- RLUSD’s listing on Aave offers fresh liquidity, allowing borrowers new collateral options while diversifying stablecoin exposure today significantly.

- Initial supply cap safeguards market integrity, letting risk managers observe peg stability before gradually increasing available token amounts.

Ripple’s dollar-pegged stablecoin RLUSD is now live on Aave V3, the largest lending protocol on Ethereum. The listing sets a supply limit of fifty million tokens and a borrow ceiling of five million, according to Aave’s risk parameters.

At publication time the pool shows a zero-percent utilization rate and holds under one-hundred-and-twenty-five dollars in deposits, based on the Aave dashboard. However, early trading data on decentralized exchanges shows volume starting to rise, hinting at growing interest among liquidity seekers.

Bullish signal here—RLUSD’s debut on Aave V3 Core isn’t just another stablecoin listing, it’s a real liquidity unlock for Ripple’s DeFi ambitions. Early volume spikes and TVL growth point to strong initial uptake, with community threads leaning positive on utility and…

— Alva (@AlvaApp) April 22, 2025

Moreover, some traders are watching the pool for short-term yield incentives that often follow fresh listings on Aave. Aave governance records show that liquidity mining or higher interest rates may be proposed within a few weeks.

Ripple positions RLUSD as a settlement token for corporate payments and cross-border transfers. Consequently, the company views its entry into decentralized lending as a bridge between traditional payment flows and on-chain liquidity.

Meanwhile, RLUSD joins a sector dominated by Tether’s USDT and Circle’s USDC, whose combined share still overshadows other dollar tokens. ETHNews analysts say a new pool on Aave gives RLUSD direct access to borrowers and lenders who may diversify away from the two incumbents

Aave set conservative limits to manage risk while the pool matures, mirroring the approach used when it added GHO and PYUSD. As deposits grow, risk managers can raise the caps in gradual steps, provided that on-chain data confirms stable liquidity and a one-to-one peg.

Therefore, liquidity depth rather than speculation will determine how quickly RLUSD becomes a routine collateral choice on Aave.

In separate comments, Ripple stated that it plans to propose RLUSD listings on other lending platforms once the Aave market reaches its capacity. Furthermore, the firm plans to connect the token to its payment rails in Latin America and Southeast Asia during the second half of 2025.

For now, the launch provides a straightforward measure of demand for a dollar token backed by bank deposits and Treasury bills. If liquidity develops, RLUSD may prove a useful hedging and settlement asset across both centralized and decentralized rails, though traders will watch peg stability and interest rates before committing large funds.

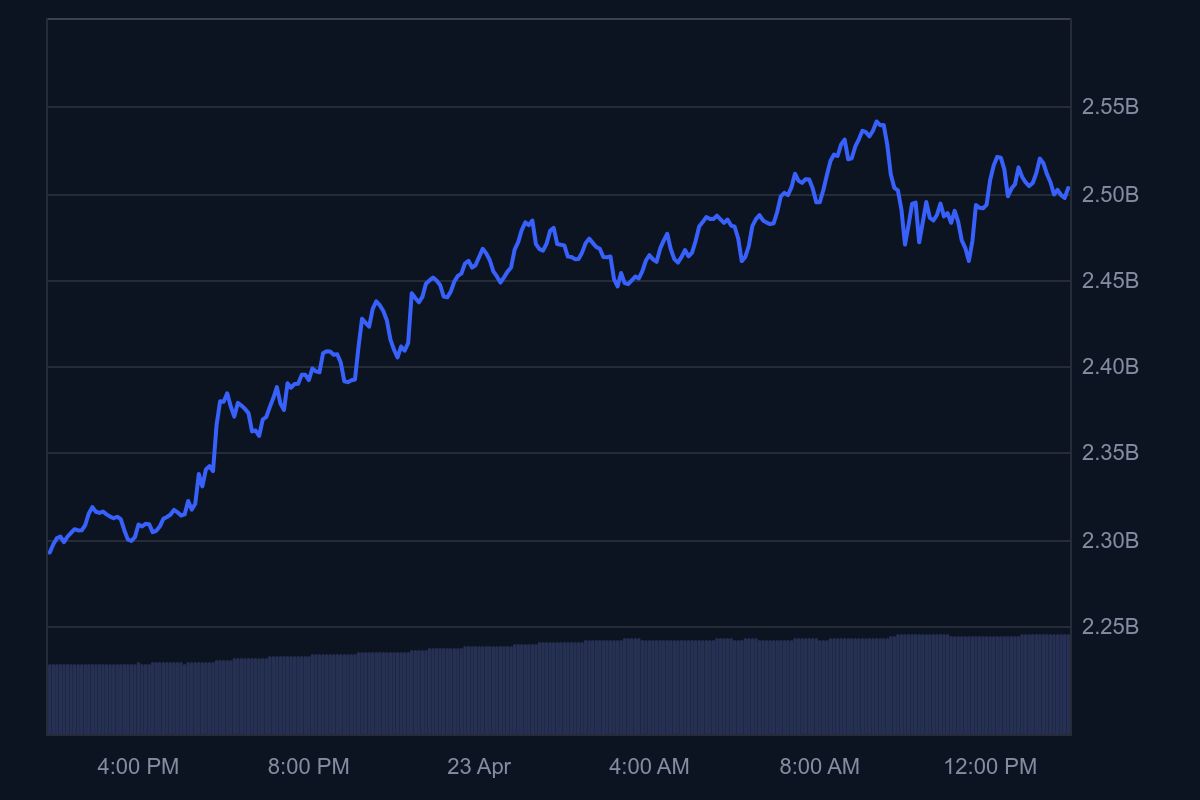

Aave (AAVE) is currently trading at $165.62, showing a strong +4.68% daily gain and a notable +23.46% increase over the past week, signaling a strong recovery phase after recent corrections.

