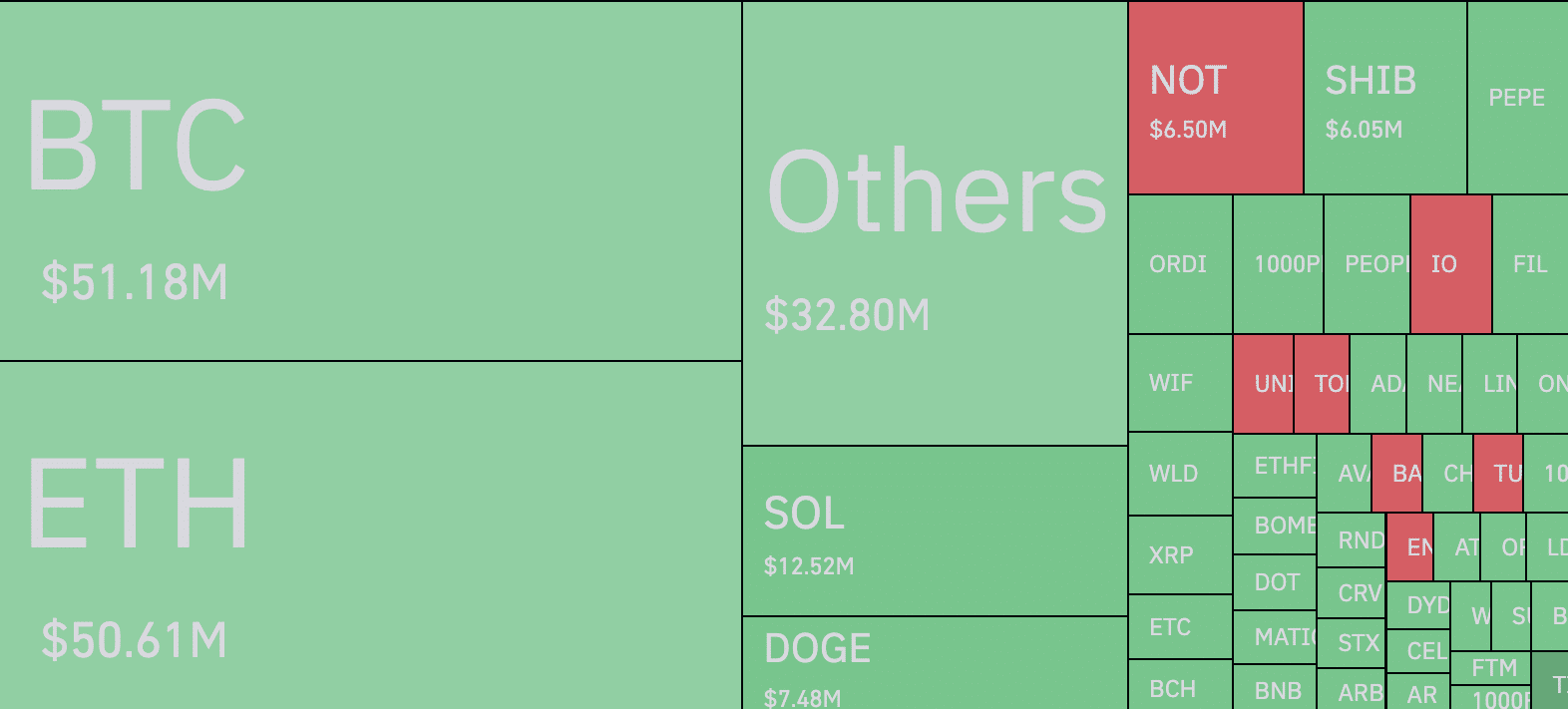

- Ethereum faces $50.61 million in liquidations as market volatility spikes, impacting both long and short position holders.

- Ethereum’s price swings from $3,368 to over $3,500 on June 14, reflecting significant market fluctuations.

Recent data from Coinglass indicates that Ethereum has undergone liquidations amounting to $50.61 million due to price volatility. Liquidations happen when traders cannot maintain the necessary margin balance, forcing a sale of their positions to prevent further financial loss.

