- Futu Securities International launches cryptocurrency trading for Bitcoin and Ether to 22 million users in Hong Kong.

- Introduction of Ether ETFs in the U.S. boosts global institutional interest, fostering more investments into crypto assets.

Futu Securities International, Hong Kong’s largest online brokerage, recently initiated cryptocurrency trading services for its 22 million users, becoming the first such brokerage in the city to offer Bitcoin and Ether trading directly to retail investors.

This introduction by Futu is a part of a broader, global increase in institutional interest in cryptocurrencies. For instance, the recent launch of the first spot Ether Exchange-Traded Funds (ETFs) in the United States has further spurred this interest. These ETFs allow for more institutional investments directly into crypto assets, enhancing the overall market’s maturity.

Adding to the momentum, Franklin Templeton, a major asset management firm, has partnered with SBI Holdings to form a crypto ETF management company in Japan. Announced on July 26, this partnership aims to provide investors with simpler access to crypto-based trading products.

“It is expected that the joint venture will provide a diversified range of investment solutions, including Franklin Templeton’s existing ETFs. As regulations on digital assets and cryptocurrencies continue to evolve in Japan, the new JV will launch related products subject to regulatory approval.”

Pending regulatory approval, this venture may soon introduce a crypto ETF in Japan, diversifying the investment solutions available to the market, including Franklin Templeton’s current ETF offerings.

The Growth in Crypto Services is not Limited to the United States and Japan

In Hong Kong, regulatory advancements aim to position the city as a pivotal global hub for cryptocurrency and blockchain innovation. In early July, Hong Kong introduced a new stablecoin licensing regime, following a two-month public consultation that concluded in February.

Eddie Yue, CEO of the Hong Kong Monetary Authority (HKMA), noted the strong support for this regulatory framework, which is designed to foster a sustainable and responsible stablecoin environment in Hong Kong.

“We believe that a well-regulated environment is conducive to the sustainable and responsible development of the stablecoin ecosystem in Hong Kong.”

Despite these efforts, challenges persist in Hong Kong’s pursuit to become a leading crypto center. Recent months have seen a withdrawal by several prominent crypto firms from the market.

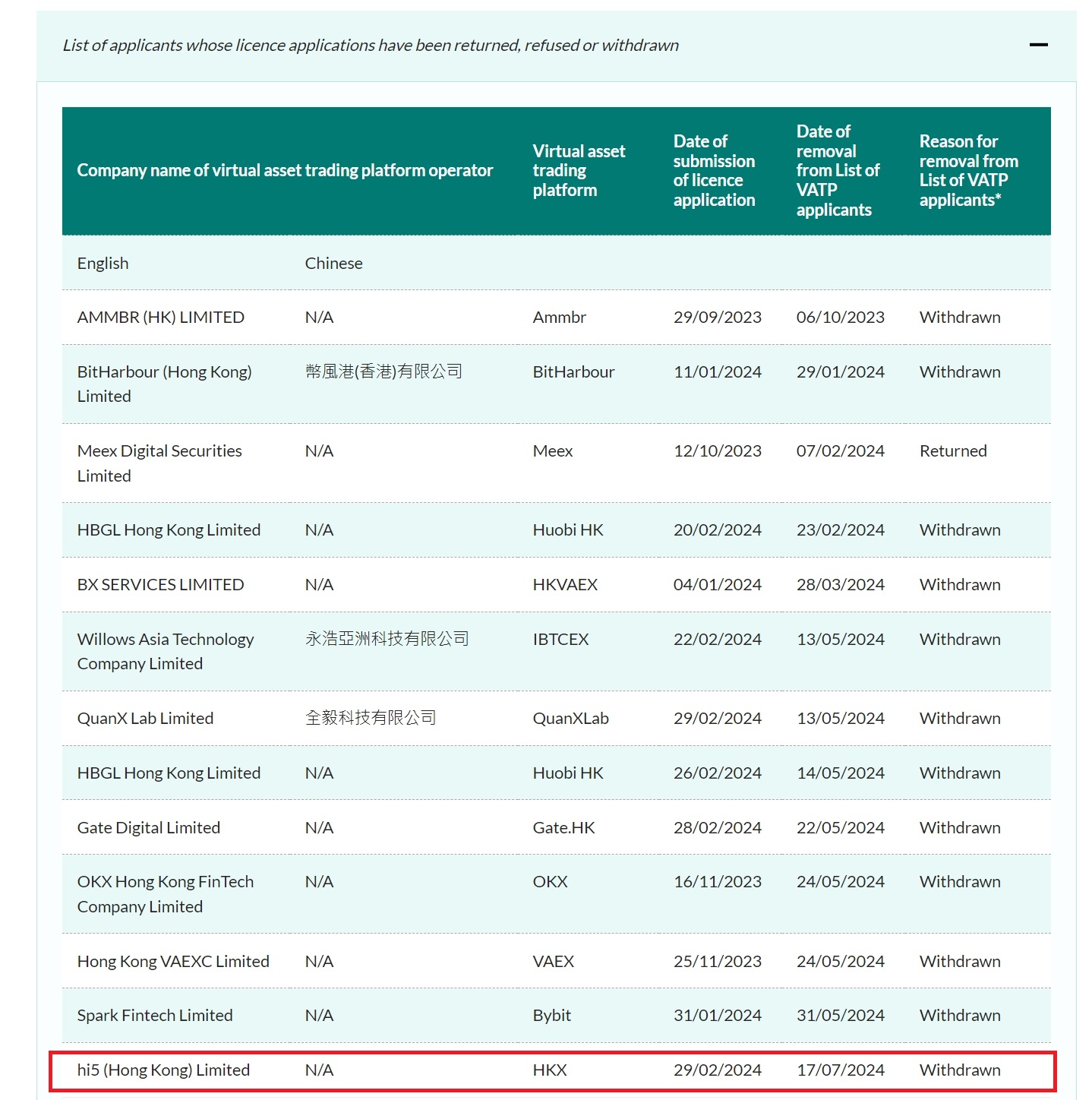

As of late July, a total of 13 cryptocurrency exchanges or trading platforms have retracted their license applications in Hong Kong, with one application being returned for reasons not publicly disclosed.

These reflect a period of growth and adjustment in the global cryptocurrency market, with Hong Kong and other major financial centers adapting to new technologies and regulatory market to better integrate digital assets into the broader economy.