- PancakeSwap rolls out Tokenomics 3.0 April 23, targets four percent annual deflation through burns and emission cuts program.

- Staking, veCAKE, gauge voting, revenue sharing, farm boosting end; locked tokens become withdrawable over six month window period.

PancakeSwap will introduce CAKE Tokenomics 3.0 on 23 April 2025, aiming to make the exchange’s native token more scarce and the reward schedule more predictable. The new framework sets an annual deflation target near 4 percent and retires several legacy features that once rewarded large token locks.

🥞The official implementation of CAKE Tokenomics 3.0 is now underway. Here's what you need to know about the changes and important dates:

Key Milestones:

🔹Retirement of CAKE Staking, veCAKE, Gauges Voting, Revenue Sharing, and Farm Boosting

🔹Voting results from Epoch 37 will… pic.twitter.com/3mj2Hk08BY— PancakeSwap (@PancakeSwap) April 21, 2025

Under the plan, CAKE staking, veCAKE voting, gauge voting, revenue sharing, and farm boosting will close. All tokens locked under these programs will become withdrawable for a six‑month window that starts on launch day. Daily token emissions will fall in phases, first from 29,000 to 20,000 CAKE, then to 14,500 CAKE. PancakeSwap will also introduce a burn schedule expected to retire about 5.3 million tokens each year.

Backers of the change say lower emissions and routine burns will push circulating supply downward and let market pricing reflect exchange activity rather than subsidy. “Cutting emissions accelerates deflation and supports holders,” said Chef Philip, one of the project’s lead contributors.

Opposition centers on PancakeSwap’s decision to end the veCAKE system without prior stakeholder alignment. Cakepie DAO—among the largest veCAKE holders—stated that removing the lock‑up model erases four‑year pledges made by builders who relied on the gauge design.

PancakeSwap has countered with a compensation offer worth up to $1.5 million in CAKE, provided Cakepie supports a one‑to‑one swap from its derivative token mCAKE back to native CAKE.

Voting within the DAO remains open

ETHNews will monitor whether daily volume offsets lower emissions and supports the burn schedule. If trading fees remain steady, the exchange can fund planned burns and maintain the advertised deflation path. Conversely, a drop in activity could limit burn capacity and slow supply reduction.

For current CAKE holders, the immediate task is operational. Tokens locked in now‑retired contracts must be withdrawn by late October 2025 to avoid orphaned balances. After that deadline, unclaimed tokens will stay in the old contracts without new yield or voting power. The coming months will show whether PancakeSwap’s simpler, leaner model draws liquidity or prompts holders to seek yield elsewhere.

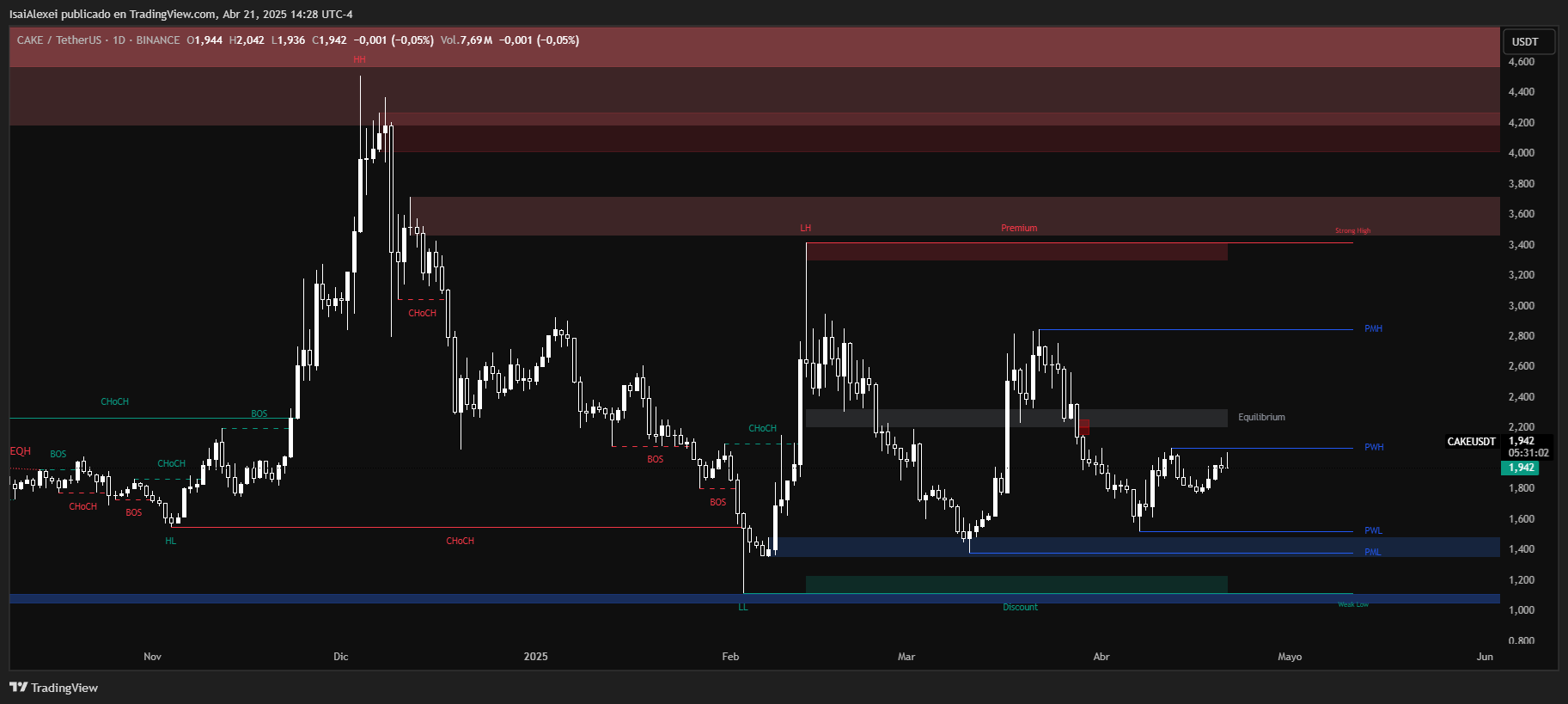

PancakeSwap (CAKE) is currently trading at $1.9463, showing a very modest +0.17% gain on the day. Despite recent short-term attempts at recovery, CAKE remains in a deep long-term downtrend, with a -22.29% year-to-date loss and a -33.54% drop over the past 12 months.

The token is trading more than 95% below its all-time high of $44.33, clearly reflecting the DeFi sector’s struggles during this bear market cycle. However, its recent 3.63% weekly gain and high trading volume ($83.7M/24h) suggest active interest at current levels.

From a technical standpoint, CAKE is consolidating around the $1.90–$2.00 support zone, which has been tested several times since late 2024. A breakout above the $2.10–$2.20 resistance range could confirm a reversal toward $2.50–$2.80, while failure to hold current levels may result in a slide toward $1.75 or even the long-term base around $1.50.

Momentum indicators are neutral, with neither bulls nor bears fully in control, indicating that CAKE is still seeking direction amid a weak macro DeFi environment.

On the fundamental side, PancakeSwap is pushing for revitalization through its upcoming Tokenomics 3.0 vote, which aims to restructure emissions and staking rewards to improve token sustainability.

It remains one of the largest decentralized exchanges on the BNB Smart Chain, and its broad reach in DeFi, coupled with frequent community events and updates, keeps it relevant despite price challenges.