- Kaiko projects Ethereum to outperform Bitcoin after U.S. ETF launches, with Ether-Bitcoin ratio rising to 0.05.

- SEC approval of 19b-4 applications signals impending Ethereum ETFs, boosting confidence and potential institutional inflows.

Ethereum’s prospects are looking brighter as market data firm Kaiko predicts that the cryptocurrency will outperform Bitcoin following the anticipated launch of spot Ethereum ETFs in the United States.

Our latest Data Debrief just dropped.

This week we took a look under the hood at $ETH as market participants await spot ETF launcheshttps://t.co/FK27GNsLTw

— Kaiko (@KaikoData) July 15, 2024

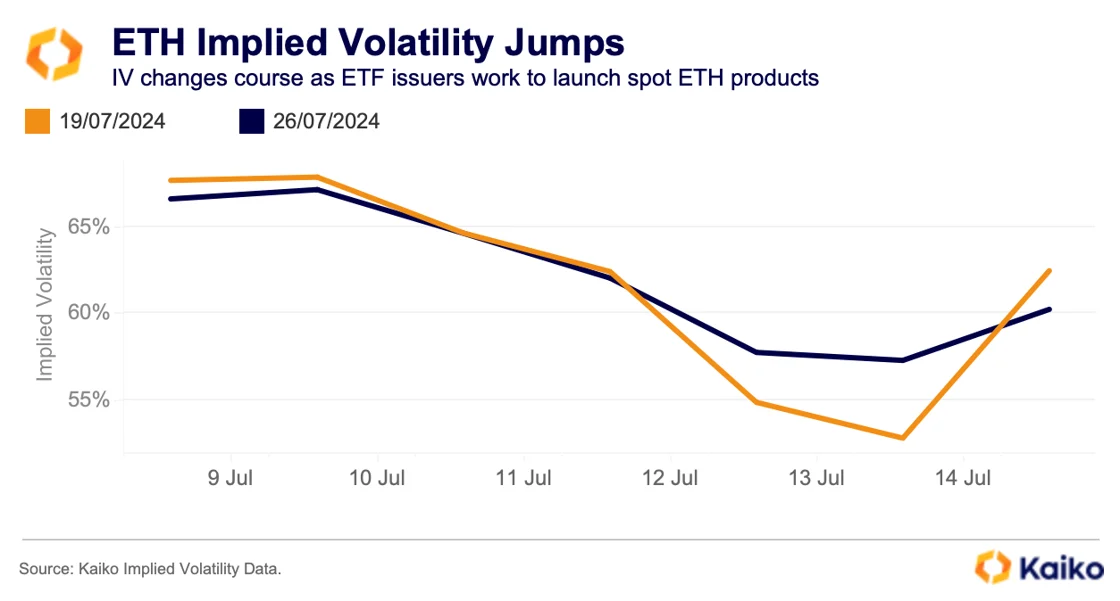

This development is set to catalyze a significant market movement, influenced by a combination of regulatory progress and institutional interest.

