- CEO Fred Thiel emphasizes Bitcoin as a strategic reserve, advising governments and corporations to hold it.

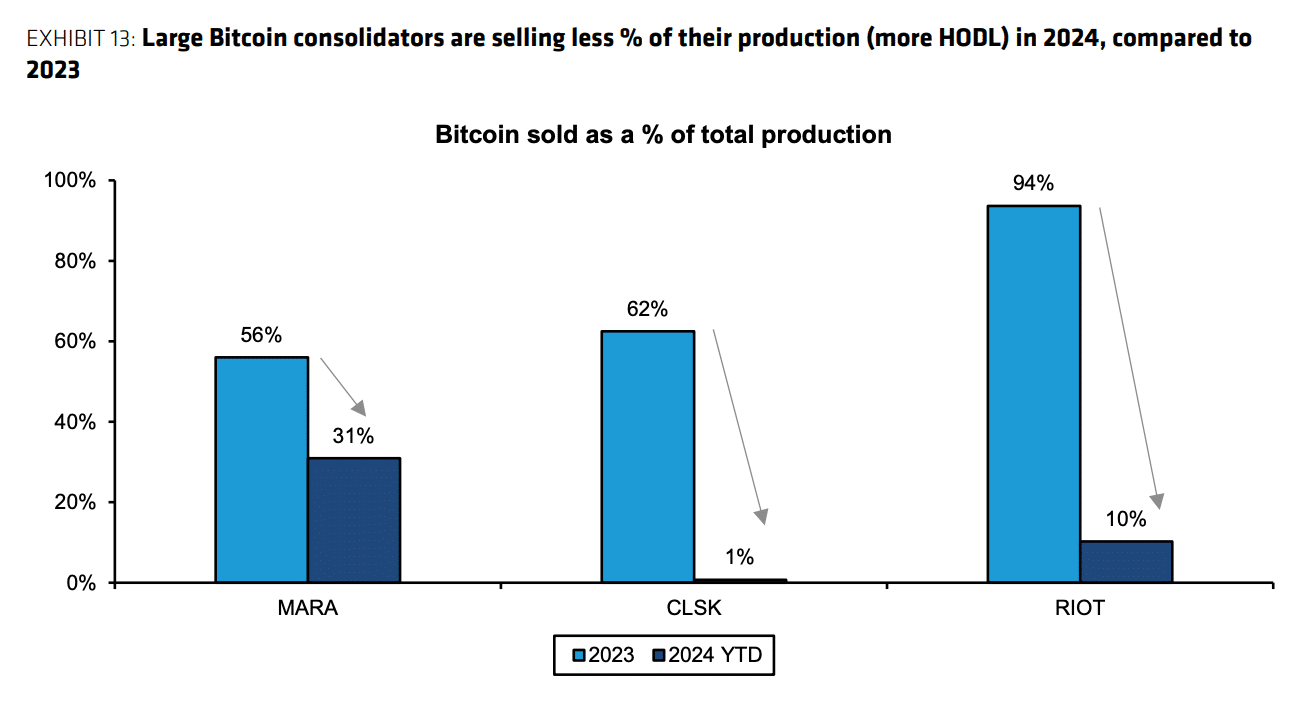

- Marathon Digital reduces its Bitcoin sales from 56% in 2023 to 31% in 2024, reflecting a trend among miners.

Marathon Digital, a well-known Bitcoin mining company, has recently increased its Bitcoin holdings by purchasing an additional $100 million of the cryptocurrency. This acquisition is part of the company’s new strategy, described as ‘full HODL,’ which involves retaining all Bitcoin mined and continuing to buy more from the open market.

Fred Thiel, CEO of Marathon Digital, explained the company’s strategy adjustment.

“To strengthen our strategy of holding Bitcoin as our strategic treasury reserve asset, we will now go full HODL,” he said.

This move indicates Marathon Digital’s commitment to Bitcoin as a long-term investment.

Today Marathon is proud to announce that to strengthen our strategy of holding #Bitcoin as our strategic treasury reserve asset, we have over the past month purchased $100 million in BTC, and will now go full HODL @saylor pic.twitter.com/Go8wHYfuY9

— Fred Thiel (@fgthiel) July 25, 2024

This shift towards a full HODL strategy is reflective of a larger trend among Bitcoin mining companies, which are increasingly focusing on holding onto their Bitcoin for future value rather than selling it immediately.

