- Hidden Road’s acquisition signals Ripple’s global expansion, though analysts doubt immediate trading volume boosts for the native token.

- Research indicates Ripple’s on-demand liquidity model yields neutral impact on XRP supply, preventing major sudden price rallies post-announcement.

Ripple has left a long-running battle with the SEC. Although the outcome forced the firm to accept a monetary penalty, it also allowed Ripple’s leaders to declare a measure of success. Recently, CEO Brad Garlinghouse said the company may pay the $50 million portion of its fine in XRP itself. This hint arrived after President Donald Trump included XRP, Solana (SOL), and Cardano (ADA) in a new crypto reserve announced earlier this month.

In a conversation with Fox Business, Garlinghouse noted that Ripple can afford a large purchase like the Hidden Road brokerage. One year ago, the idea of spending $2 billion might have seemed unrealistic, given the legal obstacles facing the company. Now, though, Ripple seems determined to grow its holdings and test deeper involvement with new services.

Garlinghouse described a shift in Washington, observing that regulators no longer seem as hostile toward digital assets as they once were. He even used the phrase “from headwinds to tailwinds” when describing crypto’s progress in the United States.

However, those who expect XRP to benefit from Hidden Road’s acquisition may want to pause. A researcher who goes by the name @DarkhorseDNME4 explained that Ripple’s internal processes might not spark sudden buying pressure for XRP.

🫡🫡🫡 Sorry @RipBullWinkle but everyone keeps making the same mistake: basing XRP price action on volume. That’s not how Ripple using the xrpl works. Here’s the truth:

🔸 ODL = 0 Net Effect

Ripple’s ODL model zeroes out transactions on both ends. Brad & David confirmed it in… https://t.co/xceAoP9upt pic.twitter.com/jseB9V00ZG— ĐΛRKHØRSΞ™ (@DarkhorseDNME4) April 10, 2025

The firm’s “on-demand liquidity” system, known as ODL, relies on balanced inflows and outflows, which often results in a neutral effect on XRP supply. Moreover, a stablecoin-based model could avoid the token altogether. If Ripple bridges through an XRPL-based version of its stablecoin, the main role for XRP would involve only minor fees.

The same analyst challenged claims that XRP might jump to $9 in the near term. Their calculations suggested that even if a fraction of the new trading volume went toward XRP, the final impact on price might not reach that high. Yet some traders point to factors like higher token burn rates and a post-lawsuit buzz as possible reasons for moderate gains. While those elements might add momentum, the researcher remained skeptical about a quick spike.

Brad Garlinghouse also offered a bold forecast for Bitcoin, saying it might reach $200,000. By contrast, he avoided public speculation about XRP’s future price, noting that it feels too close to discuss.

Meanwhile, XRP has maintained a generally strong market performance over the past quarter. Ripple hopes its ongoing strategy and newfound breathing room will keep attention on its services, but the real effects on XRP value remain uncertain.

