- Volume spikes to $1.13B hint panic selling; CMF’s institutional disinterest complicates recovery despite Litecoin’s capped supply of 84M.

- LTC’s path balances on $66 hold; reclaiming $72 may invite buyers, but negative CMF delays sustained bullish momentum.

Litecoin (LTC) fell 15.13% in 24 hours to $67.02, erasing $5.06 billion in market value. Despite the drop, trading volume jumped 301.99% to $1.13 billion, signaling heightened activity. The volume-to-market-cap ratio of 22.27% suggests traders are actively repositioning, though motives remain unclear—whether exiting positions or seeking bargains.

Litecoin’s maximum supply of 84 million tokens, with 75.55 million already circulating, caps inflation by design. However, this feature hasn’t shielded LTC from broader market declines. The token briefly rebounded to $69.50 after hitting intraday lows, illustrating fleeting buyer interest amid sustained selling pressure.

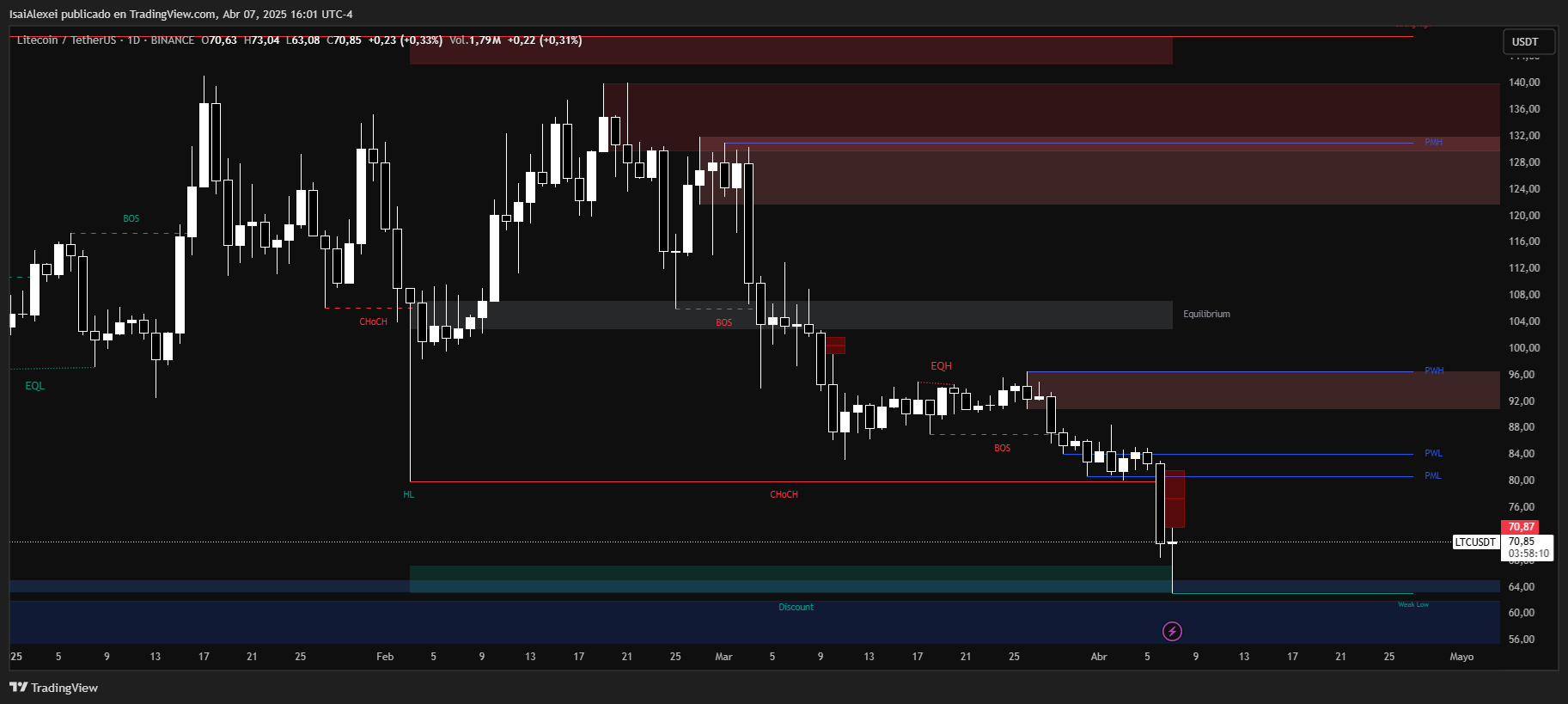

Immediate resistance sits near $72, a level Litecoin must reclaim to test $76, where prior consolidation occurred. Conversely, failure to hold $66 risks a slide toward $62, potentially extending losses to $58 if bearish momentum persists.

