- Historical trends show Ethereum peaks in September; 2016 and 2019 rallies suggest potential repeat performance this year.

- Ethereum’s market inflows reverse a nine-day outflow streak, with BlackRock’s ETHA recording $8.4M in recent inflows.

Ethereum has experienced a 4% increase in the past 24 hours, showing a strong performance compared to Bitcoin’s ongoing volatility. This recent rise prompts a critical question: could Ethereum potentially challenge Bitcoin’s long-standing dominance in the cryptocurrency market?

In a detailed review by ETHNews, Ethereum has demonstrated resilience by rebounding from the $2,400 level and achieving a noticeable gain. This performance has sparked discussions about whether Ethereum might lead in the cryptocurrency space, at least temporarily.

According to ETHNews, historical patterns support this possibility, particularly when examining Ethereum’s performance during the month of September. For instance, significant increases were recorded in September of both 2016 and 2019, with prices peaking around mid-month.

This year, the timing aligns intriguingly with the Federal Reserve’s decision to cut interest rates on September 18. Such macroeconomic factors have historically influenced cryptocurrency markets, suggesting a potential boost for Ethereum as the date approaches. If this pattern holds, Ethereum could test the resistance level at $2,800.

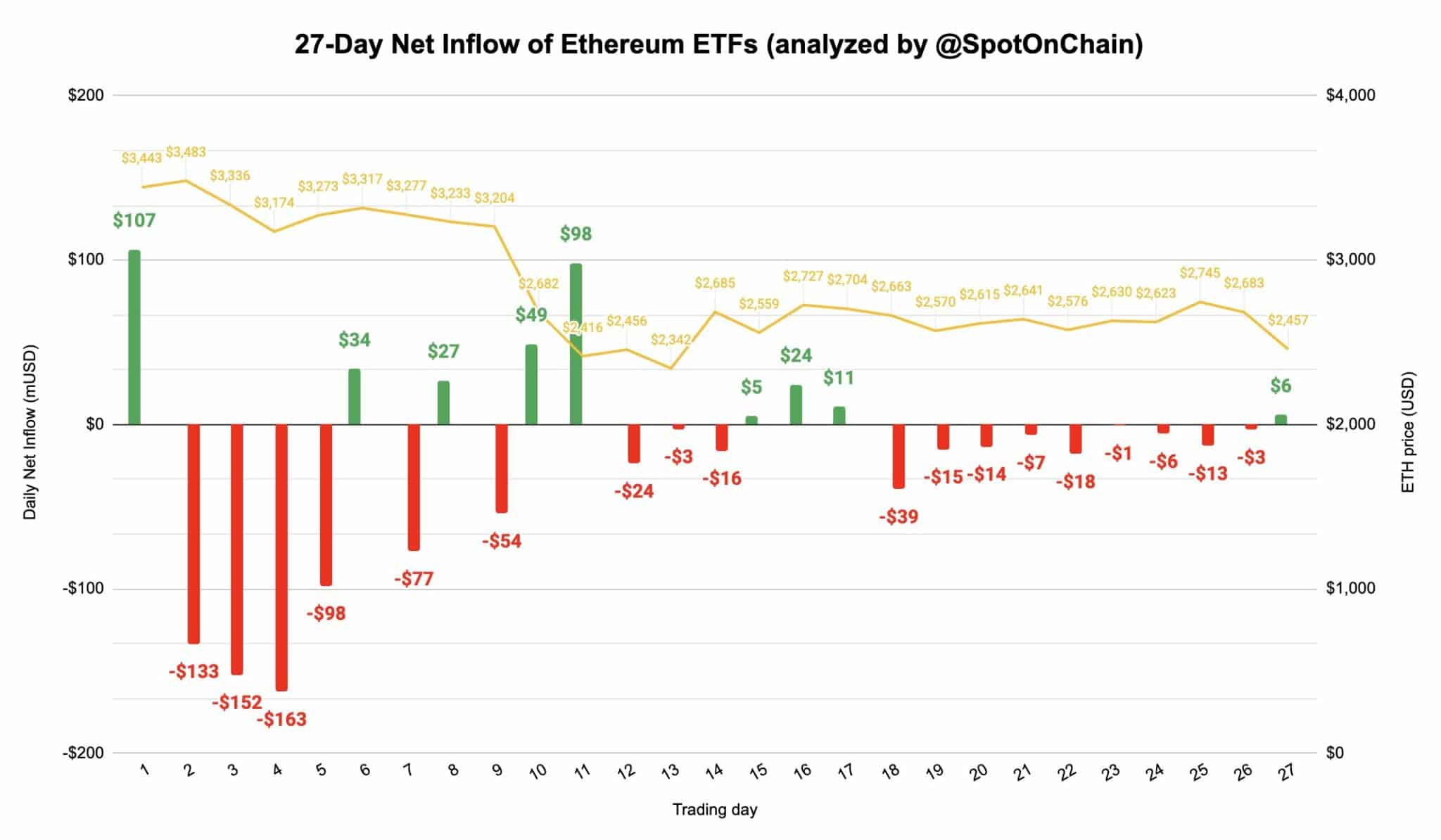

Adding to this bullish outlook, Ethereum’s market inflows have shown positive signs.

