- SAND (+23%), MANA (+25%), and ENJ (+47%) surge weekly but remain below all-time highs. Traders eye $0.30 support.

- SAND/MANA test $0.30 support; ENJ nears $0.09. Resistance zones: $0.36 (SAND/MANA), $0.11 (ENJ). Breakouts could signal rallies.

The Sandbox (SAND), Decentraland (MANA), and Enjin Coin (ENJ) — three tokens tied to virtual worlds and blockchain gaming — are rebounding this week despite lingering long-term losses. SAND has risen 23% in seven days, while MANA and ENJ climbed 25% and 47%, respectively. All three remain well below peak prices from prior cycles, with ENJ down 98% from its all-time high.

ETHNews are watching technical levels: SAND and MANA hover above $0.30, a psychological support zone, while ENJ tests $0.09. Upcoming events, like The Sandbox’s Alpha Season 5 and Decentraland’s Metaverse Fashion Week, could drive short-term activity.

However, broader challenges persist. These tokens face pressure from rival platforms and fluctuating interest in metaverse projects. Their next moves may hinge on holding key price floors or breaking resistance near $0.36 (SAND/MANA) and $0.11 (ENJ).

The Sandbox (SAND) is currently trading at $0.3060, posting a +0.88% daily gain, and showing strong short-term momentum with a +23.39% rise over the past week. However, SAND is still down -0.32% over the past month, -43.84% year-to-date, and -34.00% compared to last year. Despite these broader declines, SAND has achieved a staggering +3,570% gain since inception, showcasing its massive growth from early-stage prices.

Technically, SAND is stabilizing above the $0.30 support zone, which is now a critical level to maintain for bullish continuation. Immediate resistance sits around $0.34–$0.36, and a breakout above this could trigger a rally toward $0.42–$0.45.

If SAND fails to hold $0.30, the next support zone lies around $0.27–$0.28. Oscillators and moving averages are neutral to bullish, suggesting that the asset is consolidating ahead of a potential larger move.

Fundamentally, SAND is gearing up for Alpha Season 5, set to launch by March 31, 2025, which could inject new momentum into the metaverse narrative. As one of the top gaming and NFT-based projects, The Sandbox continues to strengthen partnerships and build out its virtual world economy.

