- Recent positive trends in Ethereum’s Exchange Net Position Change suggest potential for upcoming price gains.

- Options traders show optimism with a low Put/Call Ratio, predicting Ethereum could rise to $3,600 by June.

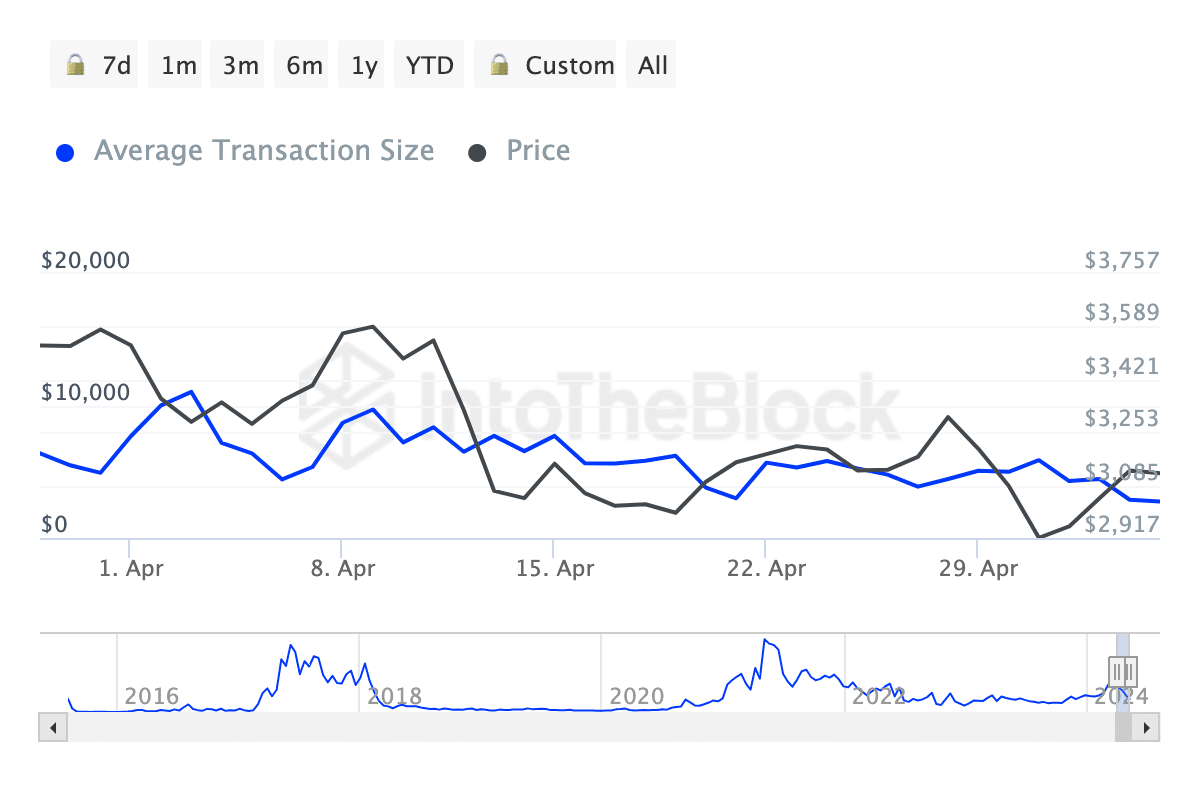

Recent data indicates a significant decrease in Ethereum’s average transaction size, dropping 54.13% from $5,893 at the beginning of May to $2,767 by May 19th, according to ETHNews analysis referencing IntoTheBlock data.

While such a decline might initially appear concerning, it reflects a shift in the user base rather than a downturn in market health.

Ethereum’s User Base Shifts from Institutional to Retail

The decrease in transaction size suggests a reduction in institutional activity, potentially indicating a transition towards greater retail participation. Historically, large spikes in transaction size are often correlated with heightened activity from major investors and institutions, whereas declines can indicate lesser institutional involvement.

This shift might signal that Ethereum is nearing a price bottom, based on historical patterns that associate lower average transaction sizes with potential market lows.

Current Market and Future Predictions

As of the latest data, Ethereum’s price stands at $3,106, demonstrating stability within this range over the last 24 hours. Despite the decline in average transaction size, Ethereum might be gearing up for an increase in its price.