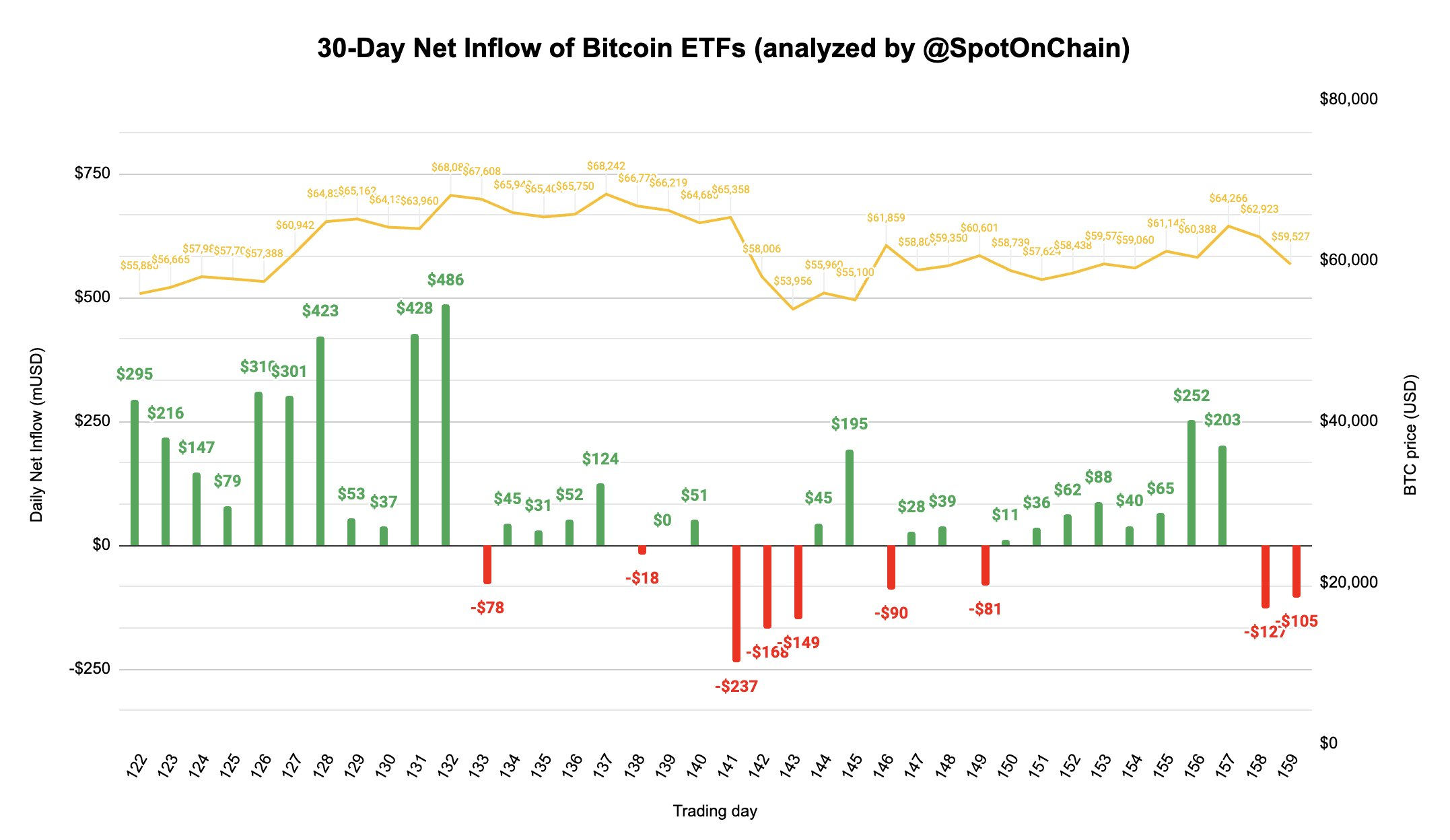

🚨 US #ETF 28 AUG: 🔴$105M to $BTC and 🟢$6M to $ETH

🌟 BTC ETF UPDATE (final): -$105M

• The net flow remains strongly negative for the 2nd day.

• No US Bitcoin ETFs saw an inflow yesterday.

• #Grayscale Mini (BTC) recorded the first outflow ever.

🌟 ETH ETF UPDATE… pic.twitter.com/RuU4JancIG

— Spot On Chain (@spotonchain) August 29, 2024

After a nine-day period of outflows, Ethereum saw a reversal, with substantial inflows noted, particularly in investment vehicles like BlackRock’s ETHA, which garnered $8.4 million after several days of stagnation.

In contrast, Bitcoin’s market data paints a different picture. It continues to experience negative net flows, with no significant inflows into U.S. Bitcoin ETFs and a notable outflow from Grayscale Mini (BTC).

This divergent market sentiment underscores a potential shift in investor preference from Bitcoin to Ethereum, at least in the short term.

