- PumpFi, launched April 1, 2025, lets users buy Solana memecoins/NFTs with a third upfront and the rest over three months.

- No credit checks required; service manages payment agreements and allows debt trading for digital assets.

On April 1, 2025, Pump.fun introduced PumpFi, a new service allowing users to purchase memecoins and NFTs on the Solana blockchain with a buy-now-pay-later option. This product offers immediate financing for digital assets without requiring credit checks. Users pay one-third of the cost upfront and the remaining balance over three months in monthly installments.

Introducing PumpFi, the Ape Now, Pay Later solution for EVERY asset & liability on Solana 🔥

our BIGGEST product yet provides immediate, manageable financing for ANY digital asset

– NO credit checks

– MONTHLY installments

– AFFORDABLE trenchinghow does it work? 👇 pic.twitter.com/rMNUmHkSwe

— pump.fun (@pumpdotfun) April 1, 2025

PumpFi aims to make Solana assets more accessible. The service supports buying any memecoin or NFT, managing financing agreements, and even trading debt. A user interface shared by Pump.fun shows a purchase example: a 9.3 SOL NFT with payments of 3.1 SOL monthly, starting April 1. The platform also provides tools to track payments and agreements.

Additionally, PumpFi emphasizes affordability with what it calls “trenching,” though details on this feature remain limited. The service has sparked interest on X, with users like WIWIWI_COIN promoting their tokens for purchase via PumpFi.

Others, such as DeFi_Cheetah, raised questions about preventing defaults. Pump.fun positions PumpFi as a game-changer, enabling users to secure assets while maintaining financial flexibility on Solana.

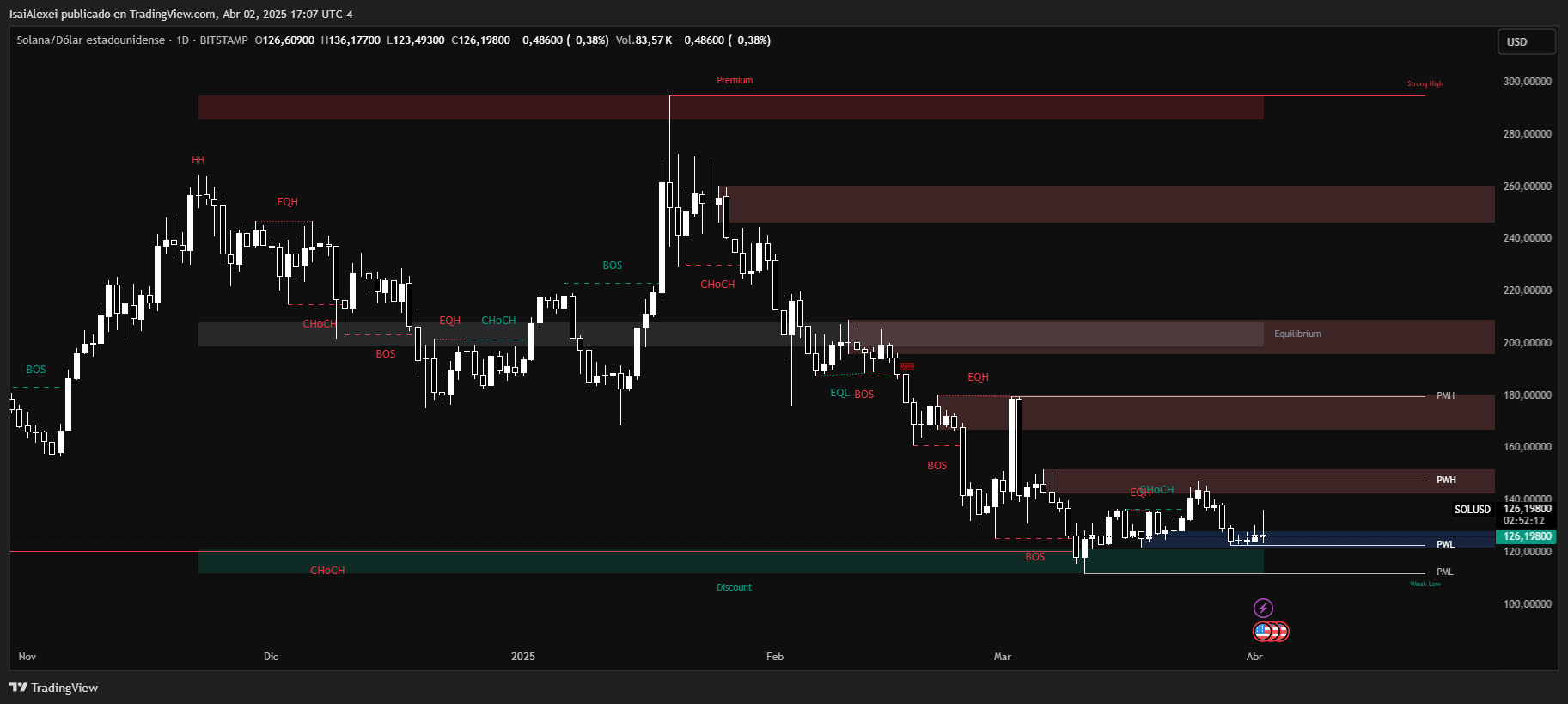

Solana (SOL) is $128.44 USDT, showing a +1.40% increase on the day. Today’s price action fluctuated within a range of $123.50 (low) to $136.21 (high). While this intraday recovery hints at short-term strength, SOL remains in a clear correction phase from its recent highs.

Over the past 7 days, SOL has dropped −10.54%, and on a 30-day view, it has declined −28.10%. Since the beginning of 2025, Solana has lost −32.12%, and over the last year, it is down −33.16%. Despite its long-term growth since inception, current market behavior confirms that the asset is under strong bearish influence.

SOL is currently consolidating near a critical support zone around $120–$125. If this support holds, Solana could attempt a recovery toward $135–$140, and potentially retest the $150 level. However, if it breaks below $120 with momentum, the next bearish targets lie around $110 and then $98–$100, which served as key accumulation areas during 2023.

The technical indicators remain mixed. Daily momentum has slightly improved, but the weekly and monthly trend structure is still bearish. Solana must reclaim the $140–$150 resistance zone to reverse the broader trend and confirm mid-term bullish momentum.