- PayPal and Venmo add Solana (SOL) and Chainlink (LINK), enabling direct in-app crypto transactions for millions of users.

- SOL’s price rises post-announcement, but long-term growth depends on user adoption and broader market conditions.

PayPal and Venmo will soon allow users to buy, sell, and transfer Solana (SOL) and Chainlink (LINK) directly within their apps, according to a company announcement. The update, rolling out over the next few weeks, builds on PayPal’s prior crypto initiatives, including support for Bitcoin and Ethereum transactions and the launch of its PayPal USD (PYUSD) stablecoin.

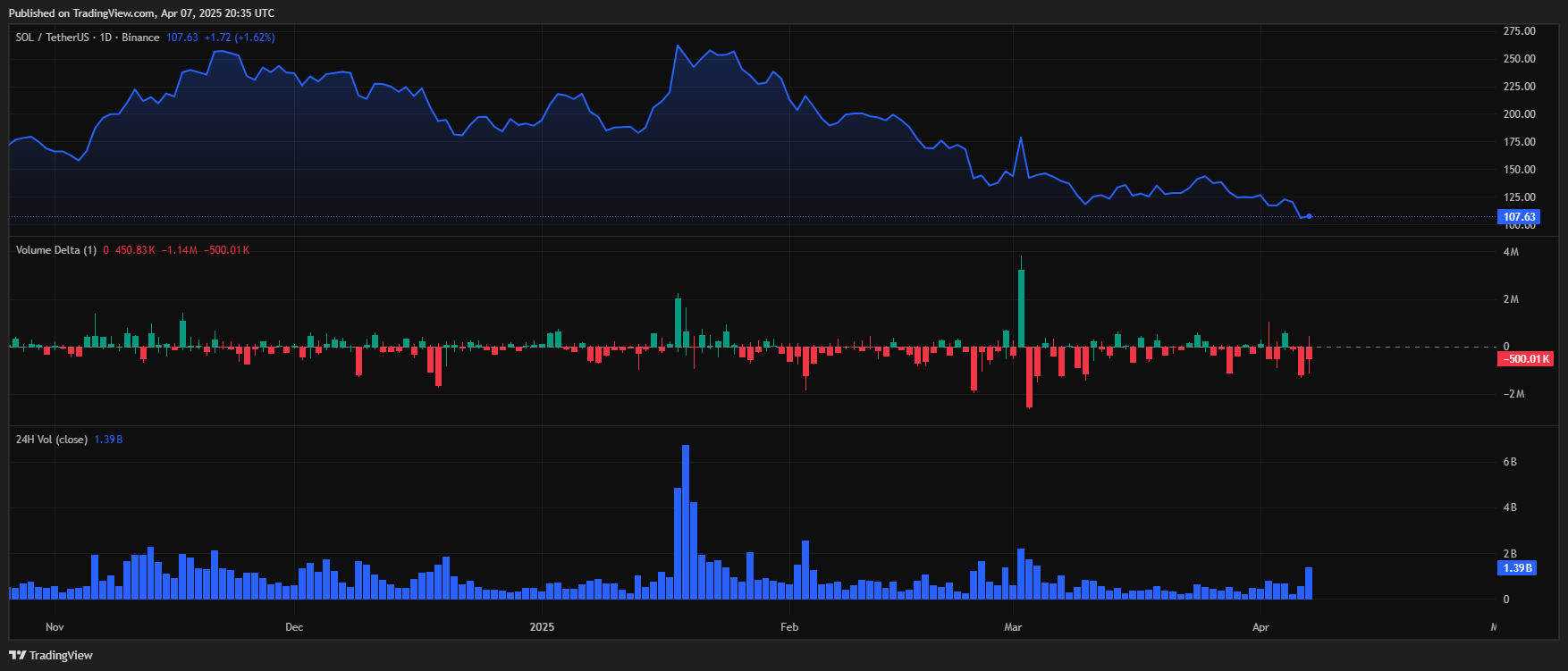

The integration introduces Solana’s blockchain to PayPal’s 435 million active accounts and Venmo’s 90 million users. Solana, known for processing transactions quickly at lower costs compared to rivals, could see increased adoption as more users access it through familiar platforms. Since the announcement, SOL’s price and trading volume rose, reflecting market optimism. However, sustaining gains will depend on broader crypto market trends and user engagement.

PayPal Vice President May Zay Zabaneh stated the move aims to offer “greater flexibility, choice, and access to crypto currencies.” By incorporating SOL and LINK, PayPal aligns with its strategy to bridge traditional finance and assets. Chainlink’s inclusion, meanwhile, supports PayPal’s infrastructure needs, as the token is widely used to connect blockchains with real-world data.

Solana’s architecture suits high-volume applications, making it a practical choice for PayPal’s scale. Its ability to handle thousands of transactions per second at minimal fees could enhance user experience for microtransactions or cross-border payments. However, regulatory challenges loom. U.S. lawmakers continue debating crypto oversight, which could affect how platforms like PayPal operate.

Competition remains another hurdle. Ethereum still dominates decentralized finance (DeFi) activity, and newer blockchains vie for market share. Solana’s recent network upgrades aim to address past outages, but reliability concerns linger among some investors.

For everyday users, the integration simplifies accessing SOL and LINK without needing external wallets or exchanges. This could attract non-crypto audiences, though volatility warnings may temper initial enthusiasm. PayPal’s existing fraud protections and buyer safeguards may reassure cautious adopters.

Solana (SOL) is currently trading at $106.95 USD, with a 24-hour trading volume of more than $10.5 billion and a market capitalization of approximately $55.1 billion. Despite a slight uptick of 0.3% in the last 24 hours, the token has posted a 14.5% decline over the past 7 days, in line with a broader crypto market correction. Still, over the last month, SOL is up 22.7%, highlighting its sustained relevance and bullish sentiment in the medium term.

The price range for the past 24 hours sits between $96.70 and $110.64, showing moderate volatility. SOL is currently trading about 63% below its all-time high of $293.31, but remains up a massive 21,200% from its historical low, underscoring its incredible long-term performance since inception.