- ETHD and ETQ surged over 200% in 2025, tracking Ether’s price drop with double-leveraged inverse exposure.

- Ethereum’s network revenue dropped 95% after the Dencun update reduced transaction fees across Layer 1 and Layer 2.

Two exchange-traded funds designed to profit from Ether’s decline have led returns among ETFs so far this year. The ProShares UltraShort Ether ETF (ETHD) and the T Rex 2X Inverse Ether Daily Target ETF (ETQ) posted gains of 247% and 219% respectively, according to Bloomberg Intelligence.

Both funds use derivatives to offer double inverse exposure to Ether, increasing in value when the asset falls.

Ether has dropped approximately 54% since January. It is currently trading near €1,437. The drop follows a downward trend that began in early 2024. ETF analyst Eric Balchunas shared the performance data on platform X, stating that these funds have benefited directly from the market’s direction.

The best performing ETF this year is the -2x Ether ETF $ETHD, up 247%. #2 is the other -2x Ether ETF. I was sure it would be $UVIX (2x VIX), but that's #3. Brutal. pic.twitter.com/e49QOPtgmb

— Eric Balchunas (@EricBalchunas) April 9, 2025

Leveraged inverse ETFs do not always match the daily movement of the assets they track, especially during extended market swings. However, their returns this year reflect the sharp decline in Ether and growing interest from traders seeking short exposure.

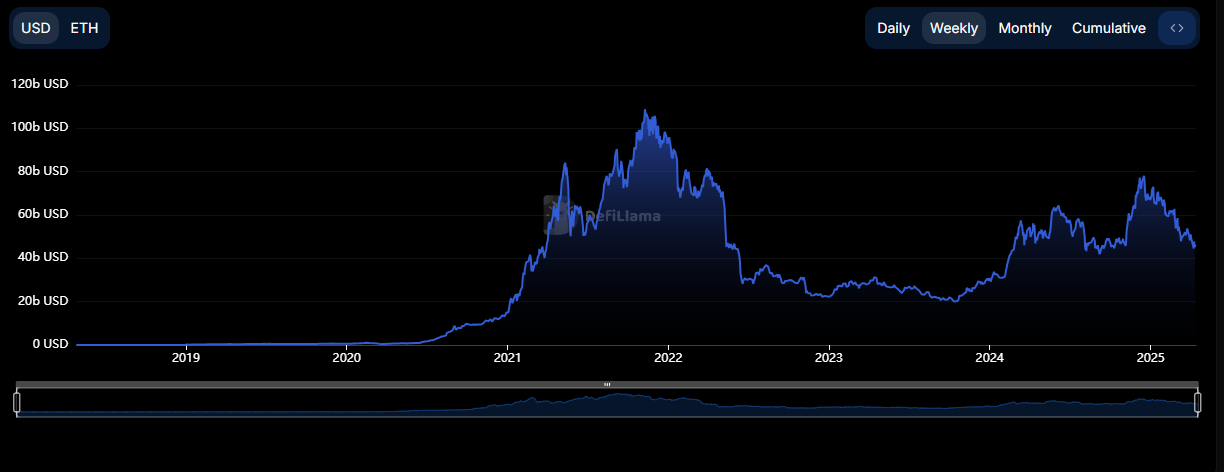

Ethereum remains the blockchain with the highest total value locked, at around $46 billion according to DefiLlama. Yet, the financial output of its network has weakened. In March 2024, Ethereum implemented the Dencun update, which cut transaction fees by a large margin. Since then, the network has struggled to regain earlier income levels.

I am offering a different perspective that Ethereum is moving beyond a settlement layer, its building out a data availability economy

The conversation around Ethereum’s fee model is changing.

Right now, fees on “blob space”, the data availability fees that Layer 2 solutions pay… pic.twitter.com/5JEpYRUHKp

— arndxt (@arndxt_xo) April 1, 2025

Data shows that Ethereum’s transaction fee revenue fell by roughly 95% after the update. The changes were intended to lower transaction costs through better data management, especially for Layer 2 rollups. However, the shift has reduced the network’s revenue from transaction fees.

Layer 2 networks like Arbitrum and Base now process a growing share of Ethereum transactions. In the final week of March, Ethereum collected only 3.18 ETH in fees from these external chains, according to Etherscan. The growing use of L2s has not translated into a steady revenue stream for Ethereum.

Michael Nadeau, founder of The DeFi Report, said on X that transaction volumes on Layer 2s would need to rise over 22,000 times to restore Ethereum’s earlier fee levels. This projection shows a wide gap between increased use of Layer 2s and the platform’s ability to collect fees from them.

Question:

How many L2 transactions on @base are needed to fully back-fill Ethereum's peak execution fees with DA fees?

Answer:

345.4 billion tx/day.

Calculation:

1. Over the last 90 days, Base has paid 625 ETH ($1.1m) to the L1 in blob submission fees.

2. Over the same… pic.twitter.com/Vu7eZScPt1

— Michael Nadeau | The DeFi Report (@JustDeauIt) March 31, 2025

Ethereum also saw a drop in activity during the first quarter of 2025. VanEck, an asset manager, reported lower usage of smart contract platforms including Ethereum and Solana. The decline occurred as investors adjusted to economic pressure and changing regulatory conditions.

