- The US Government executed one of its largest Bitcoin transactions, moving over $2 billion from confiscated Silk Road funds.

- The transaction involved about 29,800 BTC, sparking significant attention and uncertainty about the government’s intentions with these funds.

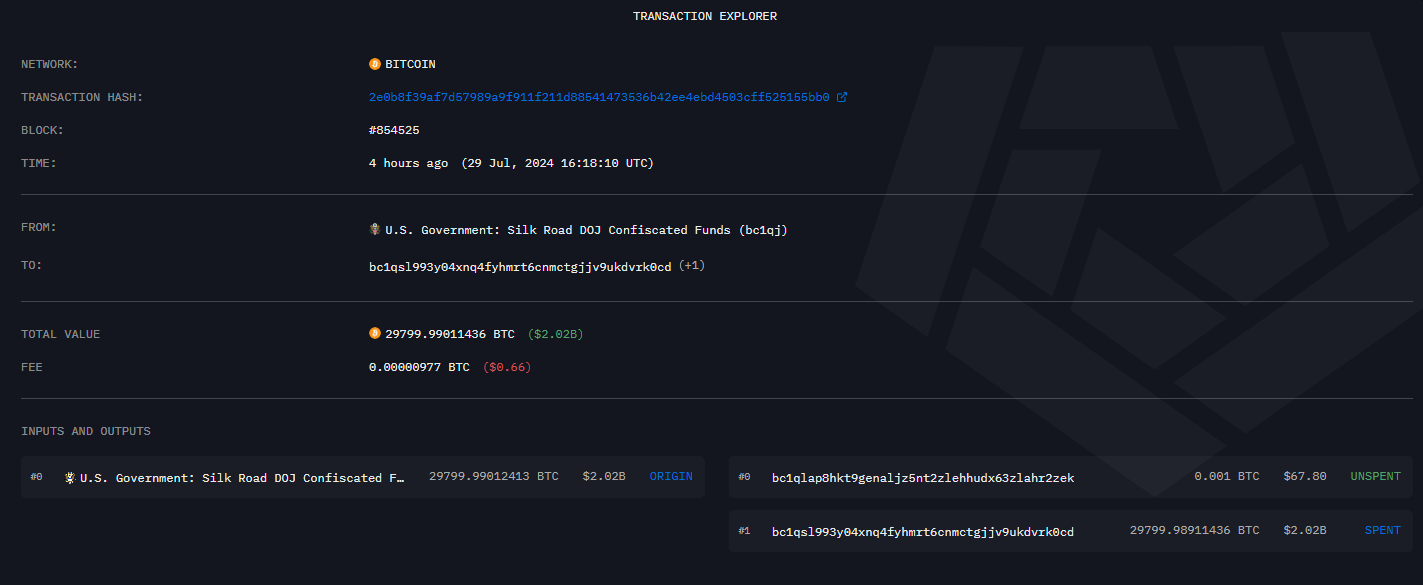

The United States Government has recently executed one of its largest Bitcoin transactions, moving over $2 billion worth of Bitcoin (BTC) that was seized from the Silk Road, a notorious dark web marketplace. This event is part of a series of substantial Bitcoin transfers by the government, stirring significant attention in the cryptocurrency market.

The transfer involved approximately 29,800 BTC moved from a wallet known as “U.S. Government: Silk Road DOJ Confiscated Funds (bc1qj),” according to Arkham Intelligence. This operation was split into two parts: one transfer of 27,799 BTC and a smaller transaction of 0.001 BTC to a different wallet. While the blockchain provides a transparent view of these transactions, the specific intentions behind the transfers remain undisclosed.

Earlier this month, the government also moved 237 BTC, valued at around $14 million at that time, originating from assets seized from Estonian crypto entrepreneurs Sergei Potapenko and Ivan Turogin, who were implicated in a large-scale cryptocurrency fraud. Prior to this large transfer, a smaller transaction of 11.84 BTC likely served as a test.

Additionally, last week witnessed another government transaction of 60 BTC, valued near $4 million. The Bitcoin was initially sent to a wallet labeled “34tXj..HUXfd” before being moved to Coinbase Prime. The purpose of these transfers is not clear, yet they have incited unease among cryptocurrency enthusiasts and investors.

These government activities coincide with a recent decision by the German Government to halt its Bitcoin selloff, which had negatively impacted Bitcoin prices. Following the series of large-scale offloads by the US government, Bitcoin has experienced a downtrend. After briefly surging above $70,000, the price of Bitcoin has corrected to $66,984.95, marking a 1.06% decline within the last 24 hours.

Market analysts express concern about the potential adverse effects these continued selloffs might have on the stability of Bitcoin’s price.