- ETHD’s 247% YTD gain leverages 2x inverse Ethereum futures, thriving amid ETH’s 14% weekly decline and bearish momentum.

- Daily rebalancing risks volatility decay; ETHD dips 0.93% over six months despite 2025’s ETF-leading returns.

The Proshares UltraShort Ether ETF (ETHD) has emerged as 2025’s highest-performing exchange-traded fund, delivering a 247% year-to-date return by capitalizing on Ethereum’s sustained downward trajectory.

The best performing ETF this year is the -2x Ether ETF $ETHD, up 247%. #2 is the other -2x Ether ETF. I was sure it would be $UVIX (2x VIX), but that's #3. Brutal. pic.twitter.com/e49QOPtgmb

— Eric Balchunas (@EricBalchunas) April 9, 2025

This leveraged inverse ETF provides 2x daily inverse exposure to the Bloomberg Ethereum Index through futures derivatives, enabling traders to amplify gains during ETH price declines—for instance, a 10% daily drop in Ethereum targets a 20% rise in ETHD.

ETHD employs futures contracts rather than direct short positions, avoiding custody complexities while maintaining synthetic bearish exposure. However, its daily rebalancing mechanism introduces volatility decay, eroding returns during choppy or sideways markets.

Despite its annual dominance, ETHD has dipped 0.93% over six months, reflecting challenges in maintaining inverse performance during sporadic ETH rebounds.

📊 Ethereum ETF Tracker | 2025-04-08

🟥 Daily Total Net Inflow -$3.29M

💰 Total Value Traded $356.04M

🏦 Total Net Assets $4.98B

📊 ETF Market Value Ratio 2.78%🥇 Net Inflows/Outflows for Each ETF

⬜️ ETHE $0

⬜️ ETHW $0

⬜️ ETHA $0

⬜️ ETHV $0

⬜️ CETH $0

⬜️ QETH $0

⬜️ EZET $0

⬜️… pic.twitter.com/NbzaZQlzpx— SSI (SoSoValue Indexes) (@SoSoValue) April 9, 2025

Ethereum’s 14% weekly decline and year-long bearish sentiment have fueled demand for inverse products. Spot Ethereum ETFs, such as the iShares Ethereum Trust (ETHA), have hemorrhaged $3.29 million in single-day outflows, with ETHA itself down 52% YTD. This contrasts sharply with ETHD’s rally, underscoring diverging strategies in a risk-averse market.

Mechanics and Risks of Inverse ETFs

ETHD does not short Ethereum directly but uses futures contracts tied to its price. The fund resets daily, meaning its long-term performance may diverge from a strict -2x Ethereum return due to compounding effects. This structure suits traders targeting short-term volatility but carries risks like “volatility decay,” where daily rebalancing erodes gains during choppy markets.

Despite its 2025 surge, ETHD has declined 0.93% over the past six months, reflecting Ethereum’s partial recoveries. The T-Rex 2X Inverse Ether ETF (ETQ) ranks second with over 100% gains, underscoring the trend of inverse products outperforming in a bearish crypto climate.

Ethereum has fallen 14% over the past week, even after a brief tariff-related rebound. The iShares Ethereum Trust (ETHA), a spot ETF, has dropped 52% year-to-date. On Tuesday, Ethereum ETFs collectively saw $3.29 million in outflows, per SoSoValue data, signaling waning investor confidence.

