- With a total of 1,149 BTC, this early miner could deplete their reserves by mid-November 2025.

- Market reacts as Bitcoin drops 2.45% in 24 hours, struggling to stay above the critical $60,000 support zone.

A Bitcoin investor, who began accumulating the cryptocurrency shortly after it was launched in 2009, is currently offloading a substantial portion of their Bitcoin assets, a move that could impact the broader cryptocurrency market. According to data from Arkham Intelligence, this seasoned miner has already disposed of $4.8 million in Bitcoin and is continuing the trend.

𝗔𝗡𝗖𝗜𝗘𝗡𝗧 𝟮𝟬𝟬𝟵 𝗕𝗜𝗧𝗖𝗢𝗜𝗡 𝗪𝗛𝗔𝗟𝗘 𝗛𝗔𝗦 𝗡𝗢𝗪 𝗦𝗢𝗟𝗗 $𝟰.𝟴𝗠

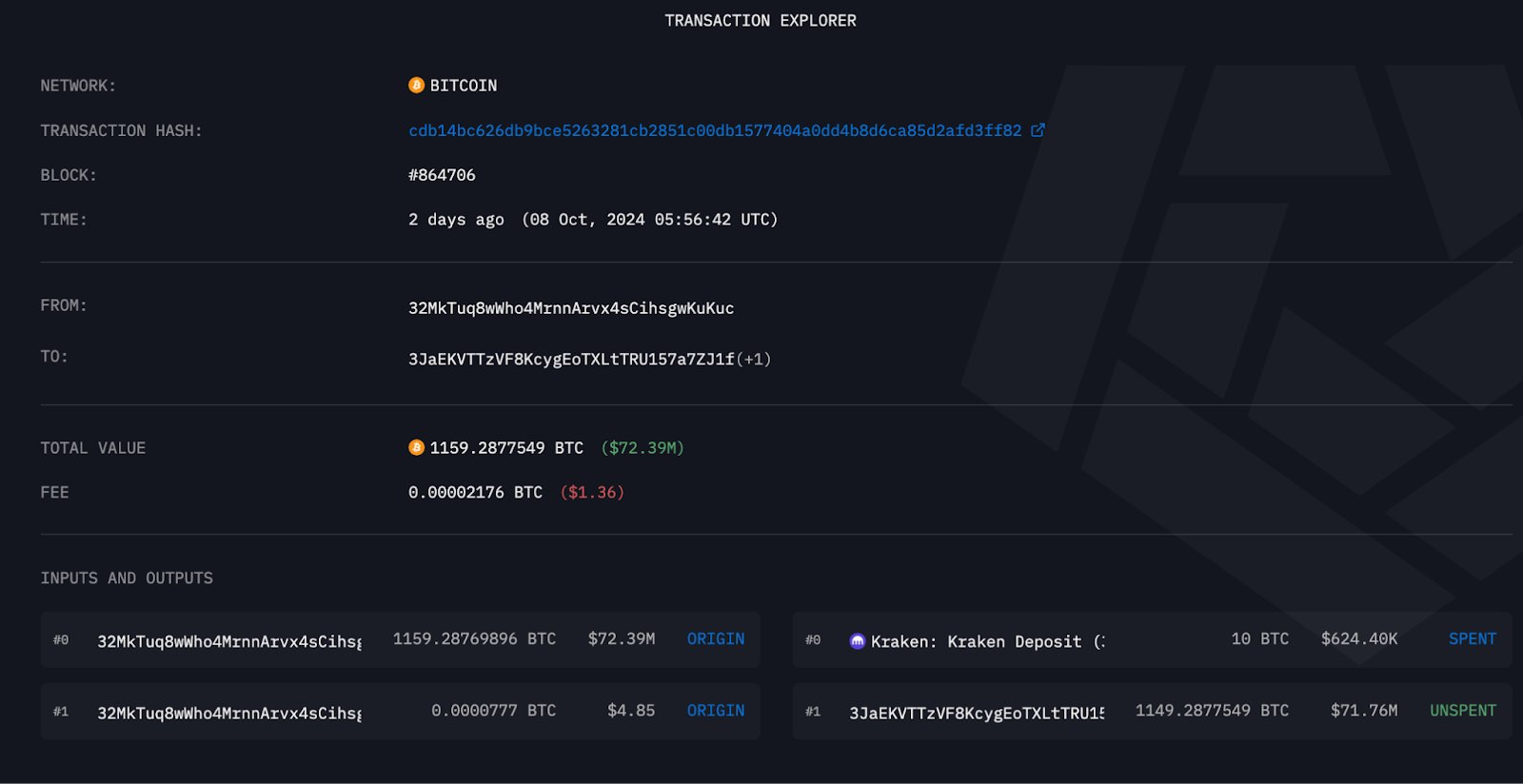

A BTC Whale who started mining Bitcoin FIVE DAYS after the first block has moved another $624K to Kraken.

