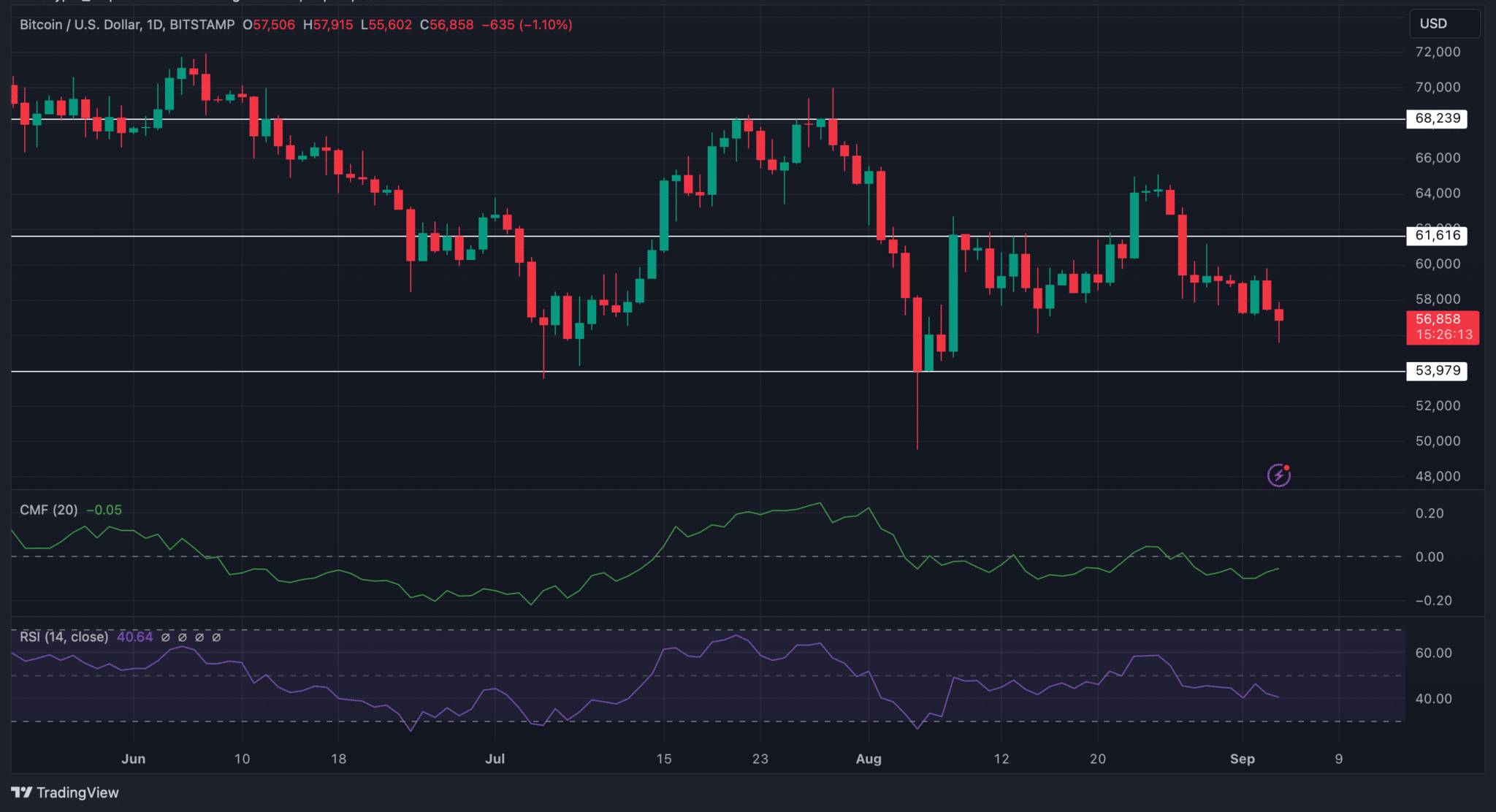

Bitcoin has recently shown modest recovery after experiencing a price drop last month. Currently, it stands at $56,320, reflecting a small daily decrease of 3.78%.

[mcrypto id=”12344″]

Over the past week, however, it has decreased by 6.32%, and a 4.37% drop over the past month positions it 20% below its all-time high earlier this year.

Market Analysis from Crypto Analysts

ETHNews analysts are observing Bitcoin’s performance closely, particularly in light of historical data which suggests potential for recovery.

