- Lubin projects that the approval of the Ethereum ETF will cause a serious supply crunch.

- Joe Lubin draws attention to the tight availability and great demand for Ether for exchange-traded funds.

After much waiting, the Securities and Exchange Commission (SEC) seems prepared to approve spot Ethereum exchange-traded funds (ETFs). It is predicted that this action will cause Ether demand to spike significantly, maybe resulting in a supply shortage.

The co-founder of Ethereum and CEO of Consensys, Joe Lubin, projects that this “floodgate” of demand will significantly affect Ether’s supply.

Ethereum ETF: Demand Driven by Institutional Diversification

Institutions that have previously made Bitcoin investments through recently introduced ETFs are probably going to add Ethereum ETFs to their portfolios. Lubin says there would be a significant pent-up demand for using these funds to buy Ether, according to DLNews reports.

But unlike Bitcoin, whose spot ETFs were approved earlier this year, there won’t be as much supply to satisfy this demand.

With Bitcoin ETFs, anytime fresh shares were issued, authorized participants may buy idle bitcoin on exchanges or over-the-counter. On-chain data for Ether shows that the Ethereum network is now holding over 27% of the entire supply.

Because it is trapped in contracts and yields to its owners, this staked ether lowers the supply that is available.

Further restricting the amount of Ether available for ETFs is its active use in the core protocol, decentralized autonomous organizations (DAOs), or decentralized finance (DeFi) systems.

Because Ether has a lower market value than Bitcoin, its price is more sensitive to inflows. Further limiting the available quantity will be the burning of a significant portion of the current Ether supply over time brought about by renewed activity on Ethereum.

Ethereum Recent Price Surge and Market Data

CoinMarketCap data show the price of ETH at the moment of writing is at $3,803.37, up 3.21% in the last day. The last week has also shown this optimistic tendency, as ETH prices have climbed by 31.36%.

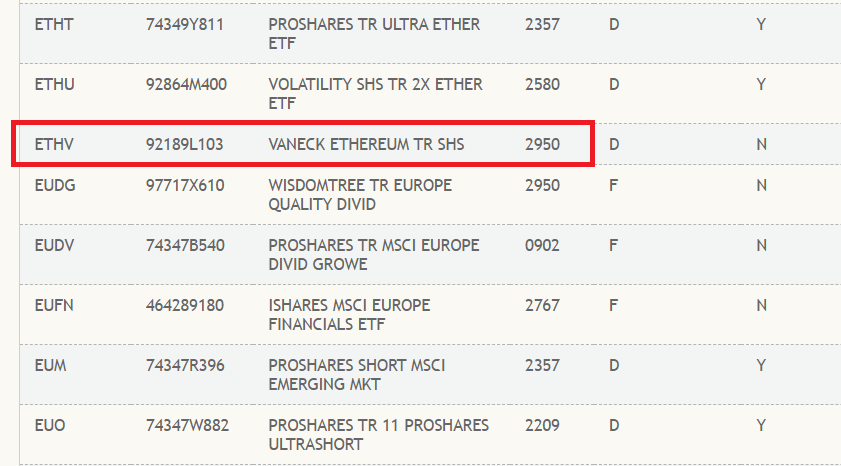

[mcrypto id=”12523″]In line with what ETHNews today disclosed, VanEck’s Ethereum ETF has achieved a critical milestone in the ETF industry with its listing on the Depository Trust & Clearing Corporation (DTCC).

Chance of a Serious Supply Crunch

Banks were even so keen to buy Bitcoins for ETFs that they contacted large Bitcoin mining companies to buy some of their holdings. With the strong demand and little supply available, the supply problem for Ethereum ETFs is predicted to be even more severe.