- Solana recovers pre-FTX LTV, reaching $2.069 billion, indicative of resilience and recovery after FTX collapse.

- Despite the increase in LTV and volume, SOL faces downtrend, reflecting challenges in market perception and confidence.

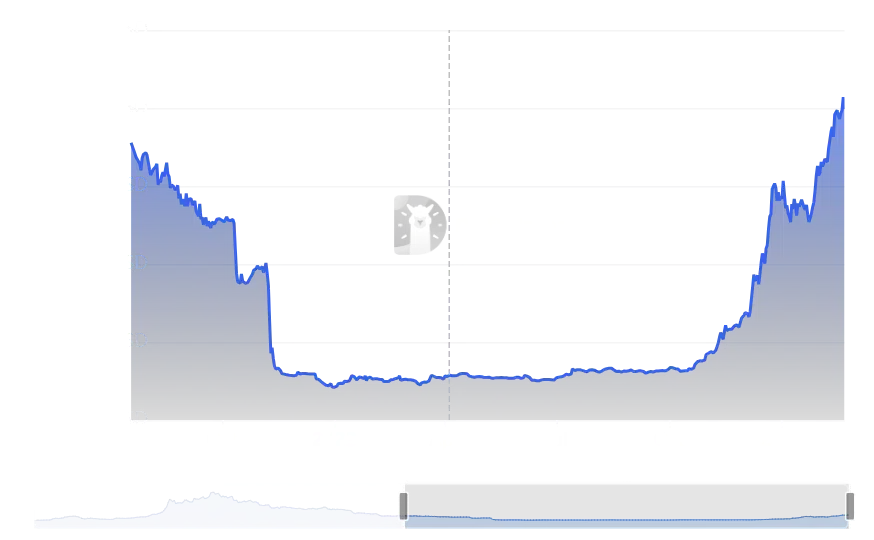

Solana’s (SOL) recent Total Value Locked (TVL) trajectory has been a focus of attention in the cryptocurrency space, especially with regard to its effort to regain the pre-FTX collapse highs.

According to DefiLlama data, Solana has shown a gradual ascent since October 2023, culminating in a significant milestone in December by reaching an LTV of approximately $2.069 billion for the first time in over a year.

This achievement not only symbolizes a remarkable recovery from the decline associated with the FTX crash but also raises questions about the sustainability of this newfound level.

Despite this progress, Solana’s LTV has experienced a slight decline to around $1.9 billion, suggesting a difficulty in maintaining the momentum previously observed .

This fluctuation in LTV is crucial in assessing Solana’s long-term stability and attractiveness as a decentralized finance (DeFi) platform.

In parallel, analysis of transaction volume on Solana indicates robustness in network activity. With a volume exceeding $765 million, this increase reflects active participation and sustained interest in the chains within the Solana network.

However, in terms of SOL’s price, the scenario is less encouraging. After peaking above $117 on February 14, SOL has experienced a downward trend, declining by approximately 7% over the past three days.

This decline has led SOL to trade around $103.8, marking a continuation in the downtrend and signaling a transition into a bear phase, albeit a weak one for the time being.

This backdrop highlights several critical points for Solana and its ecosystem. First, the recovery of LTV to pre-FTX levels is indicative of Solana’s resilience and resilience in the face of significant market adversity. The inability to sustain these levels suggests challenges to long-term stability and confidence in the platform.

Second, sustained transaction volume reflects healthy activity within the network, underscoring Solana’s continued attractiveness to DeFi users and developers. This aspect is critical to sustained growth and innovation within the Solana ecosystem.

Finally, the downtrend in SOL’s price raises questions about market perception and investor confidence in Solana’s ability to maintain its value over the long term .

While the transition into a downtrend may be temporary, it is crucial for Solana to address the underlying concerns that may be influencing this perception in order to strengthen its position in the crypto market.

While Solana has shown signs of recovery and resilience, it faces key challenges in terms of sustaining its LTV, maintaining transaction volume and the perception of SOL’s value in the market.

Solana’s ability to address these will determine its future trajectory and positioning in the competitive cryptocurrency and DeFi space.

At the time of this writing SOL is trading at $104