- Though user engagement is high, Polygon is seeing a 42% decline in income and less DeFi activity.

- Based on the TD Sequential indicator, analyst project a possible MATIC upsurge.

Mixed luck have befallen Polygon (MATIC) lately. The DeFi industry has presented the network with considerable obstacles, even if user activity has increased significantly.

High User Activity on Polygon

Polygon has shown its popularity and broad adoption by keeping a record of over a million daily active addresses for 65 days running.

NEW:

Polygon PoS has recorded more than 1 million daily active addresses for 65 consecutive days. pic.twitter.com/WJPp2FlsCQ

— Today In Polygon (@TodayInPolygon) May 25, 2024

The Polygon Proof of Stake (PoS) network had reported over a million active addresses per day for 30 days running, as ETHNews recently highlighted. This steady user participation suggests that the network is quite active.

CoinMarketCap shows the price of MATIC as of writing to be about $0.7223. After a little decline of 0.19% in the previous day, the token has shown a bullish trend with a 4.65% rise in the previous seven days. Amid the general market volatility, this price durability is remarkable.

Sector Challenges in DeFi

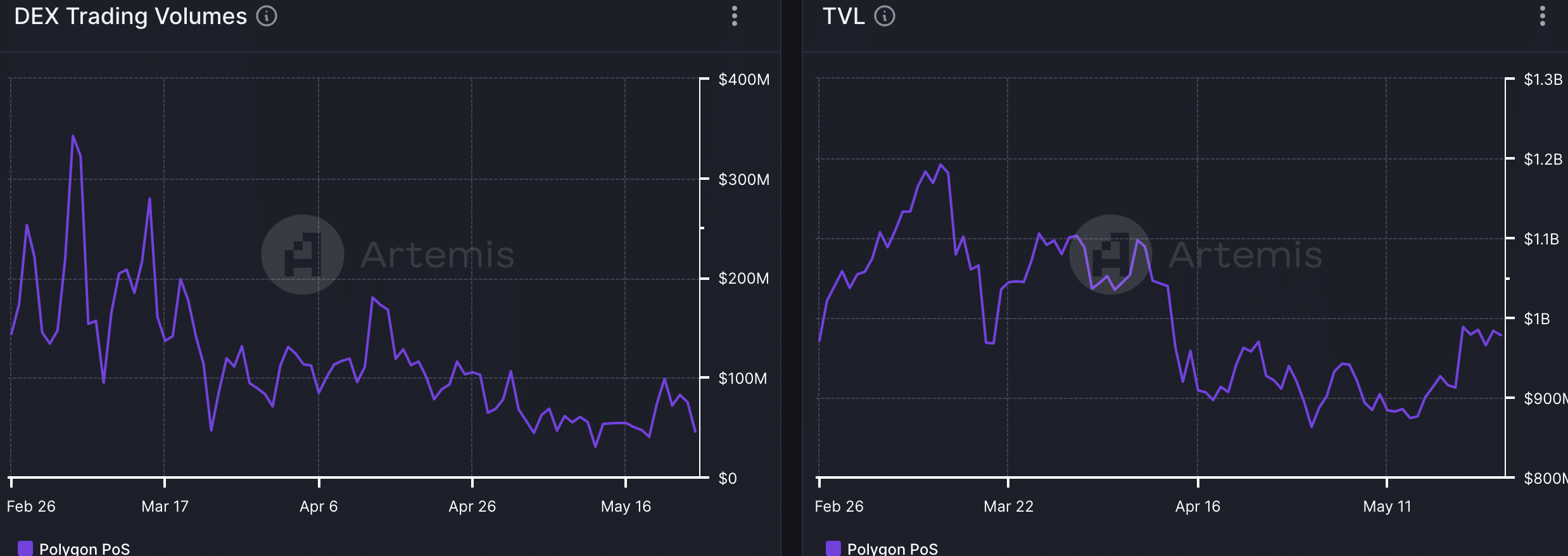

Polygon has had many difficulties in the DeFi industry, even with the high user engagement. Recently, the number of decentralized exchanges (DEX) on Polygon has dropped from $320 million to $50 million.

