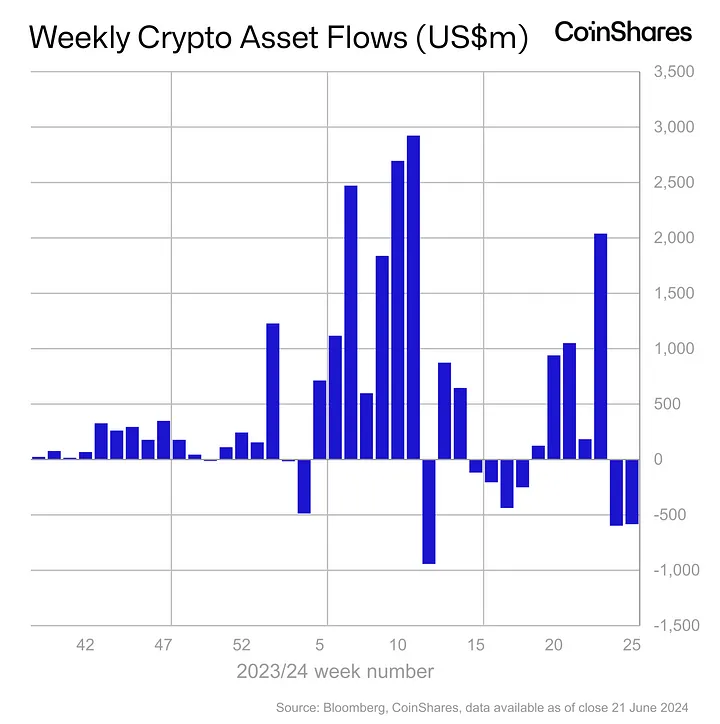

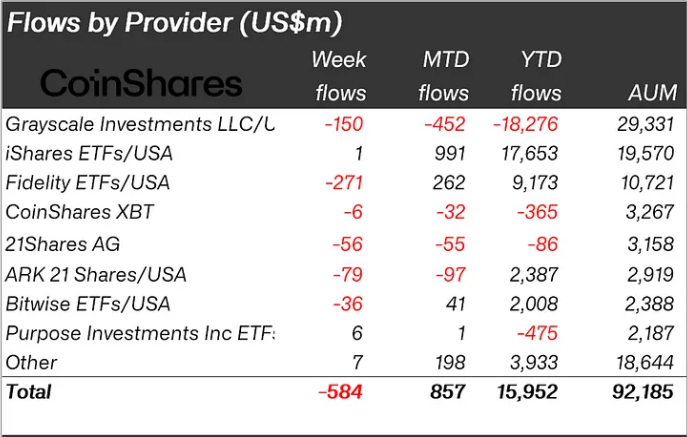

- Total institutional crypto funds saw $585 million exit last week, impacting overall market sentiment and investments.

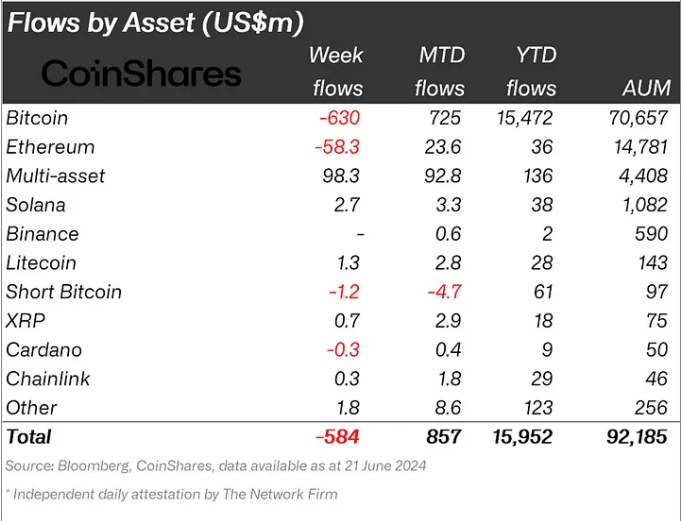

- Despite recent outflows, Ethereum products maintain a substantial $14.7 billion in assets under management.

In recent weeks, institutional investors have reduced their holdings in Ethereum-based financial products. This retreat follows a period of falling prices for crypto assets, which has influenced the broader sentiment and investment decisions in the cryptocurrency market.

Overview of Market Movements

Ethereum products have seen a significant withdrawal of funds, coinciding with a general downturn in the market. Specifically, these products experienced $58.3 million in outflows over the last seven days.

These outflows have offset the inflows earlier in the year, with year-to-date net inflows now totaling $23.6 million. Despite these outflows, Ethereum products still hold $14.7 billion in assets under management.

Broader Institutional Outflows

The wider cryptocurrency investment scene also faced challenges, with institutional crypto funds recording total outflows of $585 million last week. Bitcoin funds were particularly impacted, witnessing $630 million in withdrawals, which reduced their assets under management to $70.6 billion.

Impact on Ethereum Prices

The price of Ethereum has dropped from its recent high of $3,700 to $3,387.

[mcrypto id=”12523″]This decline in price is a direct reflection of the current market conditions, characterized by a general decrease in the cryptocurrency market capitalization from $2.6 trillion to $2.26 trillion.

Future Outlook

While the current market conditions are challenging, with substantial outflows from both Ethereum and Bitcoin products, some market participants maintain a cautious optimism. They suggest that, should macroeconomic factors improve, there could be a recovery in prices and investor interest.

The ongoing developments and adjustments in the investment strategies of institutional players are critical to watch, as they will likely influence the short-term trajectory of the crypto market.