- Large Bitcoin whale deposits 809 BTC to Binance, increasing selling pressure amid a potential bull rally.

- Technical indicators mixed: Chaikin Money Flow suggests growth potential, Money Flow Index trends bearish.

Bitcoin (BTC) has witnessed a mix of bullish and bearish signals, casting uncertainty over the direction of its price movement. The value has shown a recovery, increasing by more than 3% in the last 24 hours, breaking past the $57,000 mark.

[mcrypto id=”12344″]This recent uptick comes after a period of decline, painting a potentially optimistic future for the digital currency.

However, these positive signs are tempered by substantial selling activities. Notably, the German government has been actively liquidating its Bitcoin holdings, transferring 9,634 BTC, valued at over $551 million, to various cryptocurrency exchanges such as Kraken and Coinbase.

The #German government transferred 9,634 $BTC($551M) to #Kraken, #FlowTraders, #Coinbase, #Bitstamp, #Cumberland, and #B2C2Group today!

The #German government has transferred 24,304 $BTC($1.44B) since June 19 and still holds 28,988 $BTC($1.66B).https://t.co/F748eLlb1u pic.twitter.com/mFOnXicVvX

— Lookonchain (@lookonchain) July 8, 2024

Since June 19, the German government has offloaded a total of 24,304 BTC, worth approximately $1.44 billion. Despite these sales, it retains a significant amount of Bitcoin, with 28,988 BTC in its coffers, currently valued at around $1.66 billion.

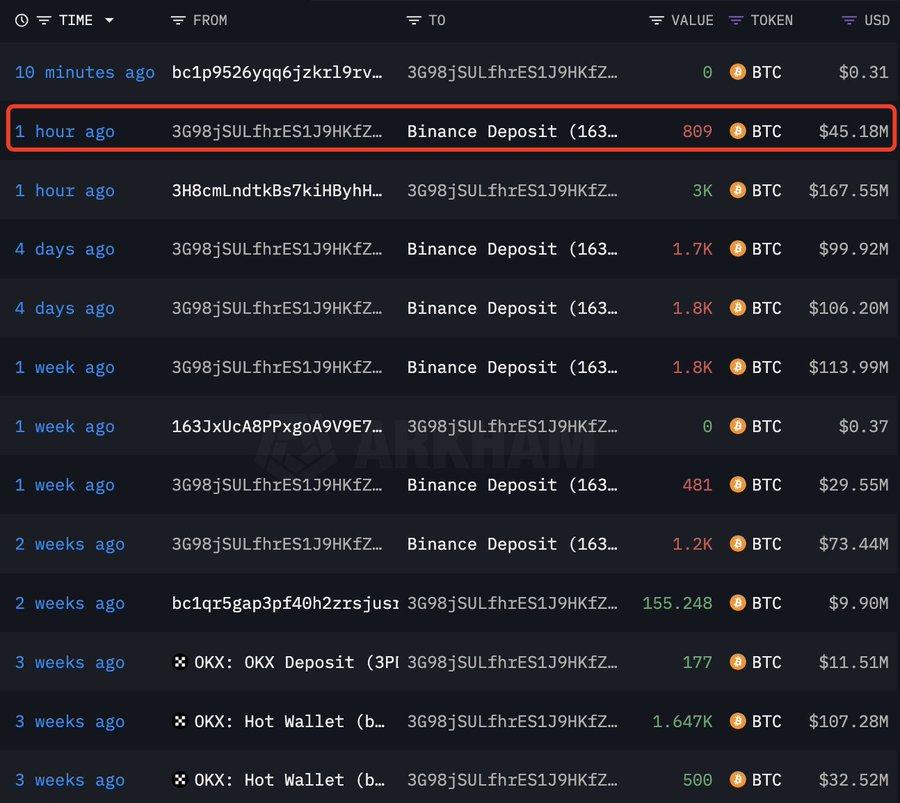

Adding to the selling pressure, recent activity from a prominent Bitcoin whale was observed, where 809 BTC, equivalent to $45.18 million, were moved to the exchange Binance. This influx of large-scale sell-offs raises concerns about the sustainability of Bitcoin’s current bullish trend.