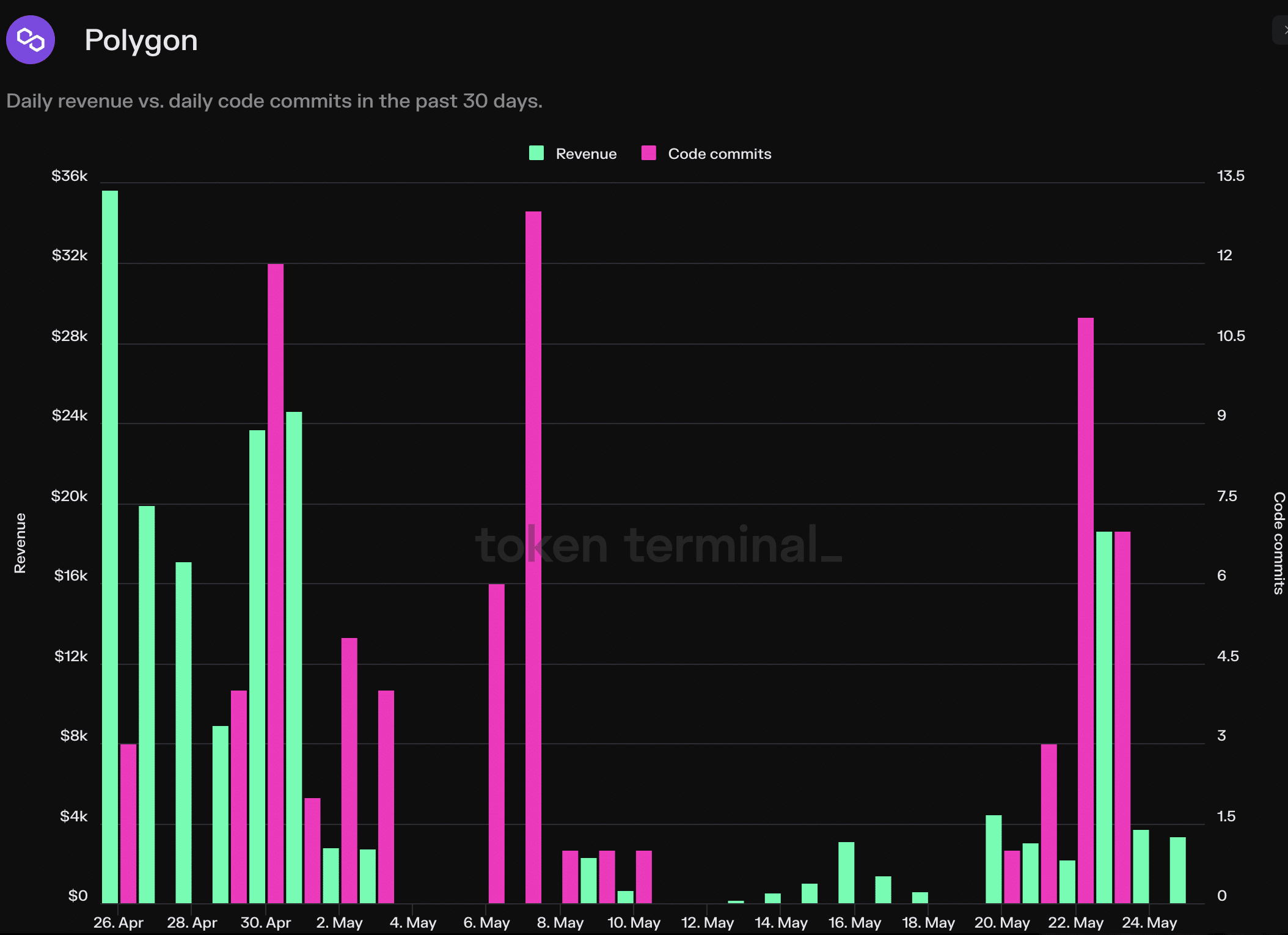

Furthermore, the Polygon network now has $980 million as Total Value Locked (TVL) instead of $1.2 billion. The revenue of the network has suffered as a result of these falls; according to data from Token Terminal, it has decreased by 42% in the last month.

Topics of Development Activities

Polygon’s development activities have likewise decreased by 14% during the last 30 days. Code commits falling off continuously could have a bad effect on the network’s capacity for innovation and development.

Should this tendency continue, Polygon might find it more difficult to keep its market-leading competitive advantage.

Though there are still obstacles to overcome, the market is nonetheless cautiously hopeful about MATIC. A buy signal from the TD Sequential indicator on the MATIC weekly chart, as noted by well-known expert Ali Martinez, indicates that Polygon may have a one- to four-week price increase.

The TD Sequential presents a buy signal on the $MATIC weekly chart, anticipating #Polygon will see a one to four weekly candlesticks upswing! pic.twitter.com/pW7PpcGHHy

— Ali (@ali_charts) May 27, 2024