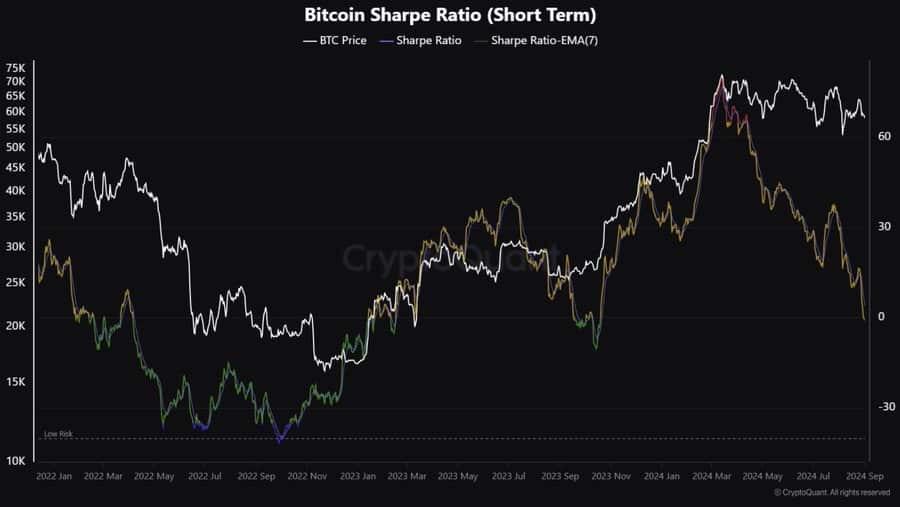

CryptoQuant analyst points to the short-term Sharpe ratio, a measure of investment performance adjusted for risk, which has declined similarly to patterns observed before notable price increases in past cycles.

Further ETHNews insights suggest Bitcoin’s performance is becoming less correlated with the broader equities market, such as the S&P 500. This could indicate a unique market path for Bitcoin that might not parallel traditional financial markets, potentially advantageous in volatile times.

