- Russian experts predict the Bitcoin bull market will fall short of 2017 highs.

- The latest rise of Bitcoin is being influenced by speculative games, according to Russian research.

Russian experts said that the current Bitcoin (BTC) bull market will fall short of 2017 highs. The biggest development-focused NGOs and conference organizers in Russia, the Roscongress Foundation, released a report on Bitcoin and cryptocurrencies, predicting that the Bitcoin bull market mania will eventually fade.

The Latest Bitcoin Rise: Games of Speculation and Market Reactions

Bitcoin’s new all-time high in March of this year was a part of a “speculative game” conducted “against the backdrop of spot Bitcoin ETFs approvals,” the report’s authors pointed out. Still, the sharp rise in Bitcoin prices in March did not generate the same kind of uproar as it did at the end of 2017.

They cited cryptocurrency search engine queries that have been well below peak levels. Comparing 2024 to 2017, there will be just half as many people looking for Bitcoin and cryptocurrency-related topics.

According to experts in the research, spot Bitcoin ETFs were supposed to increase the accessibility of bitcoin investments to a larger population. Evidence points to this not having occurred yet, though.

According to CoinMarketCap statistics, the price of BTC is currently $69,927.48, down 1.92% in the last day but showing a 12.91% bullish trend over the previous seven days. Furthermore, dispelling the idea of institutional dominance, ETHNews revealed that retail investors own 85% of spot Bitcoin ETFs.

[mcrypto id=”12344″]The Full Financial Integration Challenge

The writers of the paper clarified that complete integration into the conventional financial system is “obstacled” by the “mining-based transaction protocols of the Bitcoin network.”

Generally speaking, cryptocurrencies are still not a good fit for complete integration, mostly because they cannot be offset—that is, the net display of distinct assets and liabilities or income and expenses in financial statements.

Like tech stocks, most investors still view Bitcoin as a high-risk asset, according to market data. BTC satisfies the characteristics of a high-risk speculative asset since it is more strongly associated with stock market movements than other assets like gold.

Furthermore, the market’s muted response to the April halving event suggests that the general degree of risk-taking readiness of players in the financial markets is increasingly determining how Bitcoin behaves.

Perspectives Over Time and Speculative Play

Although not totally negative on Bitcoin, the paper did point out that spot BTC ETFs will eventually provide accessibility to cryptocurrency investing for all market participants. Temporary price increases are attributed, however, to traders’ speculative play in an attempt to profit on Washington’s acceptance of ETFs.

Analysis of Stablecoin Impact and Bitcoin Price Forecasts

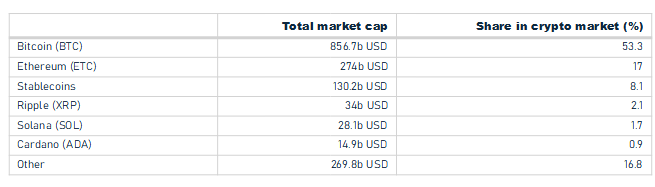

Forecasts for BTC prices at the end of the year span a very broad range; the average floor is $50,138, and the average ceiling is $121,764. Since 2017, stablecoins’ rising capitalization has sparked bull markets in Bitcoin.

The emergence of cryptocurrencies propelled the first wave of BTC price increases in 2017, while a steep rise in the stablecoin supply and the move of pricing to virtual spaces explained the second wave in 2021. Part of the cause of the 2024 all-time high peak was the stablecoin supply being restored.

Also, further impacting market dynamics, Russian specialists earlier this month projected that mining of BTC and other cryptocurrencies will increase by 20–40% before the end of the year.