- Ethereum price slipped beneath seventeen hundred dollars after transaction, exposing heightened sensitivity to large recent institutional allocation shifts.

- Whale addresses absorbed supply, accumulating approximately one hundred thirty thousand Ether, signaling confidence despite immediate downside pressure today.

Galaxy Digital, led by Michael Novogratz, moved $106 million from Ethereum into Solana earlier today. The trade took place across a series of on‑chain transactions and rebalanced one of the firm’s larger Layer 1 exposures.

The sale reduced open‑market demand for ETH and pushed the spot price under $1,700, a level last seen in early March. Order‑book depth on major exchanges thinned for several minutes, then market‑makers stepped in to restore two‑way quotes.

However, blockchain data show that large Ether holders used the dip as a buying window. According to IntoTheBlock, the ten biggest external wallets added roughly 130,000 ETH on the same day, offsetting part of Galaxy Digital’s outflow.

Meanwhile, Solana volumes rose across both centralized venues and decentralized exchanges, pointing to fresh liquidity migrating toward the network. Moreover, the firm’s timing—just days before the next Federal Reserve meeting—suggests an attempt to position ahead of potential macro‑driven volatility.

Ethereum still carries the highest total value locked across smart‑contract platforms. Nonetheless, Solana’s rising share of active users and decentralized finance flows has narrowed the gap since January. As a result, traders now track gas‑fee spreads, validator uptime, and layer‑1 staking yields more closely when modeling relative value.

Consequently, portfolio managers may reconsider weightings that were locked in during Ethereum’s 2021‑2024 expansion phase. Traders now price in a wider range of outcomes for transaction‑settlement networks, and risk desks have begun to include Solana in stress‑test scenarios once reserved for ETH and Bitcoin.

Ethereum (ETH) is currently trading at $1,747.10, marking a powerful +10.60% daily surge and +7.65% gain over the past week, signaling a strong bounce from recent lows near $1,400.

Despite the short-term rally, ETH remains down 47.53% year-to-date and 44.48% over the past year, placing it well below its all-time high of $4,868.80. However, momentum is shifting in Ethereum’s favor as it approaches critical resistance levels amid heightened whale activity and anticipation of its next major network upgrade.

Technically, ETH has reclaimed the $1,700 support level and is now testing resistance near $1,750–$1,780. If the price manages to push above $1,800, the next target lies at $1,884, which aligns with the 50-day EMA.

A successful breakout from that level could drive price action toward $2,000 in the near term. On the downside, key support now sits around $1,620, and losing this zone may send ETH back into the mid-$1,500s. Indicators are shifting bullish, with RSI climbing and daily volume showing strength—signs that momentum may sustain.

Fundamentally, Ethereum is gearing up for its Pectra upgrade, set for May 7, which is expected to significantly boost performance by introducing account abstraction, increased staking caps, and improved rollup capabilities. Whale wallets have been accumulating aggressively, including a notable withdrawal of 3,844 ETH from Bitget over the past two weeks.