He currently holds $70.4M Bitcoin and it appears that he is moving 10 BTC twice a week. At… pic.twitter.com/gSSQvM7MBQ

— Arkham (@ArkhamIntel) October 9, 2024

In a recent transaction, this investor shifted $624,000 worth of Bitcoin to Kraken, one of the leading cryptocurrency exchanges in the United States. Holding 1,149 BTC, which amounts to an estimated $69.94 million, the investor appears to be on a scheduled selling plan, offloading 10 BTC bi-weekly.

If this selling pattern holds, the investor is on track to exhaust their Bitcoin holdings by mid-November 2025.

The rationale behind the whale’s timing and strategy remains unclear

The fact that they began mining just five days after Bitcoin was launched sparks curiosity about their possible early involvement in the cryptocurrency’s origin. While speculation about the whale being Satoshi Nakamoto exists, such a scenario is highly unlikely given the public nature of the transactions via Kraken, which would risk exposing their identity.

This pattern of moving large sums of Bitcoin to an exchange is generally interpreted by market observers as a sign that a major holder is converting their crypto into cash, choosing liquidity over holding. This action is often viewed as a bearish signal, suggesting a lack of confidence in the market’s short-term trajectory by some of its earliest participants.

[mcrypto id=”12344″]

The market reaction has been notably tepid. Bitcoin’s value has decreased by 2.45% in the last 24 hours, struggling to maintain support at the $60,000 level. This downturn complicates Bitcoin’s prospects of surpassing the $66,000 mark and setting new records in October, which seemed more attainable just a week ago.