Despite this, AAVE is still down 46.26% year-to-date, and -10.46% over the past month, highlighting persistent volatility in the DeFi sector. However, the token remains +71.68% higher year-over-year, reflecting its long-term resilience. Aave’s market cap sits at $2.5 billion, with a daily trading volume of $339.6 million, underscoring renewed investor interest.

Technically, AAVE is breaking out from a short-term consolidation range, approaching the $170 resistance zone. A confirmed breakout above this level could send the price toward $185–$195, with further upside potential to $210 if momentum holds.

Conversely, a failure to maintain above $160 may lead to a pullback to $148–$150, which served as the base for the recent rally. Oscillators are turning bullish, and market structure suggests the formation of a rounded recovery pattern.

Fundamentally, Aave continues to expand its ecosystem. It recently participated in a $29 million Series A funding round for Symbiotic, a staking protocol backed by Pantera Capital and Coinbase Ventures. Aave is also actively scaling its GHO stablecoin, considered a central piece of its roadmap to 10x protocol revenue.

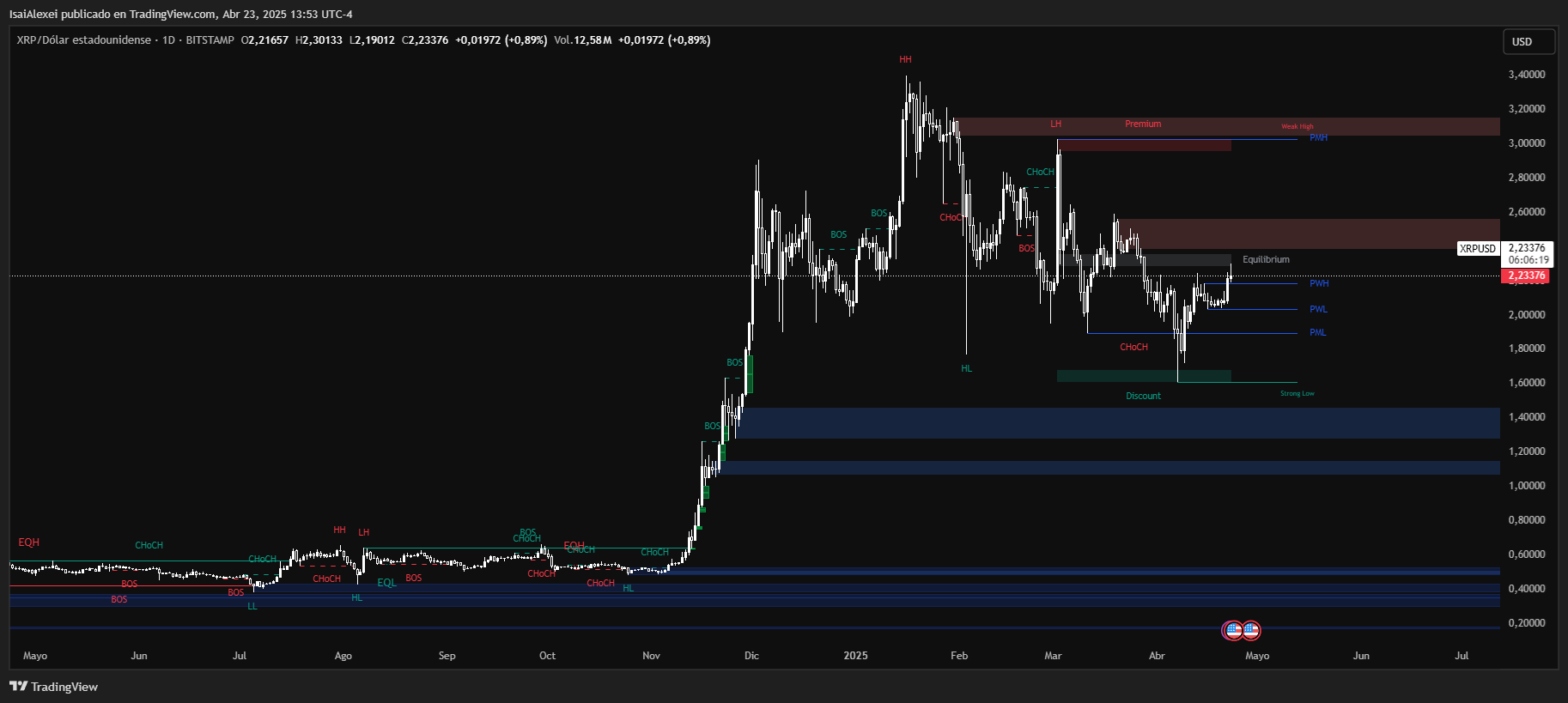

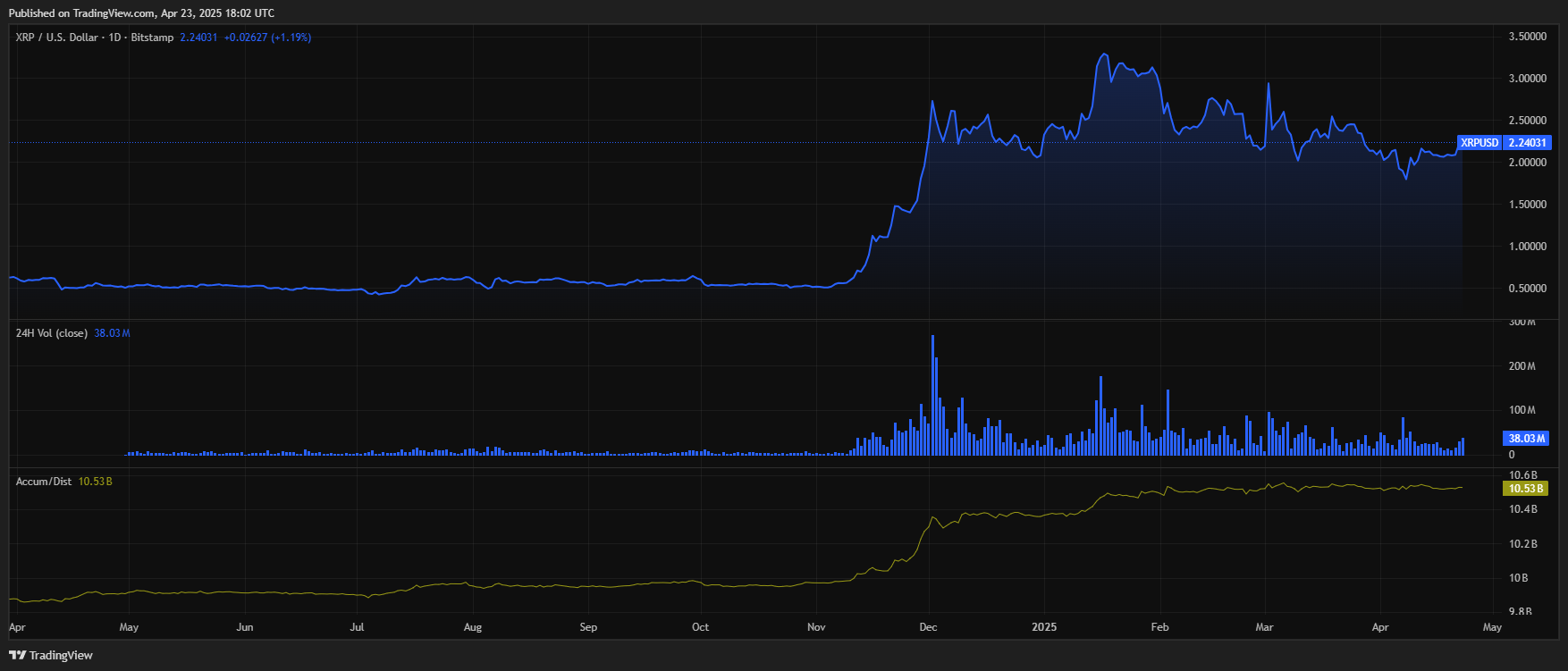