Anticipated Growth for Ethereum

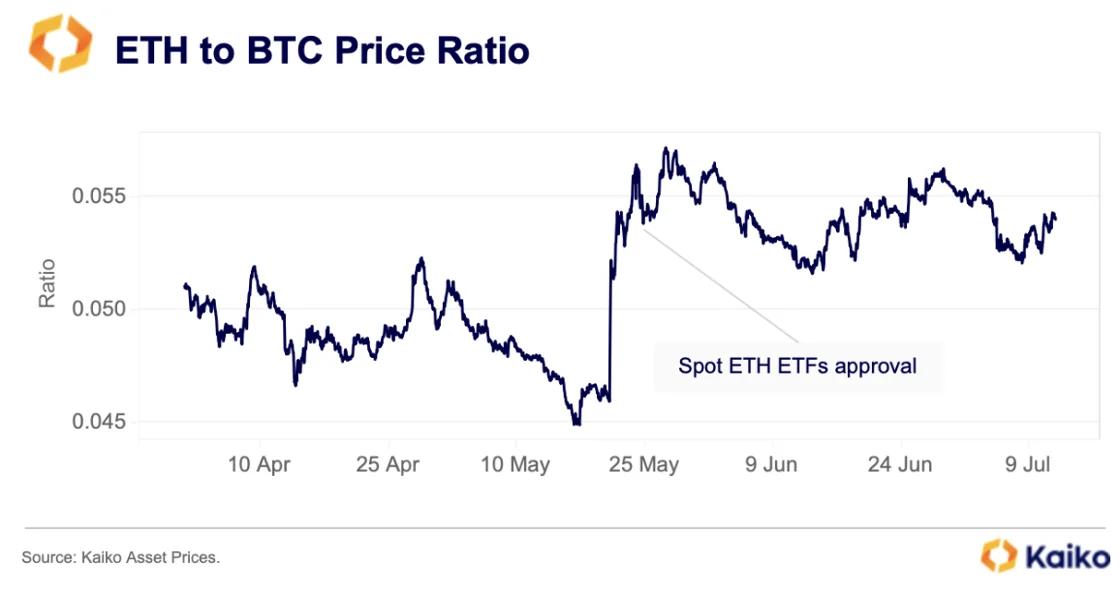

Kaiko’s recent analysis highlights a potential surge in Ethereum’s market performance relative to Bitcoin. The Ether-Bitcoin price ratio, which currently stands at 0.05, up from 0.045, indicates Ethereum’s increasing valuation against Bitcoin.

This ratio, a key metric for comparing the two assets, suggests that Ethereum may continue to gain ground, especially as ETFs come into play.

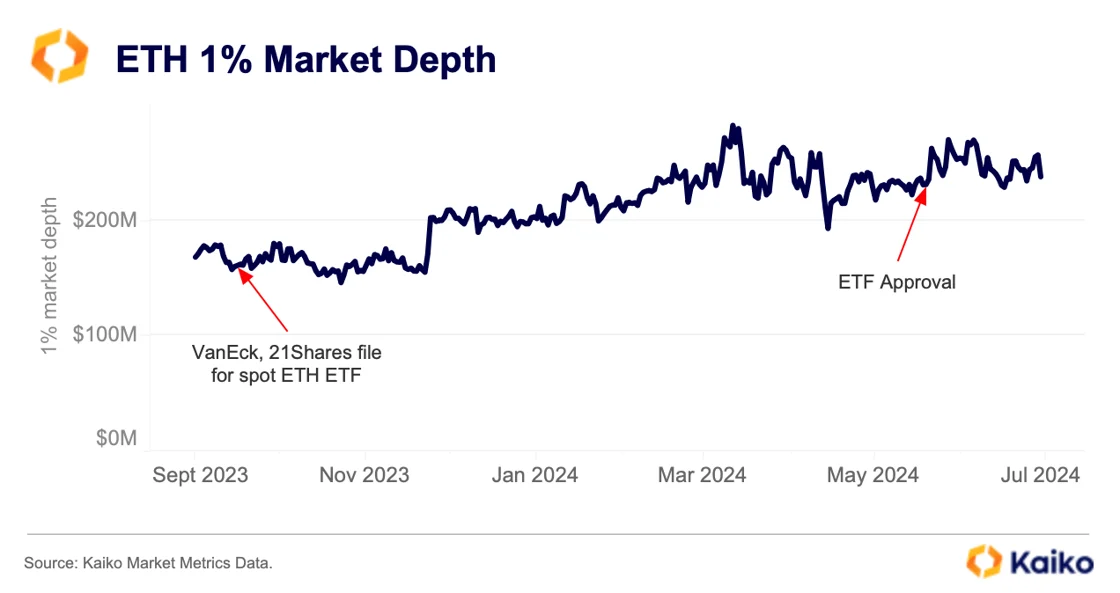

The chart discusses the state of liquidity in the Ethereum market, particularly in relation to the trading volumes and market depth, as well as the impact of newly approved spot ETFs (Exchange-Traded Funds).

Liquidity Conditions and Trading Volumes

The passage begins by noting that the overall liquidity conditions for Ethereum (ETH) have been stable, even though there is typically a decrease in trading volumes during the summer months.

- Liquidity in financial markets refers to how easily assets can be bought or sold in the market without affecting their price. Stable liquidity, despite lower trading volumes, indicates that the market is robust enough to handle trades without significant price fluctuations.

ETH’s 1% Market Depth

It mentions that Ethereum’s 1% market depth has been steady at around $230 million since the approval of the spot ETFs. Market depth, measured here, refers to the amount of Ethereum that can be bought or sold at prices close to the last traded price without significantly affecting the price.

