- Solana experiences a 13% drop in SOL, generating doubts about its future demand after the decline in airdrops.

- Despite recent low activity, Solana stands out for its collaboration with Filecoin, addressing the availability of historical data.

The recent 13% decline in the value of SOL, Solana’s coin, to $101, has caused alarm among investors and cryptocurrency experts. This pullback moves Solana away from the top spots by market capitalization, raising questions about whether peak interest in SOL has already declined, particularly after the decline in excitement generated by the airdrops.

The decline in SOL’s price is directly associated with the poor performance of Solana-specific SPL tokens such as Jito (JTO), Jupiter (JUP) and Dogwifhat (WIF), which saw declines of 17%, 16% and 18% respectively since February 19 .

This has impacted investors anticipating profits from future airdrops, as price expectations are often based on comparisons to existing options.

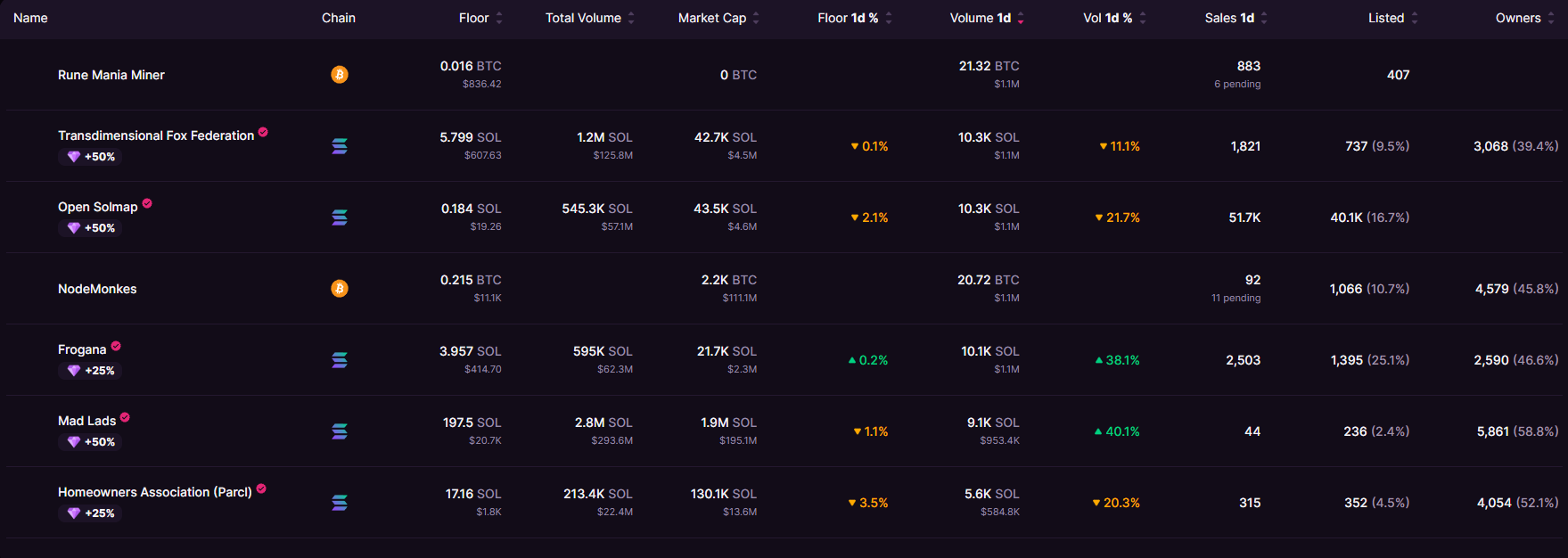

However, SOL’s valuation is not based on airdrops alone. Solana serves as a platform for a considerable number of active decentralized applications. For example, Raydium, a decentralized exchange, reported 172,440 active addresses in the last week, and the NFT marketplace Magic Eden, 167,930 addresses in the same period, demonstrating sustained activity on the network.

