- Bitcoin long-term holders (155+ days) resist selling, re-accumulating after two sell-offs, showing resilience amid price volatility.

- Investors holding Bitcoin 3-6 months, bought near peak prices, retain assets despite losses, signaling strong conviction.

Recent data from analytics firm Glassnode reveals that Bitcoin investors who purchased near the asset’s peak continue to hold their positions, resisting pressure to sell despite price declines.

The analysis highlights two key groups: long-term holders (LTHs), defined as those retaining Bitcoin for over 155 days, and a transitional cohort of investors holding coins for three to six months.

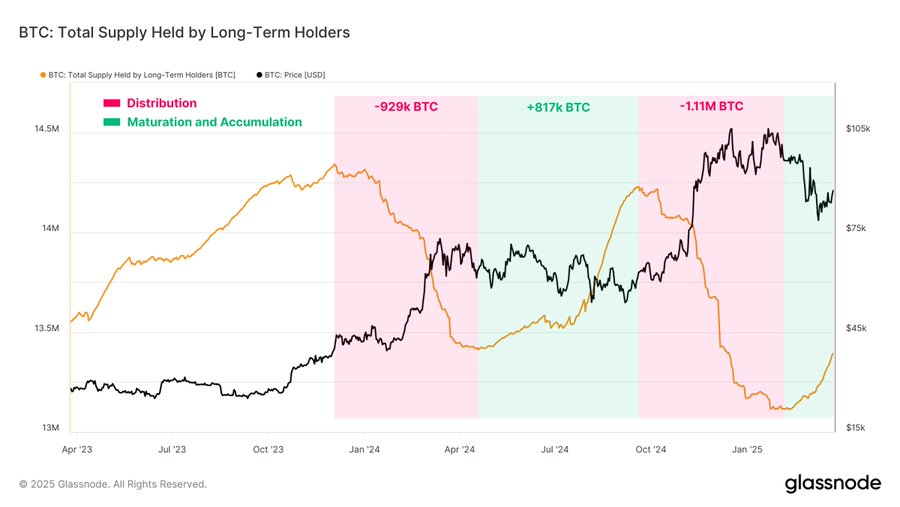

Across the 2023–25 cycle, Long-Term Holders have distributed over 2M $BTC in two distinct waves. Yet, each has been followed by strong re-accumulation, helping absorb the sell-side pressure. This cyclical balance may be stabilizing price action. pic.twitter.com/HAOZhG4q8o

— glassnode (@glassnode) March 31, 2025

LTHs, often called “diamond hands,” typically avoid frequent trading. However, Glassnode notes this group distributed 2 million BTC during two sell-offs in the current market cycle. The first occurred earlier in the cycle, followed by a period of re-accumulation that restored their holdings to prior levels.

A second sell-off between October 2024 and January 2025 has similarly been met with renewed accumulation in recent months. Glassnode suggests this cyclical pattern—selling followed by buying—could help stabilize Bitcoin’s price.