Signals of Growing Investor Confidence

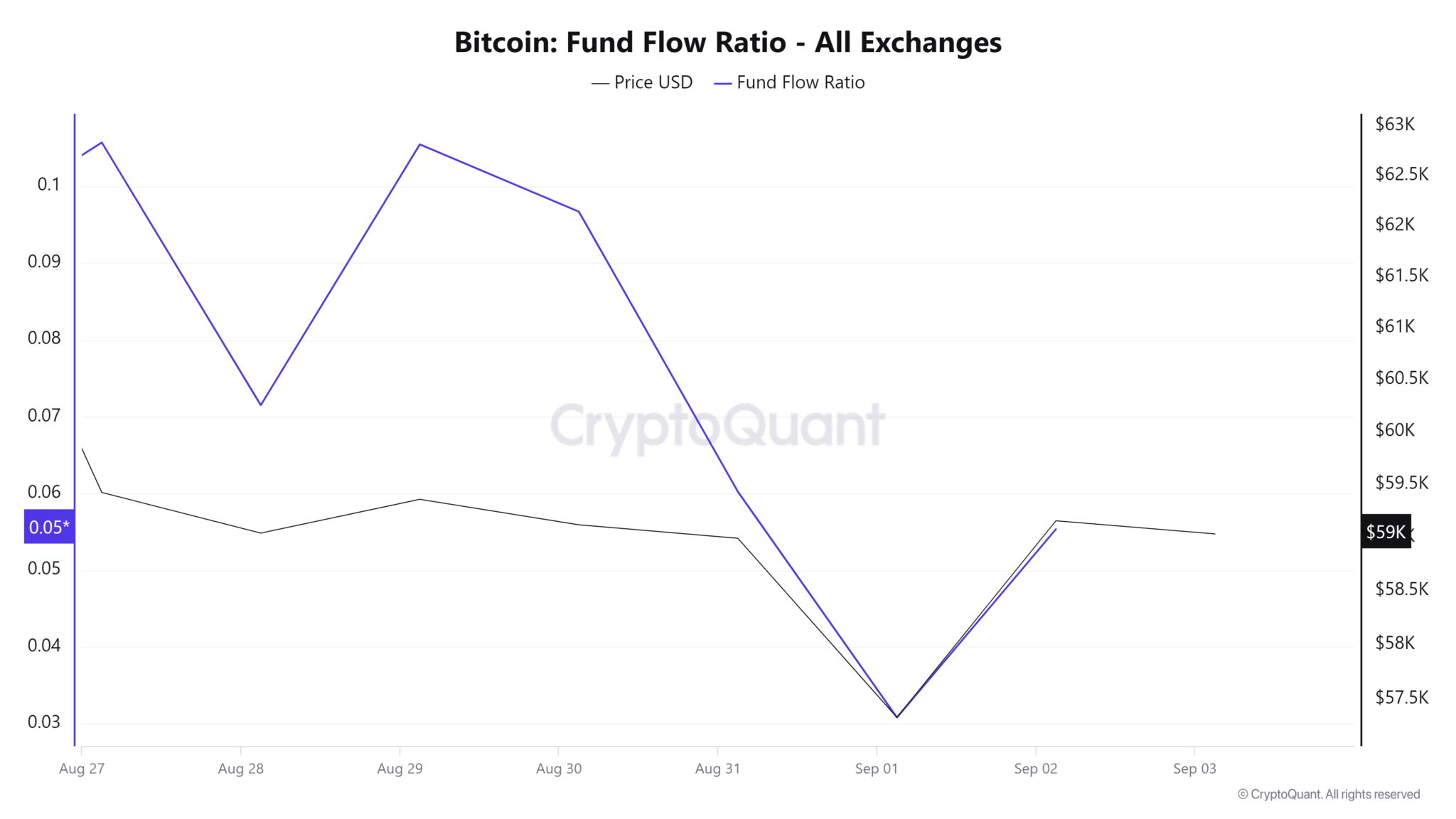

Data on Bitcoin’s transactions and holdings show good market activities. The decrease in the fund flow ratio suggests that fewer investors are selling off their Bitcoin, favoring long-term holding.

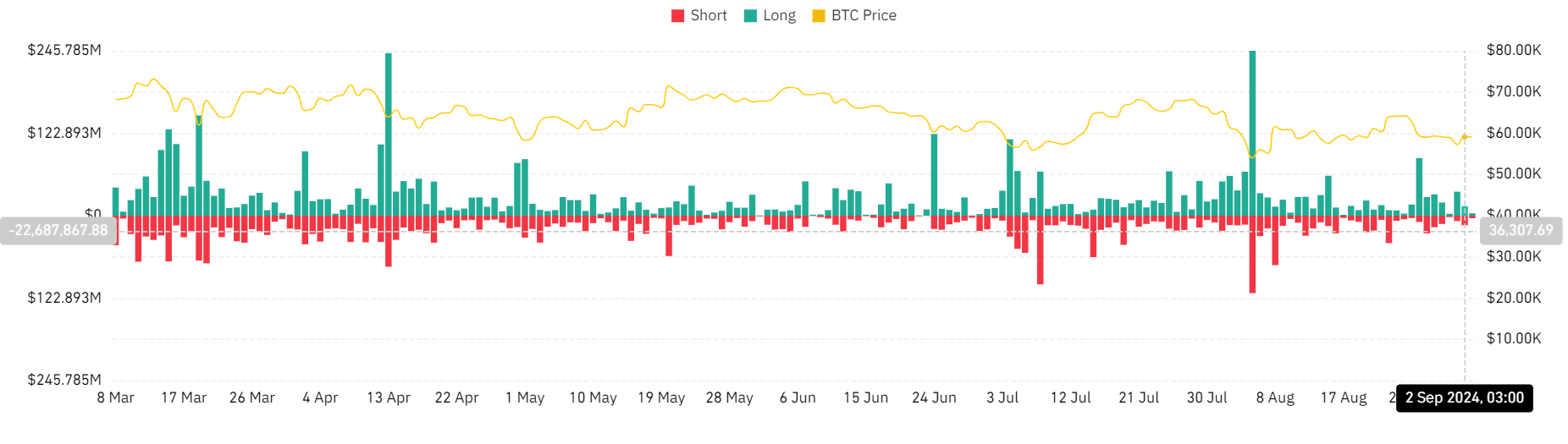

Additionally, a noticeable reduction in Bitcoin liquidations points towards sustained investor interest and a readiness to maintain positions despite market fluctuations.

Other technical indicators reinforce the possibility of a continued recovery. The reduction in liquidations and the fund flow ratio are indicative of an accumulation phase.

If these trends hold, Bitcoin could challenge existing resistance levels near $60,000 and possibly retest previous highs around $64,752.