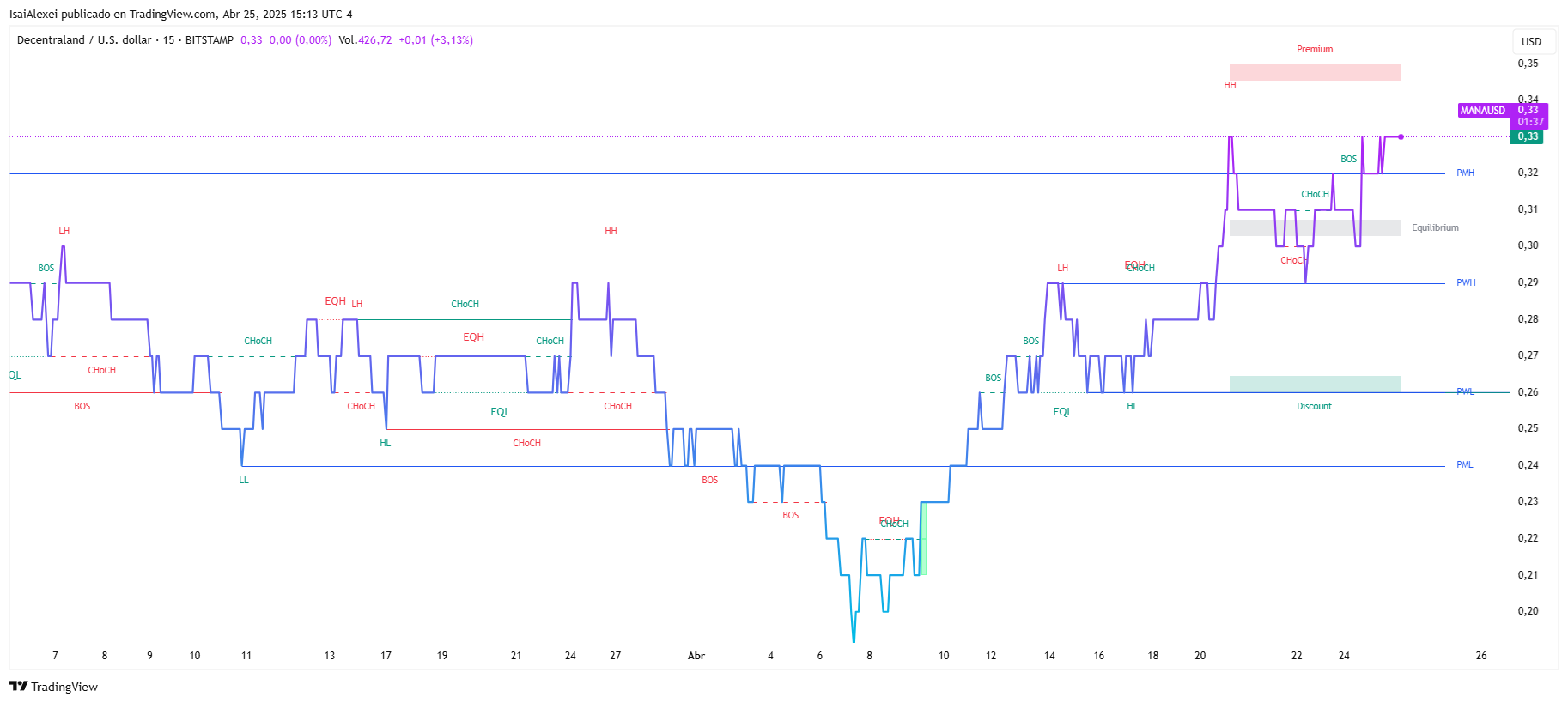

Decentraland (MANA) is currently trading at $0.3343, posting a +3.31% daily gain, and showing strong short-term momentum with a +25.10% increase over the past week and +18.33% growth over the past month.

Despite this recovery, MANA remains down -28.07% year-to-date and -27.60% over the past 12 months, trading approximately 76.38% below its all-time high of $5.91. The project maintains a market cap of $649.49 million with 24h trading volume around $79.87 million.

Technically, MANA is attempting to break out of a corrective zone, currently holding steady above the $0.30 support level. Immediate resistance is seen near $0.36–$0.38, and a confirmed breakout could open the path toward $0.42–$0.45

If MANA fails to sustain this rally, support lies around $0.30–$0.28, areas where buying interest has previously appeared. Indicators are leaning neutral, though momentum is shifting bullishly, suggesting a possible continuation if buyers remain active.

Fundamentally, Decentraland is positioning itself for renewed ecosystem activity with key events like the Metaverse Fashion Week 2025. As one of the pioneers in the virtual land and NFT sectors, Decentraland continues to push innovation within the Ethereum ecosystem.

