- Charles Hoskinson predicts Ethereum could fail within fifteen years due to mounting complexity and dependency on external Layer-2s.

- Critics call his claim hypocritical, while supporters highlight Ethereum’s recurring high fees, long upgrade timelines, and architectural sprawl.

Charles Hoskinson, founder of Cardano and early Ethereum architect, told Altcoin Daily that Ethereum “may not survive the next 10 to 15 years.” He argued that the network’s steady shift toward external Layer 2 chains drains value from the base chain and adds complexity that few users fully grasp. Hoskinson compared Ethereum’s expansion problems to the downfall of Myspace and Blackberry, two brands that lost ground after early success.

Critics on X labeled Hoskinson’s view “hypocritical,” noting that Cardano itself still seeks wider adoption. Others pointed to Ethereum’s long upgrade schedule, high transaction fees, and an intricate codebase as warning signs. Even some supporters of Ether conceded that the network “runs hot” when traffic spikes, pushing traders toward quicker chains.

Developers Answer With Euclid

Minutes after the interview circulated, Scroll—an L2 network tied to Ethereum—announced “Euclid” its largest upgrade to date. Scroll said the release will trim gas fees by up to 90 percent and increase throughput, partly by compressing data before it reaches Ethereum for settlement. The patch, live on mainnet, marks Scroll’s first change approved by its multi-signature Security Council.

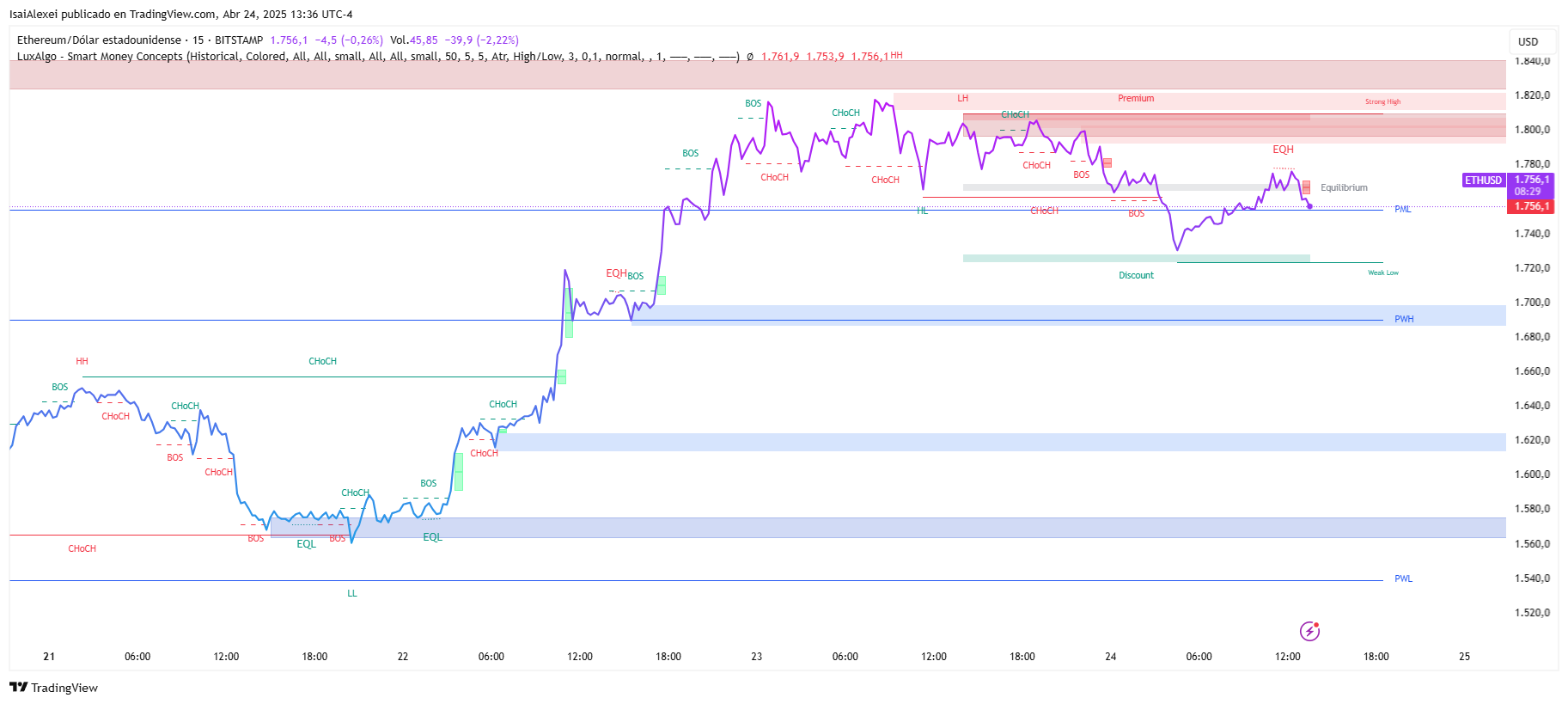

Ethereum (ETH) is currently trading at $1,754.40, down -2.32% on the day, but still holding onto a +11.27% gain over the past week. Despite the short-term momentum, ETH remains down –47.31% year-to-date and -45.49% over the past year, showing it’s still recovering from its broader bear market decline.