Price and Trading Impacts

On June 14, Ethereum’s price dropped to $3,368, later rising to $3,512, and subsequently stabilizing above $3,500. This fluctuation in price affected traders with long and short positions. Traders with long positions speculate on price increases, whereas those with short positions anticipate price declines.

Trader Sentiments and Options Market

Before the recent options expiry, the Put/Call ratio stood at 0.37, as per Deribit’s data, suggesting a bearish sentiment among traders. A ratio below 0.50 typically indicates a predominance of sell expectations over buy expectations in the market.

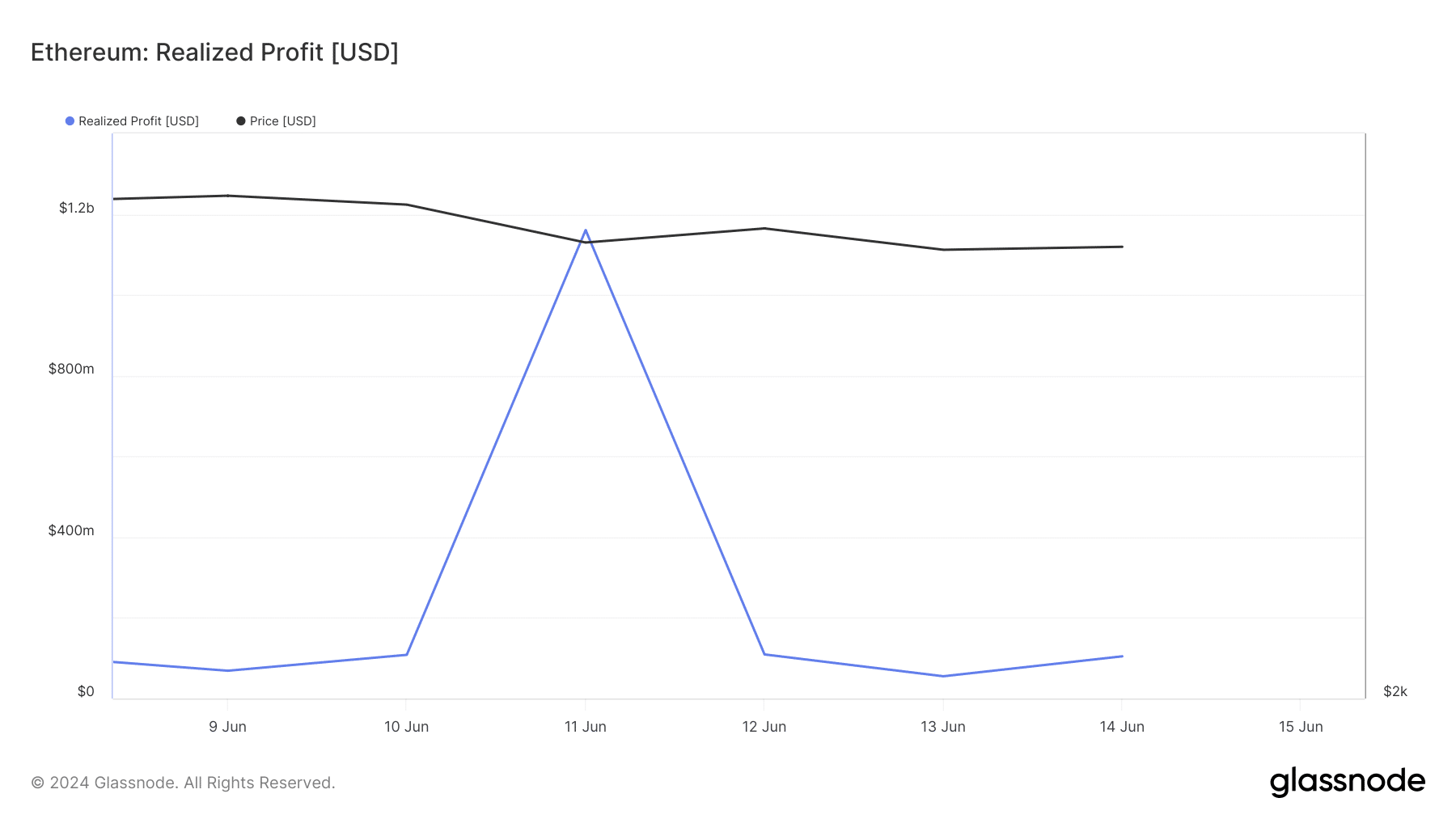

Profit Trends and Price Predictions

Analysis by ETHNews shows that Ethereum’s Realized Profit rose from $55.18 million on June 12 to $104.58 million on June 14. An increase in this metric suggests that a higher number of traders are securing profits, which could pressure the price downward.

