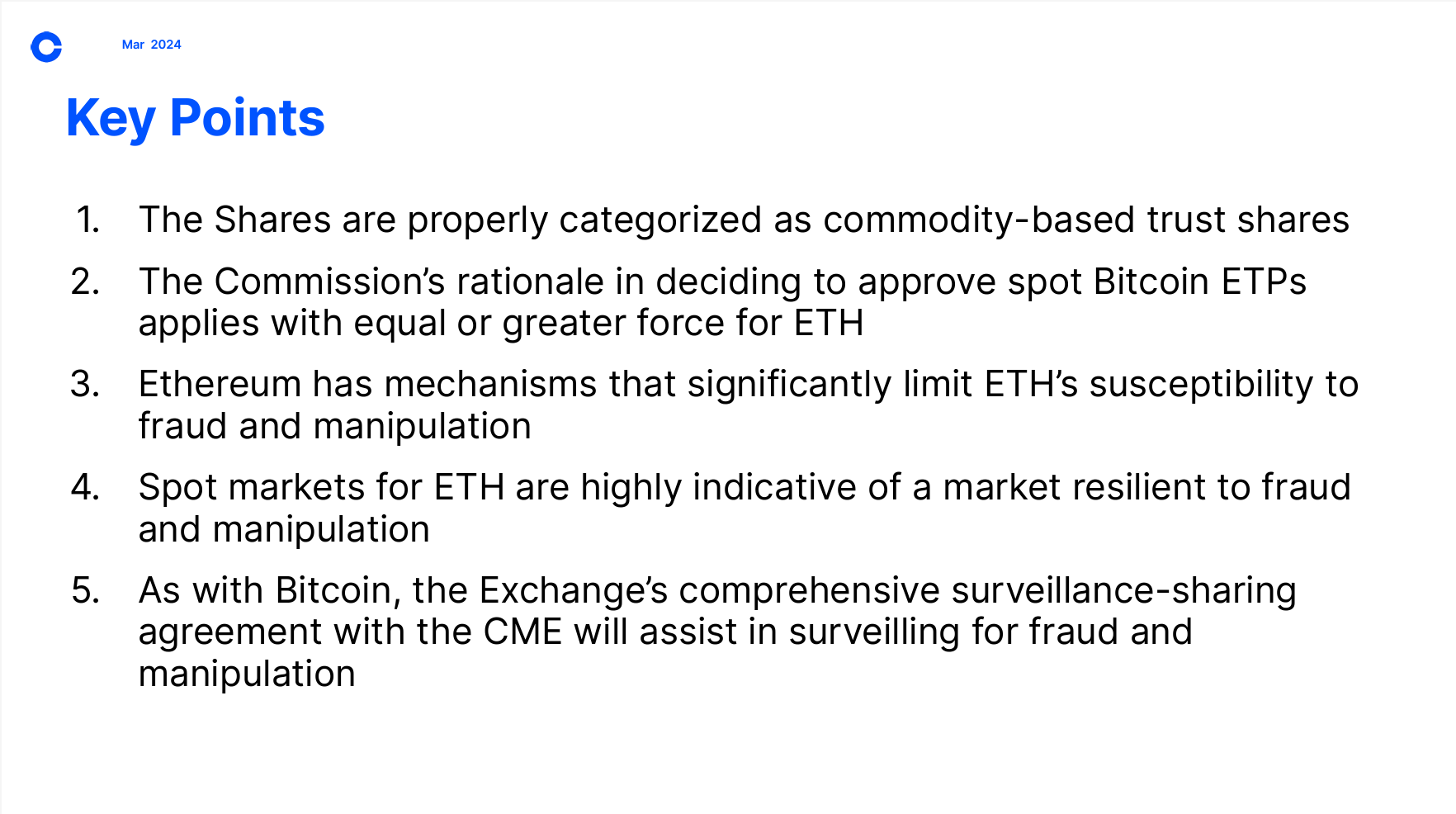

- During the meeting, Coinbase stressed that the ETH spot markets are resistant to fraud and manipulation, promoting a surveillance agreement with CME.

- Grayscale is proposing a second Ether futures-based ETF, while several asset managers are seeking the green light for a spot Ether ETF by May.

Coinbase, one of the most prominent cryptocurrency exchanges, held a meeting with the U.S. Securities and Exchange Commission (SEC) to discuss the introduction of an Ethereum ETF (Ether ETF).

During this meeting, it was raised that Ethereum ETFs would be classified as commodity-based stocks, a categorization similar to that previously adopted for bitcoin ETFs.

May 23rd –>

It’s approvals or another court case.

The firm Grayscale, also participated in these discussions, represented by Davis Polk attorneys. This meeting had as one of its main focuses the resistance of ETH spot markets against market manipulation, arguing for the integrity of these financial spaces .

As part of its commitment to maintaining transparency and security, Coinbase mentioned a surveillance agreement with the Chicago Mercantile Exchange (CME), designed to monitor and prevent fraud and manipulation in these markets.

Bloomberg analysts, such as Eric Balchunas, senior ETF analyst, have expressed concerns about the SEC’s approval and regulation process for these ETFs. The lack of feedback to issuers so far generates speculation about the eventual green light for these financial products.

Normally I'd say this was good sign but as far as I know the Staff has not given any comments yet to the issuers, which is not a good sign as we past when they gave comments on btc ETFs. Further, there's no court loss hovering over. And the correlations bt futures and spot isn't… https://t.co/AVMhL1QKGf

— Eric Balchunas (@EricBalchunas) March 8, 2024

Normally I’d say this was good sign but as far as I know the Staff has not given any comments yet to the issuers, which is not a good sign as we past when they gave comments on btc ETFs. Further, there’s no court loss hovering over. And the correlations bt futures and spot isn’t as strong = not nearly as optimistic here vs btc ETF. We will update as new info presents itself tho.

As we have mentioned elsewhere on ETHNews, the situation contrasts with previous events, where the SEC provided comments during similar stages of the approval process for bitcoin ETFs.

The proposed Ethereum ETF not only covers the spot markets, but Grayscale also suggests a second ETF focused on the Ether futures markets. This approach, which we have previously developed at ETHNews, seeks to offer investors a variety of ways to access cryptocurrency investment, either directly through the underlying assets or through futures contracts that predict the future value of these assets.

Numerous investment management companies, such as BlackRock, Fidelity, Galaxy Digital, Invesco, and Franklin Templeton, are assessing the potential to debut their individual spot Ethereum ETFs, awaiting the conclusive judgement from the SEC.

These asset managers see the regulatory development and approval of these new investment vehicles as a step toward the inclusion of cryptocurrencies in traditional financial markets.

The current price of Ethereum (ETH) is approximately 3,865.91 USD, down 2.02% from its previous price of 3,882.12 USD .The price range over the last day was 3,796.36 to 3,884.73 USD.