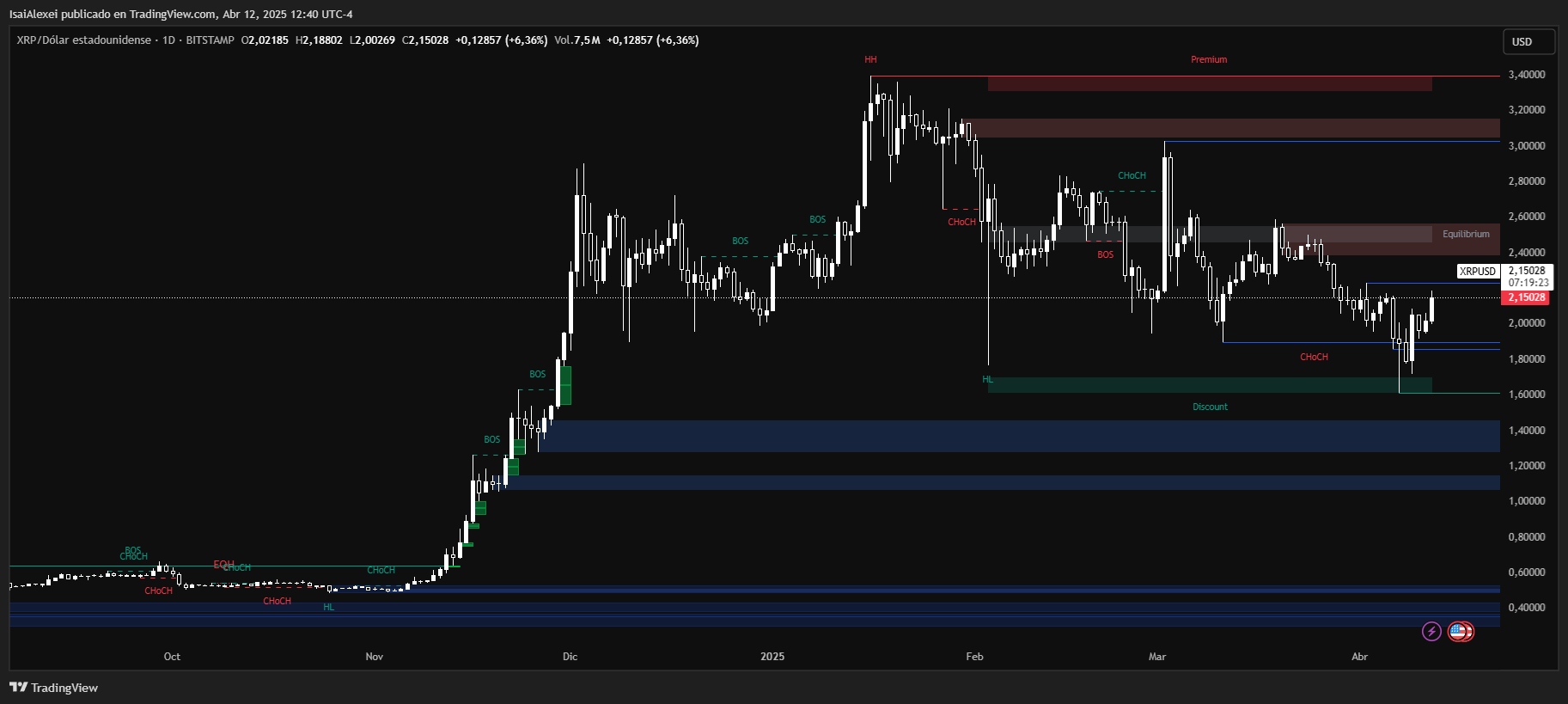

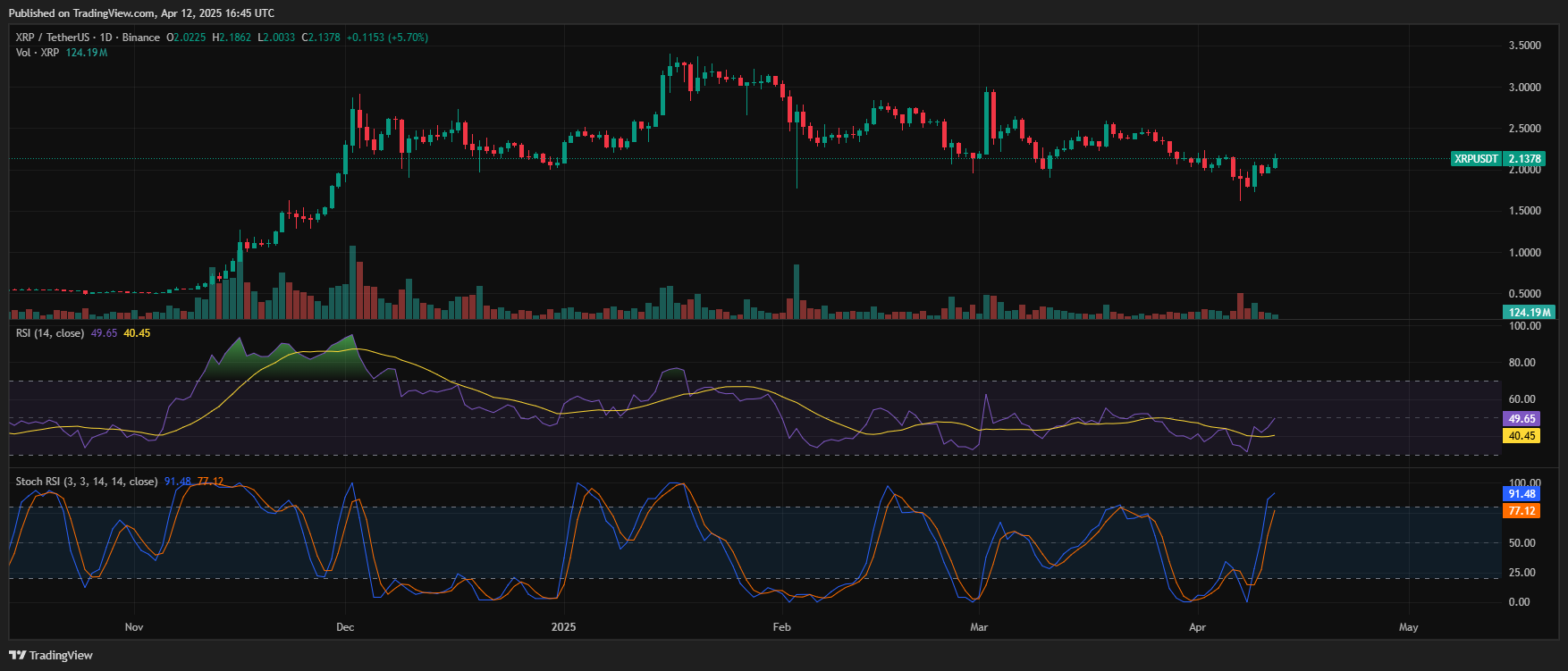

Ripple (XRP) is currently trading at $2.15, showing a sharp 6.36% increase on the day and maintaining a 304.44% gain over the last 6 months. This strong momentum reflects both renewed investor interest and optimism around Ripple’s recent legal progress against the SEC.

The market is reacting positively to the news that both parties agreed to pause appeals, signaling a likely resolution soon. Additionally, Ripple’s $1.25B acquisition of Hidden Road is accelerating institutional XRP adoption, processing over 50 million transactions per day across 300+ partners.

Technically, XRP is nearing the top of a multi-year symmetrical triangle, which if broken, could signal the start of a powerful long-term breakout phase. Key resistance lies around $2.40, while strong support has built at $1.90. RSI is rising but not yet overbought, and volume is picking up, suggesting more upside is possible.

If bulls manage to breach the upper boundary of this formation, analysts point to historical analogs that could push XRP as high as $5–7 in a strong bull cycle. However, if rejected at resistance, a retracement toward $1.70–$1.50 is expected.