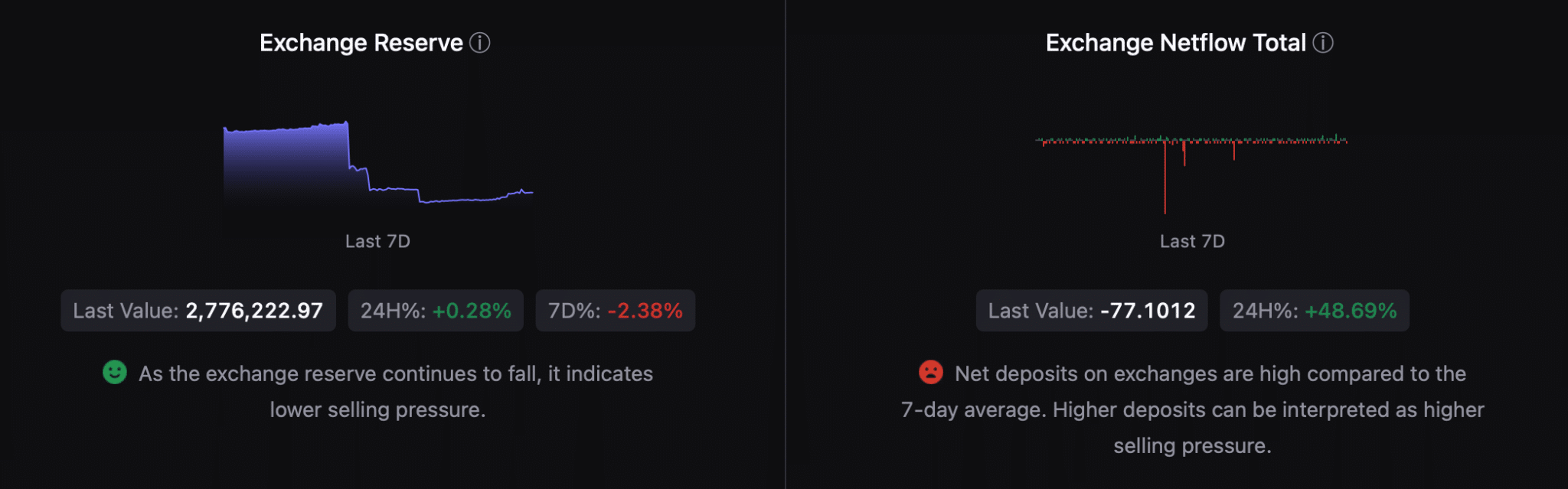

Based on some analysis done by ETHNews, data from CryptoQuant shows mixed signals. While Bitcoin’s Exchange Reserve has decreased, indicating reduced selling pressure in general, the net deposit on exchanges has been higher than the average of the past seven days, suggesting an increase in selling pressure.

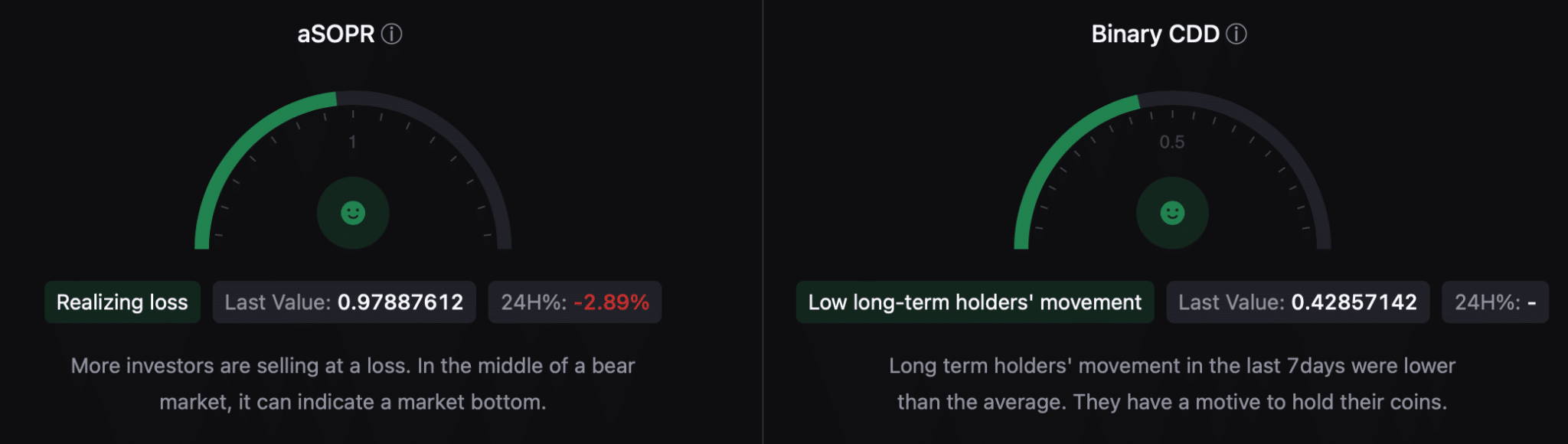

Further complicating the outlook is the sentiment among U.S. investors, as evidenced by a negative Coinbase premium, which signals a predominance of selling activities. Yet, not all indicators are bearish. The Adjusted Spent Output Profit Ratio (aSORP) suggests that many investors are selling at a loss, a scenario often observed at market bottoms.

Moreover, Bitcoin’s Binary Coin Days Destroyed (CDD) indicates that movements by long-term holders have been minimal, hinting at their continued confidence in holding onto their investments.

Looking at the technical analysis, the Chaikin Money Flow (CMF) indicator shows an uptick, suggesting potential for further price increases. However, the Money Flow Index (MFI) is trending downward, presenting a bearish counterpoint that could threaten the continuation of the bull rally.