Analyzing Market Sentiments and Trading Trends

Ali, recently tweeted that over half of the traders on Binance are leaning bullish on Bitcoin, with 51.79% of investors holding long positions. This increase in long positions typically signals a growing bullish sentiment in the market.

Top #Bitcoin traders on @Binance show a slight bullish tilt, with 51.79% currently holding long positions on $BTC. pic.twitter.com/p3gi2uLOYW

— Ali (@ali_charts) September 3, 2024

Bitcoin’s Valuation and Market Position

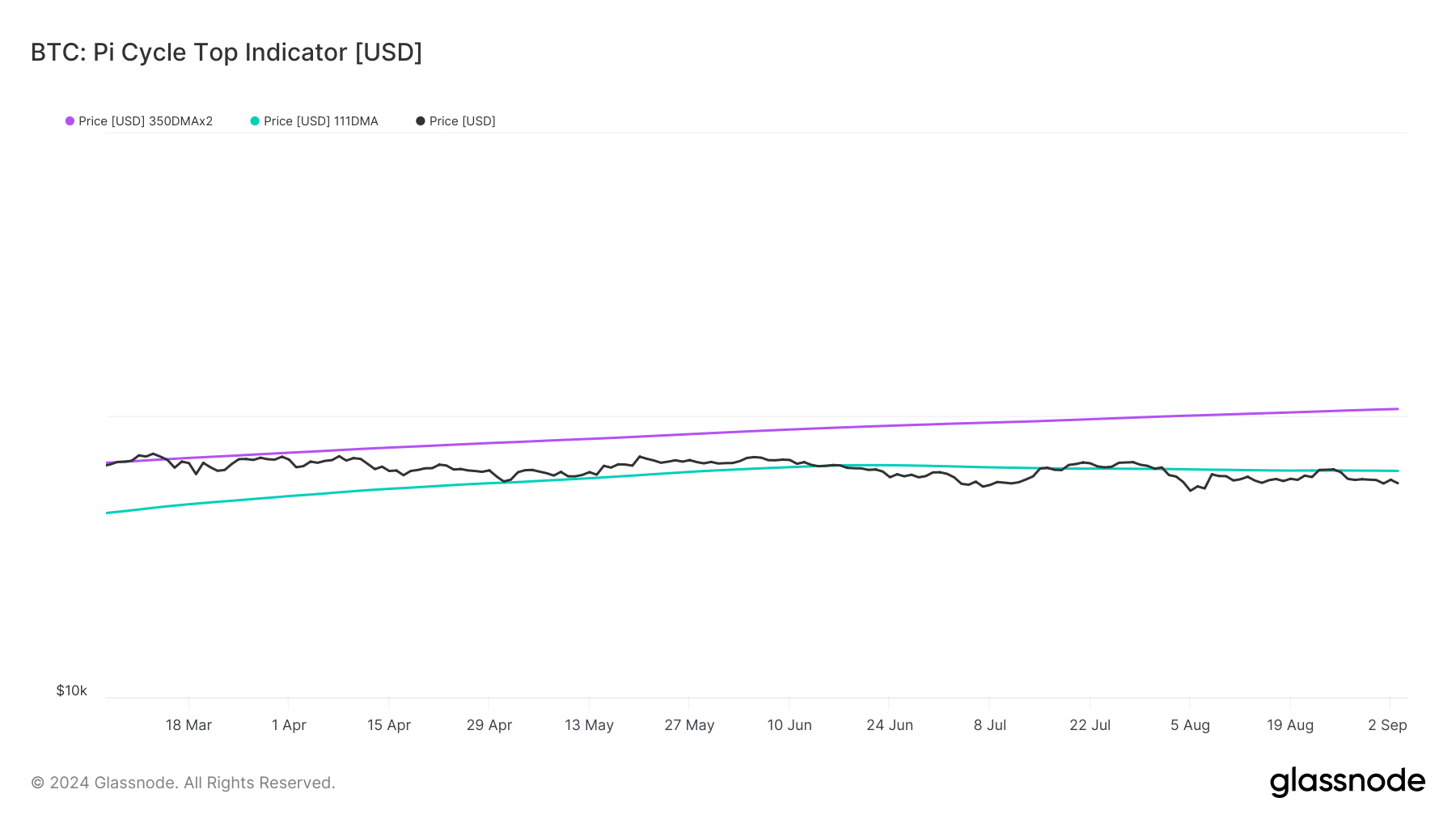

Current analyses from ETHNews reveal that Bitcoin is trading below its estimated market bottom. The Pi Cycle Top indicator places this bottom at $58.9k, suggesting potential upward movement in the near future.