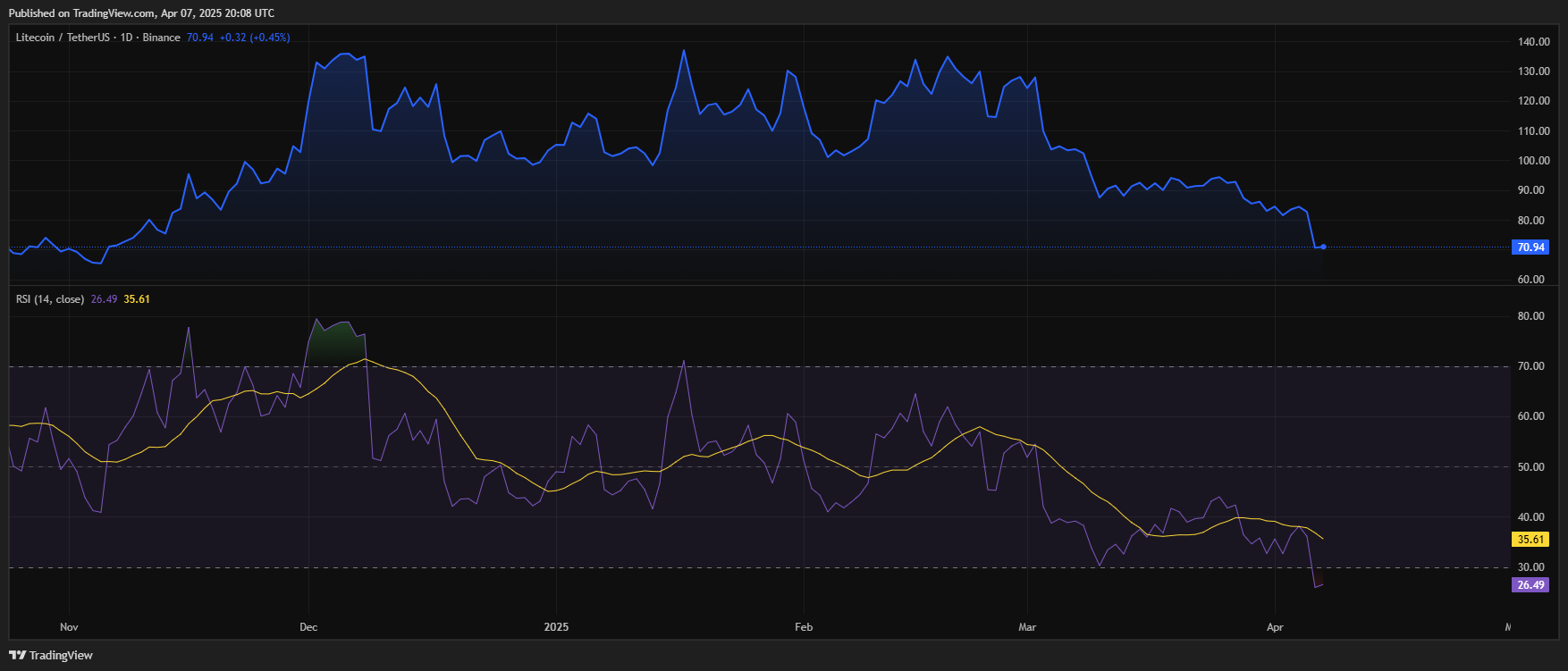

The Relative Strength Index (RSI) at 31.31 nears oversold territory, hinting at possible short-term stabilization. Its 14-period average of 33.11 reflects weak but not yet exhausted downward momentum.