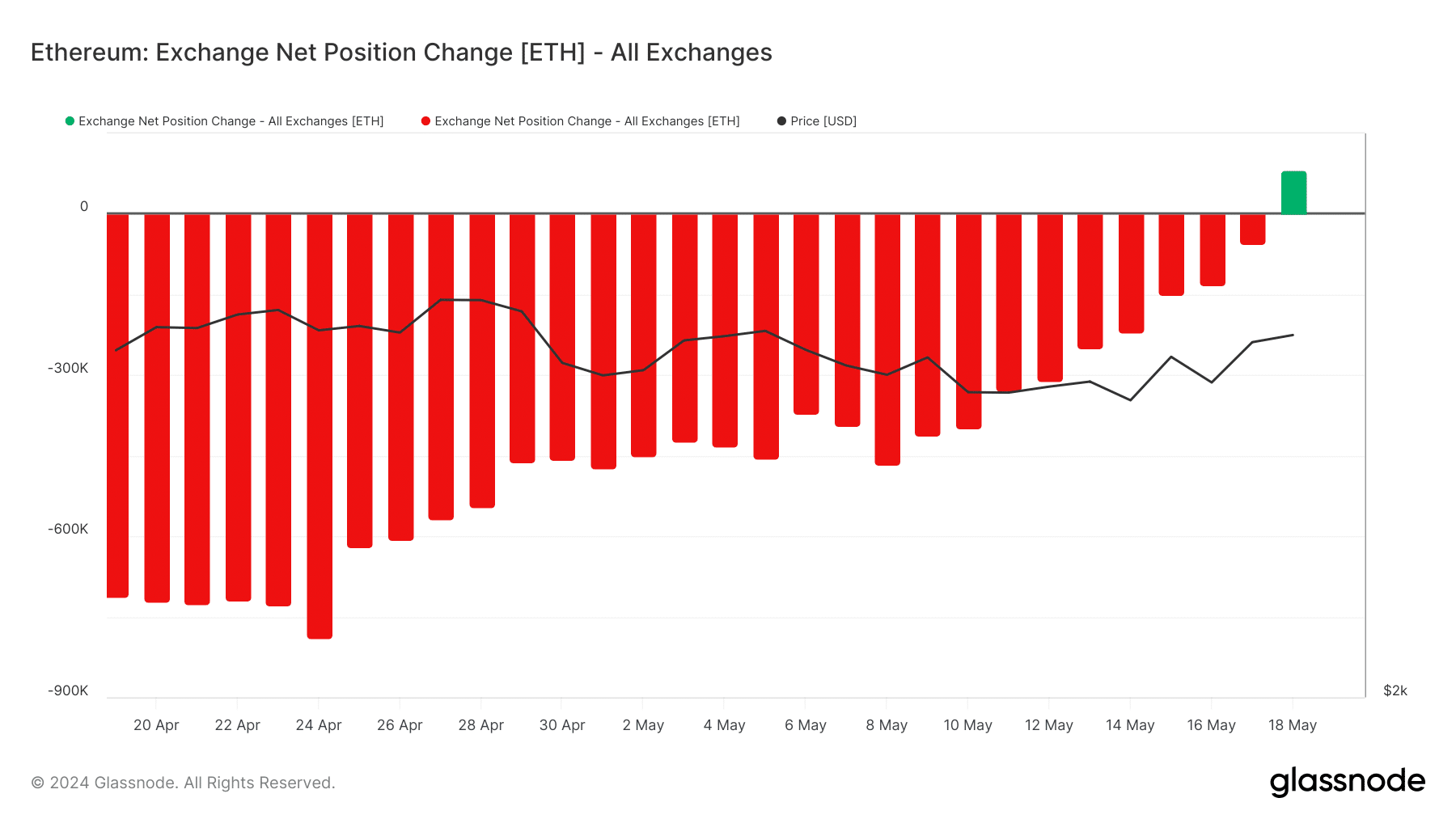

[mcrypto id=”12523″]This is supported by additional metrics from Glassnode, which show recent trends in Ethereum’s Exchange Net Position Change.

The Exchange Net Position Change, tracking the 30-day supply change in exchange wallets, recently showed an uptick on May 18th, registering at 81,715. This increase could indicate that market participants are starting to take profits following a 6.50% rise in Ethereum’s value over the past week.

If this trend of placing more coins into exchanges reverses into a pattern of withdrawals, Ethereum’s price could start a gradual ascent towards $3,500, and potentially even reach $4,000 under highly bullish conditions.

Options Market and Sentiment Analysis

Furthermore, Ethereum options traders are showing optimism about the asset’s short-term price potential. Data from ETHNews on May 17th highlighted expectations for Ethereum to reach $3,600 by the end of June.

The Put/Call Ratio (PCR), a metric used to gauge market sentiment by comparing the volume of put options against call options, further supports this outlook.

A PCR below 0.50 typically suggests a bullish sentiment among traders; Ethereum’s PCR currently stands at 0.35, confirming that the majority anticipate an increase in price.

While the reduction in Ethereum’s average transaction size points to a decrease in institutional engagement, the overall market sentiment remains positive, driven by retail activity and optimistic trading indicators.

Traders and investors alike are closely watching these developments, anticipating potential upward movements in Ethereum’s price in the coming weeks.