When contrasting the Solana network’s activity with other competing blockchains, Solana’s recent performance has been unsatisfactory. In the week to February 21, total DApps volume on Solana was $813 million, lower than Polygon’s $2.9 billion and BNB Chain’s $5.2 billion.

Solana was the only one among the top seven blockchains that did not evidence a volume increase in that period. The number of active addresses on Solana increased by 5%, while Ethereum and BNB Chain experienced increases of 14% and 27%, respectively.

The total value locked (TVL) in Solana DApps reached 37.7 million on February 17, its highest point since November 2022. The current 36.3 million SOL in TVL represents growth of 13.5% over the previous month, signaling an increase in overall demand for SOL beyond forecasts by airdrops.

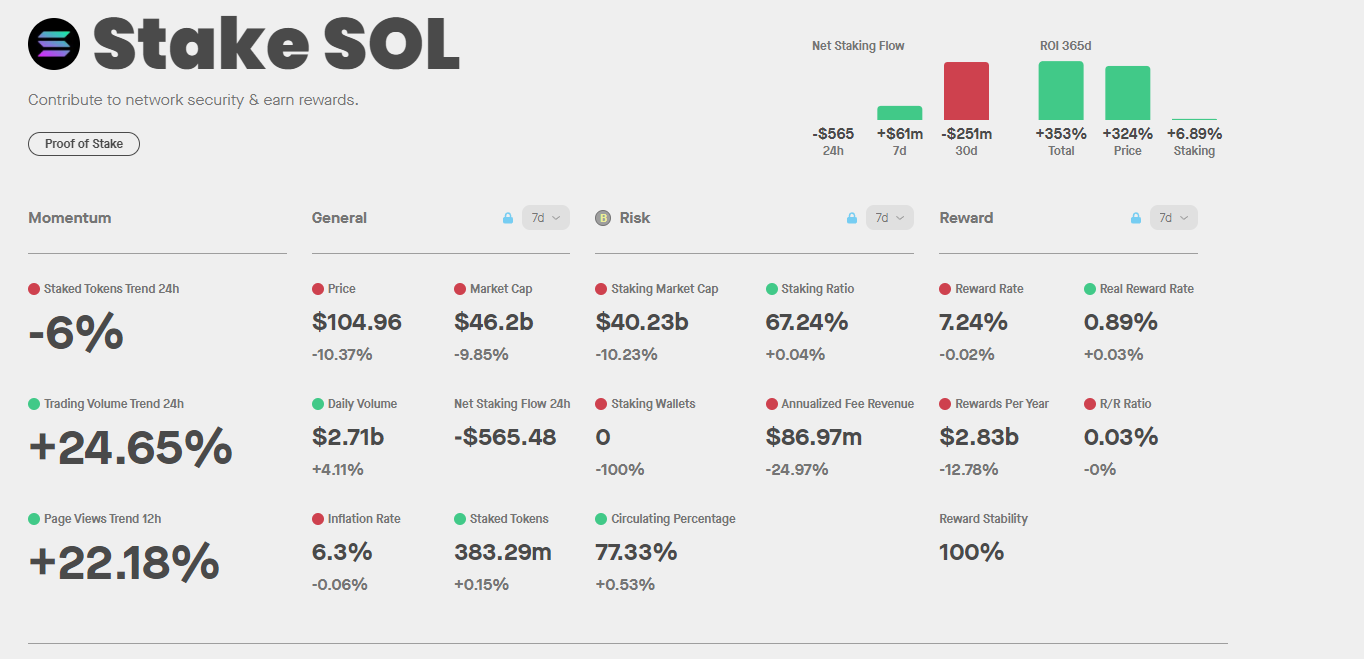

The SOL percentage reached 67.3% on February 21, according to StakingRewards, indicating a lower short-sale trend by owners, who appear unfazed by the recent price correction.

A positive for Solana investors is its partnership with Filecoin (FIL), which addresses the challenge of historical data availability, exceeding 250 terabytes of storage .