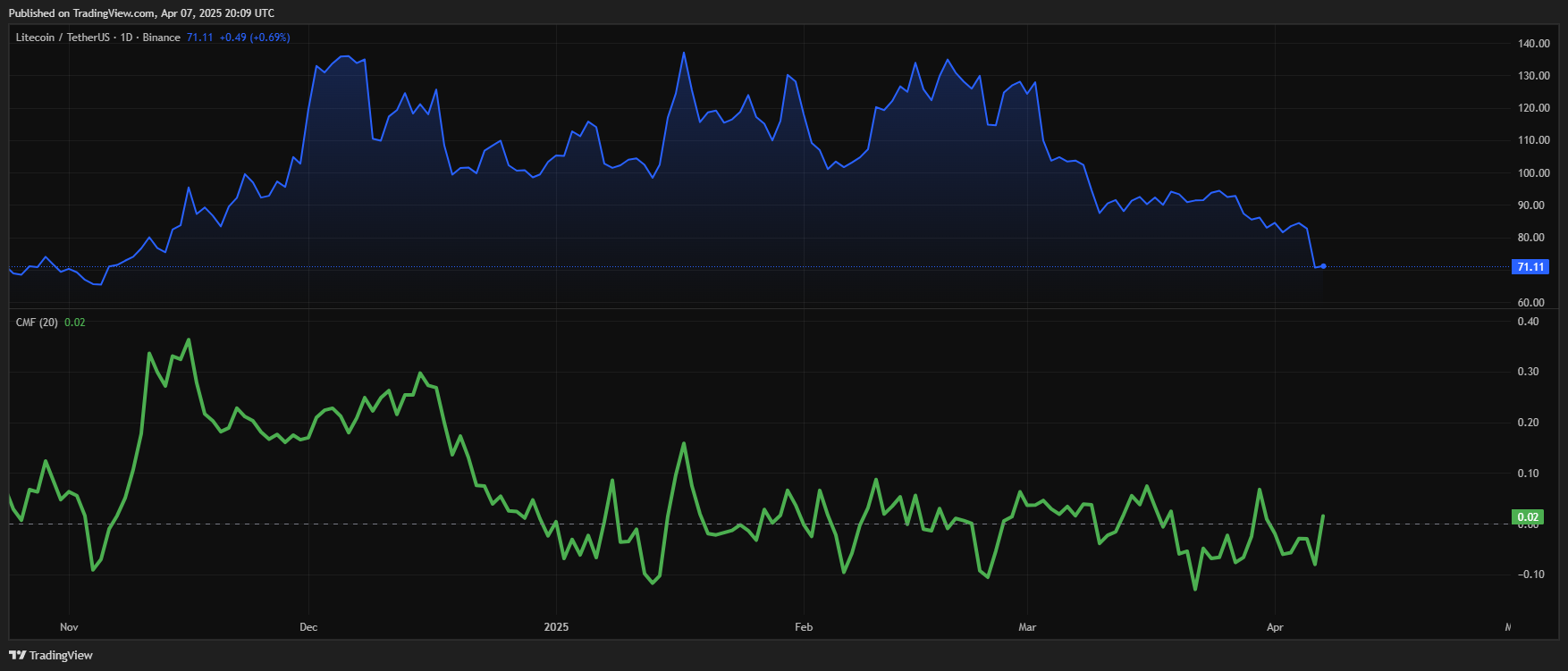

The Chaikin Money Flow (CMF), measuring capital movement, remains negative at -0.19. This indicates continued outflows, with buyers hesitant to commit. For a trend reversal, CMF must cross above zero, signaling renewed accumulation. Until then, rallies may face skepticism.

Volume Spike Raises Questions

The surge in trading volume to $1.13 billion—often a hallmark of capitulation—suggests panic selling rather than strategic buying. While oversold conditions can precede rebounds, Litecoin lacks clear catalysts to drive sustained recovery. Traders now watch the $66–$72 range: holding above $66 may stem bleeding, while breaking $72 could invite cautious optimism.

Institutional disinterest, reflected in CMF data, complicates recovery efforts. Retail traders dominate activity, but without whale participation, upward moves may lack conviction. Historical patterns show Litecoin often mirrors Bitcoin’s movements, which remain subdued amid macroeconomic uncertainty.

Litecoin (LTC) is currently priced at $70.87 USD, with a 24-hour trading volume of approximately $1.1 billion and a market capitalization of $5.36 billion. Over the last 24 hours, LTC has decreased by 2.32%, and over the past 7 days, it has dropped by 15.15%, following the broader bearish trend affecting the crypto market. Despite this downturn, Litecoin has shown a 31.9% increase over the past month, which indicates a degree of resilience in its mid-term trend.

The price range in the last 24 hours has moved between $63.71 and $73.02, suggesting moderate volatility. Litecoin is still trading over 82% below its all-time high of $410.26, yet it’s more than 6,000% above its historical low, which illustrates its long-term growth potential and historical importance as one of the earliest and most established altcoins.

Litecoin’s market capitalization stands at around $5.36 billion, with a circulating supply of approximately 75.7 million LTC. The 24-hour trading volume is $1.11 billion, reflecting renewed activity and potential accumulation by traders near current levels. While it’s trading over 82% below its all-time high of $410.26, it’s also massively above its historical lows, pointing to long-term resilience as one of the more established altcoins.