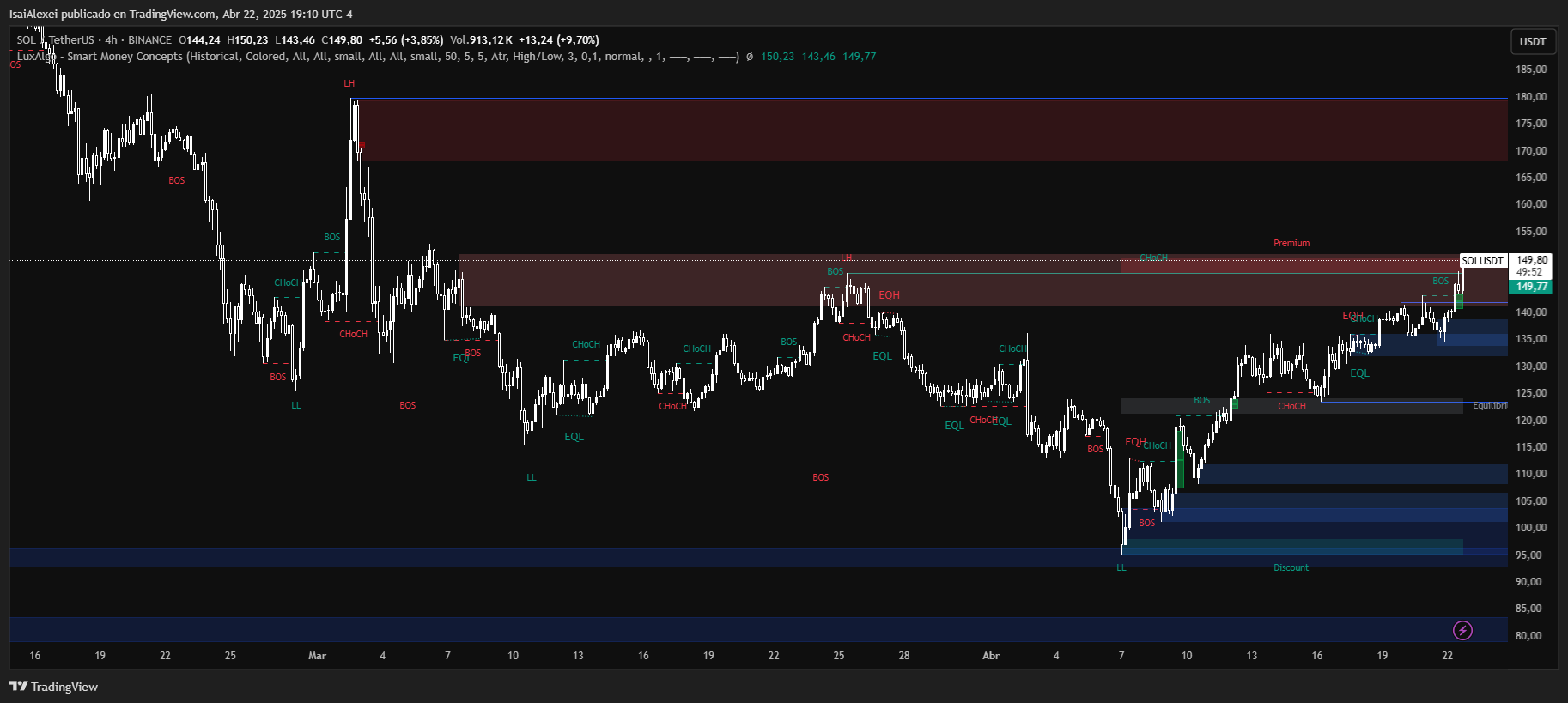

Solana (SOL) is currently trading at $147.70, with a strong +2.19% daily gain and an impressive +7.84% over the past week, showing continued strength and bullish momentum.

SOL has also increased +8.72% over the past month, recovering from its early-year correction. However, SOL is still trading ~50% below its all-time high of $295, reached in January 2025, indicating there’s more room for upside if resistance levels are broken.

Technically, Solana is now pressing up against a critical resistance zone at $148–$150. A successful breakout above this area could open the door to a short-term rally targeting $165–$180, while failure to breach may result in a pullback toward $136 or even $123, both of which serve as near-term support levels.

Indicators on the daily and monthly charts are flashing buy signals, while the weekly analysis remains neutral, reflecting cautious optimism.

Fundamentally, Solana is gaining serious institutional attention. There are currently 11 active filings for Solana-based ETFs, including one from Fidelity, positioning it as a top Layer 1 ETF candidate alongside XRP.

However, recent reports from Pine Analytics exposed market manipulation on the Pump.fun platform, impacting over 15,000 meme coin launches—highlighting both the explosive growth and risks in Solana’s ecosystem.