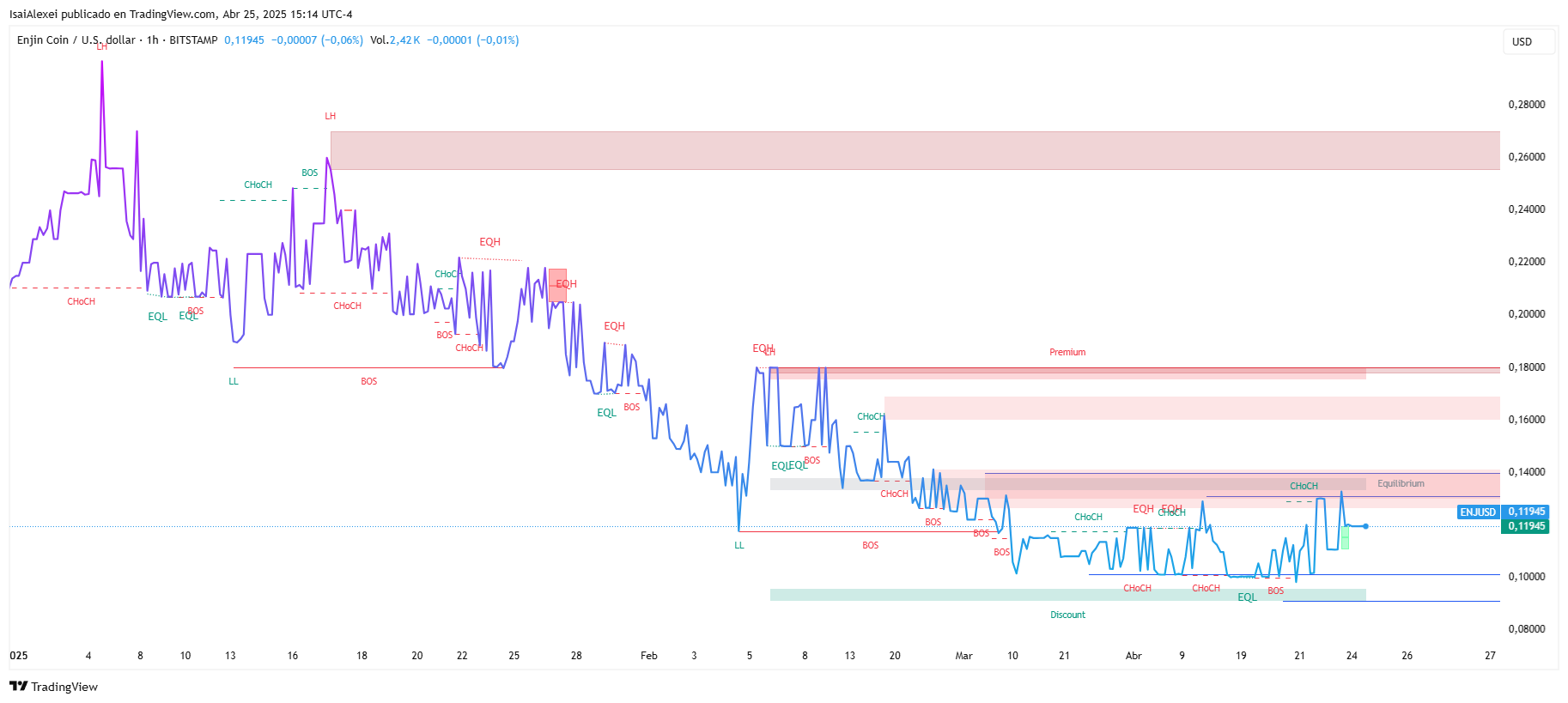

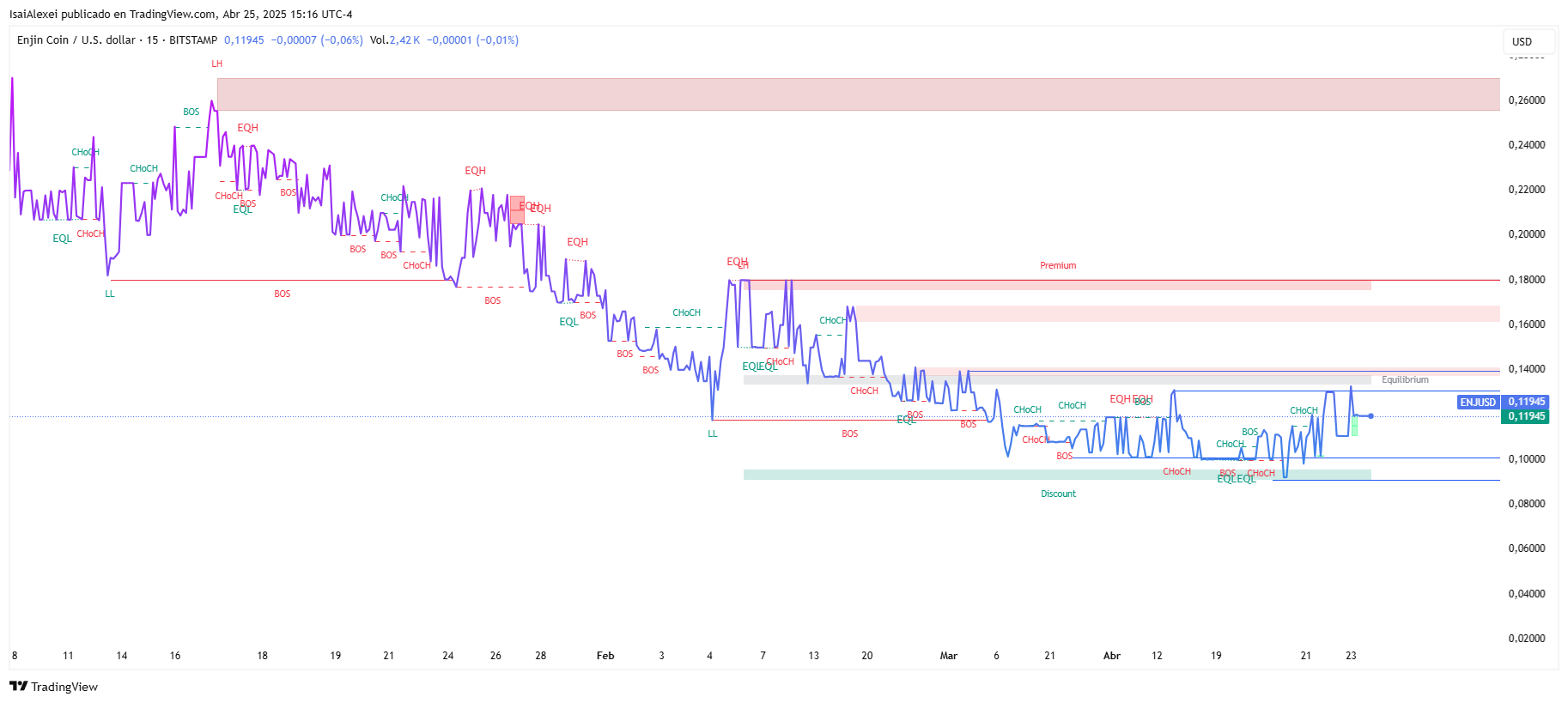

Enjin Coin (ENJ) is currently trading at $0.0901, registering a daily loss of -1.00%, though showing a strong +47.44% gain over the past week, indicating significant bullish momentum after prolonged declines.

Despite this rally, ENJ remains down -10.64% over the past month, -37.09% over the last 6 months, and -57.12% year-to-date. Compared to its all-time high of $4.99, ENJ is still down by over 98%, although it shows a +268.32% growth since inception. Its market cap stands at $165 million with a 24h trading volume of $32.87 million.

Technically, ENJ appears to be attempting a bottom reversal, bouncing from extreme oversold conditions. Immediate resistance lies at $0.10–$0.11, where previous attempts to rally have stalled.

A breakout above $0.11 could set the stage for a move toward $0.15–$0.18. On the downside, if the recent gains lose momentum, support is seen at $0.085–$0.08. Oscillators are turning slightly bullish, and volume has picked up considerably, hinting at possible accumulation phases.

Fundamentally, Enjin remains a leader in blockchain gaming and NFT infrastructure. It has upcoming catalysts such as the Validator Limit Increase scheduled for April 28th, 2025, and continued development of the Matrixchain upgrade.