This points to a possibly undervalued state for Bitcoin, hinting at a strategic buying opportunity.

Technical Indicators and Investment Opportunities

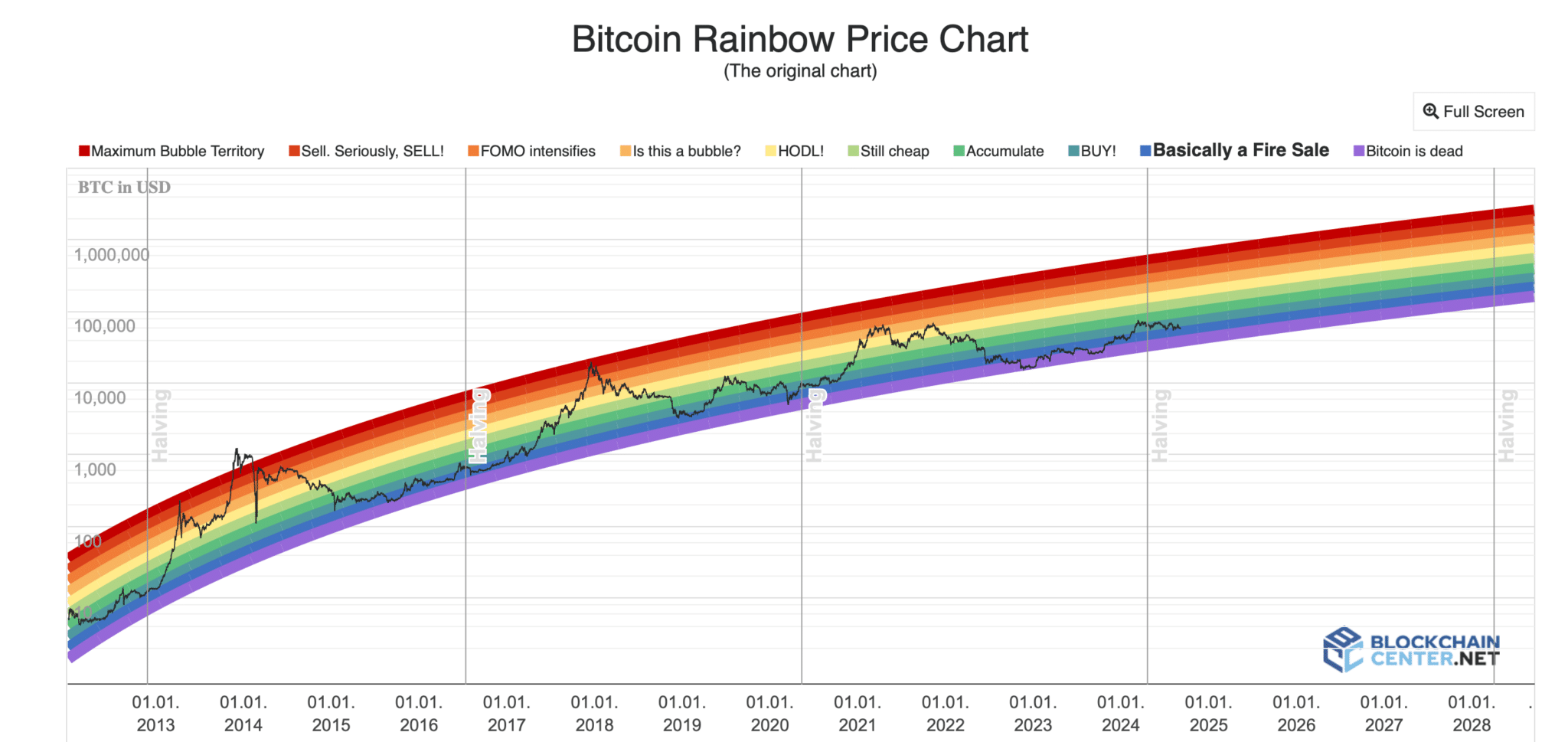

Further investigation into Bitcoin’s trading patterns shows promising signs for buyers. The Bitcoin Rainbow Chart categorizes the current price level as “Basically a Fire Sale,” indicating that Bitcoin’s price is lower than its value potential.

This discrepancy highlights an excellent chance for accumulation.

