- Despite the increase in mining and security difficulty, LTC falls 2.72% in one month, reflecting decoupling with strength metrics.

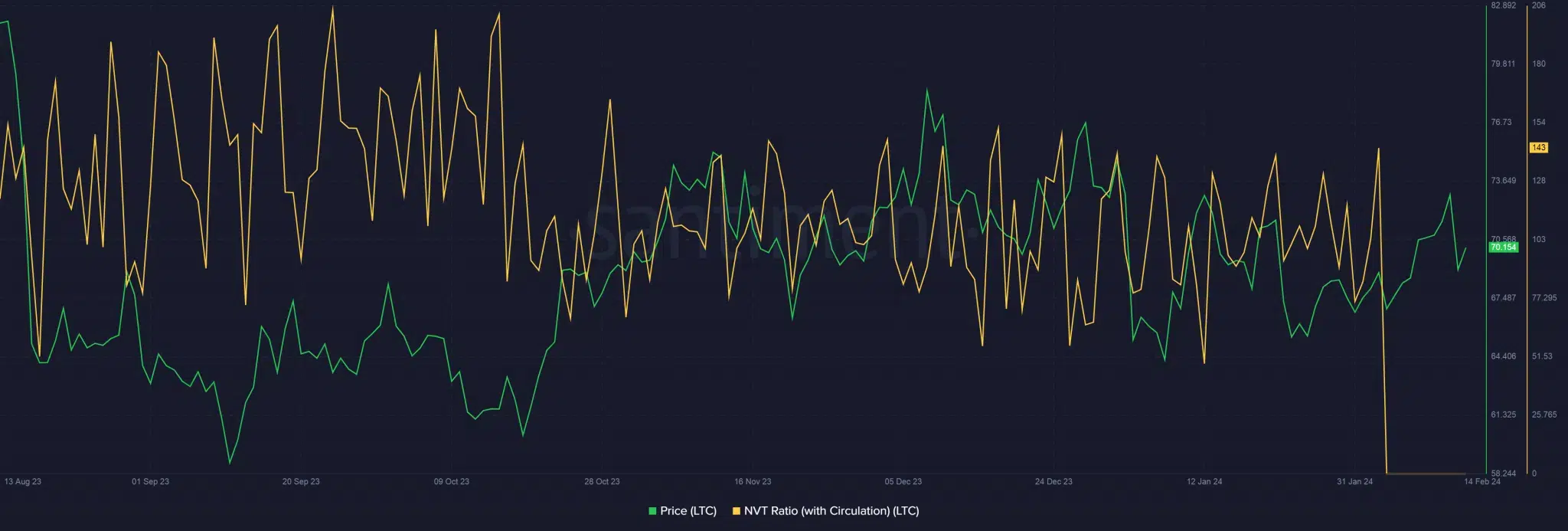

- The declining NVT ratio suggests network usage outpacing market value, a potentially bullish long-term indication for Litecoin.

Analysis of Litecoin mining statistics reveals a complex scenario that, while underscoring the robustness and technical growth of the network, does not necessarily translate into immediate benefits for LTC investors.

Here I break down how these signals impact Litecoin

Increased mining difficulty and network security

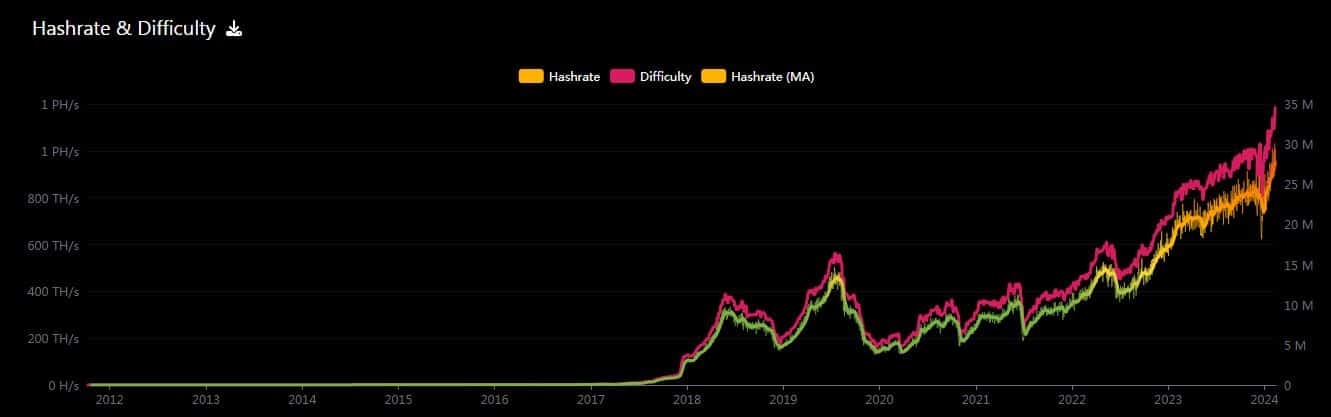

Litecoin mining difficulty reached an all-time high of 34.58 million, evidencing an 8.4% increase in the last week and more than 20% year-to-date. This increase responds to a spike in the network’s hash rate, which reached 1.03 PetaHashes per second, marking a 21% increase year-to-date.

