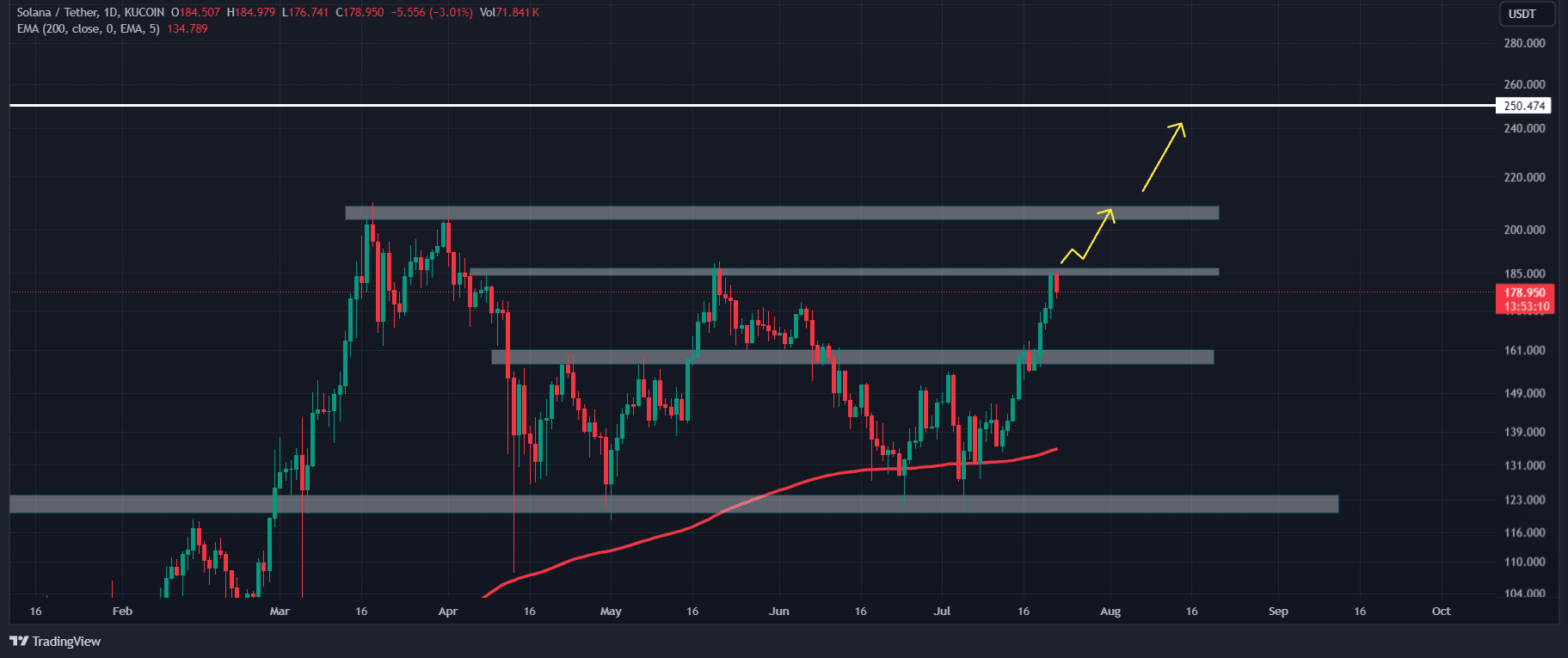

- Solana’s market performance shows promise, having surpassed the 200-day EMA with resistance observed around the $186 mark.

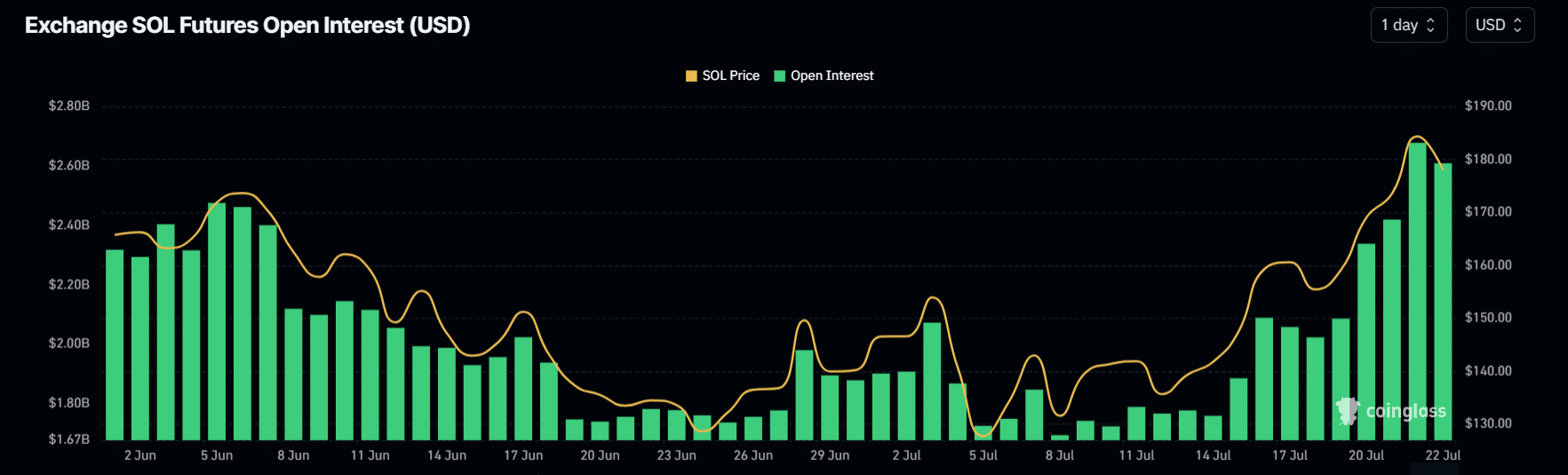

- On-chain data indicates a 9% increase in Solana’s Open Interest, reflecting growing trader engagement and market confidence.