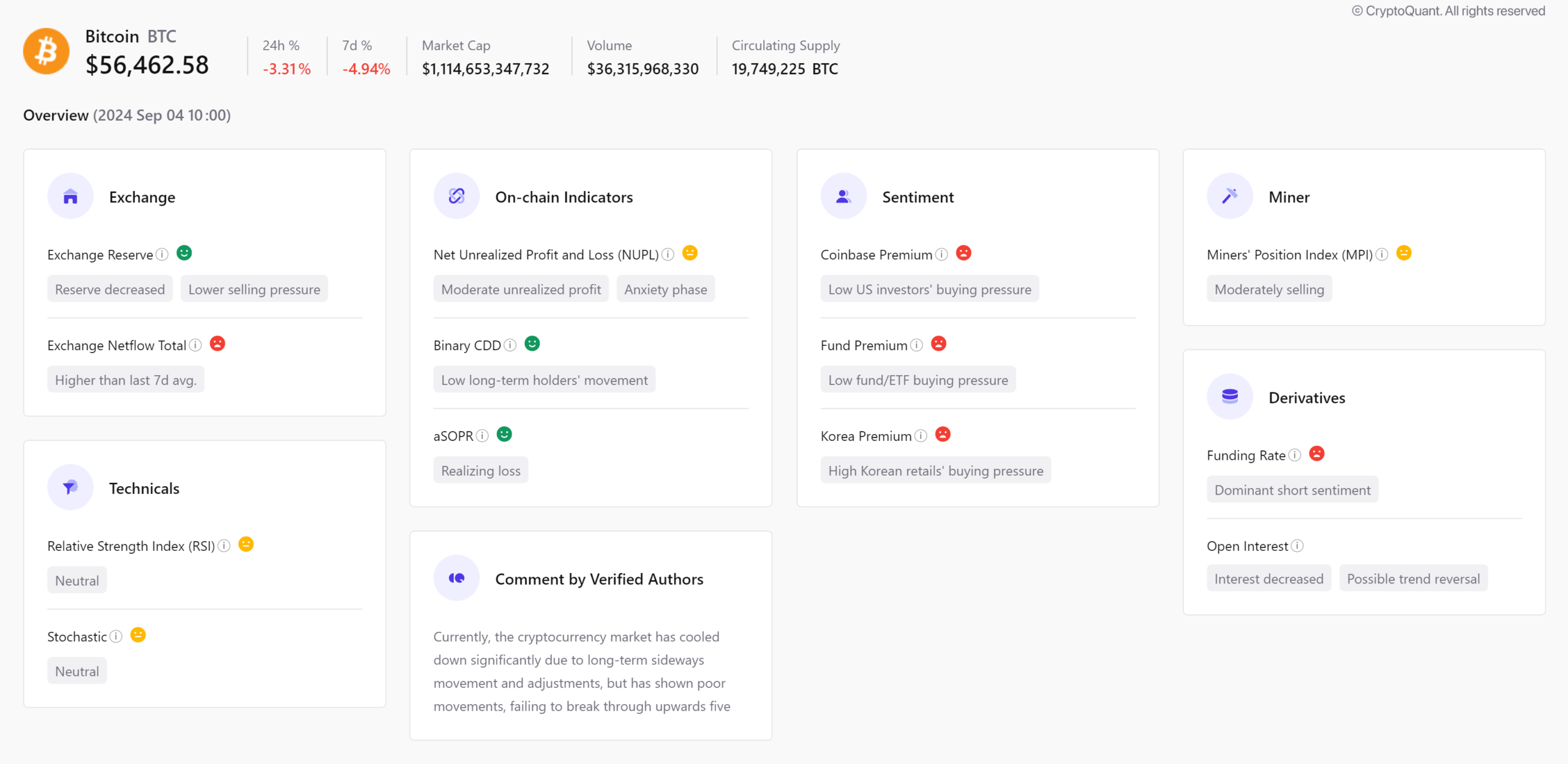

Data from CryptoQuant shows a decrease in Bitcoin’s Exchange Reserve, indicating increased buying activity as investors start to accumulate more BTC.

The Korea Premium index is green, suggesting strong buying sentiment among Korean investors.

However, the situation looks different in the U.S., where the Coinbase Premium has turned red, indicating a possible inclination towards selling among American traders.

The Chaikin Money Flow (CMF) has seen an uptick, which might signify an approaching end to bearish price actions.