This partnership presents an alternative to Google Cloud’s previous BigQuery solution, more closely matching the preferences of some DApps users and developers.

The justification of a $44.6 billion market capitalization for Solana is complicated when considering that the network is behind competitors such as Polygon and Arbitrum in active users and volumes.

With a market valuation of $8.8 billion for Polygon and only $2.3 billion for Arbitrum, this data does not necessarily imply a future correction in SOL’s price, but it does decrease the incentives for investors to hold prices above $100.

SOL Analysis

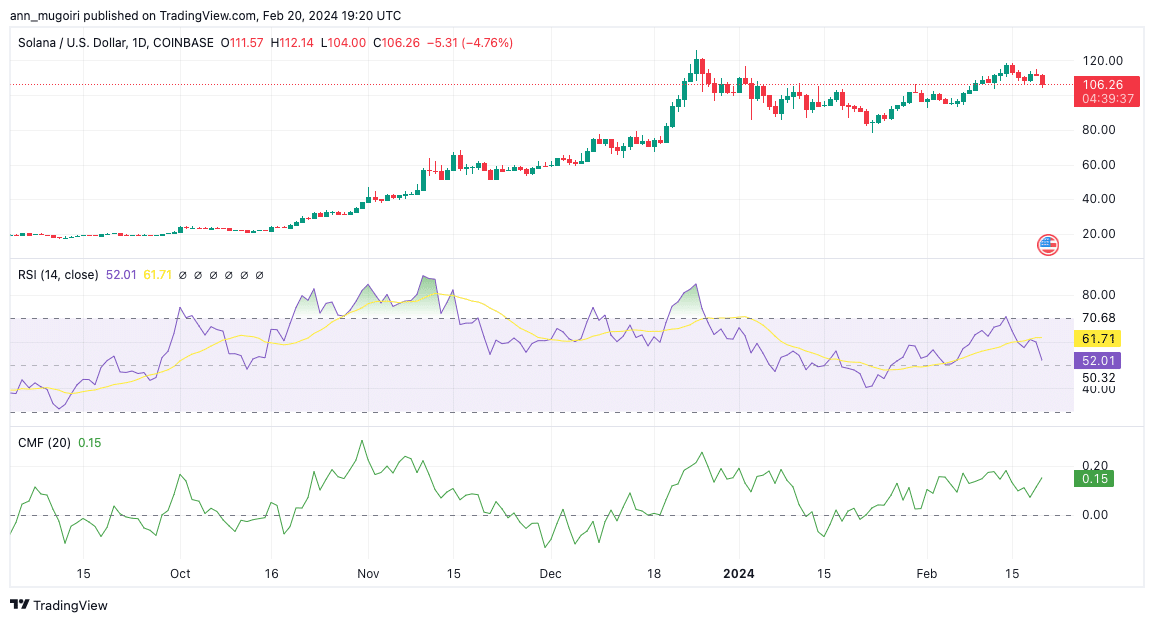

Daily technical price analysis of Solana indicates that if the current downtrend continues, the price is likely to fall to a support area located between $106 and $100.

Technical analysis on a daily scale suggests a possible short-term downward shift. The Relative Strength Index (RSI) is balanced at 52, suggesting near-term bearish momentum.

However, the Chaikin Money Flow Index (CMF) at 0.15 supports the bullish outlook. Negative trends in the 20-day Exponential Moving Average (EMA) and 50-day EMA further accentuate the possibility of a bearish scenario.

On the other hand, a resurgence of bullish momentum could take SOL price beyond the $115 threshold, thus setting the stage for an ascent towards the $120 resistance level. Even a sustained positive trend could lead price to test the more formidable $130 resistance level.

Currently, SOL price is under the influence of bullish forces, approaching the peak of an ascending triangle formation. However, the latest market consolidation phase has given the bears an opportunity, taking the price towards the critical ascending support line.

This situation raises questions about Solana’s future position in the competitive cryptocurrency and blockchain technology environment.