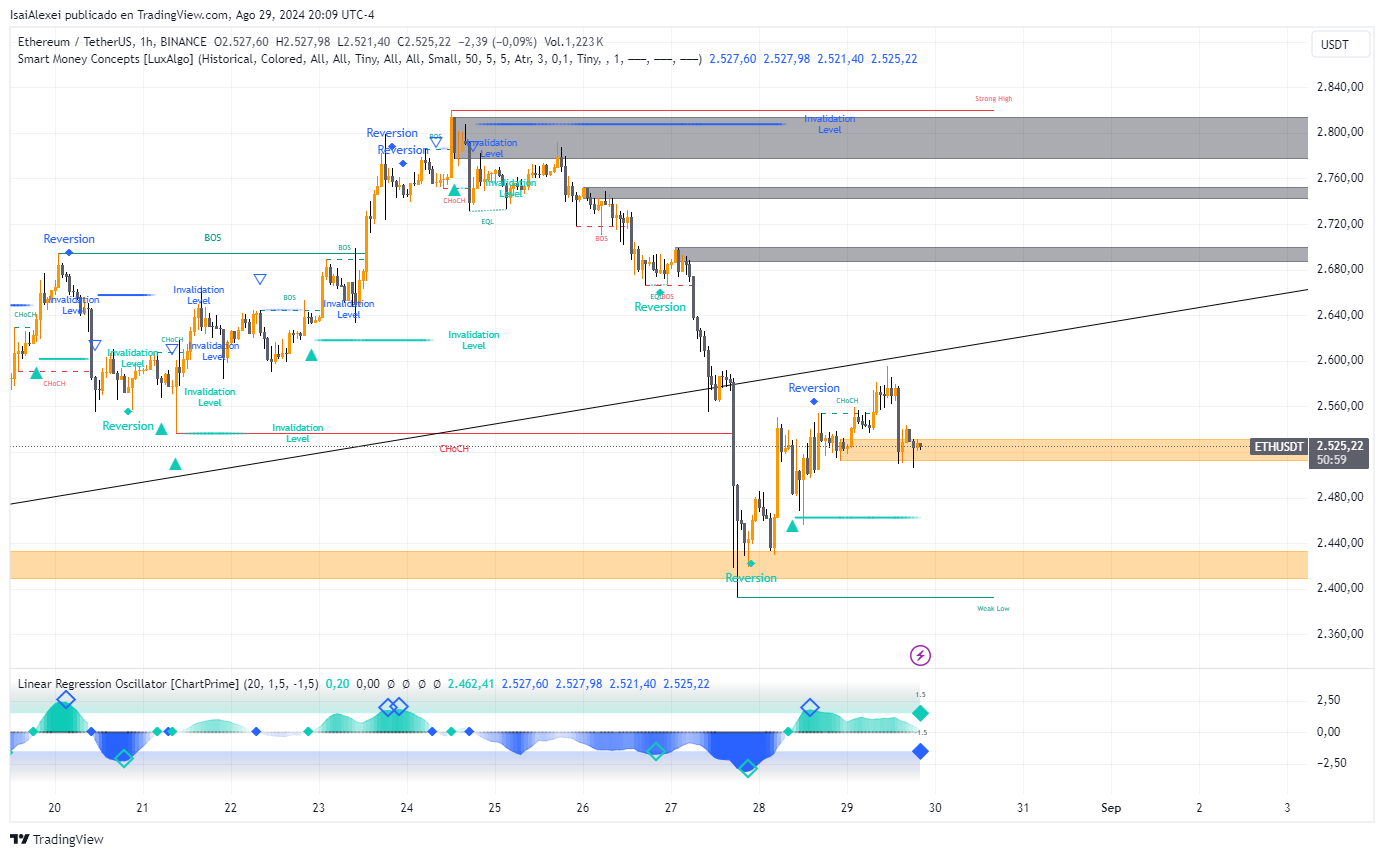

Ethereum Price Key Levels and Zones

- Resistance Levels: There are multiple shaded grey zones indicating strong resistance areas around $2,720 – $2,760 and $2,800 – $2,840. These areas are where previous price attempts were rejected, leading to downward movements.

- Support Levels: There are key support zones, particularly around $2,440 – $2,480 (shaded in orange) and a lower support zone closer to $2,360. The price appears to have tested the $2,480 level recently and showed some support there.

- Trendline Support: A long ascending trendline from lower lows is drawn, suggesting an overall uptrend on a larger timeframe. The price recently bounced above this trendline, indicating that the trendline support is holding for now.

Ethereum Market Structure

- The chart shows multiple “Reversion” markers indicating price rejections at certain points, suggesting potential areas of price reversals. These markers suggest a volatile market with frequent price changes.