The U.S. Securities and Exchange Commission (SEC) may soon approve the first Spot Solana Exchange Traded Fund (ETF), according to Nate Geraci, president of The ETF Store.

This approval could potentially increase investment and interest in Solana’s cryptocurrency ecosystem. Currently, ETFs for Bitcoin exist, and Ethereum may soon follow, with Solana anticipated as the next digital asset to receive such financial product endorsement.

Regulatory Developments and Market Reactions

The potential SEC approval is viewed as a response to evolving market demands and investor interest in broader cryptocurrency exposure through regulated financial products.

Prediction…

An ETF issuer will file for combined spot btc, eth, & sol ETF in next few months.

We’re quickly heading down path towards index-based & actively managed crypto ETFs.

— Nate Geraci (@NateGeraci) July 22, 2024

Geraci suggests that ETF issuers like BlackRock, Fidelity, and VanEck are preparing to submit applications for combined ETFs that would include Bitcoin, Ethereum, and Solana.

Solana’s Performance and Market Outlook

At the moment, Solana exhibits positive market movement. It has surpassed the 200-day Exponential Moving Average (EMA), signaling increased market activity and investor confidence. However, Solana faces resistance around the $186 price level. Overcoming this resistance could lead to further gains, potentially approaching or surpassing the $200 mark.

Investor Sentiment and On-Chain Data

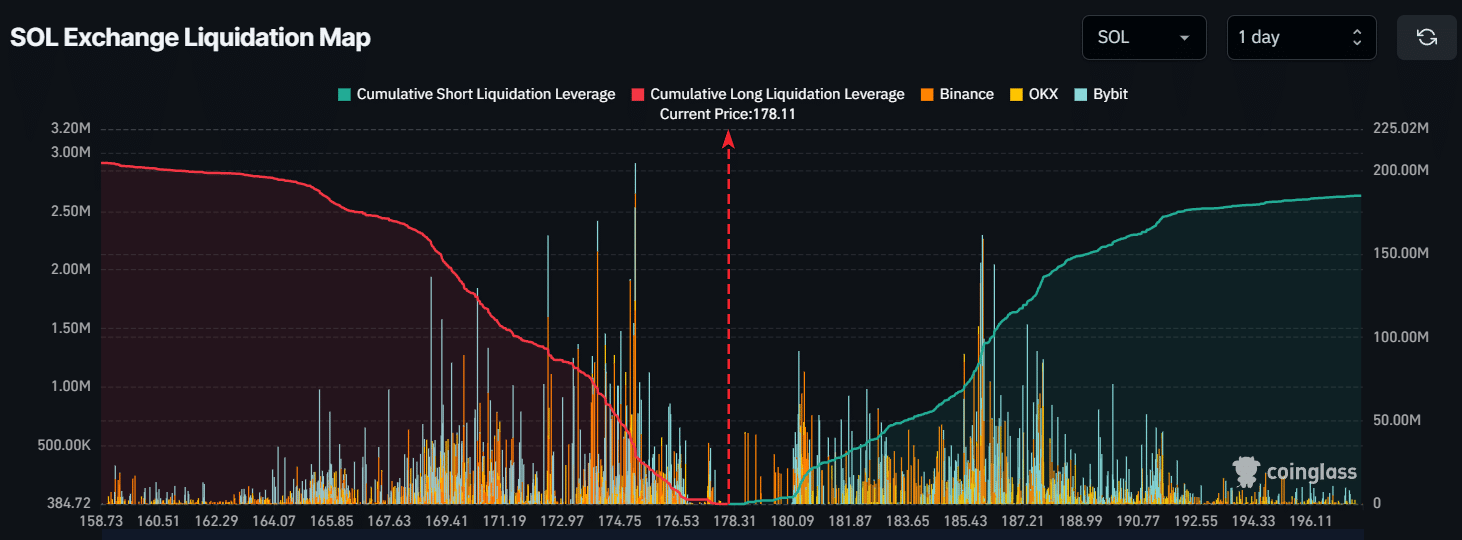

On-chain analytics indicate that Solana’s Open Interest has risen by over 9% in the last 24 hours, reaching a peak since June 2024. This suggests a robust engagement from traders. Liquidation data shows that the market currently favors long positions over short, with significant short positions placed at the $186.5 level, indicating a pivotal price point for Solana.

The anticipated approval of a Spot Solana ETF by the SEC could significantly impact Solana’s crypto market, boosting both its price and the legitimacy of cryptocurrencies in the broader financial ecosystem. The outcome of this regulatory decision will likely play a critical role in shaping future investment in Solana and memecoin market.