- The consistent market depth suggests a healthy amount of orders on both the buy and sell sides, contributing to stable liquidity.

Impact of SEC Approval

Before the approval of spot ETFs, the market depth had dipped below $200 million at the start of May. However, it reversed this downtrend following the SEC’s approval of spot ETFs.

- This indicates that the market responded positively to the regulatory approval, seeing it as a sign of increased legitimacy and potential growth, which likely attracted more traders and investors back into the market.

Comparison with Bitcoin ETFs

The passage concludes by suggesting that the Ethereum spot ETFs could further improve liquidity conditions, similar to what was observed with Bitcoin after the launch of its ETFs in January.

- Spot ETFs allow investors to trade shares in a fund that directly holds the underlying asset (in this case, Ethereum) on traditional stock exchanges. This typically attracts more institutional investors and can lead to increased buying and selling activity, thereby enhancing liquidity.

Regulatory Advances and Market Response

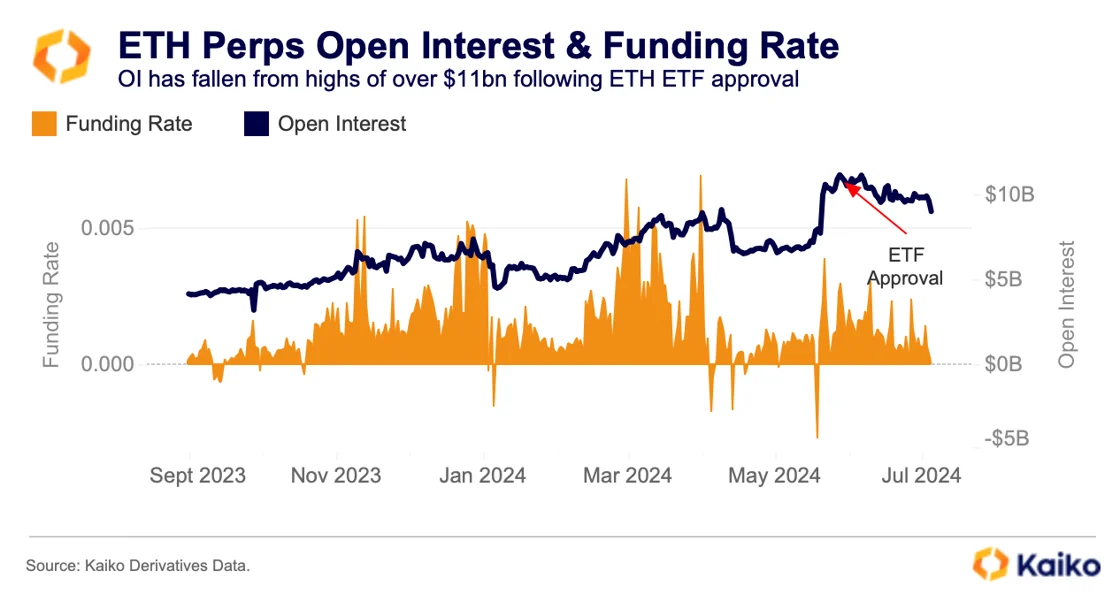

The approval of 19b-4 applications by the Securities and Exchange Commission (SEC) marks a critical step towards the launch of these ETFs. Historically, such regulatory milestones have led to increased market activity and investor interest.

In the past two months, despite a 20% dip in Ethereum’s price linked to broader macroeconomic factors, the anticipation surrounding Ethereum ETFs suggests a rebound may be imminent.

Institutional Interest and the Smart Contract Appeal

Continuing with the previous ETHNews report, Ethereum’s appeal extends beyond its potential for price appreciation. Its foundational role in the smart contract and decentralized application (DApp) sectors makes it a significant asset in the crypto ecosystem. Last year, wealth managers pinpointed Ethereum as possessing a substantial growth trajectory, making it a favored asset among traditional investors.

Broad Market Implications

The introduction of spot crypto ETFs has reshaped the investment market, with billions of dollars flowing from institutional investors into the market since the approval of Bitcoin spot ETFs earlier in January. The success of these Bitcoin-based products has paved the way for Ethereum’s entry, with a ripple effect anticipated across the market.

The forthcoming trading of Ethereum products this summer, coupled with the positive sentiment surrounding them, has also spurred filings for Solana ETFs, indicating a broader acceptance and integration of major cryptocurrencies into conventional investment portfolios.