- Break of Structure (BOS) and Change of Character (CHOCH) markers indicate where significant shifts in price momentum occurred. BOS markers suggest bearish signals, while CHOCH indicates potential bullish reversals. There is a notable BOS around $2,760, confirming a bearish trend from that level.

Despite Ethereum’s promising surge and potential market indicators, it still lags behind Bitcoin in terms of volume dominance.

Bitcoin remains the more actively traded cryptocurrency with greater liquidity, factors that have historically enabled it to recover more consistently from downturns.

As of now, Ethereum is trading at $2,550, yet to surpass the crucial $2,600 resistance level. Market analysts are closely monitoring this situation, recognizing that breaking through this barrier could be pivotal for Ethereum’s short-term trajectory.

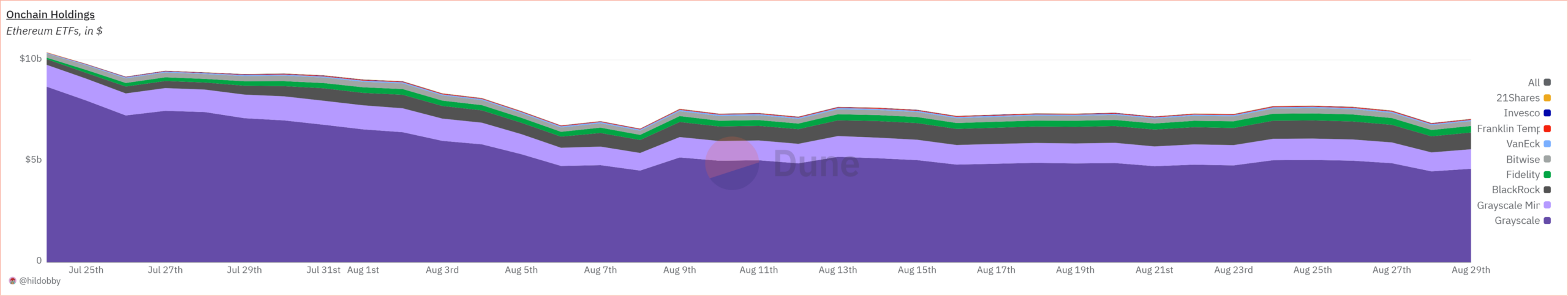

Ethereum ETF Key Periods

- July 25 – August 3: The chart starts with holdings above $10 billion. There is a steady and significant decline until around August 3rd. This period reflects a sustained decrease in the value of the ETFs.