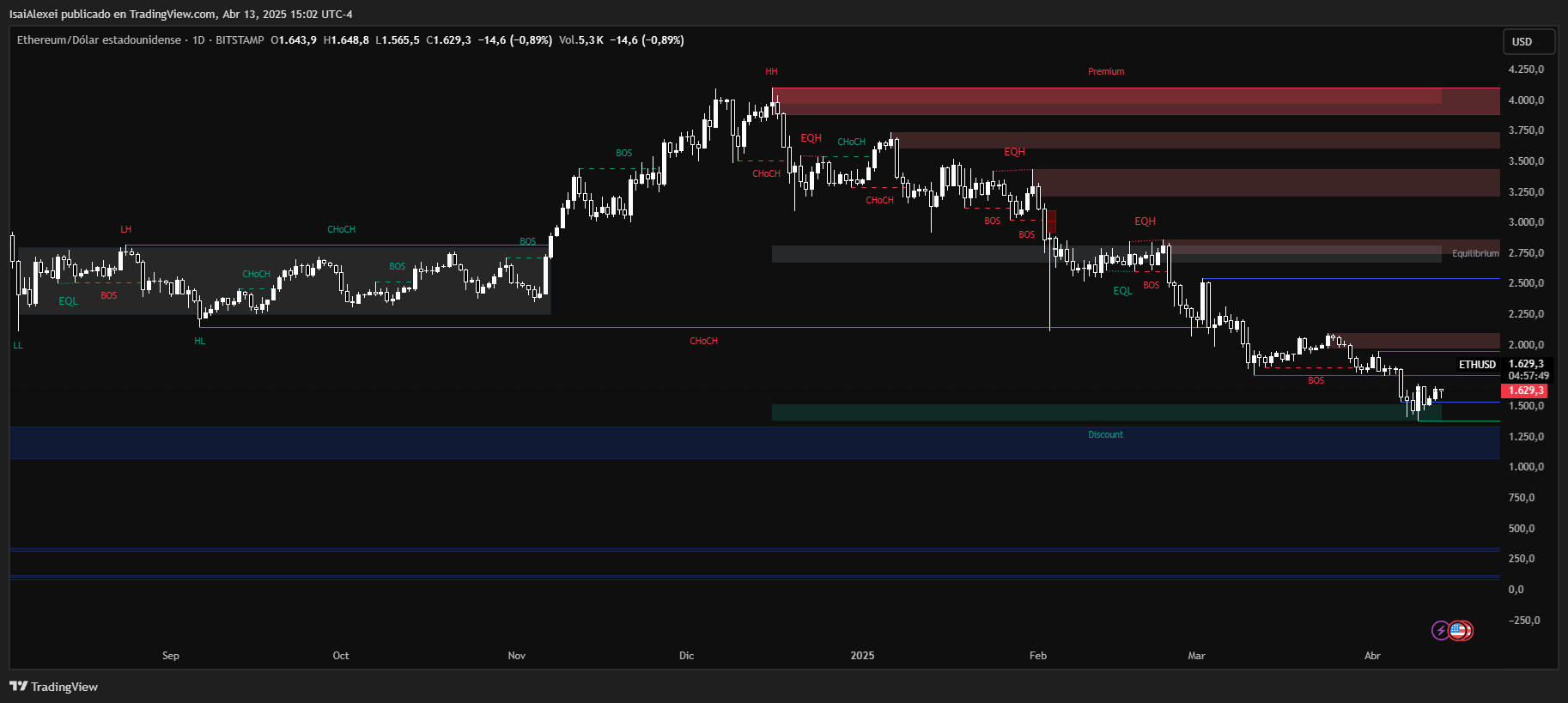

Ethereum (ETH) is currently trading at $1,629.20, showing a minor 0.89% dip in the last 24 hours, reflecting ongoing market hesitation following recent sell-offs. ETH has dropped 51.09% year-to-date and nearly 49.68% over the past 12 months, placing it in a critical long-term correction zone. Despite the broader weakness, ETH is holding key technical support around $1,580–$1,600, a range that has historically triggered accumulation phases.

Technically, ETH is hovering near the lower bounds of its multi-month channel. The next upside resistance is near $1,700, with a stronger confirmation needed above $1,850 to shift sentiment.

On the downside, a break below $1,570 may expose Ethereum to a deeper retracement toward $1,450. Momentum indicators like RSI and MACD suggest the asset is approaching oversold conditions on the daily chart, while a bullish divergence may be forming on shorter timeframes.

News of the upcoming Pectra upgrade (May 7) and renewed focus on network efficiency are potential catalysts, but macro sentiment and ETF-related developments continue to weigh heavily. If buyers reclaim $1,700 with conviction, a short-term recovery toward $1,800+ is likely.

Exact Price Prediction: Based on current technical positioning and reversal signals, Ethereum is projected to reach $1,715 within the next 5 days, assuming support at $1,600 holds and volume rebounds.