Today, we are announcing that MARA has purchased $100,000,000 worth of BTC. And effective immediately, we are once again adopting a full HODL strategy. Learn more about our #Bitcoin Strategic Reserve: pic.twitter.com/pYxiclOtQa

— MARA (@MarathonDH) July 25, 2024

A recent Bernstein report showed that Marathon Digital has reduced the percentage of its Bitcoin sales from 56% in 2023 to 31% in 2024, aligning with similar trends at other mining companies like Riot Platforms and CleanSpark.

Additionally, Thiel promotes the use of Bitcoin as a strategic reserve asset, suggesting it for both government and corporate financial strategies.

“We believe Bitcoin is the world’s best treasury reserve asset and support the idea of sovereign wealth funds holding it. We encourage governments and corporations to all hold Bitcoin as a reserve asset,” Thiel stated.

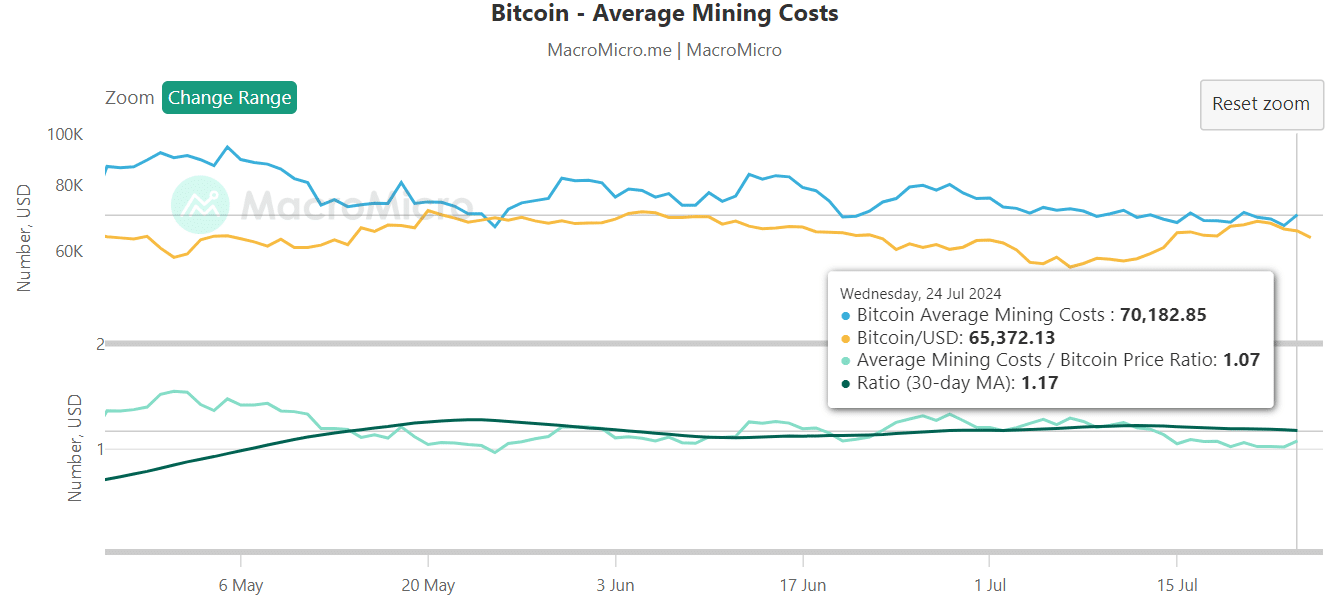

Despite the strategic moves by major mining companies, the profitability of Bitcoin mining remains a challenge. The average cost of mining stands at $70,000, which exceeds the current market price of Bitcoin at $65,000. This cost disparity poses profitability issues, especially for smaller, private mining operations.

However, according to Bitcoin analyst Willy Woo, there may be a positive shift soon. Woo anticipates that an end to the current phase of miner capitulation could lead to a rally in Bitcoin miner stocks, potentially improving the economic outlook for companies like Marathon Digital.