Predictions based on current trends suggest that Ethereum might oscillate between $3,400 and $3,600 in the near future. Stability in the Realized Profit metric could lessen selling pressure, potentially stabilizing the price.

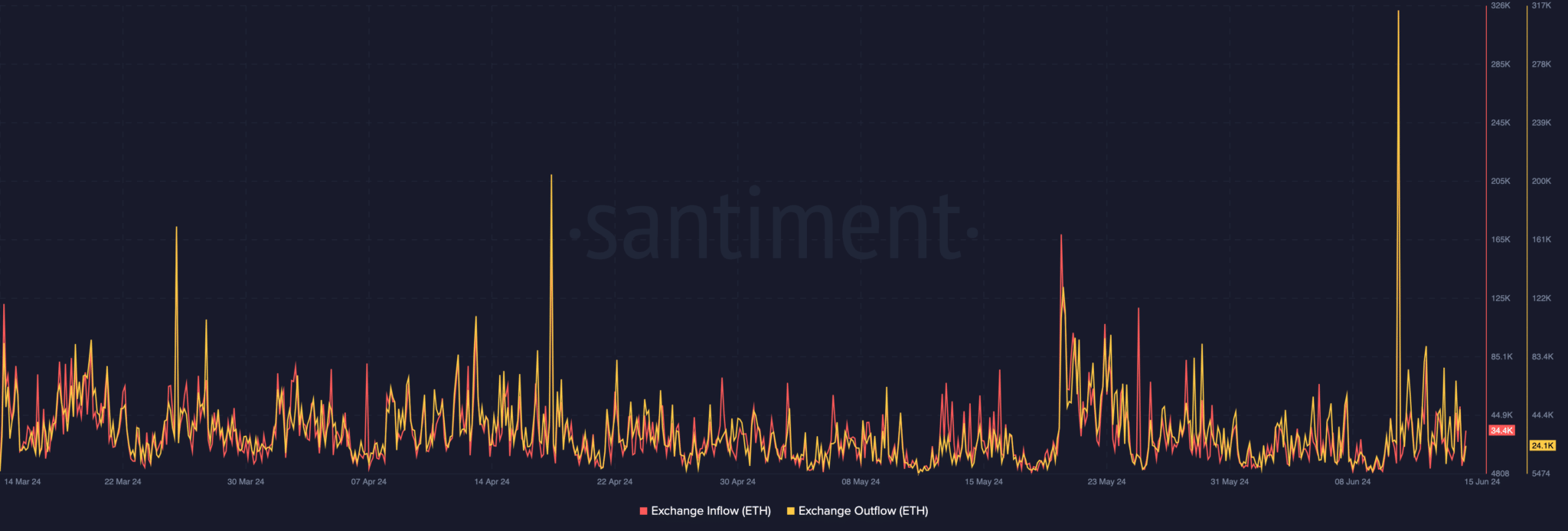

Exchanges and Market Liquidity

Regarding Ethereum’s market activity, exchange inflows were reported at $34,400 compared to outflows of $24,100. This data suggests that there is currently more Ethereum being deposited for sale than being withdrawn for storage, indicating potential selling pressure.

The high volatility underscores the risks inherent in cryptocurrency trading and the importance of strategic decision-making based on market data.