- Solana’s price has dropped to $126 amid concerns over an upcoming 11.2 million SOL unlock.

- The token’s ETF listing on DTCC sparks hope for institutional adoption.

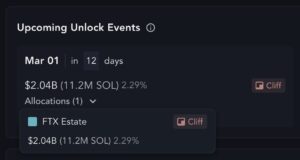

Solana has taken a sharp hit, falling to $126 today, marking its lowest point since October. The dip comes as investors brace for the unlocking of 11.2 million SOL from the FTX bankruptcy estate. This batch of tokens, worth about $2.06 billion, is set to be released on March 1, potentially flooding the market with more supply.

FTX has previously offloaded 41 million SOL in three giant sales, in which key buyers paid between $64, $95, and $102 per token. Galaxy, Pantera, and Figure are among the key over-the-counter (OTC) buyers who have been scooping these tokens.

Market response has been brisk with added selling pressure in Solana since traders anticipated additional volatility. FTX creditors prepare to kick off the next phase of payments.

According to an update by Sunil, the next payment record date is to be April 11, 2025, while payments should begin May 30, 2025. This is to settle claims valued over $50,000 in value and whatever is remaining in below-$50k claims not paid in the previous phase.

FTX Distribution Dates

11 April 2025: Distribution Record Date Claims > $50k

30 May 2025: Next Distribution Date

Claims > $50K

Claims < $50k: Those claims that have been allowed and not received distribution in the 1st distribution— Sunil (FTX Creditor Champion) (@sunil_trades) February 18, 2025

Can SOL Hold $115, or Is a Drop to $70 Next?

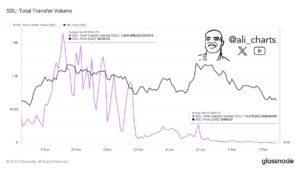

The overall market downfall has only added to Solana’s woes. One market watcher recently posted about an unprecedented dip in transfer volume by Solana, from an all-time high in November 2024 of $1.99 billion to just $14.57 million now. This steep decline is an indicator of drastically slowed down on-chain activity.

Solana is now valued at $131.07, down by 8% in the previous 24 hours. This sharp fall has led to liquidations among heavily-levered traders, further driving momentum downwards.

[mcrypto id=”12347″]Crypto Patel, a leading voice in this market, described how Solana has fallen by 56% since an all-time high in just 40 days. He stressed that risk management is imperative because SOL is now testing an integral support zone between $120 and $140.

If Solana is over $115, a potential comeback is underway, with an upside goal of approximately $500 in this next altcoin cycle.

If this support price point is not maintained, Patel suggests that SOL can fall sharply to approximately $100 or to around $70. The next few days will be crucial as investors watch whether the token can stabilize or if more selling pressure will drive prices lower.

Solana ETF Listing Brings Institutional Hopes

Amid price troubles, Solana has registered a potential game-changer achievement: an exchange-traded fund (ETF) listing with the Depository Trust & Clearing Corporation (DTCC). This is a key development towards institutional adoption because DTCC listing is an absolute prerequisite to enabling a fund to go live in traditional exchanges.

Solana ETF Listed on DTCC for the First Time!

Solana ($SOL) just took a massive leap towards institutional adoption as a Solana ETF has been officially listed on the DTCC (Depository Trust & Clearing Corporation).

💡 What does this mean?

✅ Regulatory Green Light? DTCC listing… pic.twitter.com/amI2cVhJP5— Crypto Patel (@CryptoPatel) February 27, 2025

The inclusion in an ETF has generated speculation about Solana getting regulatory approval to join ranks with Ethereum and Bitcoin. If this is achieved, the resultant ETF can unleash institutional investments to push institutional demand in SOL. Analysts believe this can push Solana toward making a comeback.

Donald Trump’s endorsement further fuelled this. He used Solana to launch his viral TRUMP meme coin. Although the endorsement by the meme coin has novelty value only, an ETF listing should be seriously considered because this can mean legitimate support for the network.

Polymarket traders have predicted an 84% chance of an ETF’s introduction this fall. Bloomberg analysts James Seyffart and Eric Balchunas have been similarly optimistic about Solana’s approval. If this is approved, it can be a turning point in token fortunes to offset part of the current negative sentiment.