XRP (Ripple) is currently trading at $2.228, with a +0.63% daily gain and a strong +6.87% increase over the past week, continuing its bullish recovery. Over the last month, the token has experienced a -8.72% dip, but it remains significantly up by +318.90% over the past 6 months, and +299.71% year-over-year, reinforcing its momentum as one of the most high-performing large-cap altcoins.

XRP is now the #4 crypto by market cap, valued at $130 billion, with an impressive $5.87 billion in 24-hour trading volume.

Technically, XRP is pushing against a key breakout zone around $2.23–$2.25. If bulls can maintain buying pressure and break through this level, the next targets are $2.47 and $2.67, ETHNews analysts projecting an extension toward $3.00–$3.40, its former all-time high.

The asset recently cancelled a “death cross” signal and formed a bullish inverse head-and-shoulders pattern, indicating a possible continuation to the upside. Support rests near $2.00 and $1.92, with further downside limited unless broader market sentiment turns.

On the fundamental side, XRP has seen a resurgence of institutional demand. Last week alone, XRP investment products attracted $37.7 million in inflows, outpacing both Bitcoin and Ethereum.

Additionally, XRP futures were launched on April 21 by Coinbase Derivatives, opening the door for more structured exposure. Despite a recent vulnerability found in the XRPL JavaScript SDK (since patched), sentiment remains strongly bullish, and legal clarity from the SEC case continues to support confidence in the token’s future.