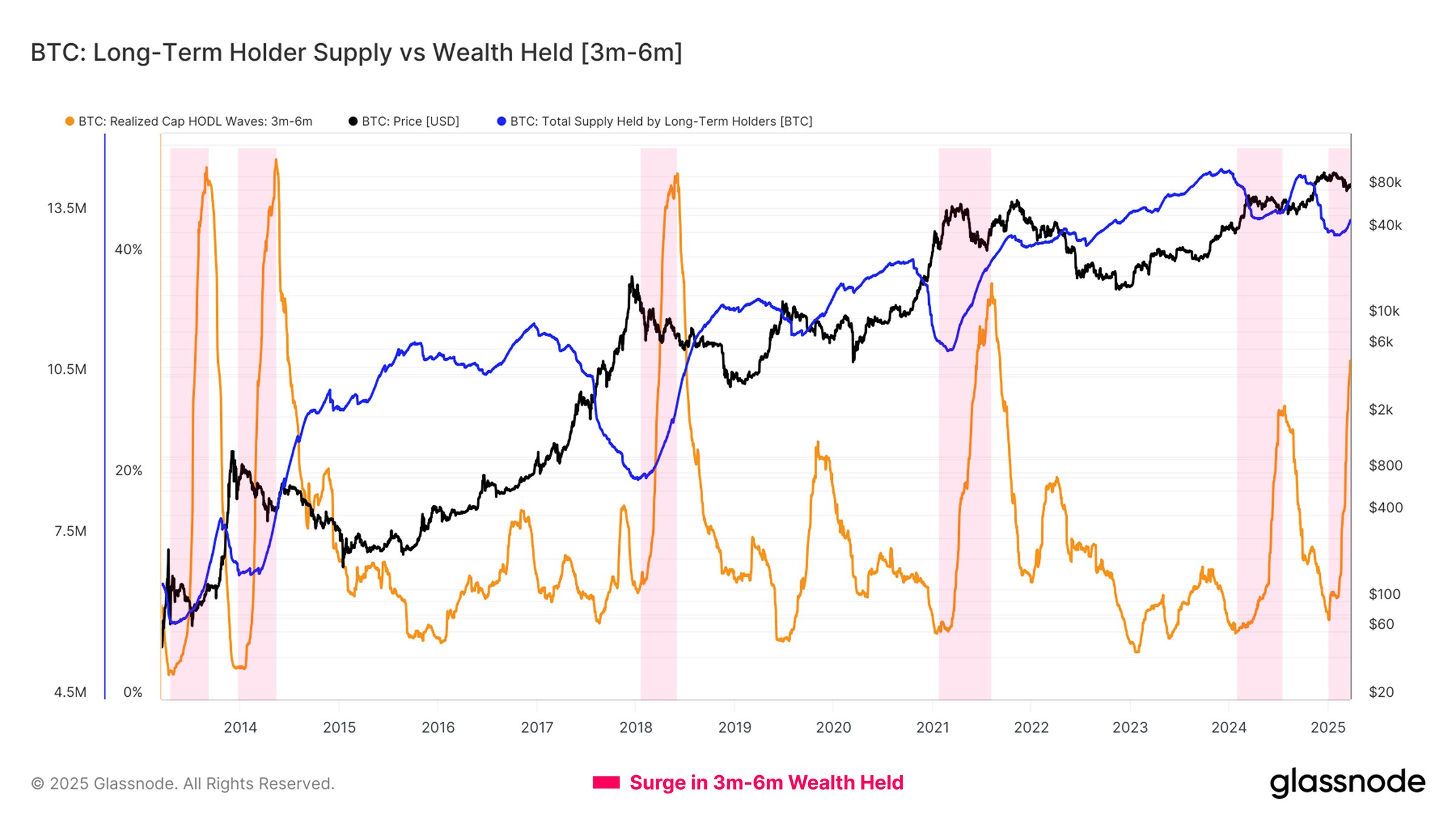

The LTH supply metric reflects coins held past the 155-day threshold, not immediate buying activity. Current LTH additions stem from purchases made in late November, when Bitcoin surpassed $90,000. Many of these investors now hold at a loss but have retained their assets, aligning with the “HODL” mentality.

A separate group, holders of three- to six-month-old Bitcoin, faces heightened pressure. These investors bought near the all-time high and remain underwater. Yet Glassnode data shows their holdings have grown, indicating resolve to wait out market turbulence. ETHNews analysts argue weaker investors likely sold earlier, leaving those with greater conviction.

Bitcoin’s price struggles have not triggered widespread capitulation among these groups. While short-term traders may react to volatility, LTHs and transitional holders appear focused on longer horizons. This behavior underscores a divide between speculative trading and strategic accumulation.

Spending from 3m–6m $BTC holders is at the lowest levels since mid-2021. This inactivity reinforces the idea that recent top buyers are holding their positions rather than exiting, despite recent volatility. pic.twitter.com/cS4bPa4bWo

— glassnode (@glassnode) March 31, 2025

Glassnode’s findings suggest enduring confidence among core Bitcoin holders, even as broader market sentiment fluctuates. The interplay between selling and re-accumulation cycles may offer clues about future price stability. For now, the data paints a picture of patience prevailing over panic.