- Delays stem from Ripple’s push to revise penalties, including a sales ban, amid SEC’s shifting crypto enforcement strategy.

- The firm argues SEC’s leniency toward others undermines its case; accepting original terms implies admitting fault.

The SEC and Ripple Labs are reportedly close to resolving their ongoing legal dispute, according to sources familiar with the matter. The case, initiated in 2020, centers on allegations that Ripple conducted unregistered securities sales through its XRP cryptocurrency. A federal court ruling in August 2023 mandated Ripple to pay $125 million and barred the company from selling XRP directly to institutional investors.

Delays in finalizing the case are attributed to negotiations over modifying the court’s original penalties. Ripple’s legal team is seeking adjustments to the terms, particularly the permanent injunction restricting institutional XRP sales.

The company argues that recent shifts in the SEC’s approach to crypto enforcement—including dropped cases against other firms—undercut the rationale for maintaining strict penalties. Ripple contends that accepting the original ruling without changes would imply an admission of wrongdoing, a stance the SEC now appears hesitant to enforce uniformly.

Continuing with the Ripple reports in ETHNews, legal experts note that a settlement agreement, rather than a court-approved judgment, is the most plausible path to a swift resolution. Such an agreement would require both parties to dismiss pending appeals and negotiate terms privately, bypassing judicial ratification.

This approach would keep settlement details confidential, unlike public court rulings. Eleanor Terrett, a journalist covering the case, suggested that the SEC might permit Ripple to pursue registered XRP sales to institutions, aligning with the court’s injunction while offering the company operational flexibility.

🚨SCOOP: Two well-placed sources tell me that the @SECGov vs. @Ripple case is in the process of wrapping up and could be over soon.

My understanding is that the delay in reaching an agreement is due to Ripple's legal team negotiating more favorable terms regarding the August…

— Eleanor Terrett (@EleanorTerrett) March 12, 2025

Historical precedents, such as Taco Bell’s 2006 settlement in a trademark lawsuit, demonstrate that private resolutions can occur after initial court decisions. In that case, terms were disclosed only after leaks, highlighting the potential for opaque outcomes.

If settled privately, the Ripple case’s specifics may remain undisclosed, leaving observers to infer details from subsequent corporate actions. The outcome could influence how regulatory bodies handle similar disputes in the evolving cryptocurrency sector.

For now, the focus remains on whether both parties can reconcile differing demands to close a case that has drawn attention from investors and regulators alike.

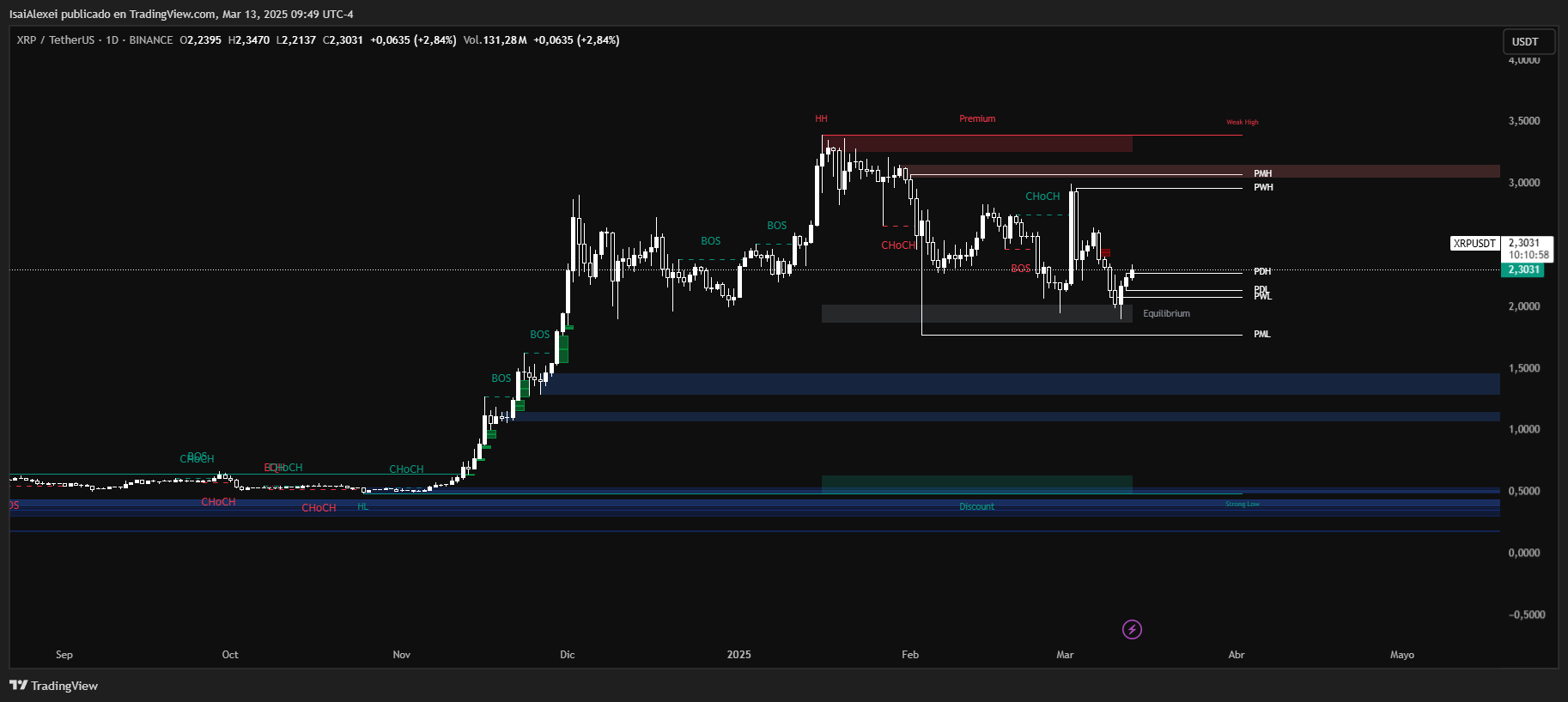

As of today, XRP is trading at $2.3162, reflecting a 0.65% decline in the past 24 hours. Over the past week, XRP has dropped by 11.00%, and in the last month, it has decreased by 8.21%. Despite this recent downturn, XRP remains one of the top-performing cryptocurrencies over the past year, with a 236.66% increase in its value.

XRP reached its highest price of $3.40 on January 16, 2025, before entering its current correction phase.

Technical indicators show a neutral signal for today, but the weekly and monthly outlooks suggest a buy signal, indicating potential bullish momentum in the near future.

If XRP holds above $2.20, it could retest resistance at $2.50-$2.70. However, if selling pressure increases, key support levels to watch are $2.10 and $1.95.