Impact of Inflation and Federal Reserve Expectations on Bitcoin’s Price

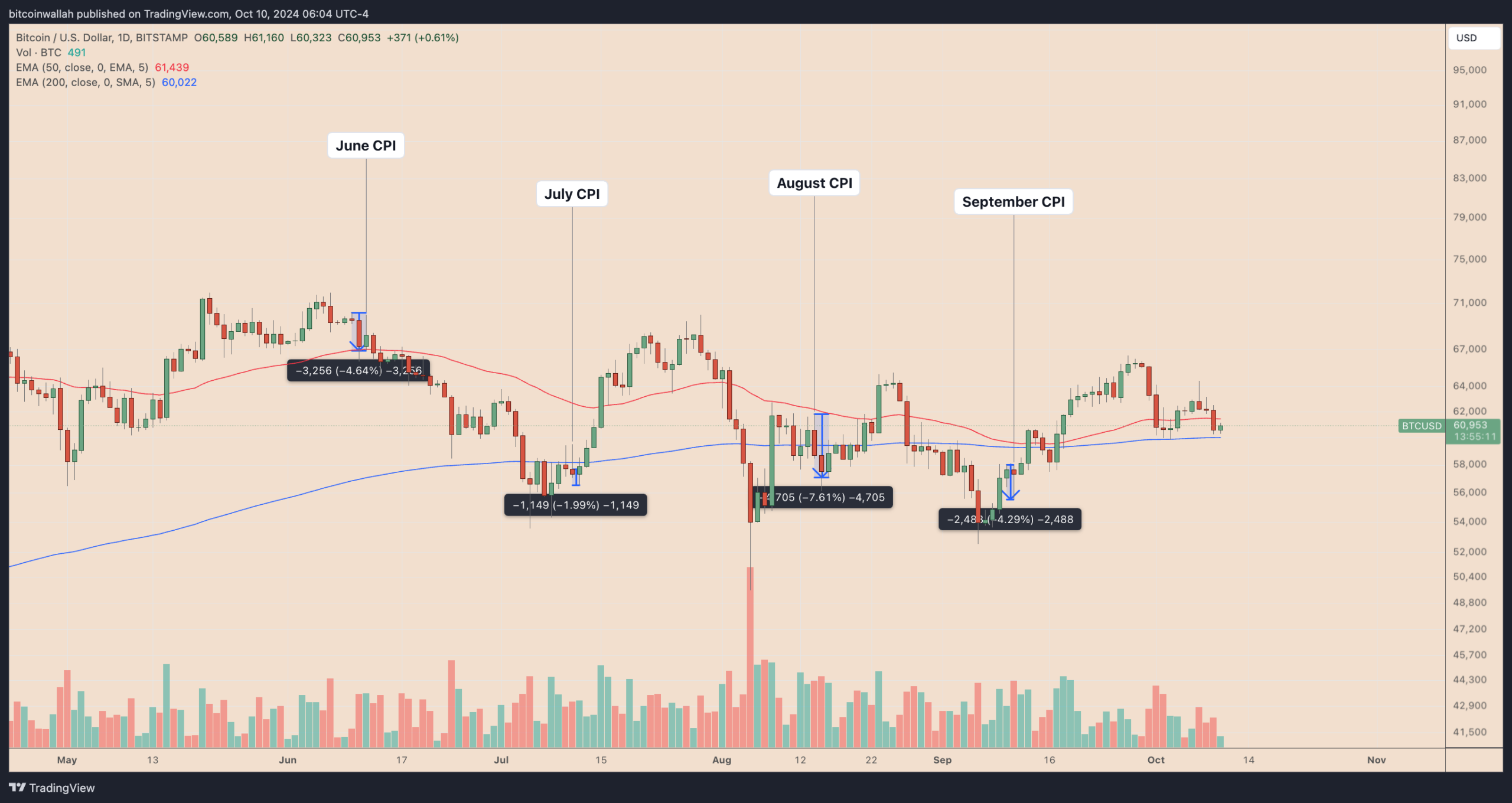

Market Reaction Ahead of CPI Report On the eve of the release of September’s Consumer Price Index (CPI) report, Bitcoin has seen a downturn, dropping over 2% in the last 24 hours to approximately $60,320 as of October 10. This decline mirrors movements in the US stock market futures just hours before the inflation report is due.

According to median estimates from a Bloomberg survey, the CPI overall and the core measure, which excludes food and energy, are expected to have increased by 0.1% and 0.2%, respectively, in September. These figures suggest a slowdown compared to August’s increases, potentially signaling easing inflationary pressures.

Rate Cut Expectations This perceived slowdown in inflation has heightened expectations that the Federal Reserve might opt for a rate cut at its November meeting. Current data from the Chicago Mercantile Exchange indicates an 80% chance of a 25-basis-point cut.

Moreover, there’s now a 20% chance that rates will remain unchanged, a sharp increase from zero just a week ago. Typically, rate cuts provide a bullish signal for Bitcoin and the broader cryptocurrency market, as lower rates can stimulate risk-on investment behavior.

Cautious Market Behavior However, it is common for traders to adopt a more cautious stance ahead of significant US inflation reports. Many choose to cash out or reduce their exposure to volatile assets like cryptocurrencies, anticipating market volatility triggered by such economic reports.