On a technical level, this increase in difficulty and hash rate is indicative of a more secure network, as it hinders the ability of malicious actors to manipulate transactions. It also reflects network growth, which could be interpreted as a bullish sign for LTC in the longterm.

This suggests that, although miners face greater challenges in validating transactions and adding new coins to circulation, the network itself benefits from increased security and robustness.

Decoupling between mining metrics and price action

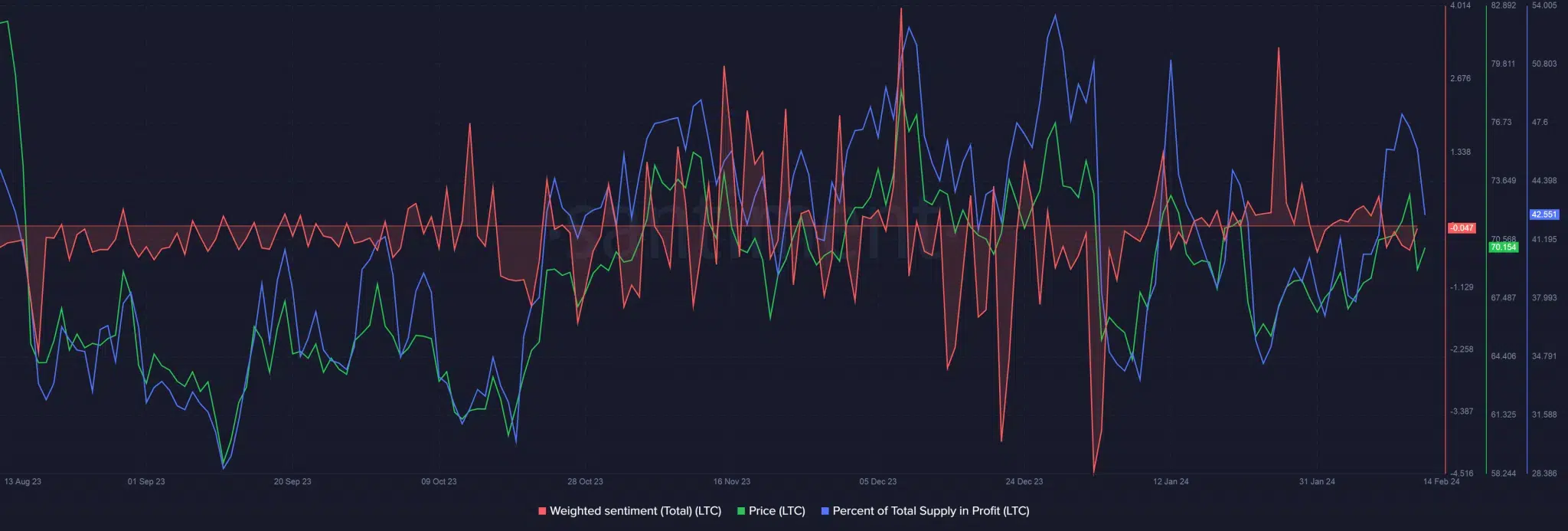

Despite impressive mining statistics, the price of LTC has not responded positively. LTC has experienced a 2.72% drop in the last month and trades 38% below its 2023 high, which has lowered the overall profitability of the network, with only 46% of total supply in earnings, compared to 78% in July.

This points to a decoupling between the technical strength of the network and its perception in the market. Negative sentiment towards LTC currently limits its near-term upside potential, despite signs of underlying growth and safety in the network.

The scenario for Litecoin is doubly facetious

On the one hand, mining data reflects a strengthening, more secure and potentially growing network, which could bode well for LTC’s long-term value. On the other hand, the market reaction so far has been tepid, influenced by negative sentiment and a decline in returns for investors.

However, the declining NVT ratio suggests that network usage is outpacing market value growth, a historically bullish indicator. Therefore, while investors may be dissatisfied in the short term, the underlying metrics could set the stage for a brighter future for LTC.