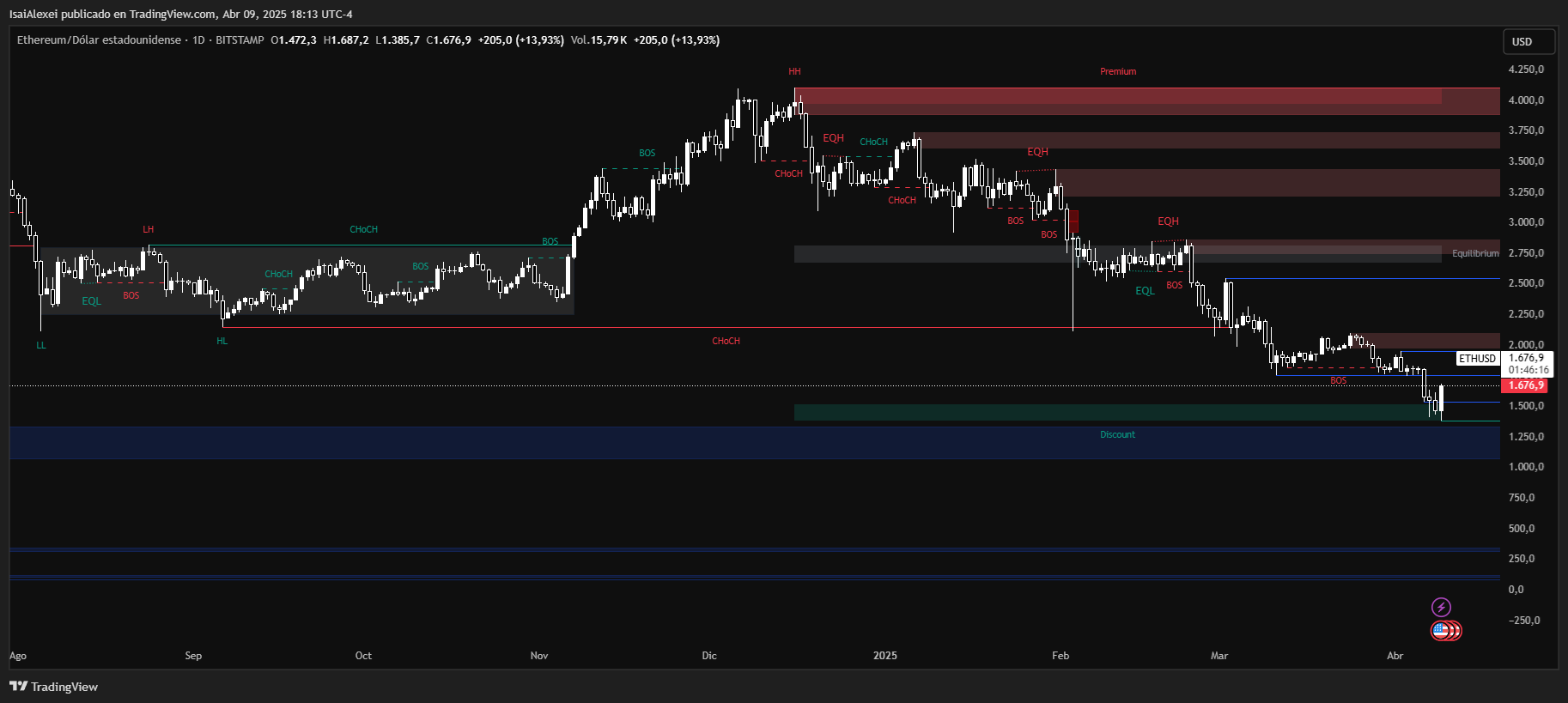

As of now, Ethereum (ETH) is trading at $1,669.90, marking a strong 13.45% increase in the last 24 hours. Despite this daily surge, ETH remains in a broader downtrend, having lost nearly 50% year-to-date and over 54% in the past year. However, today’s price movement suggests a potential short-term reversal, especially as the asset tests critical support zones.

If the momentum continues, a move toward the 20-day EMA near $1,786 is likely. Conversely, if support breaks at $1,368, ETH could tumble further to around $1,150.

From a technical standpoint, Ethereum is in a make-or-break moment. The RSI and oscillators are neutral, indicating consolidation, while the moving averages reflect pressure from a previous bearish structure.

Market sentiment is split: some traders are bullish due to new support from recent ETF-related news and whale accumulation, while others remain cautious due to continued lower highs and broader macroeconomic uncertainty. Despite bearish outlooks from some, ETHNews analysts note that ETH remains appealing in the $1,300–$1,500 range for long-term positions.