- Private transactions on Ethereum’s Layer 1 consume 50% of gas while accounting for only 30% of total volume.

- High gas usage in private transactions correlates with the need for security and increased computational resources.

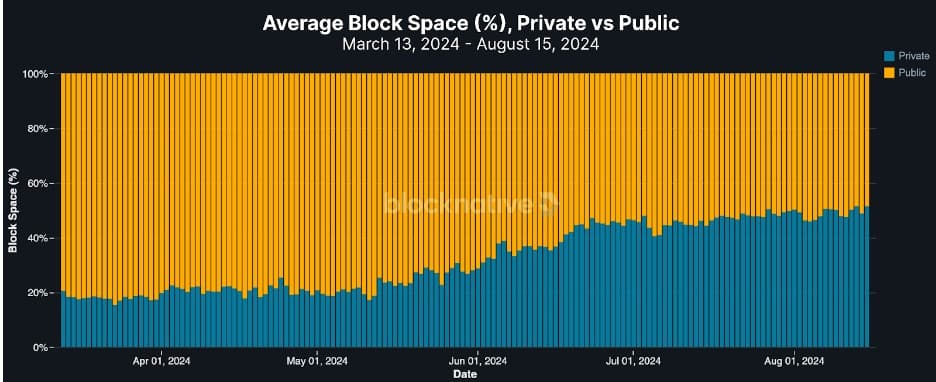

Recent data indicates a rising trend in the usage of private transactions on the Ethereum network, particularly for complex transactions that require protection from frontrunning.

According to a study by Blocknative, private transactions, although representing only 30% of the total transaction volume on Ethereum’s Layer 1, account for 50% of the gas used, highlighting their intensive nature.

This shift towards private transactions underscores the value users place on security and privacy, particularly when transacting large values or sensitive information.

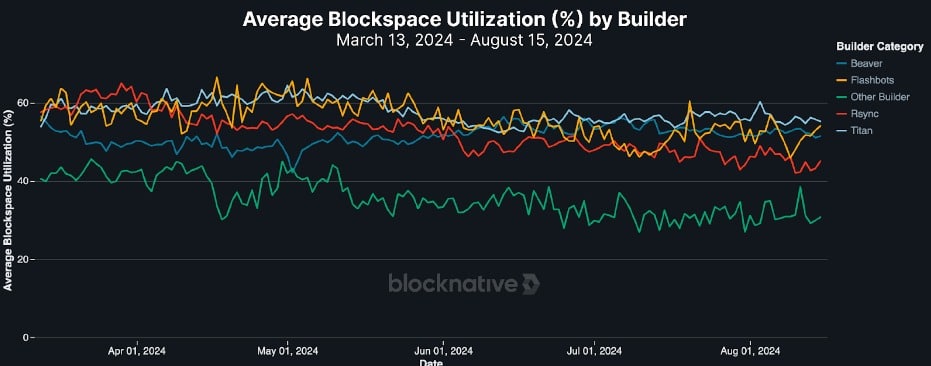

Such transactions demand more computational resources, hence their higher gas consumption. As we reported on ETHNews, gas, the fee paid for executing transactions on the Ethereum network, correlates directly with the economic value of the blockchain’s block space.

The introduction of the EIP-1559 upgrade in 2021, which implemented a dynamic base fee system adjusting fees based on network demand, has seen increased fluctuations due to the rise in private transactions. This fluctuation leads to what are termed “vanilla blocks,” where base fees become less predictable.

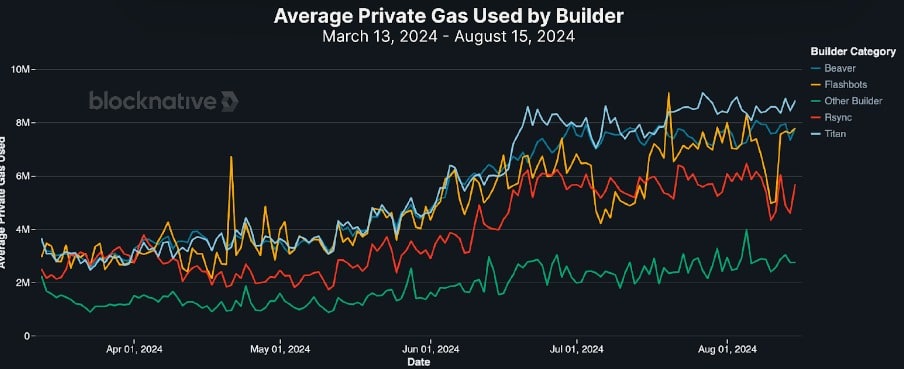

Significantly, this trend impacts not just individual users but also large organizations involved in Ethereum transactions. For example, entities like Titan, Rsync, Beaver, and Flashbots have markedly increased their use of private transactions within the last year.

Titan, for instance, has escalated its gas usage from 3.5 million to 8.5 million as of March, illustrating this increase.

However, this surge in private transaction usage has broader implications, particularly for smaller developers or builders. These groups face increased challenges in competing within the network due to the higher costs associated with the necessary gas for transactions.

As larger players consume more resources, smaller participants struggle to meet the high gas thresholds, which were set following the EIP-1559 update.