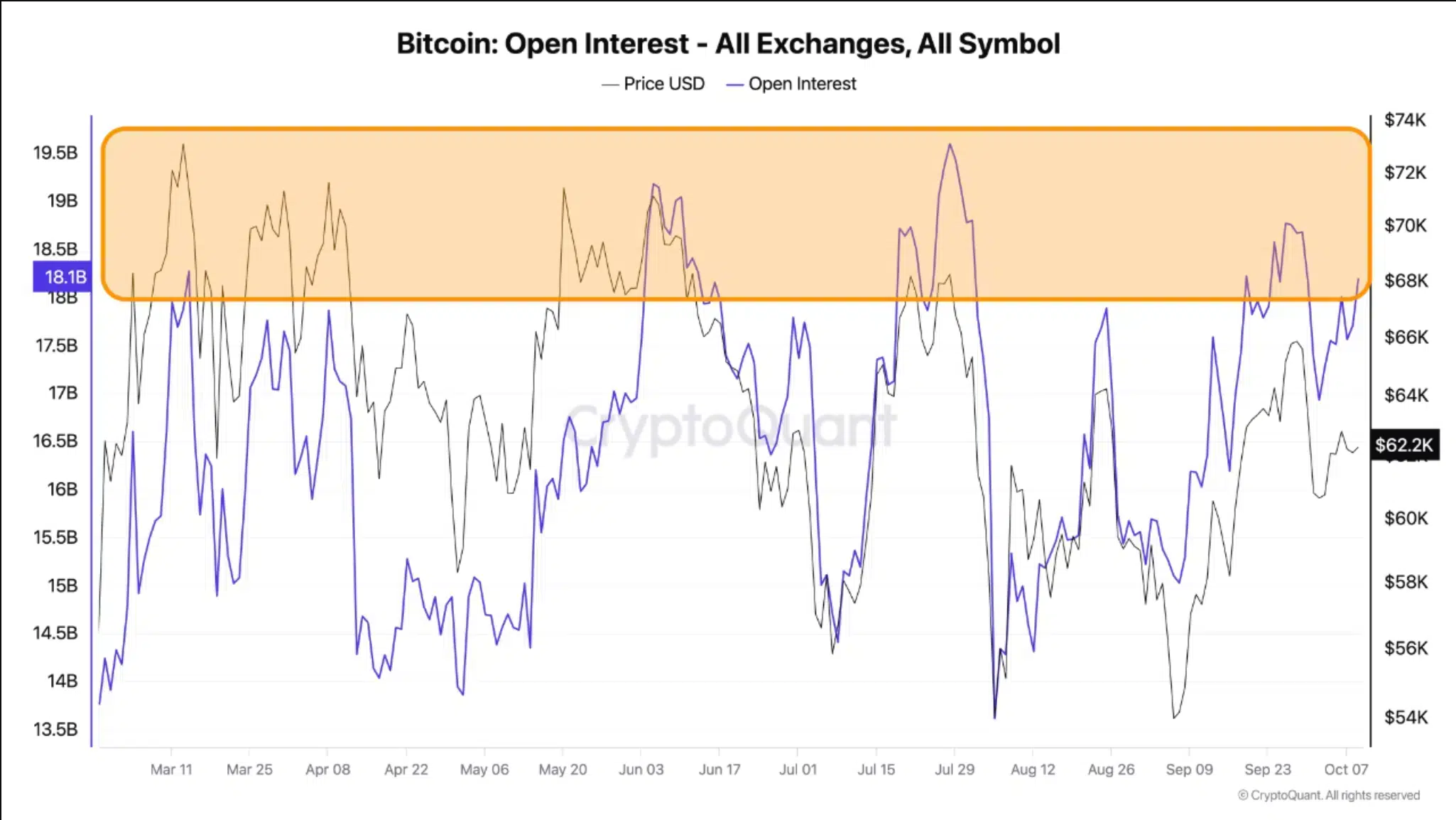

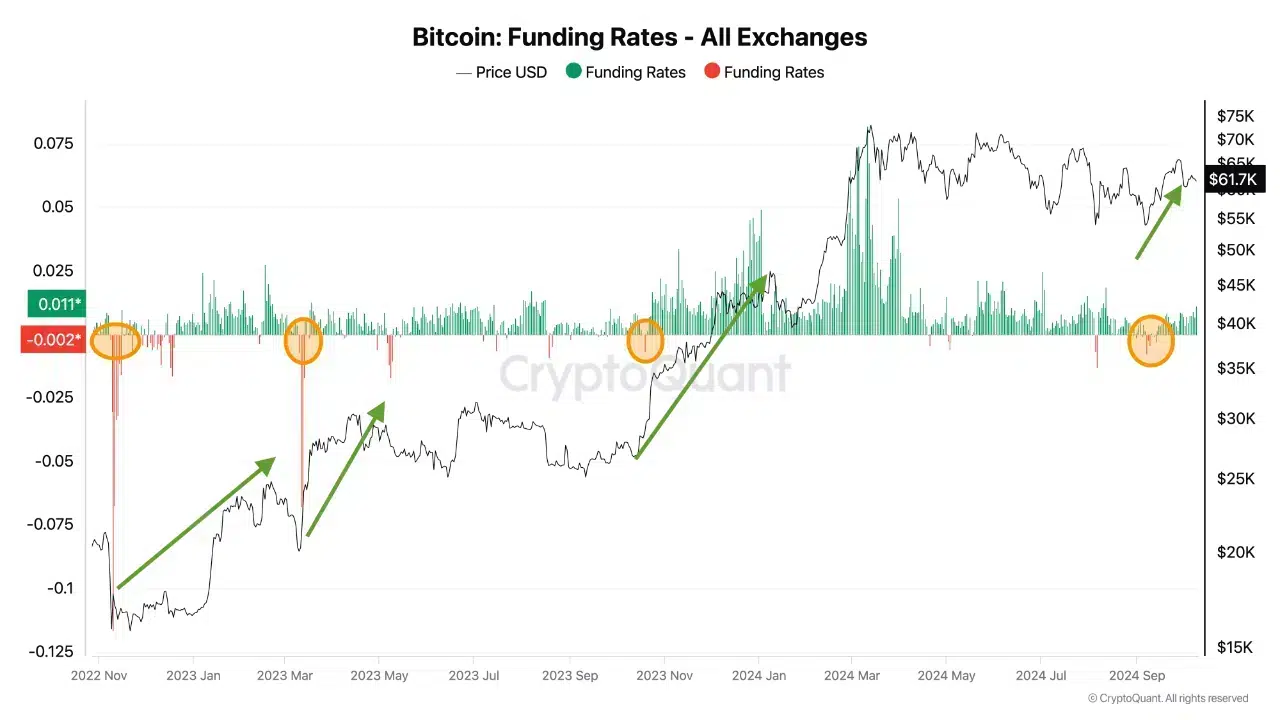

Technical Indicators and Bitcoin’s Derivatives Market In the derivatives market, signs suggest that Bitcoin might be overleveraged. Open interest recently surpassed the critical $18 billion threshold, historically a precursor to market corrections.

Despite this, funding rates are not excessively high, suggesting that any upcoming liquidations may not be profound.

[mcrypto id=”12344″]The current price of Bitcoin is $60,899.59, with a daily range of $60,375.67 to $61,215.27. It has dropped 1.67% today.