- August 3 – August 13: During these days, the value remains relatively stable with minor fluctuations. This stability could indicate a period of consolidation or equilibrium in the market after the initial drop.

- August 13 – August 21: Another slight decrease is observed during this period. However, the rate of decline is slower than in the initial period, suggesting the market may be stabilizing or selling pressure has eased.

- August 21 – August 29: Towards the end of the period, there is a slight uptick in values starting from August 23rd, which seems to persist until August 29th. This small increase could indicate a possible recovery or renewed interest in Ethereum ETFs.

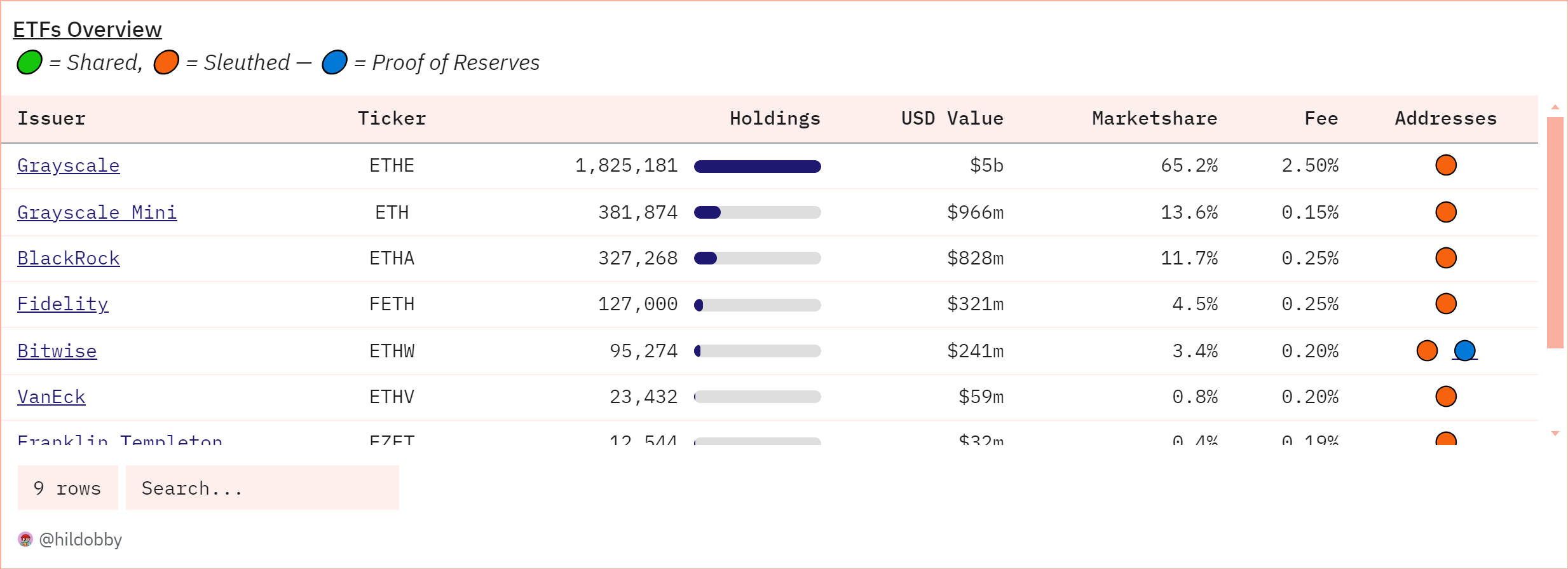

Ethereum ETF Holdings Distribution

The majority of the chart is dominated by Grayscale, followed by Grayscale Mirrored and other institutions such as BlackRock, Fidelity, Bitwise, VanEck, Franklin Templeton, Invesco, and 21Shares.

Grayscale appears to have a significant influence on the Ethereum ETF space, meaning its performance heavily impacts the overall trend of the chart.