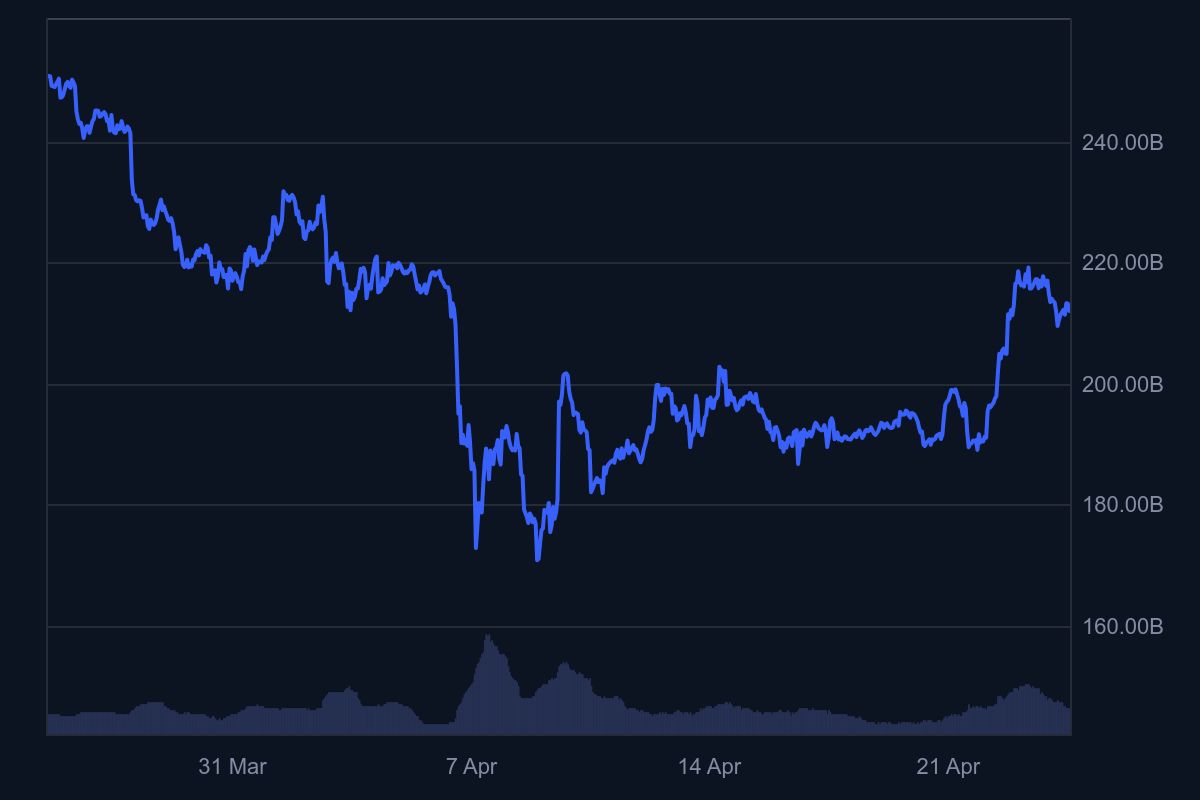

Its current market capitalization is $211.86 billion, with 24h trading volume of $15.61 billion, reflecting solid liquidity and investor interest.

Technically, ETH is facing resistance near the $1,780–$1,800 level, where prior rallies have lost steam. Support is forming around $1,695, with downside risk extending to $1,580 if the bulls fail to regain strength.

ETHNews analysts highlight a potential bullish divergence and falling wedge breakout, signaling a likely trend reversal if volume increases. Still, the macro structure remains fragile until ETH can break back above $2,000 with conviction.

Fundamentally, the Ethereum network is preparing for its “Pectra” upgrade on May 7, 2025, which includes 11 Ethereum Improvement Proposals (EIPs) aimed at boosting network efficiency and introducing features like smart accounts and Layer 2 scalability.

However, Ethereum faces ongoing pressure from high gas fees, regulatory headwinds, and intensified competition from Layer 2s like Arbitrum and Base. CoinShares also reported $26.7 million in weekly outflows from ETH investment products, pointing to a dip in institutional sentiment, though year-to-date inflows still total $215 million.

Cardano (ADA) is currently trading at $0.7261, with a strong +4.04% daily gain, continuing a rally that has lifted it +18.91% over the past week. Although it remains down -13.89% year-to-date, ADA has delivered a solid +122.69% gain over the past 6 months, and +45.24% over the last 12 months, indicating a clear medium-term bullish trend. However, it is still trading -56.12% below its all-time high of $3.09.

From a technical standpoint, ADA has successfully crossed the 20-day EMA at $0.64 and is now consolidating above its 50-day SMA at $0.68—a crucial support zone. If it sustains this level, the next resistance is expected near $0.83, followed by a potential breakout target toward $1.00.

On the downside, support lies around $0.68–$0.70, and a drop below this could signal short-term weakness. Analysts point to a potential continuation pattern in development, with increasing volume suggesting growing investor conviction.

Fundamentally, Cardano has completed its original roadmap from 2020, according to founder Charles Hoskinson, and now boasts a $25 billion ecosystem with thousands of dApps.

The network is also facing governance and scaling challenges, especially as the community calls for renewed focus on ecosystem funding and faster development. While regulatory concerns remain—ADA was recently named in an Oregon AG lawsuit targeting Coinbase—the token continues to be favored for its energy-efficient proof-of-stake model and robust developer engagement.